What Is Form 8959 Additional Medicare Tax

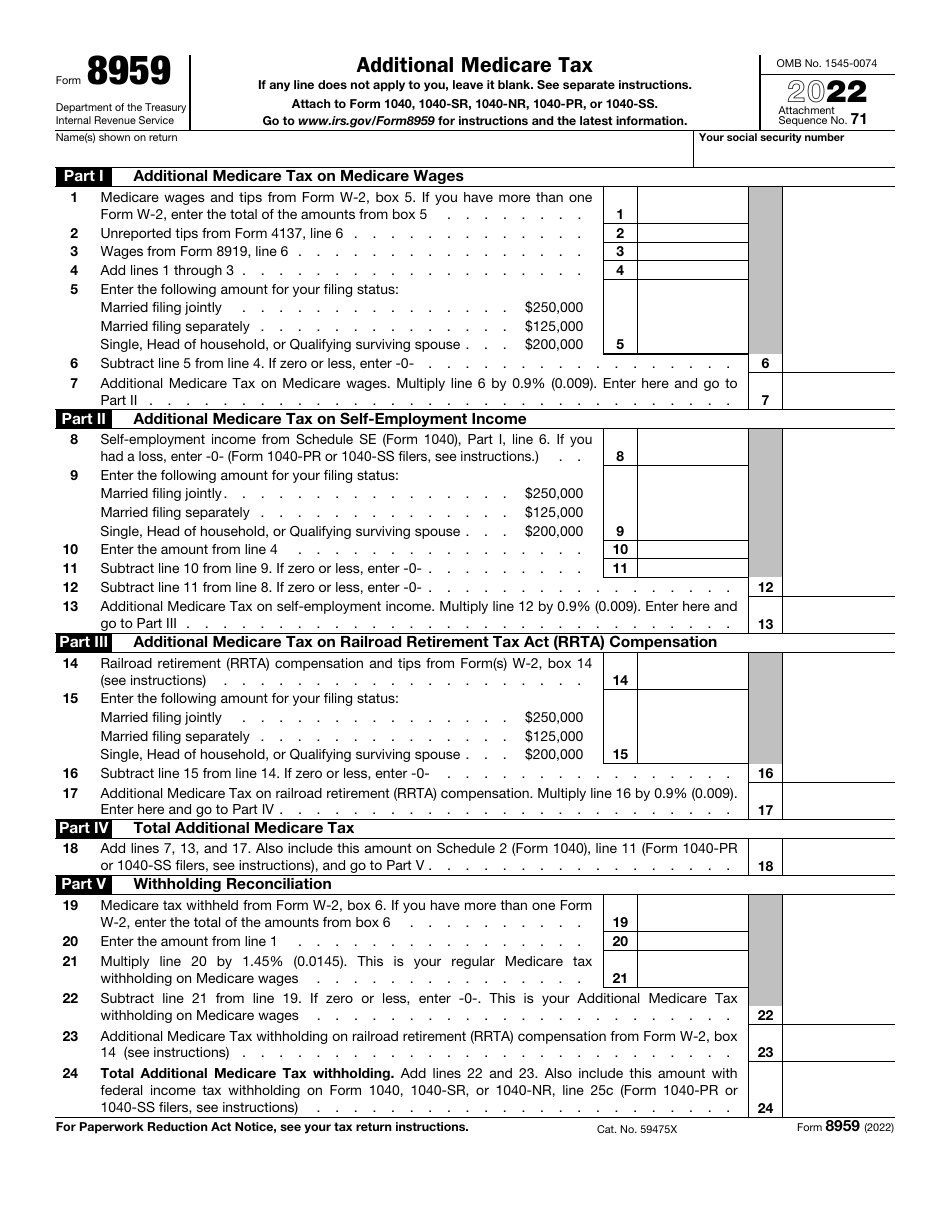

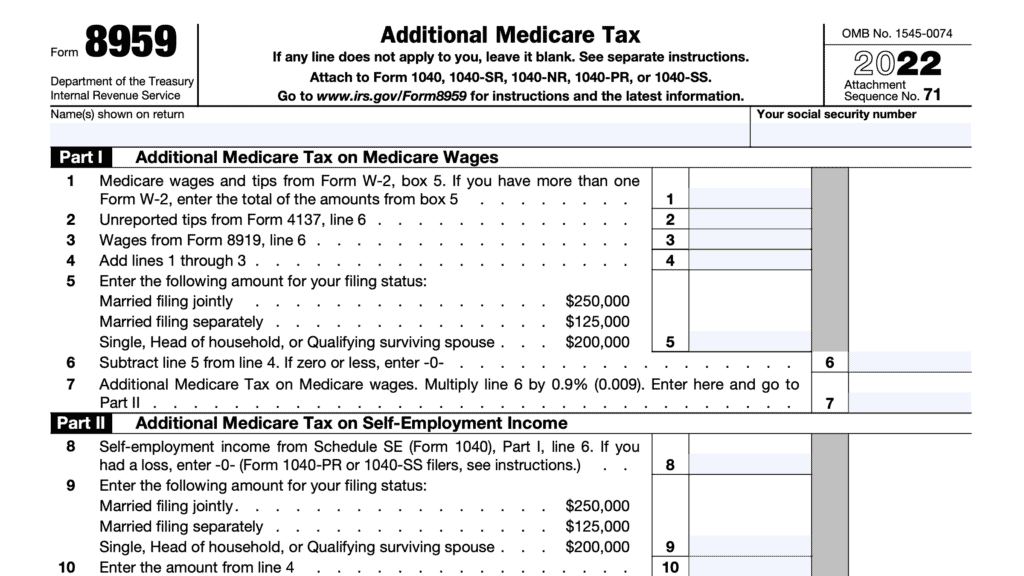

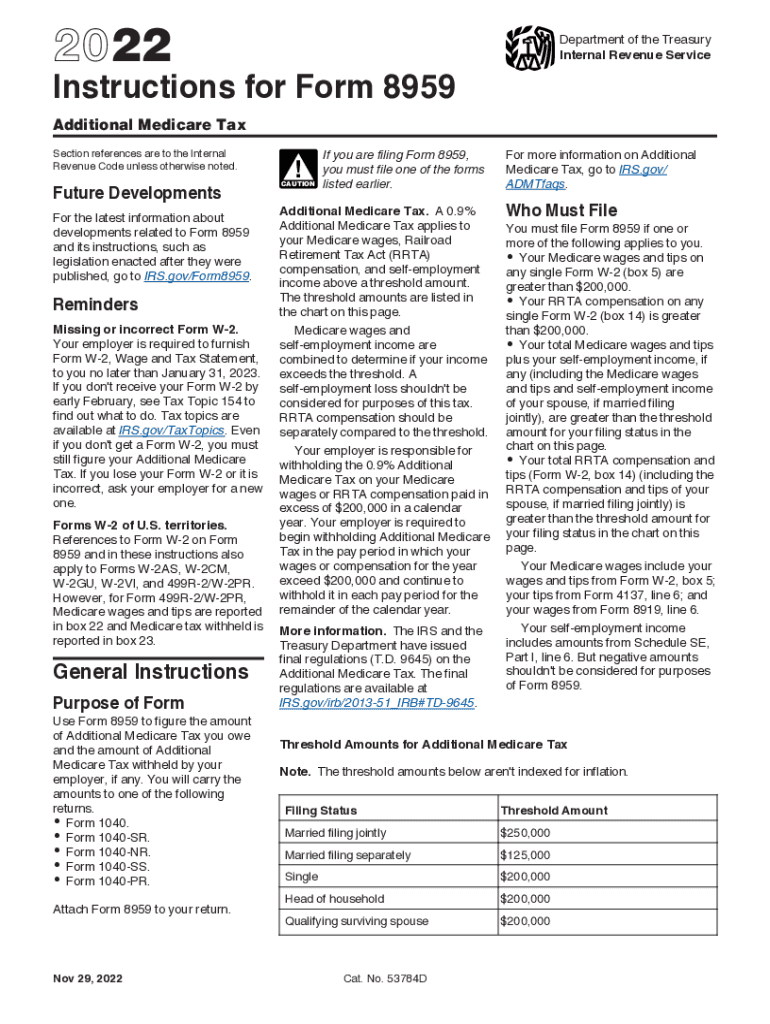

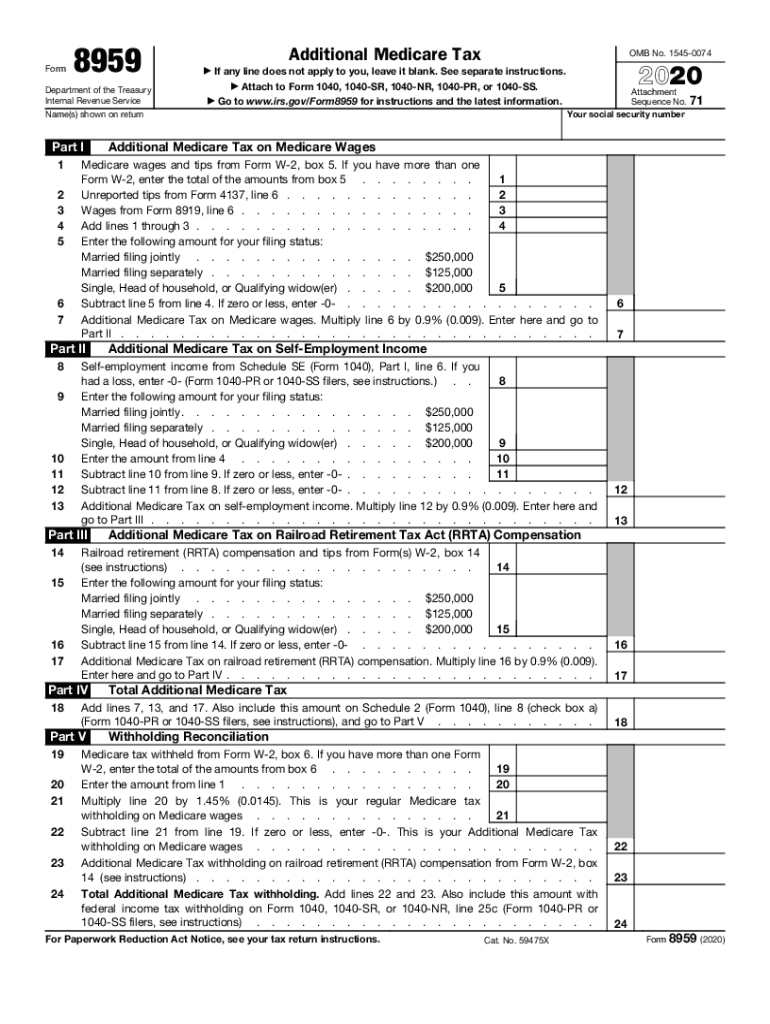

What Is Form 8959 Additional Medicare Tax - Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Parts i, ii, and iii calculate any additional medicare tax. Medicare wages and tips are greater than $200,000. Web this additional tax is reported on form 8959. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Web what is the additional medicare tax? Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Complete, edit or print tax forms instantly. Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts.

Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Web this additional tax is reported on form 8959. Web what is the additional medicare tax? Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has already withheld. Medicare wages and tips are greater than $200,000. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any.

Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Complete, edit or print tax forms instantly. Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has already withheld. The 0.9 percent additional medicare tax applies to. Medicare wages and tips are greater than $200,000. Web you may need to file form 8959 and pay more into medicare if one or more of these stipulations apply to you: Web what is the additional medicare tax?

IRS Form 8959 Download Fillable PDF or Fill Online Additional Medicare

Web what is the additional medicare tax? Medicare wages and tips are greater than $200,000. Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has.

What Is the Form 8959 Additional Medicare Tax for Earners

Web this additional tax is reported on form 8959. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what.

IRS Form 8960 Instructions Guide to Net Investment Tax

Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has already withheld. Medicare wages and tips are greater than $200,000. The 0.9 percent additional medicare tax applies to. Web department of the treasury internal revenue service additional medicare tax if any line does.

2022 Form IRS 8959 Instructions Fill Online, Printable, Fillable

Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web this additional tax is reported on form 8959. The 0.9 percent additional medicare tax applies to. Web this tax is calculated on federal form 8959 additional medicare tax and that form also.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Web you may need to file form 8959 and pay more into medicare if one or more of these stipulations apply to you: Ad register and subscribe now to work on your irs form 8959 & more fillable forms. You will carry the amounts to. Web what is the additional medicare tax? Web department of the treasury internal revenue service.

Form 8959 Fill Out and Sign Printable PDF Template signNow

Medicare wages and tips are greater than $200,000. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. The 0.9 percent additional medicare tax applies to. Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Web irs form 8959, additional medicare.

Form 8959 Additional Medicare Tax (2014) Free Download

Parts i, ii, and iii calculate any additional medicare tax. Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. Medicare wages and tips are greater than $200,000. The 0.9 percent additional medicare tax applies to. Web use form 8959 to figure the amount of additional medicare tax you owe and the.

How to Complete IRS Form 8959 Additional Medicare Tax YouTube

Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Medicare wages and tips are greater than $200,000. Complete, edit or print tax forms instantly..

Form 8959 additional medicare tax Australian instructions Stepby

Parts i, ii, and iii calculate any additional medicare tax. Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has already withheld. Web this additional tax is reported on form 8959. Complete, edit or print tax forms instantly. Web what is the additional.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. The 0.9 percent additional medicare tax applies to. Web what is the additional medicare tax? Web you may need to file form 8959 and pay more into medicare if one or more.

The 0.9 Percent Additional Medicare Tax Applies To.

Web what is the additional medicare tax? Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Complete, edit or print tax forms instantly.

Web This Tax Is Calculated On Federal Form 8959 Additional Medicare Tax And That Form Also Reconciles The Amount Of Tax Owed Against What An Employer Has Already Withheld.

Web this additional tax is reported on form 8959. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. Web you may need to file form 8959 and pay more into medicare if one or more of these stipulations apply to you:

Medicare Wages And Tips Are Greater Than $200,000.

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: Parts i, ii, and iii calculate any additional medicare tax.

You Will Carry The Amounts To.

Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other.