What Is Form 8825

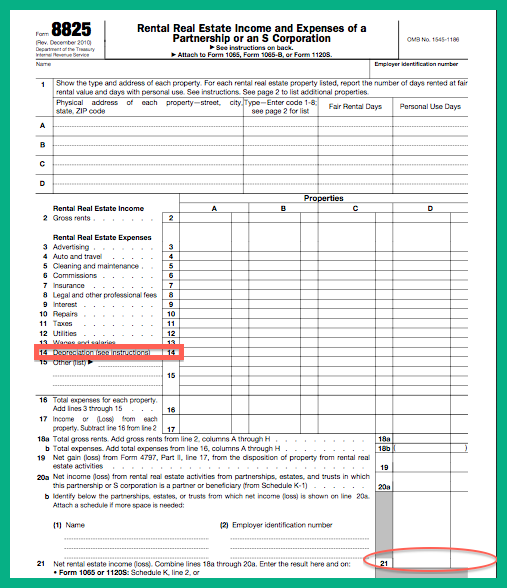

What Is Form 8825 - Web we last updated the rental real estate income and expenses of a partnership or an s corporation in february 2023, so this is the latest version of form 8825, fully. Web w hen the irs issued the latest version of form 8825, rental real estate income and expenses of a partnership or an s corporation, in december 2010, it added three new. Complete, edit or print tax forms instantly. Web what is the form used for? Ad access irs tax forms. The abcd can be used for up to four properties in a single form. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. The 8825 tax form is the rental real estate income and expenses of a partnership or an s corporation. Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter rental number (enter as a negative if not real estate) field located.

Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income. The abcd can be used for up to four properties in a single form. Web what is form 8825? The 8825 tax form is the rental real estate income and expenses of a partnership or an s corporation. Web what is form 8825? Web what is the 8825 tax form for and how do i file it? Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation.

Web what is form 8825? The rent screen is used to enter rental income from sources other than real estate, such as. Web tax line mapping 8825. Ad access irs tax forms. Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web the 8825 screen is used to enter income and expenses from rental real estate. Complete, edit or print tax forms instantly. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web what is form 8825?

Linda Keith CPA » All about the 8825

Web w hen the irs issued the latest version of form 8825, rental real estate income and expenses of a partnership or an s corporation, in december 2010, it added three new. Web what is the form used for? Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s.

Form 8825 Rental Real Estate and Expenses of a Partnership or

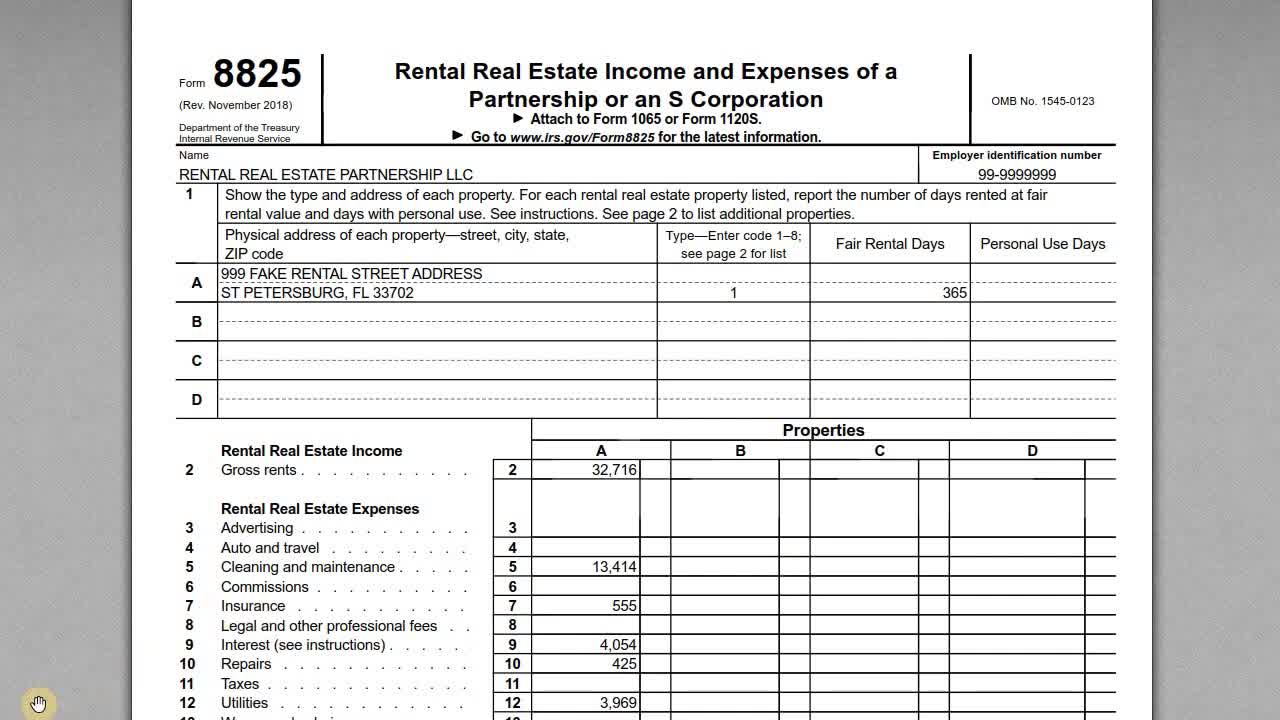

Web w hen the irs issued the latest version of form 8825, rental real estate income and expenses of a partnership or an s corporation, in december 2010, it added three new. Web what is the form used for? The abcd can be used for up to four properties in a single form. Rents form 8825 is matched to partnership.

IRS Form 8825 Other Misc. Expenses Irs forms, Irs, Form

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. The rent screen is used to enter rental income from sources other than real estate, such as. Web form 8825 will generate as blank if a number is entered in the if disposition.

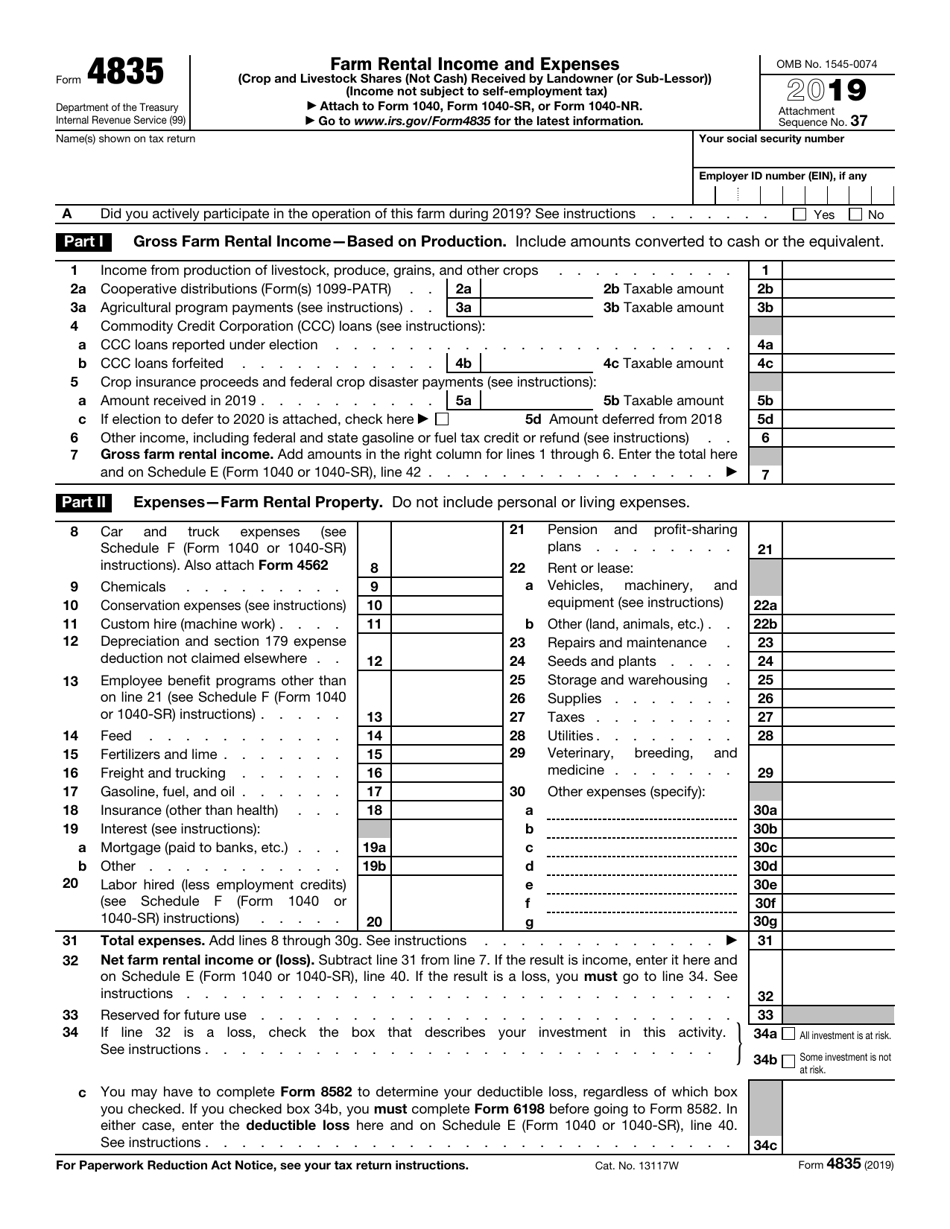

IRS Form 4835 Download Fillable PDF or Fill Online Farm Rental

Web w hen the irs issued the latest version of form 8825, rental real estate income and expenses of a partnership or an s corporation, in december 2010, it added three new. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. The form allows you to.

Form 8825 Rental Real Estate and Expenses of a Partnership or

Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web we last updated the rental real estate income and expenses of a partnership or an s corporation in february 2023, so this is the latest version of form 8825, fully. Web what is the form used for?.

Form 8825 Rental Real Estate and Expenses of a Partnership or

Web what is form 8825? Get ready for tax season deadlines by completing any required tax forms today. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter.

IRS Form 8825 Reporting Rental and Expenses

Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. The abcd can be used for up to four properties in a single form. Web the 8825 screen is used to enter income and expenses from rental real estate. Web we last updated the rental real estate.

Form 8825 Fill Out and Sign Printable PDF Template signNow

Web the 8825 screen is used to enter income and expenses from rental real estate. Complete, edit or print tax forms instantly. Web form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from. Irs form 8825 is a special tax form specifically for reporting.

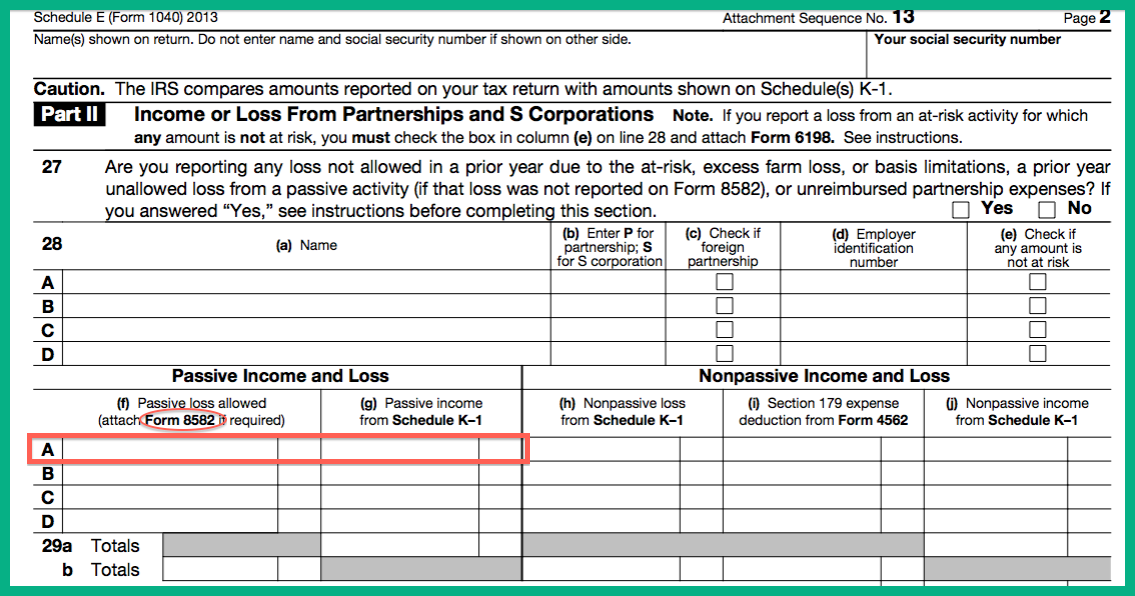

3.11.15 Return of Partnership Internal Revenue Service

Web w hen the irs issued the latest version of form 8825, rental real estate income and expenses of a partnership or an s corporation, in december 2010, it added three new. Web what is the form used for? Web what is form 8825? Web form 8825 to report income and deductible expenses from rental real estate activities, including net.

Linda Keith CPA » All about the 8825

Web what is form 8825? Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter rental number (enter as a negative if not real estate) field located. Rents.

Web What Is Form 8825?

Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Ad download or email irs 8825 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation.

The Form Allows You To Record.

Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web we last updated the rental real estate income and expenses of a partnership or an s corporation in february 2023, so this is the latest version of form 8825, fully. Web the 8825 screen is used to enter income and expenses from rental real estate. Web what is the 8825 tax form for and how do i file it?

Ad Access Irs Tax Forms.

Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income. The abcd can be used for up to four properties in a single form. Complete, edit or print tax forms instantly. Web what is form 8825?

The 8825 Tax Form Is The Rental Real Estate Income And Expenses Of A Partnership Or An S Corporation.

Rents form 8825 is matched to partnership return forms 1065 or 1120. Web what is the form used for? Web form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss).