What Is Form 8821 Used For

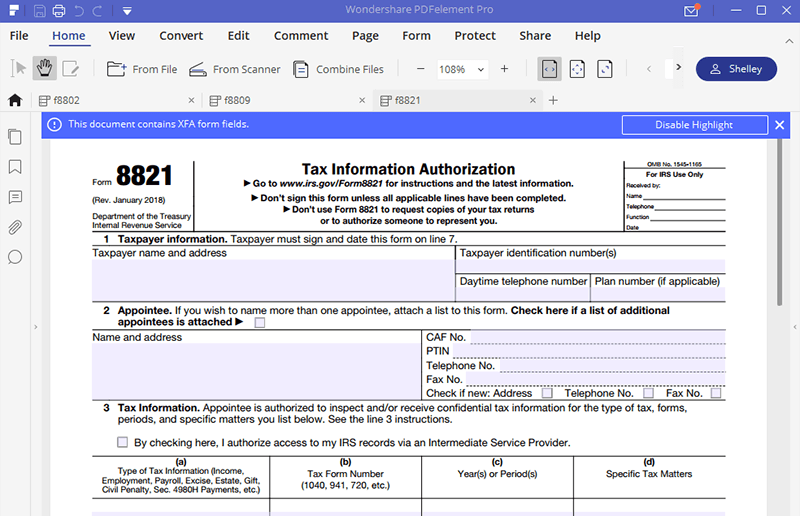

What Is Form 8821 Used For - Web irs form 8821 allows you to share specific tax information with a tax professional of your choice. You may file your own tax information authorization without. Web irs form 8821, tax information authorization , allows the individual, corporation, firm, organization, or partnership that you choose to obtain information about your tax account. If yes then in the process you. Web irs form 8821 is used by taxpayers to allow another individual, irs tax advocate, corporation, firm, or organization to access and receive information about their. Taxpayer name and address taxpayer identification number(s) daytime telephone number plan number. Web if you’re not familiar, the irs form 8821 allows you to choose someone who can receive your tax information for any tax queries needed over a specific time period. Web the form instructions clearly state that form 8821 does not authorize a designee to: Retention/revocation of prior tax information authorizations: Web each form 2848 or 8821 can only cover one taxable entity and the tax or taxes related to that entity

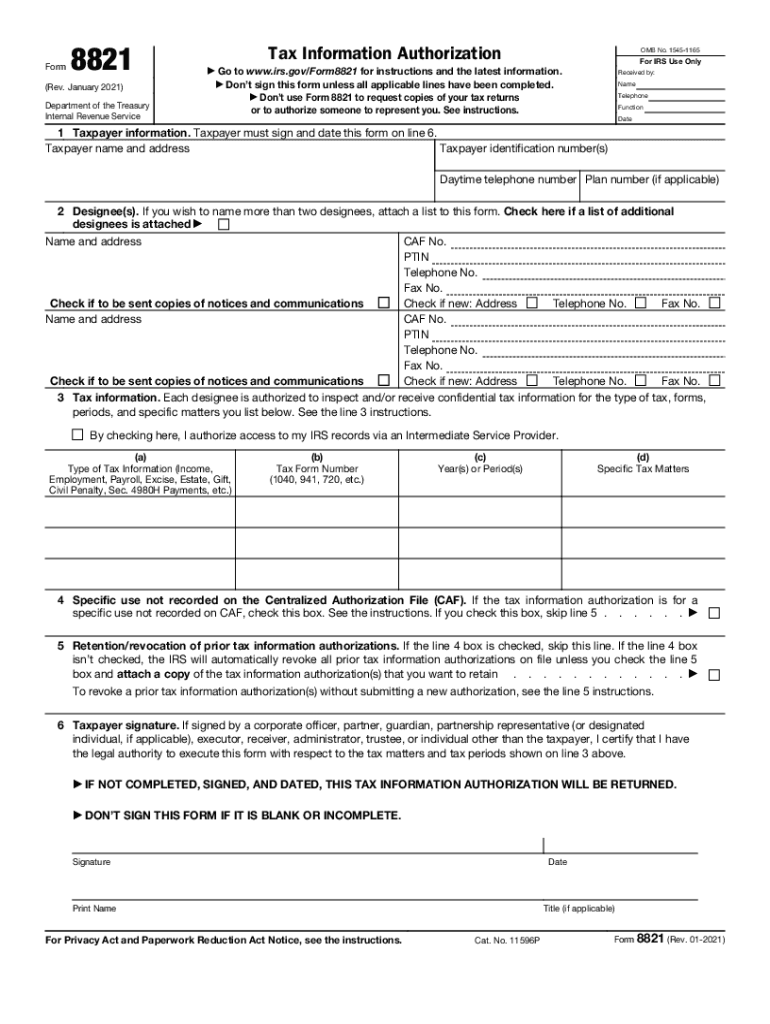

Web (step by step guide) what is & how to fill irs form 8821? Web tax information 4. Web form 8821 is also used to delete or revoke prior tax information authorizations. Web irs form 8821 and 2848 are two forms used by taxpayers to authorize another person to act on their behalf regarding their tax matters. Web form 8821 is also used to delete or revoke prior tax information authorizations. In addition to tax attorneys and cpas, form 8821 may also. Ad get ready for tax season deadlines by completing any required tax forms today. See the instructions for line 5, later. Taxpayer who is in the idle of the tax preparation process? Complete, edit or print tax forms instantly.

Taxpayer must sign and date this form on line 6. Taxpayer name and address taxpayer identification number(s) daytime telephone number plan number. You may file your own tax. Web the form instructions clearly state that form 8821 does not authorize a designee to: Ad get ready for tax season deadlines by completing any required tax forms today. Web each form 2848 or 8821 can only cover one taxable entity and the tax or taxes related to that entity Web form 8821 is also used to delete or revoke prior tax information authorizations. Complete, edit or print tax forms instantly. Web irs form 8821 and 2848 are two forms used by taxpayers to authorize another person to act on their behalf regarding their tax matters. See the instructions for line 5, later.

Quick Tips Filling Out IRS Form 8821 Tax Information Authorization

Web irs form 8821, tax information authorization grants access to an individual, organization, or firm to receive and inspect your confidential tax information. Web irs form 8821, tax information authorization , allows the individual, corporation, firm, organization, or partnership that you choose to obtain information about your tax account. Web the form instructions clearly state that form 8821 does not.

Top 14 Form 8821 Templates free to download in PDF format

If yes then in the process you. Web irs form 8821 allows you to share specific tax information with a tax professional of your choice. You may file your own tax. Web each form 2848 or 8821 can only cover one taxable entity and the tax or taxes related to that entity You may file your own tax information authorization.

Form 8821 IRS Mind

Taxpayer must sign and date this form on line 6. Web the form instructions clearly state that form 8821 does not authorize a designee to: How long does irs take to process 8821?. In addition to tax attorneys and cpas, form 8821 may also. Web form 8821 is a taxpayer’s written authorization designating a third party to receive and view.

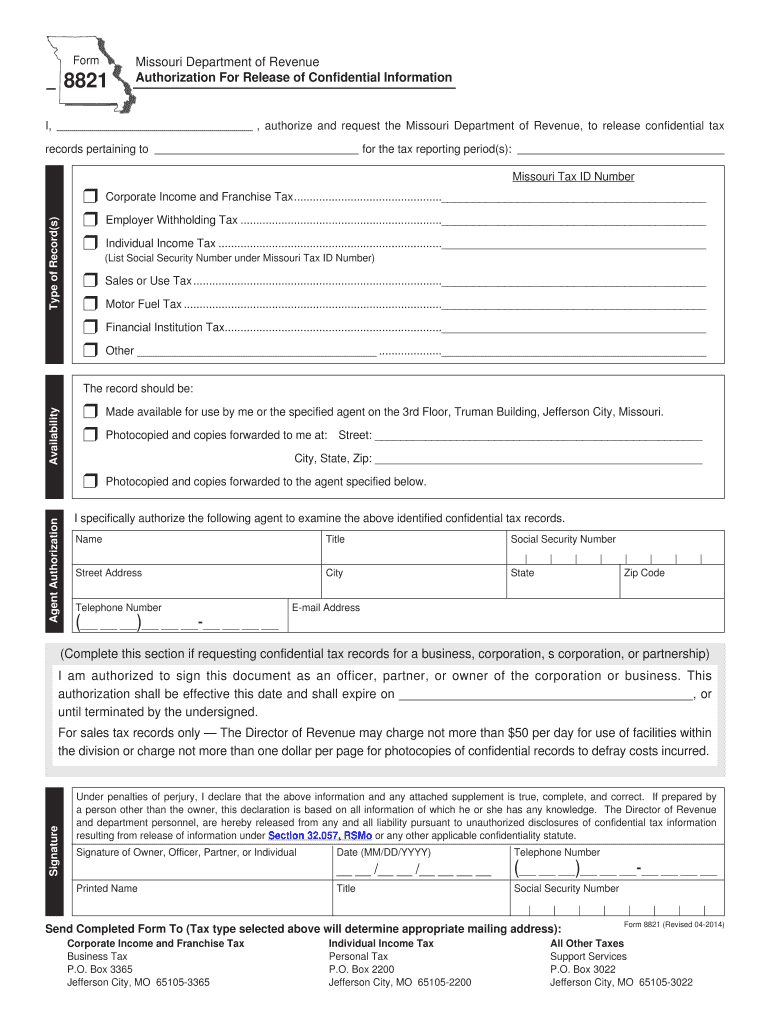

Missouri Form 8821 Authorization for Release of Confidential

See the instructions for line 5, later. You may file your own tax information authorization without. See the instructions for line 5, later. Web the form instructions clearly state that form 8821 does not authorize a designee to: Specific use not recorded on caf 5.

Fill Free fillable form 8821 tax information authorization PDF form

Taxpayer must sign and date this form on line 6. Ad download or email irs 8821 & more fillable forms, register and subscribe now! Web (step by step guide) what is & how to fill irs form 8821? Web irs form 8821, tax information authorization grants access to an individual, organization, or firm to receive and inspect your confidential tax.

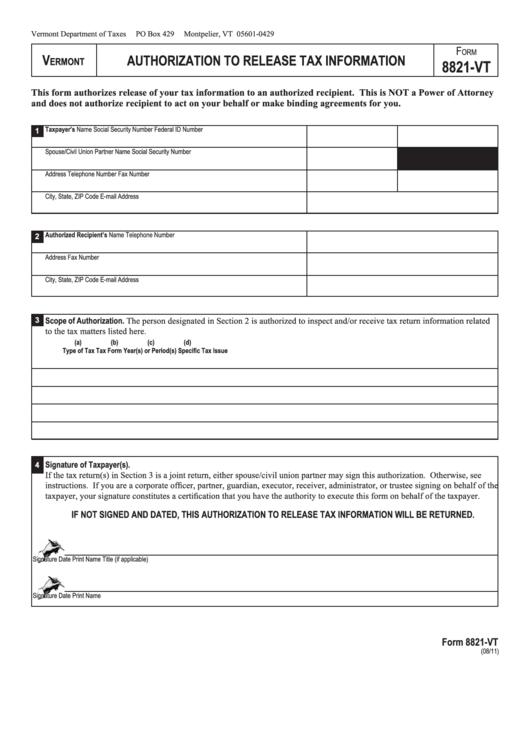

Form 8821Vt Authorization To Release Tax Information 2011

You may file your own tax. Web irs form 8821, tax information authorization grants access to an individual, organization, or firm to receive and inspect your confidential tax information. Taxpayer must sign and date this form on line 6. Taxpayer name and address taxpayer identification number(s) daytime telephone number plan number. Web form 8821 is a taxpayer’s written authorization designating.

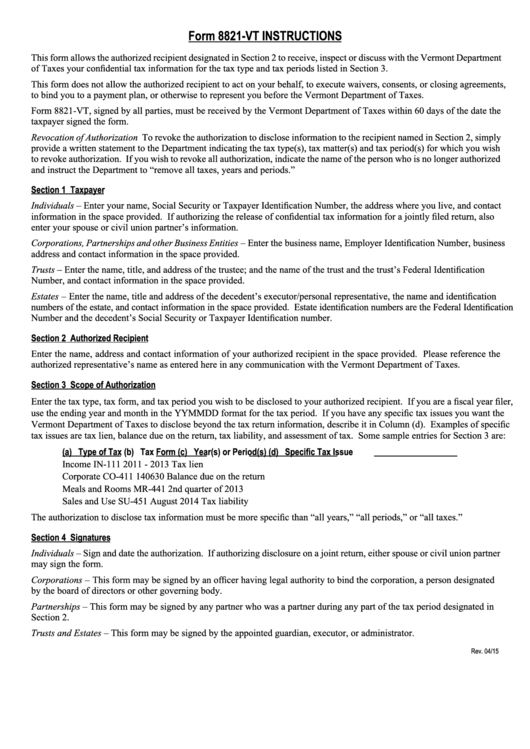

Download Instructions for IRS Form 8821 Tax Information Authorization

If yes then in the process you. Web irs form 8821, tax information authorization grants access to an individual, organization, or firm to receive and inspect your confidential tax information. The form is similar to a. Specific use not recorded on caf 5. Web (step by step guide) what is & how to fill irs form 8821?

Form 8821 Fill Out and Sign Printable PDF Template signNow

Taxpayer who is in the idle of the tax preparation process? See the instructions for line 5, later. Web irs form 8821 is used by taxpayers to allow another individual, irs tax advocate, corporation, firm, or organization to access and receive information about their. How long does irs take to process 8821?. Web irs form 8821, tax information authorization grants.

IRS Form 8821 Fill it out with the Best Program

3 years ago are you a u.s. Web (step by step guide) what is & how to fill irs form 8821? January 2021) tax information authorization department of the treasury internal revenue service go to www.irs.gov/form8821 for instructions and the latest. Web if you’re not familiar, the irs form 8821 allows you to choose someone who can receive your tax.

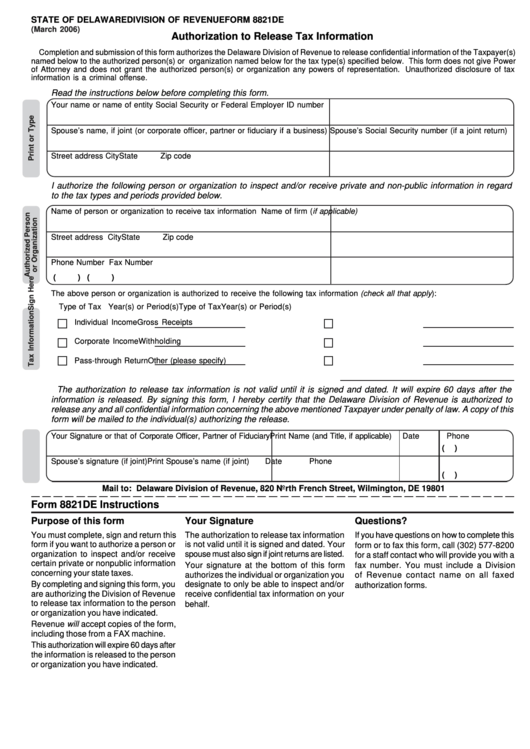

Fillable Form 8821de Authorization To Release Tax Information

Web irs form 8821 allows you to share specific tax information with a tax professional of your choice. You may file your own tax. Web (step by step guide) what is & how to fill irs form 8821? Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today.

Web Irs Form 8821 Is Used By Taxpayers To Allow Another Individual, Irs Tax Advocate, Corporation, Firm, Or Organization To Access And Receive Information About Their.

3 years ago are you a u.s. If yes then in the process you. Taxpayer must sign and date this form on line 6. Web (step by step guide) what is & how to fill irs form 8821?

Complete, Edit Or Print Tax Forms Instantly.

See the instructions for line 5, later. You may file your own tax information authorization without. You may file your own tax. How long does irs take to process 8821?.

The Form Is Similar To A.

Web the form instructions clearly state that form 8821 does not authorize a designee to: Web each form 2848 or 8821 can only cover one taxable entity and the tax or taxes related to that entity January 2021) tax information authorization department of the treasury internal revenue service go to www.irs.gov/form8821 for instructions and the latest. In addition to tax attorneys and cpas, form 8821 may also.

Web Form 8821 Is A Taxpayer’s Written Authorization Designating A Third Party To Receive And View The Taxpayer’s Information.

To execute a request to allow disclosure of return or. Specific use not recorded on caf 5. Web form 8821 is also used to delete or revoke prior tax information authorizations. Web if you’re not familiar, the irs form 8821 allows you to choose someone who can receive your tax information for any tax queries needed over a specific time period.