What Is Form 590

What Is Form 590 - Trip.dhs.gov an official website of the. Other names used (if any); Thewithholding agent will then be relieved of. The withholding agent keeps this form with their records. Web the partnership or llc will file a california tax return. Family name (last name) given name (first name) middle name (if applicable) 2. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. California residents or entities should complete and present form 590 to the. An ira is a personal savings plan that gives you tax advantages for setting aside money. Web use form 590, withholding exemption certificate.

Web you can download a copy of the dhs form 590 from the menu options for your representative to enclose with your application. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web withholding exemption certificate (form 590) submit form 590 to your withholding agent; Web 590 the payee completes this form and submits it to the withholding agent. Trip.dhs.gov an official website of the. Web dhs form 590 (8/11) page 1 of 1. The withholding agent keeps this form with their records. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. Other names used (if any); Web dhs form 590 (8/11) page 1 of 1.

Web use form 590, withholding exemption certificate. Web dhs form 590 (8/11) page 1 of 1. If the partnership or llc ceases to do any of the above, i will promptly inform the withholding agent. Web more about the california form 590 individual income tax ty 2022. By checking the appropriate box below, the payee certifies the reason for the exemption from the. Web dhs form 590 (8/11) page 1 of 1. An ira is a personal savings plan that gives you tax advantages for setting aside money. California residents or entities should complete and present form 590 to the. Web 590 the payee completes this form and submits it to the withholding agent. Trip.dhs.gov an official website of the.

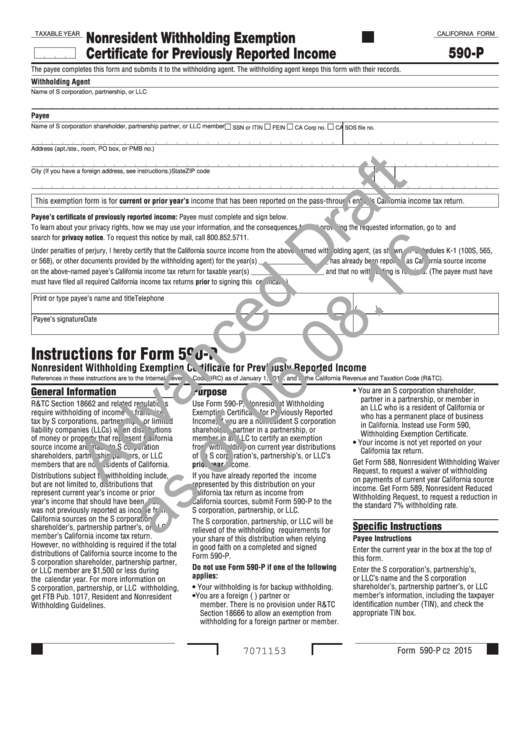

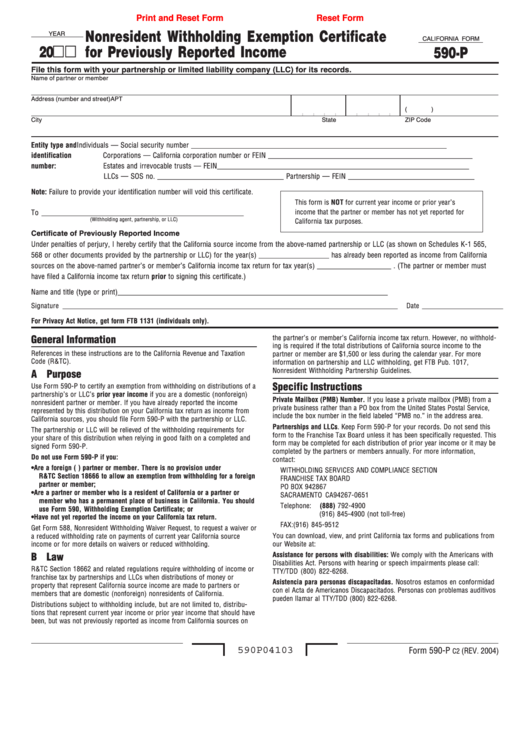

California Form 590P Draft Nonresident Withholding Exemption

Authorization to release information to another person. Web dhs form 590 (8/11) page 1 of 1. Use this form to certify exemption from withholding; The payee is a corporation, partnership, or limited liability company (llc) that has a permanent place of business in california or. Thewithholding agent will then be relieved of.

2016 Form 590 Withholding Exemption Certificate Edit, Fill, Sign

Withholding agent information name payee. Authorization to release information to another person. An ira is a personal savings plan that gives you tax advantages for setting aside money. Family name (last name) given name (first name) middle name (if applicable) 2. Web more about the california form 590 individual income tax ty 2022.

Fill Free fillable I590 Form I590, Registration for Classification

An ira is a personal savings plan that gives you tax advantages for setting aside money. If the partnership or llc ceases to do any of the above, i will promptly inform the withholding agent. 14, 2022, solely on the basis that evidence of an informal marriage was insufficient to. The withholding agent keeps this form with their records. Web.

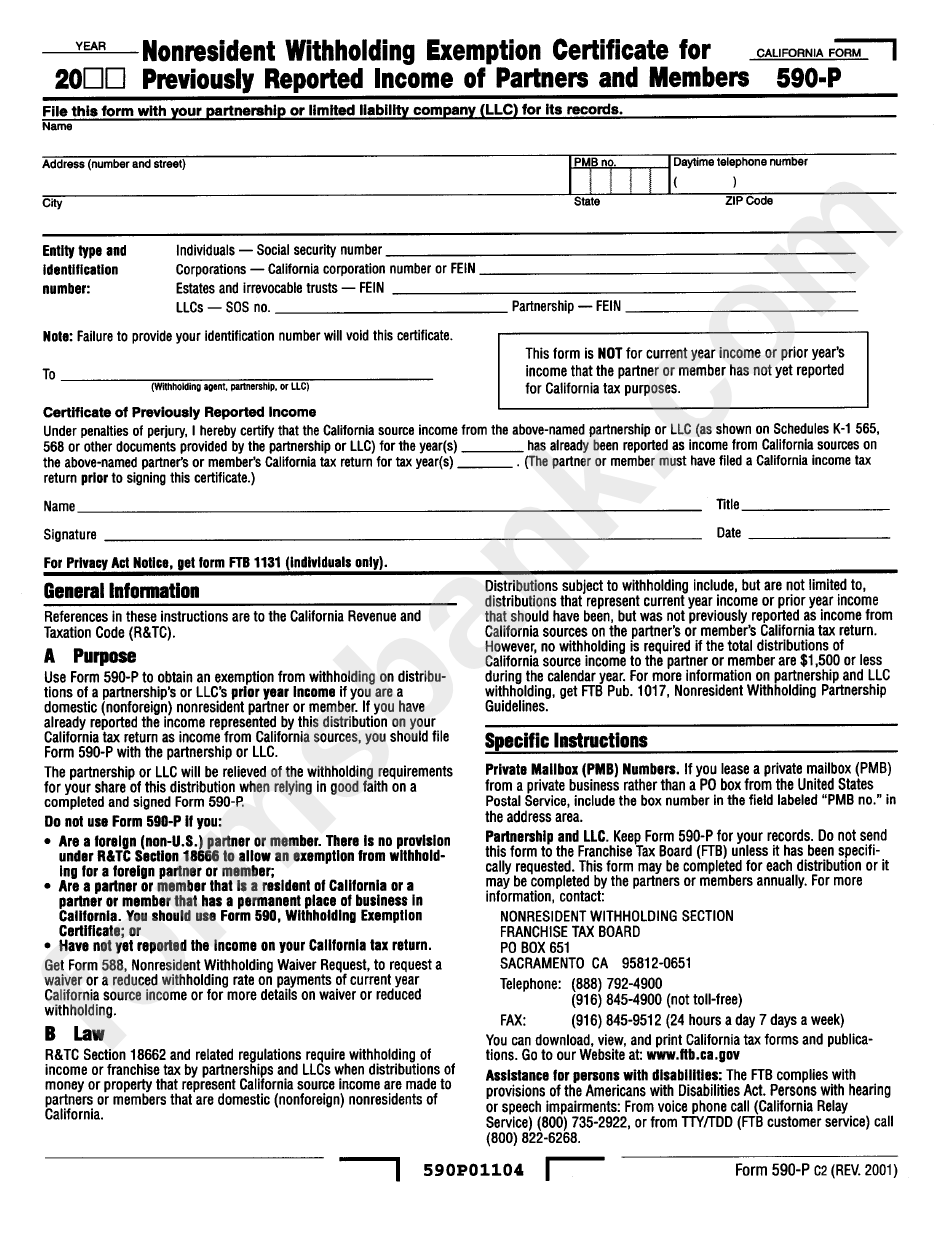

Form 590P Nonresident Withholding Exemption Certificate For

An ira is a personal savings plan that gives you tax advantages for setting aside money. Family name (last name) given name (first name) middle name (if applicable) 2. Web the partnership or llc will file a california tax return. Other names used (if any); Authorization to release information to another person.

Fillable California Form 590P Nonresident Witholding Exemption

By checking the appropriate box below, the payee certifies the reason for the exemption from the. Web dhs form 590 (8/11) page 1 of 1. Include maiden name, names by previous marriages, and all. An ira is a personal savings plan that gives you tax advantages for setting aside money. An ira is a personal savings plan that gives you.

Canvas DHS Form 590, Authorization to Release Information to Another

Authorization to release information to another person. Thewithholding agent will then be relieved of. Trip.dhs.gov an official website of the. Withholding agent information name payee. If the partnership or llc ceases to do any of the above, i will promptly inform the withholding agent.

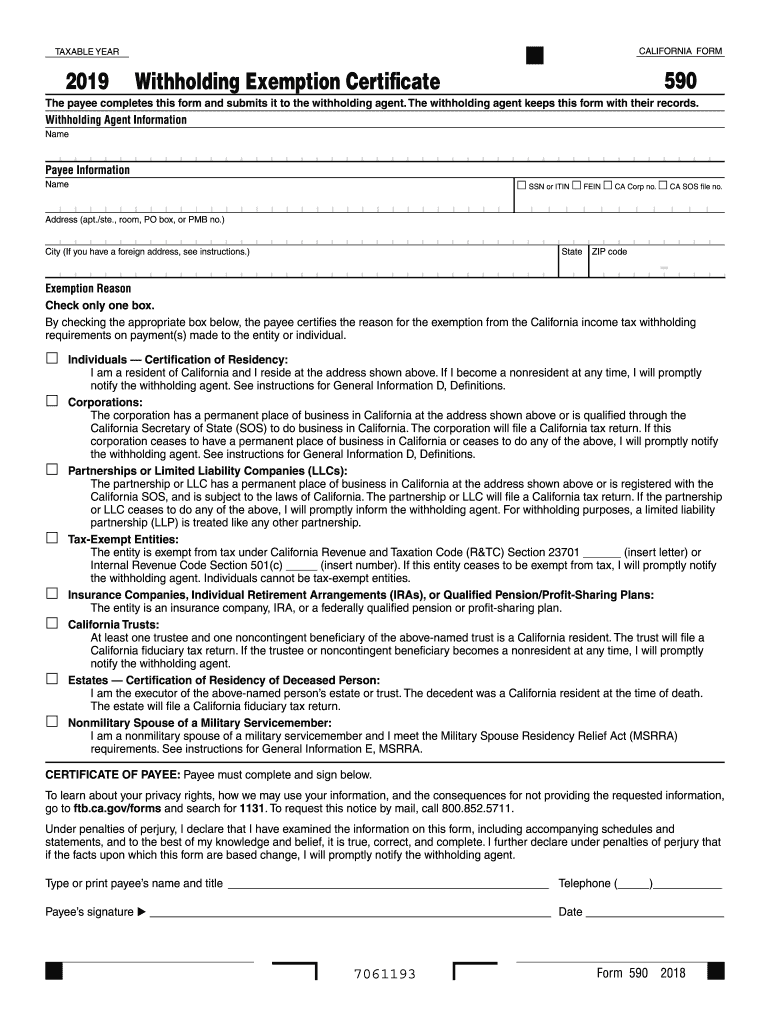

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

Web form 590, general information e, for the definition of permanent place of business. The payee is a corporation, partnership, or limited liability company (llc) that has a permanent place of business in california or. The withholding agent keeps this form with their records. Web dhs form 590 (8/11) page 1 of 1. The payee is a corporation, partnership, or.

2010 Form USCIS I590 Fill Online, Printable, Fillable, Blank pdfFiller

Use this form to certify exemption from withholding; 14, 2022, solely on the basis that evidence of an informal marriage was insufficient to. Web form 590, general information e, for the definition of permanent place of business. Web you can download a copy of the dhs form 590 from the menu options for your representative to enclose with your application..

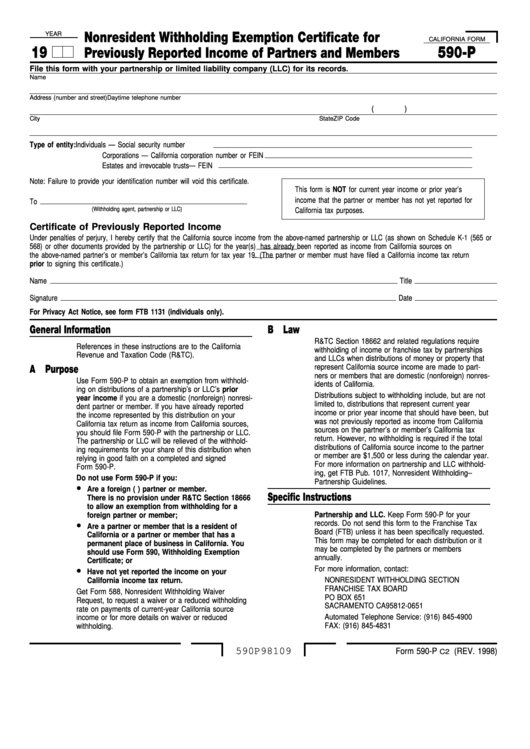

Fillable California Form 590P Nonresident Withholding Exemption

Web withholding exemption certificate (form 590) submit form 590 to your withholding agent; Withholding agent information name payee. Web use form 590, withholding exemption certificate. Web the partnership or llc will file a california tax return. By checking the appropriate box below, the payee certifies the reason for the exemption from the.

20182022 Form USCIS I590 Fill Online, Printable, Fillable, Blank

Web dhs form 590 (8/11) page 1 of 1. By checking the appropriate box below, the payee certifies the reason for the exemption from the. Trip.dhs.gov an official website of the. Family name (last name) given name (first name) middle name (if applicable) 2. Web 590 the payee completes this form and submits it to the withholding agent.

An Ira Is A Personal Savings Plan That Gives You Tax Advantages For Setting Aside Money.

California residents or entities should complete and present form 590 to the. 14, 2022, solely on the basis that evidence of an informal marriage was insufficient to. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Family name (last name) given name (first name) middle name (if applicable) 2.

Withholding Agent Information Name Payee.

Web form 590, general information e, for the definition of permanent place of business. Complete and presentform 590 to the withholding agent. The payee is a corporation, partnership, or limited liability company (llc) that has a permanent place of business in california or. Web you can download a copy of the dhs form 590 from the menu options for your representative to enclose with your application.

Other Names Used (If Any);

Web the partnership or llc will file a california tax return. Web 590 the payee completes this form and submits it to the withholding agent. Web dhs form 590 (8/11) page 1 of 1. Trip.dhs.gov an official website of the.

Include Maiden Name, Names By Previous Marriages, And All.

Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. An ira is a personal savings plan that gives you tax advantages for setting aside money. Authorization to release information to another person. Web dhs form 590 (8/11) page 1 of 1.