What Is 1042 Form

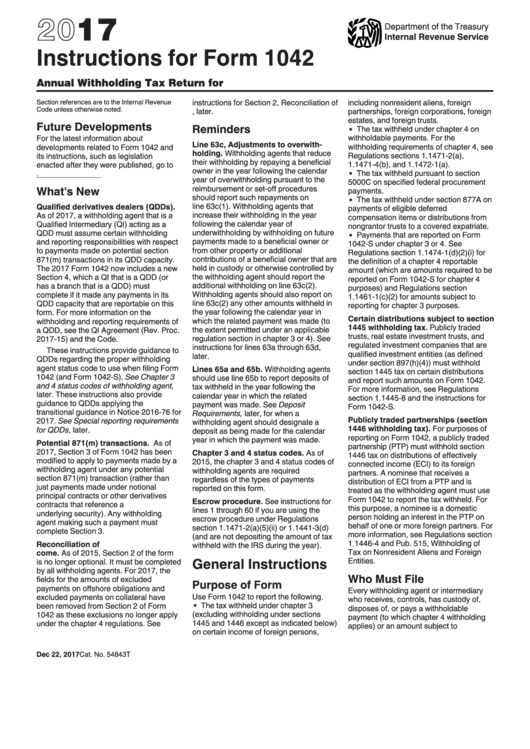

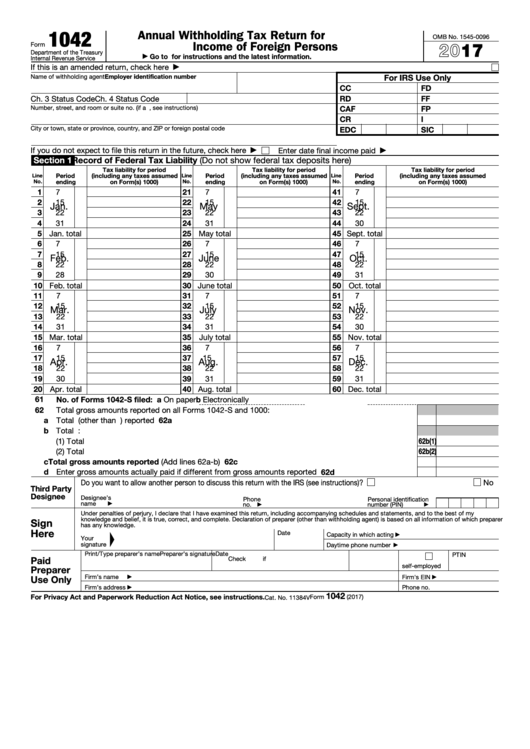

What Is 1042 Form - Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions for the application for automatic extension of time to file certain business income tax, information and other returns. Get federal tax return forms and file by mail. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Who it’s for & how to fill it out us businesses that work with noncitizens or foreign entities may need to file form 1042, an annual withholding tax return furnished by the internal revenue service (irs). Persons 4 who make fdap payments to those foreign persons noted above are required to file form 1042, annual withholding tax return for u.s. This shows the income you earned for the previous year and the taxes withheld from those earnings. Source income of foreign persons. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign.

Web form 1042 — annual withholding tax return for u.s. Web about form 1042, annual withholding tax return for u.s. Tax on income from u.s. Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a united states based institution or business. Source income of foreign persons. This includes payments for rent, prizes & awards, medical & health. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Really flows off the tongue, right? Every withholding agent or intermediary that receives, controls, has custody of, disposes of, or pays a with holdable payment must file an annual return for the preceding calendar year on form 1042.

Web form 1042, also annual withholding tax return for u.s. Web the 1042 form reports tax withheld on certain income paid to foreign persons, such as nonresident aliens, [foreign] partnerships, corporations, estates, and trusts. Persons 4 who make fdap payments to those foreign persons noted above are required to file form 1042, annual withholding tax return for u.s. Web about form 1042, annual withholding tax return for u.s. Potential liabilities in relevant part, sec. Who it’s for & how to fill it out us businesses that work with noncitizens or foreign entities may need to file form 1042, an annual withholding tax return furnished by the internal revenue service (irs). A 1042 is required even if no tax was withheld. March 10, 2022 last updated: Web use form 1042, annual withholding tax return for u.s. Source income subject to withholding, is used for this purpose.

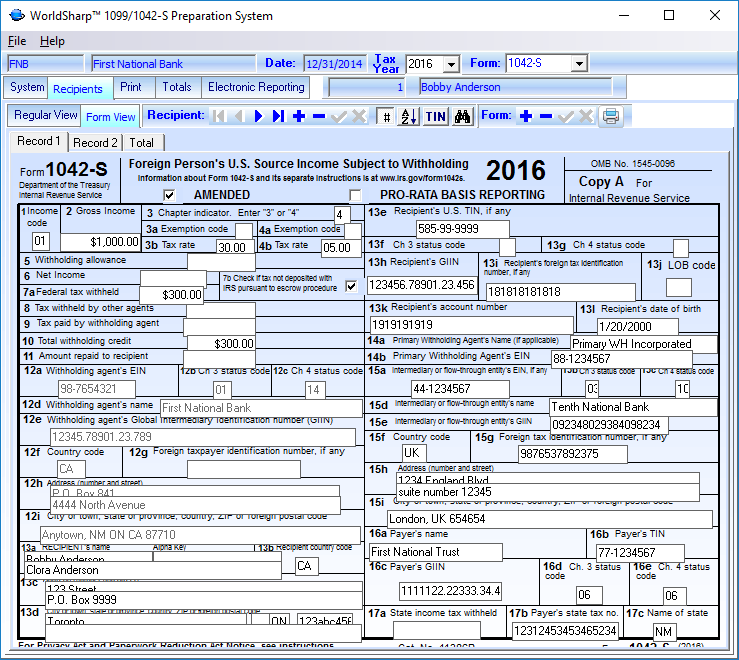

1042 S Form slideshare

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Reporting & withholding for foreign contractors published: Web use form 1042, annual withholding tax return for u.s. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. March 10, 2022 last updated:

Form 1042 Alchetron, The Free Social Encyclopedia

The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign. Web use form 1042, annual withholding tax return for u.s. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web of course, the form 1042 instructions, publication 515 which explains the withholding.

2018 2019 IRS Form 1042 Fill Out Digital PDF Sample

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. The tax withheld under chapter 3 on certain income.

Form Instruction 1042S Fill Online, Printable, Fillable Blank form

Web use form 1042, annual withholding tax return for u.s. Potential liabilities in relevant part, sec. Reporting & withholding for foreign contractors published: Web about form 1042, annual withholding tax return for u.s. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s.

Top 12 Form 1042 Templates free to download in PDF format

Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Get federal tax return forms and file by mail. Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a united states based institution or business. Source income subject to withholding, to the internal revenue.

1042 S Form slideshare

Source income subject to withholding, is used for this purpose. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web form 1042, also annual withholding tax return for u.s. International law can make reporting compensation for foreign employees complicated. Reporting & withholding for foreign contractors published:

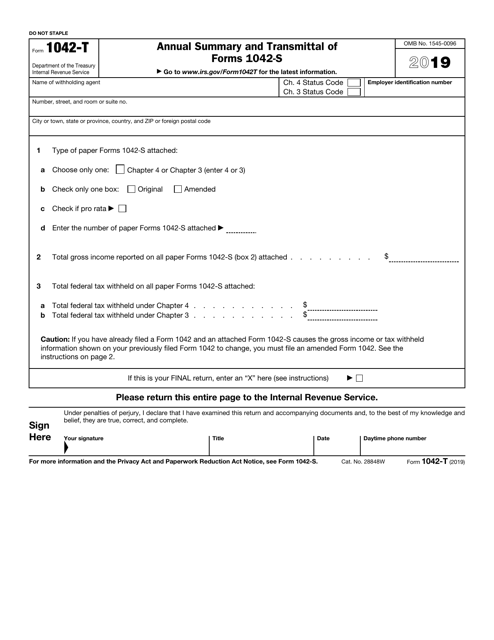

Form 1042T Annual Summary and Transmittal of Forms 1042S (2015

Tax on income from u.s. Reporting & withholding for foreign contractors published: Tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts; Source income of foreign persons, to report: Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to.

IRS Form 1042T Download Fillable PDF or Fill Online Annual Summary and

Tax on income from u.s. Web form 1042 — annual withholding tax return for u.s. Who it’s for & how to fill it out us businesses that work with noncitizens or foreign entities may need to file form 1042, an annual withholding tax return furnished by the internal revenue service (irs). This shows the income you earned for the previous.

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. This shows the income you earned for the previous year and the taxes withheld from those earnings. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web form 1042, also annual withholding tax return for u.s. 1461.

Fillable Form 1042 Annual Withholding Tax Return For U.s. Source

Web form 1042 — annual withholding tax return for u.s. March 10, 2022 last updated: Its official name is ‘the foreign person’s us source income subject to withholding’. Web the 1042 form reports tax withheld on certain income paid to foreign persons, such as nonresident aliens, [foreign] partnerships, corporations, estates, and trusts. If this is an amended return, check here.

Web Form 1042 — Annual Withholding Tax Return For U.s.

Web use form 1042, annual withholding tax return for u.s. Persons 4 who make fdap payments to those foreign persons noted above are required to file form 1042, annual withholding tax return for u.s. Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a united states based institution or business. If this is an amended return, check here.

Potential Liabilities In Relevant Part, Sec.

Web form 1042, also annual withholding tax return for u.s. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Get federal tax return forms and file by mail. Source income of foreign persons, to report:

Web About Form 1042, Annual Withholding Tax Return For U.s.

Tax on income from u.s. Source income subject to withholding, to the internal revenue service. This shows the income you earned for the previous year and the taxes withheld from those earnings. A withholding agent must ensure that all required fields are completed.

1461 Provides That Every Person Required To Deduct And Withhold Any Tax Under.

Reporting & withholding for foreign contractors published: This includes payments for rent, prizes & awards, medical & health. Source income of foreign persons. The employer only needs to submit form 1042 to the irs, not to their employee.