Weak Form Efficient Market Hypothesis

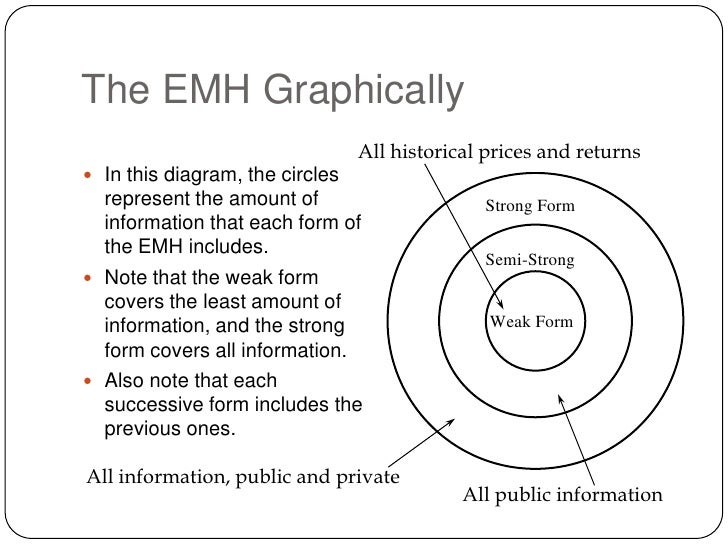

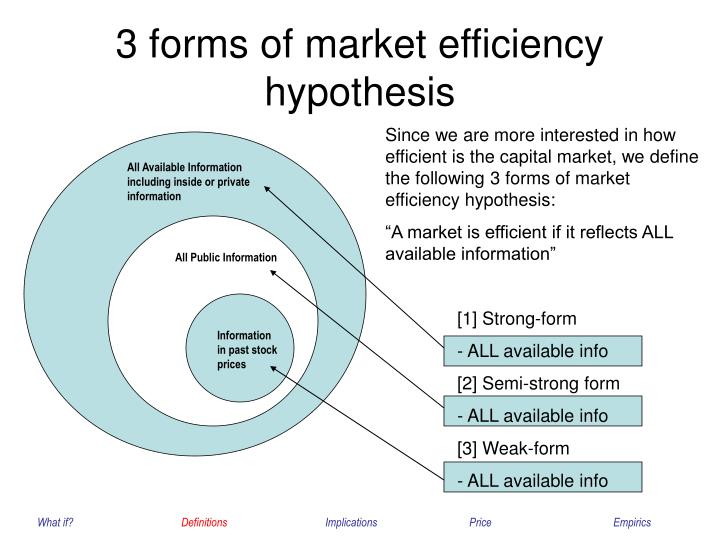

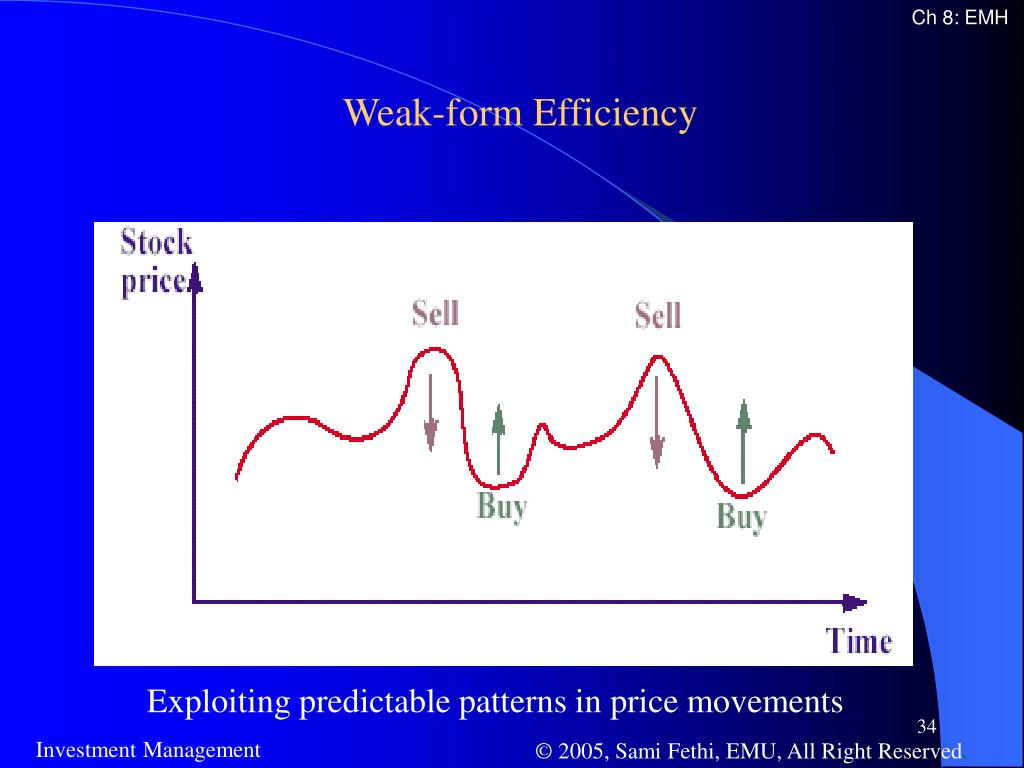

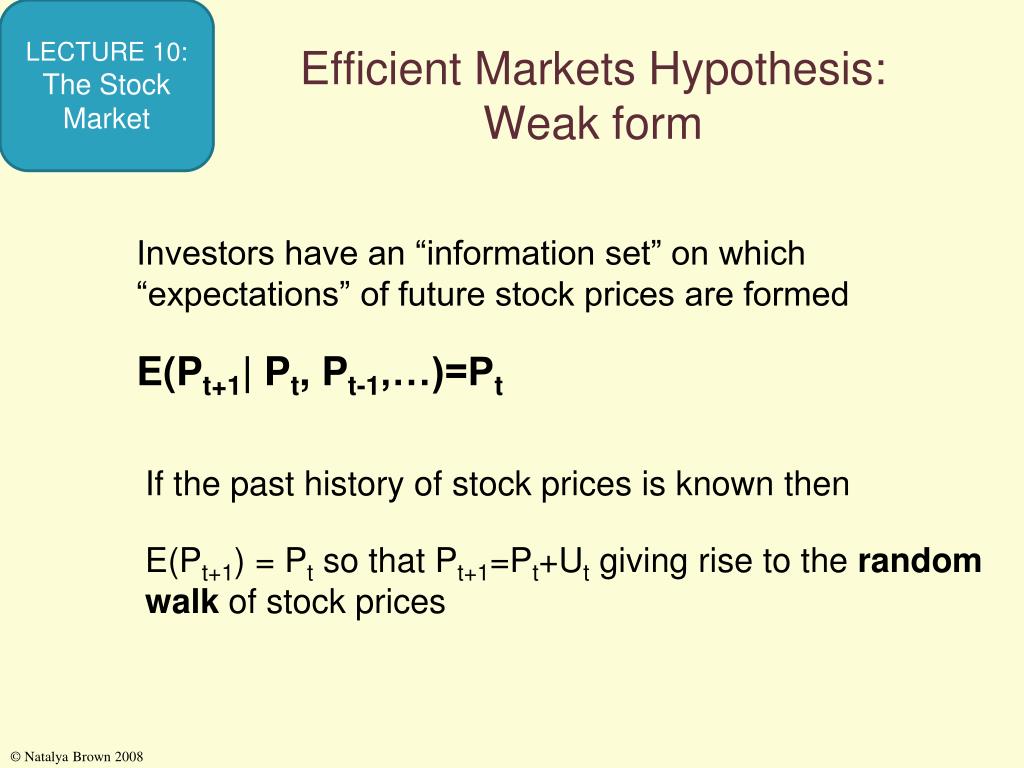

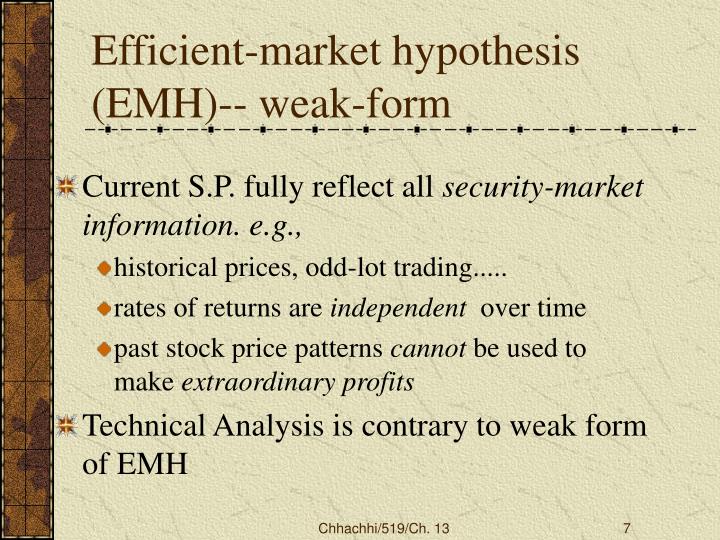

Weak Form Efficient Market Hypothesis - Web the hypothesis of financial market efficiency is an analytical approach aimed at explaining movements in prices of financial assets over time and is based on the insight that prices for such assets are determined by the rational behaviour of agents interacting in the market. Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess profits by investing since everything is already fairly and accurately priced. Web what is weak form market efficiency? Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Here's what each says about the market. Web the efficient market hypothesis says that the market exists in three types, or forms: The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Weak form emh suggests that all past information is priced into securities. Weak form efficiency states that stock prices reflect all current information. Web there are three forms of emh:

Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: Weak form emh suggests that all past information is priced into securities. Web there are three forms of emh: The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Here's a little more about each: Web the hypothesis of financial market efficiency is an analytical approach aimed at explaining movements in prices of financial assets over time and is based on the insight that prices for such assets are determined by the rational behaviour of agents interacting in the market. Here's what each says about the market. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web what is weak form market efficiency? Weak form efficiency states that stock prices reflect all current information.

The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: Web there are three forms of emh: Here's a little more about each: Weak form emh suggests that all past information is priced into securities. Weak form efficiency states that stock prices reflect all current information. Web the efficient market hypothesis says that the market exists in three types, or forms: Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web weak form efficiency is an element of efficient market hypothesis.

Efficient market hypothesis

Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. Web the efficient market hypothesis says that the market exists in three types, or forms: Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess profits by investing since everything is already fairly and.

Efficient market hypothesis

Weak form emh suggests that all past information is priced into securities. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Weak form efficiency states that stock prices reflect all current information. Here's what each says about the market. Web the hypothesis of financial market efficiency is an.

PPT Capital Market Efficiency The concepts PowerPoint Presentation

Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web weak form efficiency is an element of efficient market hypothesis. Web the efficient market hypothesis says that the market exists in three types, or forms: The efficient market hypothesis concerns the extent to which outside information has an effect upon the.

PPT The Efficient Market Hypothesis PowerPoint Presentation, free

Web what is weak form market efficiency? The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web weak form efficiency is an element of efficient market hypothesis. Here's a little more about each: Fundamental analysis of securities can provide you with information to produce returns above market averages.

Efficient Market Hypothesis презентация онлайн

Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. Web what is weak form market efficiency? Weak form efficiency states that stock prices reflect all current information. Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess profits by investing since everything is.

PPT The Stock Market and Stock Prices PowerPoint Presentation, free

Web what is weak form market efficiency? Weak form efficiency states that stock prices reflect all current information. Web there are three forms of emh: Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: Fundamental analysis of securities can provide you with information to.

Weak form efficiency indian stock markets make money with meghan system

Web there are three forms of emh: Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Here's what each says about the market. Web weak form efficiency is an element of efficient market hypothesis. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market.

What is the Efficient Market Hypothesis (EMH)? IG NO

Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Weak form emh suggests that all past information is priced into securities. Web what is weak form market efficiency? Web there are three forms of emh: Here's what each says about the market.

WeakForm Efficient Market Hypothesis, 9783659378195, 3659378194

Weak form efficiency states that stock prices reflect all current information. Weak form emh suggests that all past information is priced into securities. Here's a little more about each: Web what is weak form market efficiency? Web there are three forms of emh:

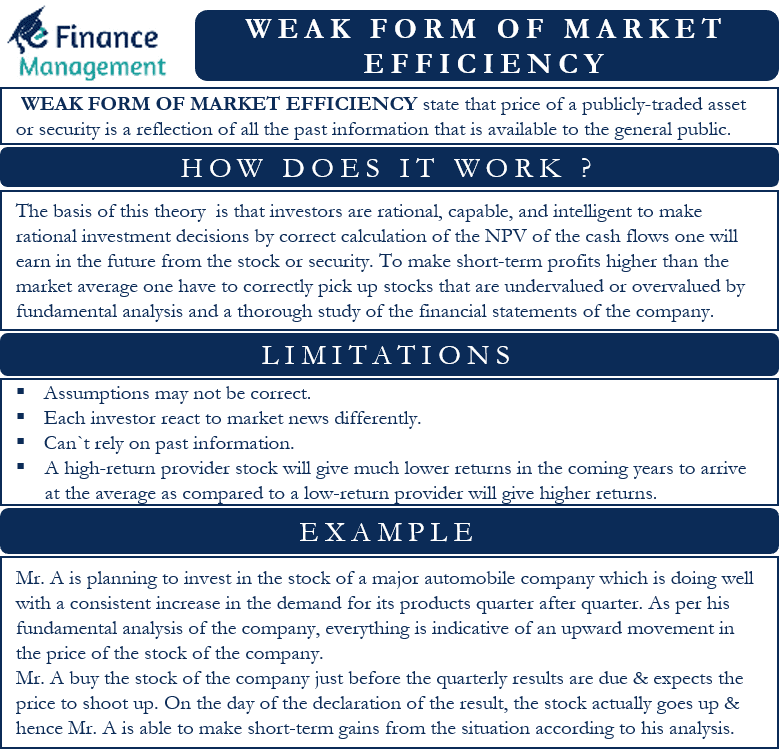

Weak Form of Market Efficiency Meaning, Usage, Limitations

Web the hypothesis of financial market efficiency is an analytical approach aimed at explaining movements in prices of financial assets over time and is based on the insight that prices for such assets are determined by the rational behaviour of agents interacting in the market. Web what is weak form market efficiency? Weak form market efficiency, also known as he.

Weak Form Efficiency States That Stock Prices Reflect All Current Information.

Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess profits by investing since everything is already fairly and accurately priced. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web the efficient market hypothesis says that the market exists in three types, or forms: Here's a little more about each:

Web There Are Three Forms Of Emh:

Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web weak form efficiency is an element of efficient market hypothesis.

Here's What Each Says About The Market.

Web what is weak form market efficiency? Weak form emh suggests that all past information is priced into securities. Web the hypothesis of financial market efficiency is an analytical approach aimed at explaining movements in prices of financial assets over time and is based on the insight that prices for such assets are determined by the rational behaviour of agents interacting in the market.