W2 Form Vs W9

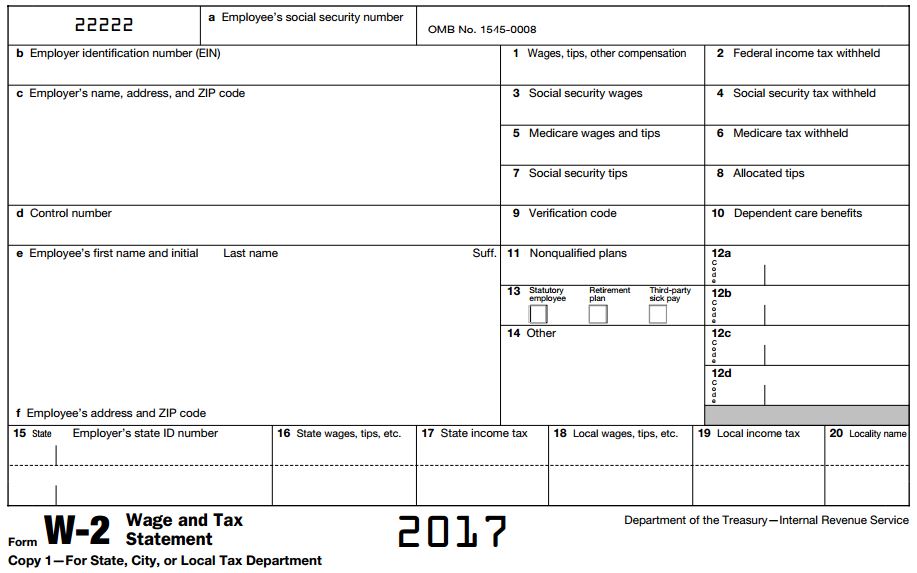

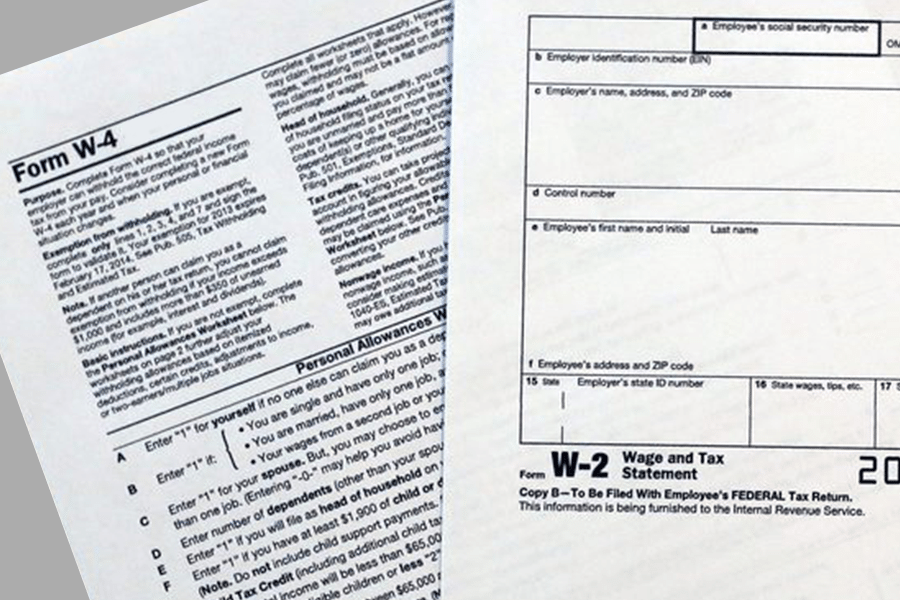

W2 Form Vs W9 - Freelancers, or independent contractors, fill out. Let’s dig into each form type to provide a clear. This ensures that the proper taxes are. Web it's a common question, and for good reason. Web when selecting form w2 from w2 vs w9 vs 1099, make sure to remember all w2 forms get sent to the irs. Knowing which form is the right one to issue to your employees takes some research. Any llcs must fill out a w9 form for their owners in order to report any income received. Commissions do not affect our editors' opinions or. If you worked as an employee for a company in the previous year, you should. Web limited liability companies.

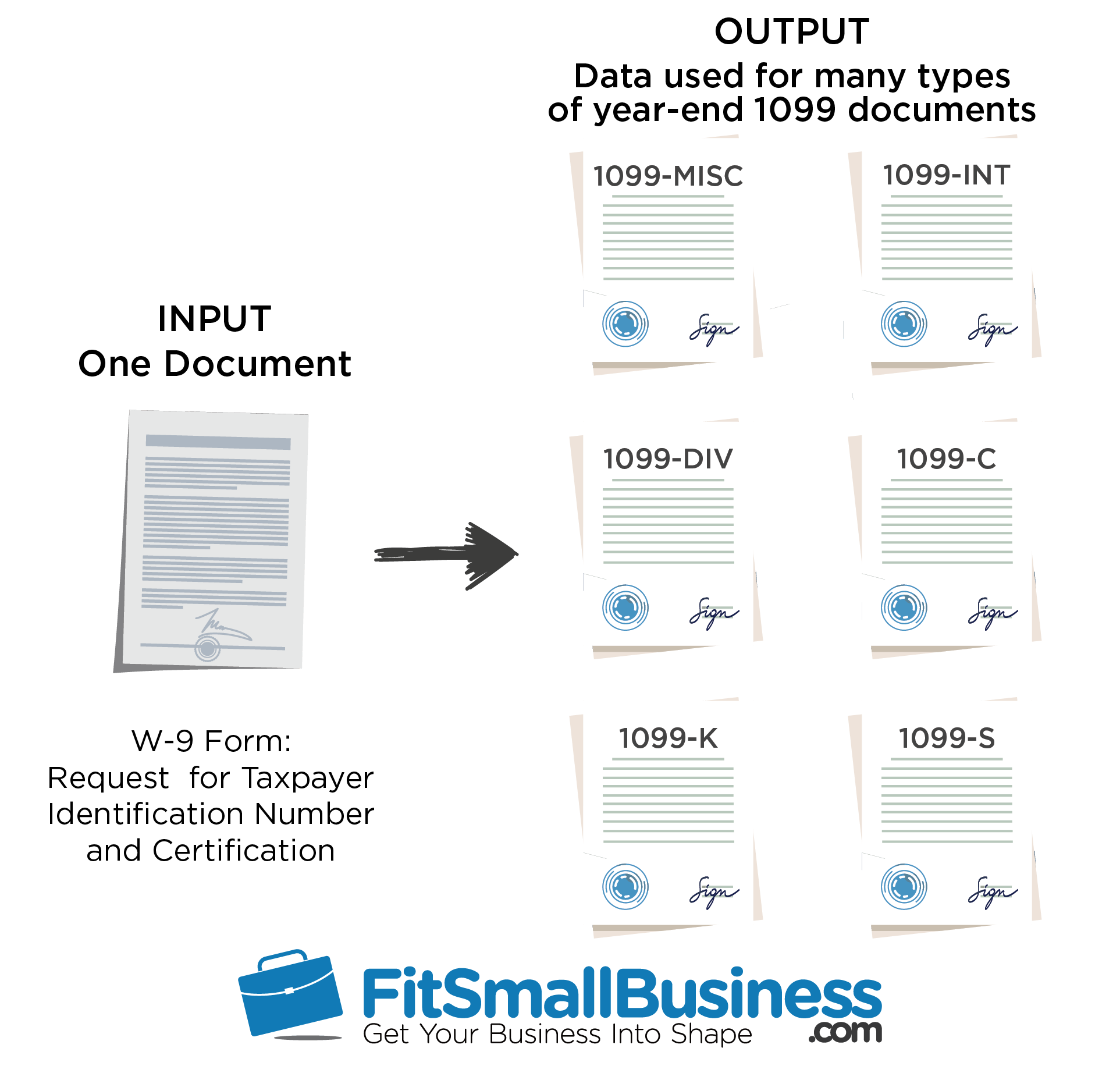

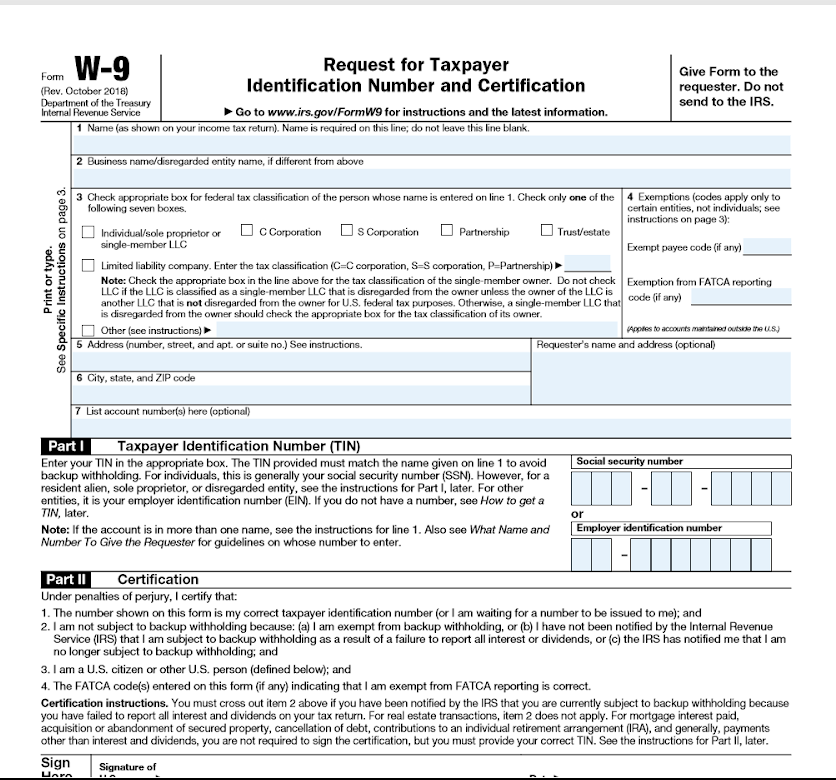

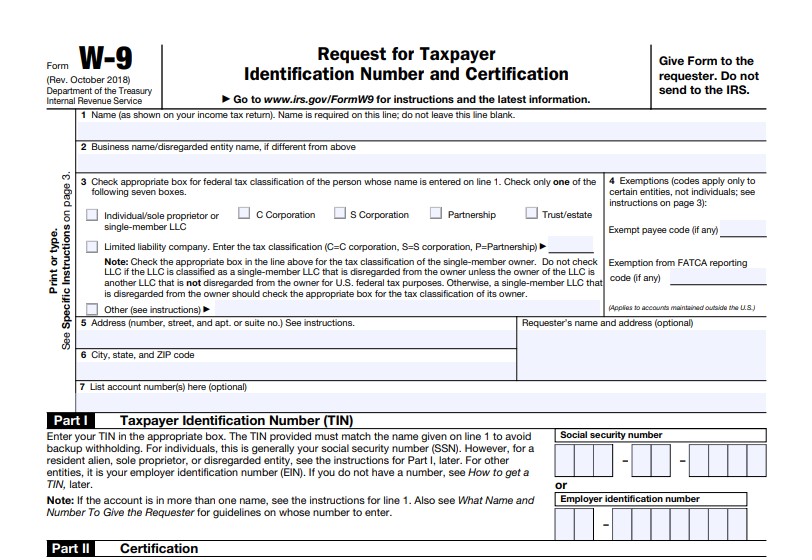

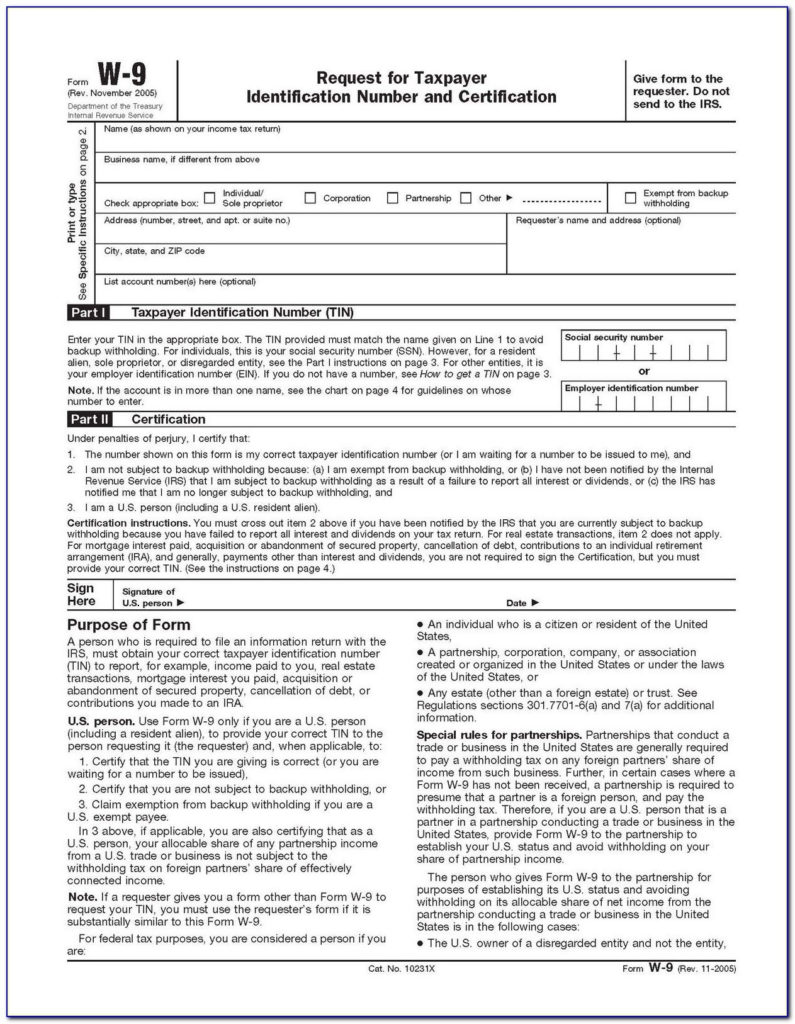

Any llcs must fill out a w9 form for their owners in order to report any income received. Knowing which form is the right one to issue to your employees takes some research. Luckily, we've done the research. We earn a commission from partner links on forbes advisor. Web it's a common question, and for good reason. If a freelancer receives more than $600 in a calendar year from a business, an organization is to send form 1099. Commissions do not affect our editors' opinions or. Web a form w9 is used to prepare informational returns to the irs. If you worked as an employee for a company in the previous year, you should. Web when selecting form w2 from w2 vs w9 vs 1099, make sure to remember all w2 forms get sent to the irs.

This ensures that the proper taxes are. Web when selecting form w2 from w2 vs w9 vs 1099, make sure to remember all w2 forms get sent to the irs. Any llcs must fill out a w9 form for their owners in order to report any income received. Knowing which form is the right one to issue to your employees takes some research. Web limited liability companies. Let’s dig into each form type to provide a clear. Freelancers, or independent contractors, fill out. Aug 18, 2022, 1:35pm editorial note: Web a form w9 is used to prepare informational returns to the irs. If you worked as an employee for a company in the previous year, you should.

Difference Between W2 W4 and W9 Compare the Difference Between

Web it's a common question, and for good reason. Knowing which form is the right one to issue to your employees takes some research. Any llcs must fill out a w9 form for their owners in order to report any income received. Let’s dig into each form type to provide a clear. This ensures that the proper taxes are.

W9 vs 1099 IRS Forms, Differences, and When to Use Them 2019

Luckily, we've done the research. Freelancers, or independent contractors, fill out. If you worked as an employee for a company in the previous year, you should. If a freelancer receives more than $600 in a calendar year from a business, an organization is to send form 1099. When to file form w9?

W2 vs. W4 vs. W9 vs. I9 YouTube

Freelancers, or independent contractors, fill out. Let’s dig into each form type to provide a clear. Any llcs must fill out a w9 form for their owners in order to report any income received. This ensures that the proper taxes are. Knowing which form is the right one to issue to your employees takes some research.

Difference Between W2 W4 and W9 Compare the Difference Between

We earn a commission from partner links on forbes advisor. Freelancers, or independent contractors, fill out. This ensures that the proper taxes are. Web when selecting form w2 from w2 vs w9 vs 1099, make sure to remember all w2 forms get sent to the irs. Let’s dig into each form type to provide a clear.

Free Printable W9 Form From Irs

Web a form w9 is used to prepare informational returns to the irs. Aug 18, 2022, 1:35pm editorial note: This ensures that the proper taxes are. Web it's a common question, and for good reason. Luckily, we've done the research.

What Is A W9 Form 2020? Free Printable

Web it's a common question, and for good reason. If you worked as an employee for a company in the previous year, you should. Freelancers, or independent contractors, fill out. Commissions do not affect our editors' opinions or. This ensures that the proper taxes are.

Blank W9 Tax Form

When to file form w9? Any llcs must fill out a w9 form for their owners in order to report any income received. Web when selecting form w2 from w2 vs w9 vs 1099, make sure to remember all w2 forms get sent to the irs. Freelancers, or independent contractors, fill out. Knowing which form is the right one to.

W9 Form New Hire The Five Common Stereotypes When It Comes To W9 Form

If you worked as an employee for a company in the previous year, you should. Let’s dig into each form type to provide a clear. This ensures that the proper taxes are. Web when selecting form w2 from w2 vs w9 vs 1099, make sure to remember all w2 forms get sent to the irs. Commissions do not affect our.

Best Free Printable W9 Form Hudson Website

Luckily, we've done the research. Commissions do not affect our editors' opinions or. Any llcs must fill out a w9 form for their owners in order to report any income received. When to file form w9? If you worked as an employee for a company in the previous year, you should.

Web Limited Liability Companies.

When to file form w9? Commissions do not affect our editors' opinions or. Web when selecting form w2 from w2 vs w9 vs 1099, make sure to remember all w2 forms get sent to the irs. Web a form w9 is used to prepare informational returns to the irs.

Freelancers, Or Independent Contractors, Fill Out.

Let’s dig into each form type to provide a clear. Luckily, we've done the research. Aug 18, 2022, 1:35pm editorial note: If a freelancer receives more than $600 in a calendar year from a business, an organization is to send form 1099.

This Ensures That The Proper Taxes Are.

We earn a commission from partner links on forbes advisor. Knowing which form is the right one to issue to your employees takes some research. If you worked as an employee for a company in the previous year, you should. Web it's a common question, and for good reason.