Virginia State Tax Form 760

Virginia State Tax Form 760 - 07/21 social security number first 4 letters. Change of address check if your address has changed. Web form 760 is the general income tax return for virginia residents; Ad download or email form 760 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Virginia's date of conformity with the federal enhanced earned. Virginia department of taxation, p.o. If you make $70,000 a year living in virginia you will be taxed $11,623. Corporation and pass through entity tax. Web tax due returns:

Web instructions virginia state income tax forms for tax year 2022 (jan. Web file now with turbotax we last updated virginia form 760 in january 2023 from the virginia department of taxation. Web 2021 virginia resident form 760, individual income tax return. Web find forms & instructions by category. Web please enter your payment details below. Make use of the tips about how to fill out the. Web virginia resident form 760 *va0760120888* individual income tax return. We last updated the resident individual income tax return in january 2023, so. Complete, edit or print tax forms instantly. Web tax due returns:

Web 1957 westmoreland street richmond, va 23230 directions multiple locations find a location connect online facebook department of taxation twitter department of. Web virginia resident form 760 *va0760120888* individual income tax return. Web virginia form 760 instructions what's new virginia's fixed date conformity with the internal revenue code: Web file now with turbotax we last updated virginia form 760 in january 2023 from the virginia department of taxation. Web get your virginia income tax return form 760 (2021) in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately virginia income tax return. 07/21 social security number first 4 letters. Details on how to only. Corporation and pass through entity tax. For more information about the. Ad download or email form 760 & more fillable forms, register and subscribe now!

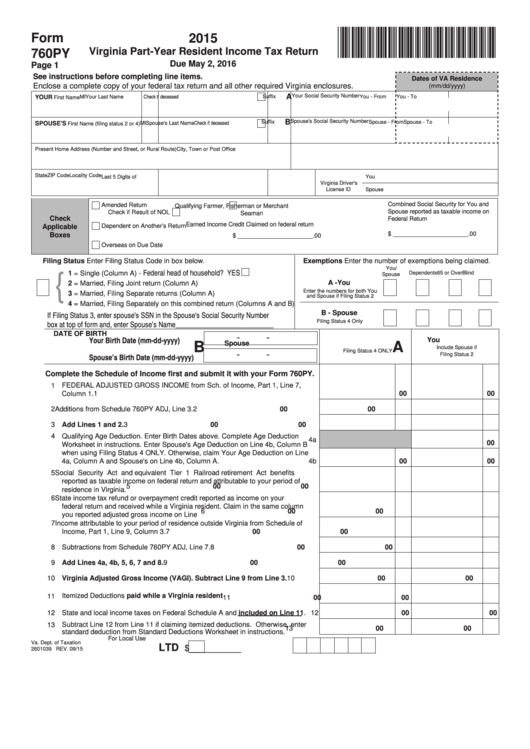

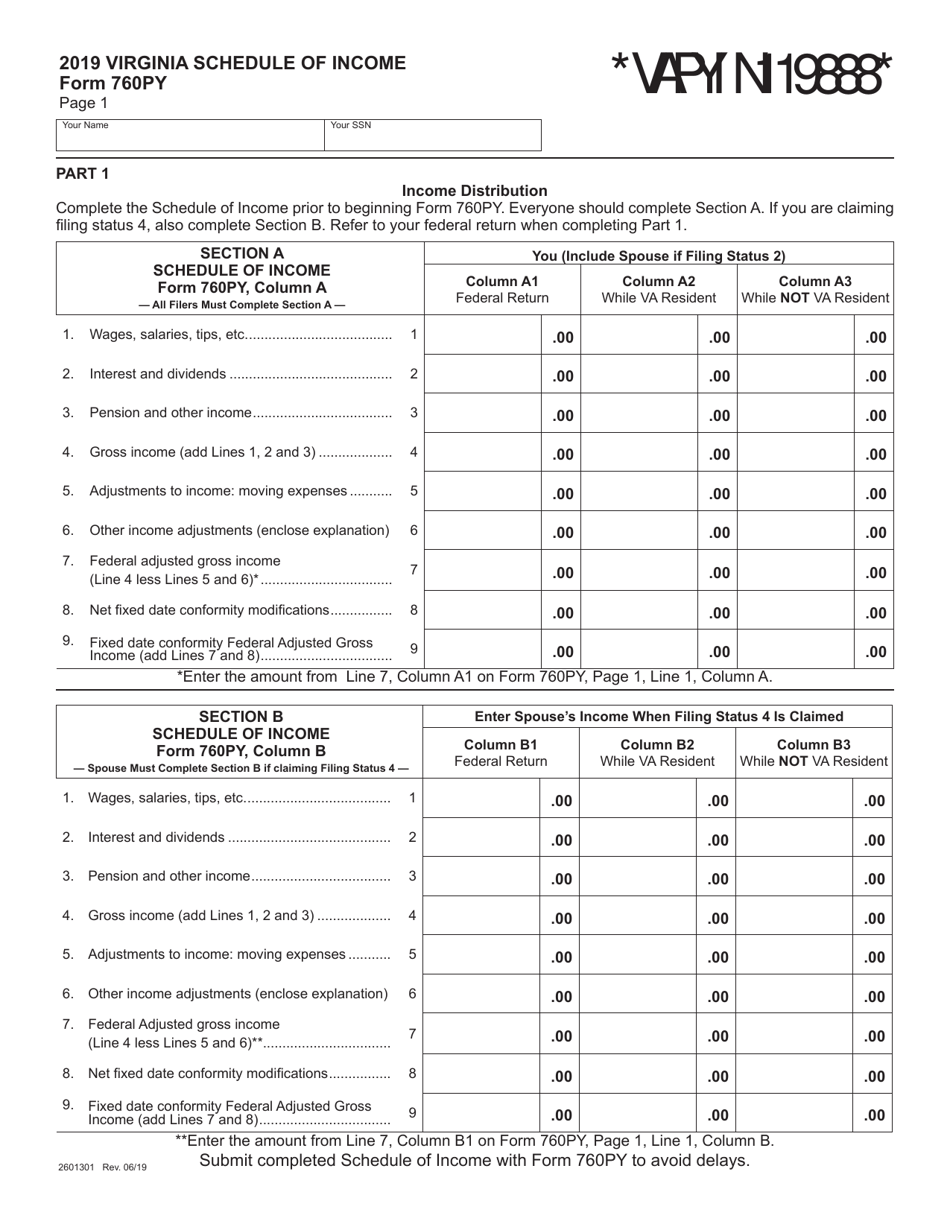

Fillable Form 760py Virginia PartYear Resident Tax Return

Virginia department of taxation, p.o. Web please enter your payment details below. Virginia's date of conformity with the federal enhanced earned. If you make $70,000 a year living in virginia you will be taxed $11,623. We last updated the resident individual income tax return in january 2023, so.

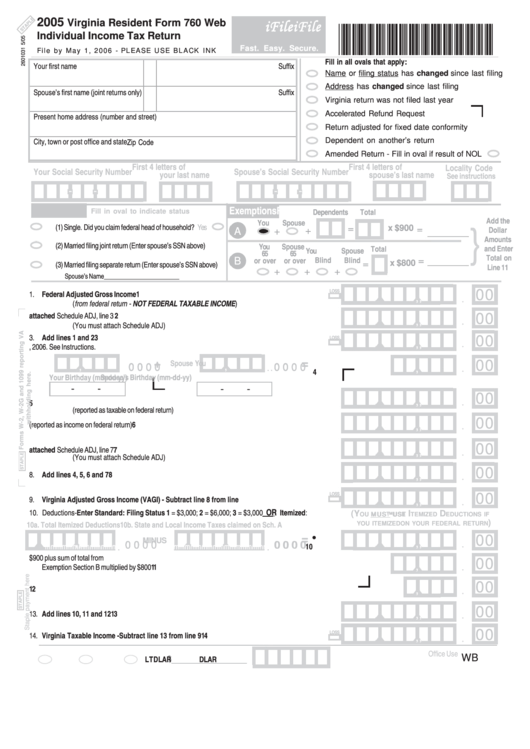

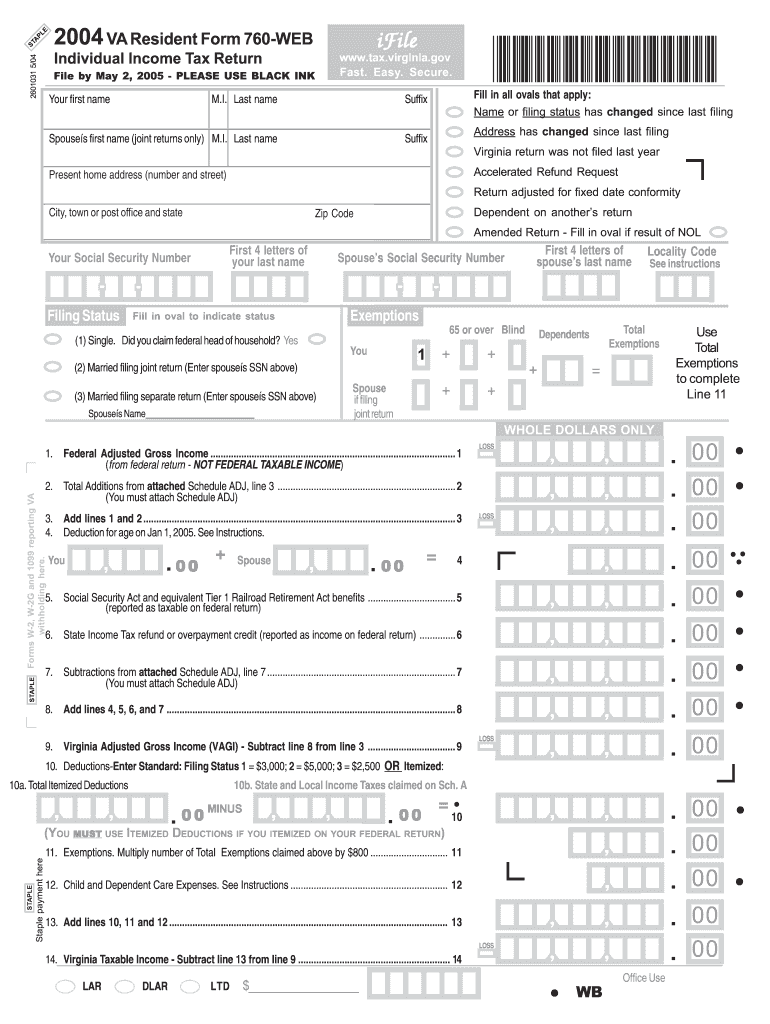

Virginia Resident Form 760 Web Individual Tax Return 2005

For more information about the. Web file now with turbotax we last updated virginia form 760 in january 2023 from the virginia department of taxation. Web form 760 is the general income tax return for virginia residents; Virginia department of taxation, p.o. Web instructions virginia state income tax forms for tax year 2022 (jan.

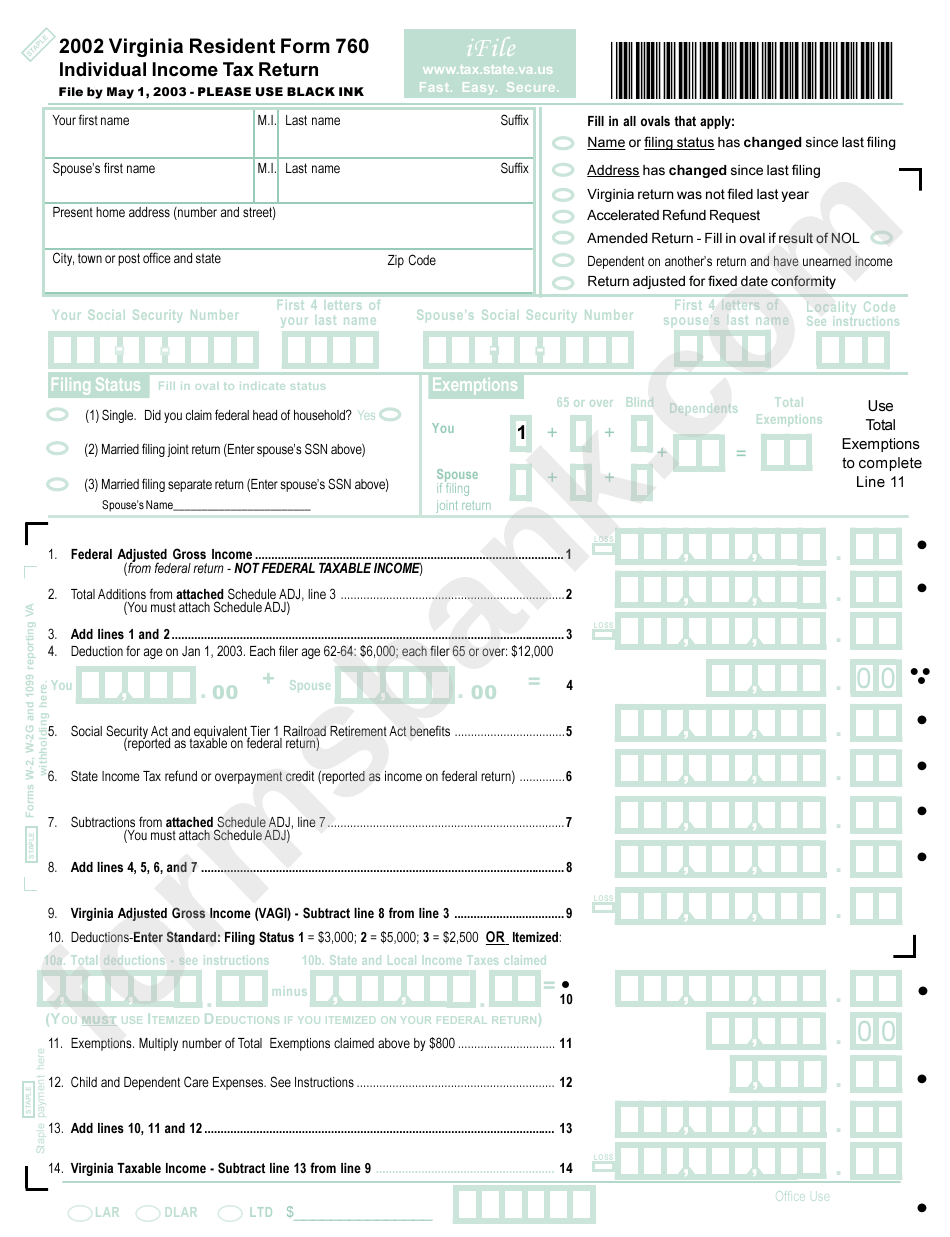

Virginia Resident Form 760 Individual Tax Return 2002

Web 1957 westmoreland street richmond, va 23230 directions multiple locations find a location connect online facebook department of taxation twitter department of. Change of address check if your address has changed. Form 760 is the general income tax return for virginia residents; If your bank requires authorization for the department of taxation to debit a payment from your checking account,.

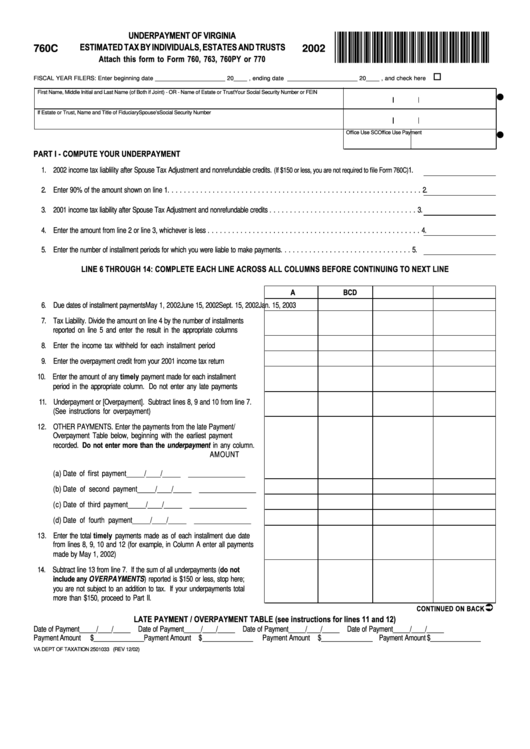

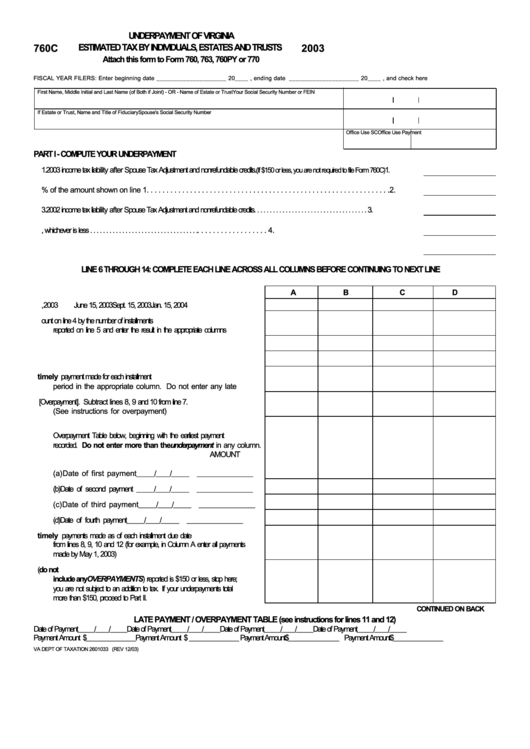

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

07/21 social security number first 4 letters. Web 2019 form 760 resident individual income tax booklet This form is for income earned in tax year 2022, with. Virginia department of taxation, p.o. Web form 760 is the general income tax return for virginia residents;

VA Resident Form 760 WEB Fill Out and Sign Printable PDF Template

Details on how to only. Complete, edit or print tax forms instantly. Web virginia resident form 760 *va0760120888* individual income tax return. Get ready for tax season deadlines by completing any required tax forms today. Make use of the tips about how to fill out the.

Form 760PY Download Fillable PDF or Fill Online Schedule of

Details on how to only. Form 760 is the general income tax return for virginia residents; Virginia department of taxation, p.o. Web please enter your payment details below. If your bank requires authorization for the department of taxation to debit a payment from your checking account, you must.

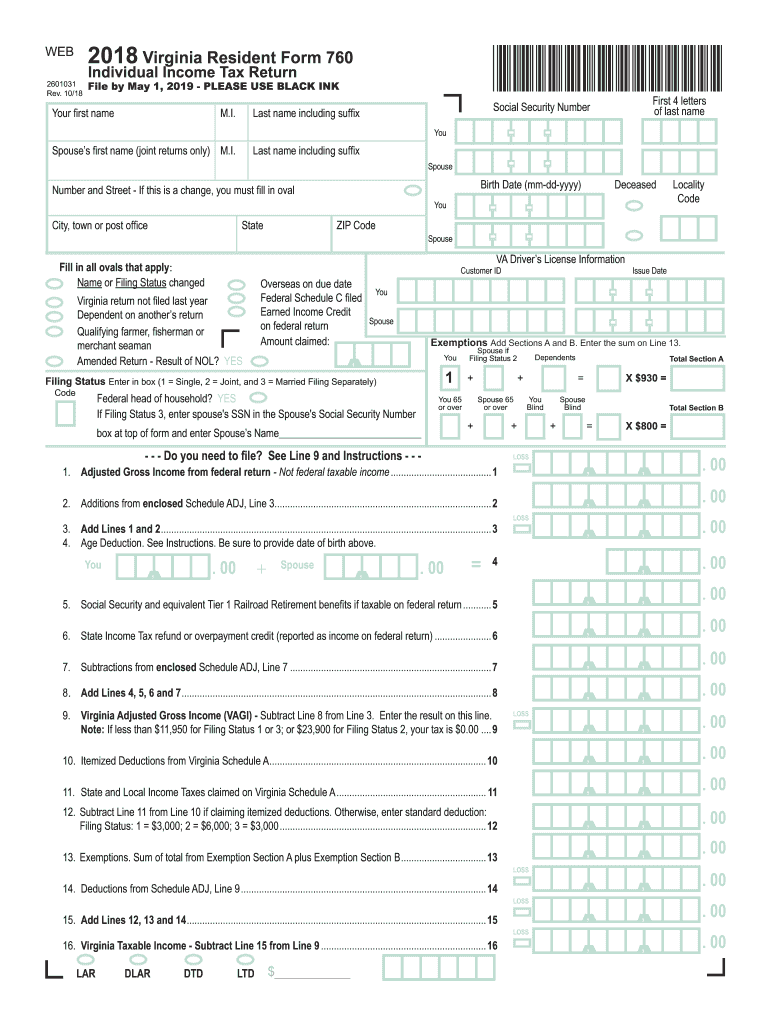

Virginia 760 Form Fill Out and Sign Printable PDF Template signNow

Web file now with turbotax we last updated virginia form 760 in january 2023 from the virginia department of taxation. Complete, edit or print tax forms instantly. Web get your virginia income tax return form 760 (2021) in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately virginia income tax return. To.

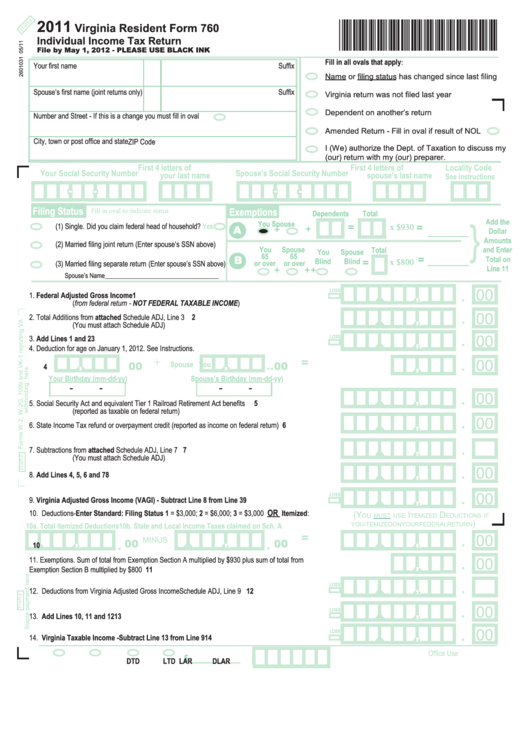

Virginia Resident Form 760 Individual Tax Return 2011

Virginia department of taxation, p.o. For more information about the. Change of address check if your address has changed. Web web2021 virginia form 760 resident income tax return file by may 1, 2022 — use black ink *va0760121888* 2601031rev. Web 2019 form 760 resident individual income tax booklet

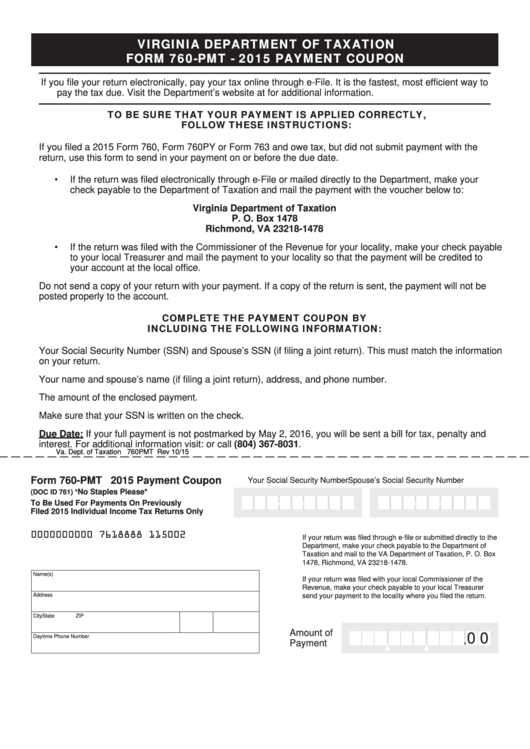

Fillable Form 760Pmt Virginia Payment Coupon 2015 printable pdf

For more information about the. Details on how to only. Ad download or email form 760 & more fillable forms, register and subscribe now! Web printable virginia income tax form 760. Get ready for tax season deadlines by completing any required tax forms today.

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

Web find forms & instructions by category. Web get your virginia income tax return form 760 (2021) in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately virginia income tax return. Make use of the tips about how to fill out the. 07/21 social security number first 4 letters. Change of address.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web form 760 is the general income tax return for virginia residents; Web 2019 form 760 resident individual income tax booklet Change of address check if your address has changed. Web instructions virginia state income tax forms for tax year 2022 (jan.

We Last Updated The Resident Individual Income Tax Return In January 2023, So.

Form 760 is the general income tax return for virginia residents; Make use of the tips about how to fill out the. Virginia's date of conformity with the federal enhanced earned. Web 2021 virginia resident form 760, individual income tax return.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web 1957 westmoreland street richmond, va 23230 directions multiple locations find a location connect online facebook department of taxation twitter department of. Corporation and pass through entity tax. 07/21 social security number first 4 letters. This form is for income earned in tax year 2022, with.

Web Tax Due Returns:

Web web2021 virginia form 760 resident income tax return file by may 1, 2022 — use black ink *va0760121888* 2601031rev. Web get your virginia income tax return form 760 (2021) in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately virginia income tax return. Web printable virginia income tax form 760. If your bank requires authorization for the department of taxation to debit a payment from your checking account, you must.