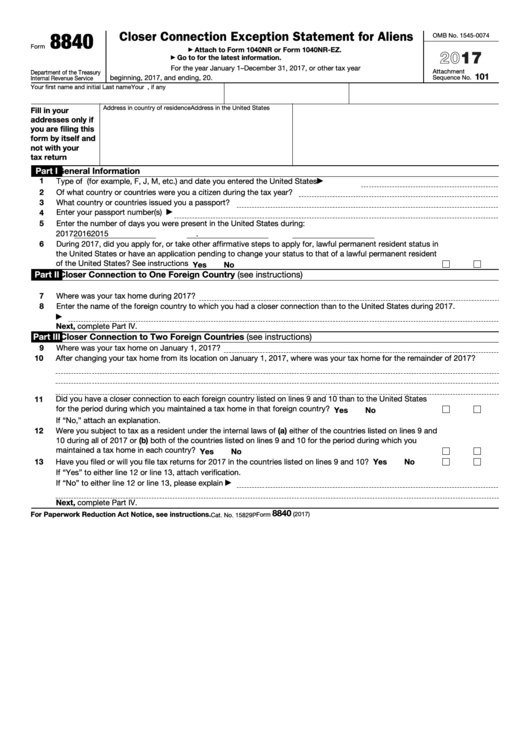

Us Form 8840

Us Form 8840 - Web to claim the closer connection, the individual must file a us form (form 8840) for each year for which the substantial presence test is met and the closer. The form 8840 must be filed by the due. Start completing the fillable fields and. Use get form or simply click on the template preview to open it in the editor. Web the form 8840 is the closer connection exception statement for aliens. Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception. Go to www.irs.gov/form8840 for the. Ad access irs tax forms. Web form 8843 is filed by alien individuals who want to exclude days in the united states from being considered for purposes of the substantial physical presence test. Get ready for tax season deadlines by completing any required tax forms today.

Ad access irs tax forms. Web to claim the closer connection, the individual must file a us form (form 8840) for each year for which the substantial presence test is met and the closer. Use get form or simply click on the template preview to open it in the editor. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Are technically subject to u.s. Web in addition, if you have applied for permanent residence, you cannot avoid u.s. A taxpayer must file a form 8840 with their income tax return to claim a closer connection to a foreign country or countries. The reason the foreign person files a. Fill out all required fields in the selected doc making use of our convenient pdf. Web information about form 8840, closer connection exception statement for aliens, including recent updates, related forms, and instructions on how to file.

Start completing the fillable fields and. Ad access irs tax forms. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Go to www.irs.gov/form8840 for the. The reason the foreign person files a. Complete, edit or print tax forms instantly. Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception. Are technically subject to u.s. A taxpayer must file a form 8840 with their income tax return to claim a closer connection to a foreign country or countries. Web form 8840 must be filed by the due date of the person’s us tax return.

Form 8840 Closer Connection Exception Statement for Aliens (2015

Complete, edit or print tax forms instantly. Are technically subject to u.s. Web form 8840 tips & articles tax season checklist for canadian snowbirds last updated: Each alien individual must file a separate form 8840. Web the form 8840 is the closer connection exception statement for aliens.

Form 8840 year 2023 Fill online, Printable, Fillable Blank

Ad access irs tax forms. Click the button get form to open it and begin editing. Start completing the fillable fields and. Web in addition, if you have applied for permanent residence, you cannot avoid u.s. Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that.

How Tax Form 8840 Exception to Substantial Presence Works

Ad access irs tax forms. Fill out all required fields in the selected doc making use of our convenient pdf. Web form 8840 tips & articles tax season checklist for canadian snowbirds last updated: Web form 8843 is filed by alien individuals who want to exclude days in the united states from being considered for purposes of the substantial physical.

Top 8 Form 8840 Templates free to download in PDF format

A taxpayer must file a form 8840 with their income tax return to claim a closer connection to a foreign country or countries. Complete, edit or print tax forms instantly. Web form 8840 must be filed by the due date of the person’s us tax return. It is used to declare that the person has a closer connection to a.

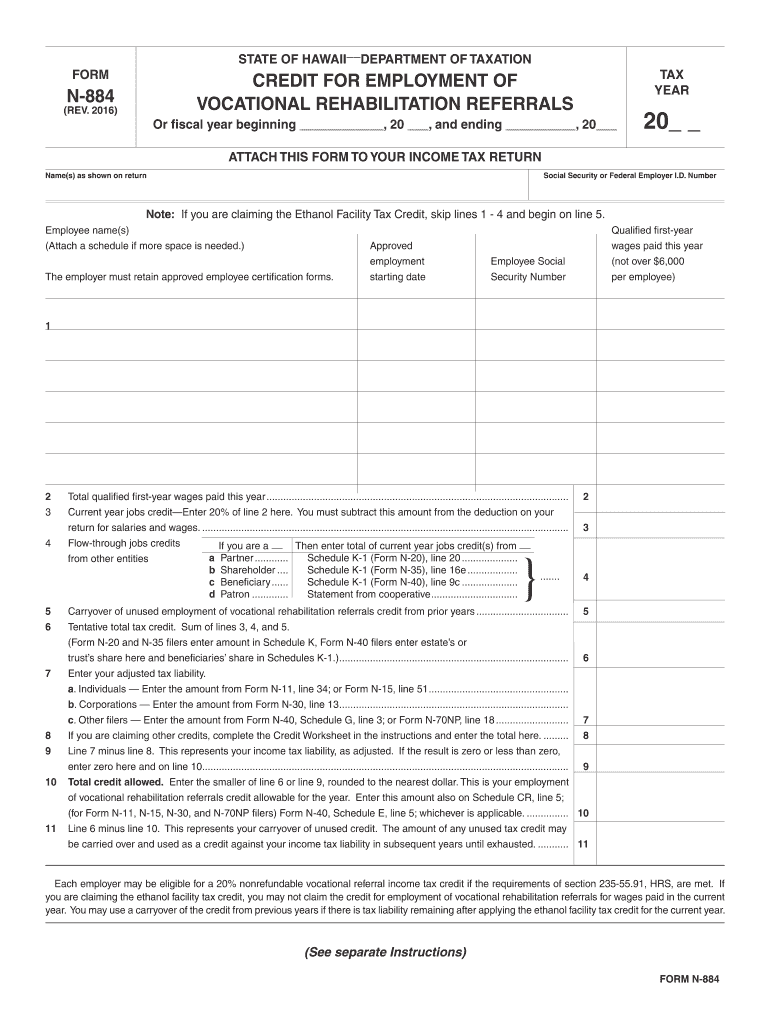

Form N 884, Rev Forms Fill Out and Sign Printable PDF Template signNow

Each alien individual must file a separate form 8840. Web information about form 8840, closer connection exception statement for aliens, including recent updates, related forms, and instructions on how to file. Web form 8840 must be filed by the due date of the person’s us tax return. Complete, edit or print tax forms instantly. Are technically subject to u.s.

Form 8840 Closer Connection Exception Statement for Aliens (2015

Each alien individual must file a separate form 8840. Use get form or simply click on the template preview to open it in the editor. Taxes using the “closer connection” exception in form 8840 (see further discussion. Go to www.irs.gov/form8840 for the. Edit, sign and save alien closer exempt state form.

IRS Form 8840 Download Fillable PDF or Fill Online Closer Connection

It is filed at the same time a person files their u.s. A taxpayer must file a form 8840 with their income tax return to claim a closer connection to a foreign country or countries. Are technically subject to u.s. Complete, edit or print tax forms instantly. April 11, 2023 as tax season approaches in both canada and the u.s.,.

총칙, 놀이터공사 샘플, 양식 다운로드

Web form 8840 tips & articles tax season checklist for canadian snowbirds last updated: Web form 8840 is a federal other form. Get ready for tax season deadlines by completing any required tax forms today. Use get form or simply click on the template preview to open it in the editor. Web form 8840 must be filed by the due.

Us application ser no 13 092869

Each alien individual must file a separate form 8840. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Web the form 8840 is the closer connection exception statement for aliens. Get ready for tax season deadlines by completing any required tax forms today. Start completing the fillable fields and.

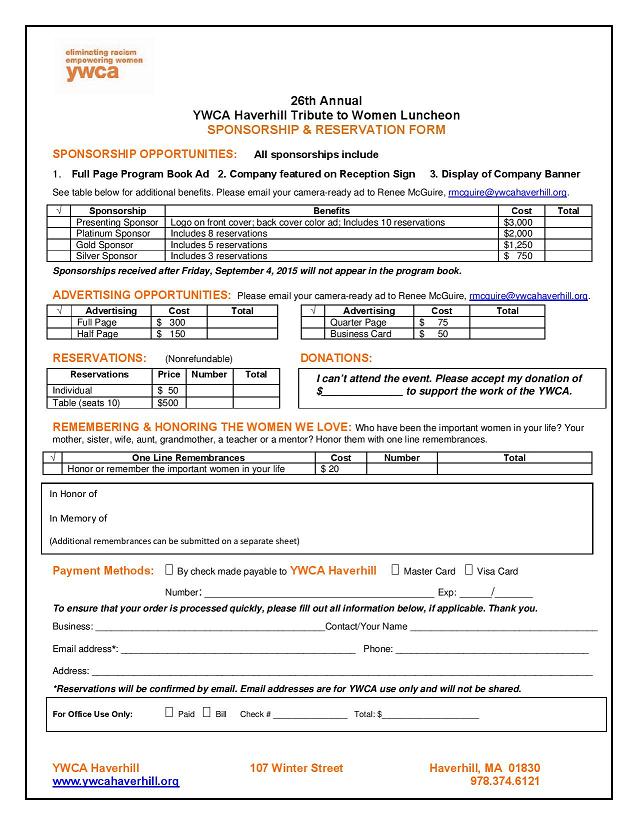

Haverhill Tribute Sponsorship Form YWCA Northeastern MA

Web form 8843 is filed by alien individuals who want to exclude days in the united states from being considered for purposes of the substantial physical presence test. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web the form 8840 is the closer.

It Is Filed At The Same Time A Person Files Their U.s.

Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Go to www.irs.gov/form8840 for the. Web information about form 8840, closer connection exception statement for aliens, including recent updates, related forms, and instructions on how to file. April 11, 2023 as tax season approaches in both canada and the u.s., many canadian.

Taxes Using The “Closer Connection” Exception In Form 8840 (See Further Discussion.

Web the form 8840 is the closer connection exception statement for aliens. Edit, sign and save alien closer exempt state form. Start completing the fillable fields and. Web form 8840 is a federal other form.

Income Tax If They Exceed A Specific Number Of.

A taxpayer must file a form 8840 with their income tax return to claim a closer connection to a foreign country or countries. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web to claim the closer connection, the individual must file a us form (form 8840) for each year for which the substantial presence test is met and the closer.

Fill Out All Required Fields In The Selected Doc Making Use Of Our Convenient Pdf.

Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception. Each alien individual must file a separate form 8840. Click the button get form to open it and begin editing. Web form 8840 tips & articles tax season checklist for canadian snowbirds last updated: