Turbotax Form 990

Turbotax Form 990 - You can download the fillable pdf form from the irs. Web claim credit from form 8941. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. Form 990 also includes a section for the organization to outline its accomplishments in the previous year to justify. Form 990 is used to report certain income in an ira account.this form is not supported by the tt program. Web the irs requires all u.s. The following links can offer additional information. Claim a refund shown on form 2439 i check if a 501(c)(3) organization filing a consolidated return with a 501(c)(2) titleholding corporation. Since the payment from the ira is not a personal expense, it is not reportable anywhere on. Web form 990 (officially, the return of organization exempt from income tax [1]) is a united states internal revenue service form that provides the public with financial information about a nonprofit organization.

Web claim credit from form 8941. Form 990 is used to report certain income in an ira account.this form is not supported by the tt program. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. If this organization has filed. Web required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. In a nutshell, the form gives the irs an overview of the organization's activities, governance and detailed financial information. Responses to frequently asked questions about 990s can be found in our knowledge portal. Web form 990 (officially, the return of organization exempt from income tax [1]) is a united states internal revenue service form that provides the public with financial information about a nonprofit organization. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Request for transcript of tax return.

Certain exempt organizations file this form to provide the irs with the information required by section 6033. Web up to three years of forms 990; Web no, turbotax doesn't support form 990, but you can download it from the irs: Go to www.irs.gov/form990 for instructions and the latest information. Read the irs instructions for 990 forms. Web claim credit from form 8941. Responses to frequently asked questions about 990s can be found in our knowledge portal. Claim a refund shown on form 2439 i check if a 501(c)(3) organization filing a consolidated return with a 501(c)(2) titleholding corporation. The following links can offer additional information. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

TURBOTAX Logical Progression of Where Ordinary AND Capital Gains

Since the payment from the ira is not a personal expense, it is not reportable anywhere on. I would recommend contacting a local professional. The following links can offer additional information. Web required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. Claim a refund shown on form 2439 i.

Pin by Sandy HansenMaciejewski on Dog Related Tax return, Tax, Tax forms

Web updated may 25, 2023. Responses to frequently asked questions about 990s can be found in our knowledge portal. Since the payment from the ira is not a personal expense, it is not reportable anywhere on. Form 990 also includes a section for the organization to outline its accomplishments in the previous year to justify. Return of organization exempt from.

TurboTax makes filing (almost) fun Inside Design Blog

You can download the fillable pdf form from the irs. Web the irs requires all u.s. Read the irs instructions for 990 forms. Web claim credit from form 8941. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

How To Delete 1099 Form On Turbotax Armando Friend's Template

Form 990 is used to report certain income in an ira account.this form is not supported by the tt program. Instructions for form 990, return of organization exempt from income tax; In a nutshell, the form gives the irs an overview of the organization's activities, governance and detailed financial information. 2 hours ago 0 12 reply. Request for taxpayer identification.

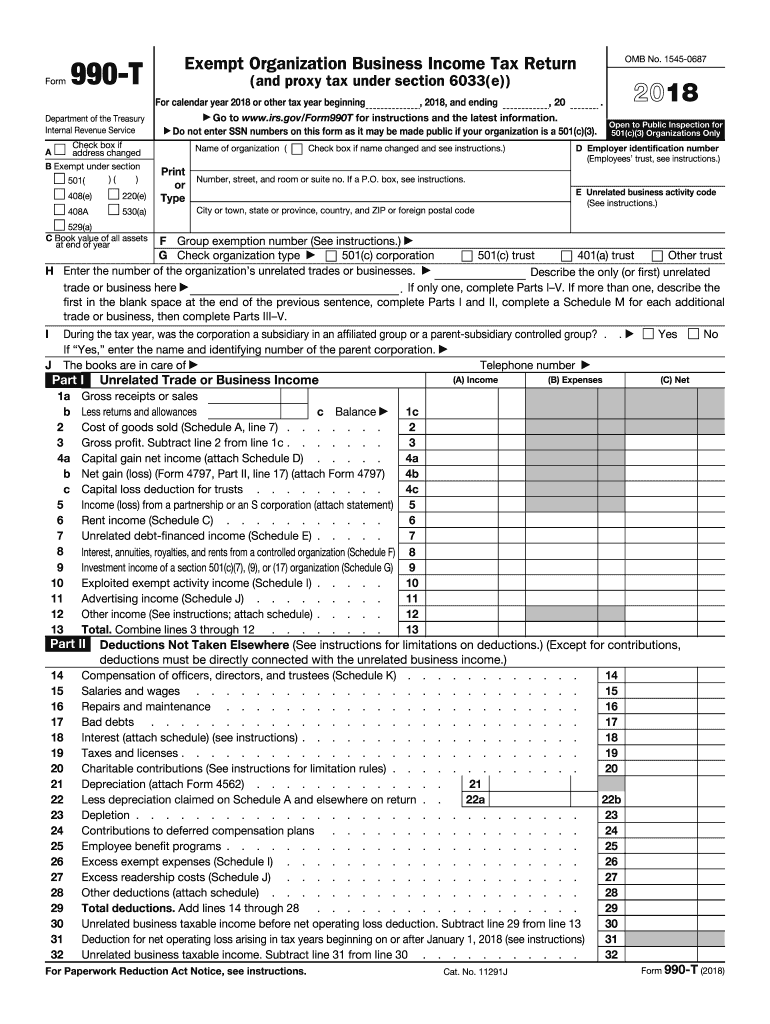

990 t Fill out & sign online DocHub

Web no, turbotax doesn't support form 990, but you can download it from the irs: You can download the fillable pdf form from the irs. Web no, unfortunately, turbotax does not support form 990 and its variants. Form 990 is used to report certain income in an ira account.this form is not supported by the tt program. Since the payment.

form 2106 turbotax Fill Online, Printable, Fillable Blank

If this organization has filed. Form 990 is used to report certain income in an ira account.this form is not supported by the tt program. Additional information see form 990 resources and tools for more information on annual filing requirements Web form 990 is an annual information return required to be filed with the irs by most organizations exempt from.

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

Claim a refund shown on form 2439 i check if a 501(c)(3) organization filing a consolidated return with a 501(c)(2) titleholding corporation. In a nutshell, the form gives the irs an overview of the organization's activities, governance and detailed financial information. Since the payment from the ira is not a personal expense, it is not reportable anywhere on. Responses to.

Don’t to File Form 990 Charity Lawyer Blog Nonprofit Law

Below are some ways you can get an organization's 990s. Instructions for form 990, return of organization exempt from income tax; You can download the fillable pdf form from the irs. Web up to three years of forms 990; For prior year forms, use the prior year search tool on the irs forms, instructions & publications page.

Nonprofit software improves Form 990 processes

Web form 990 resources and tools. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Request for taxpayer identification number (tin) and certification. Read the irs instructions for 990 forms. Since the payment from the ira is not a personal expense, it is not reportable anywhere.

form 2555 turbotax Fill Online, Printable, Fillable Blank irsform

Web no, turbotax doesn't support form 990, but you can download it from the irs: Read the irs instructions for 990 forms. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web no, unfortunately, turbotax does not support form 990 and its variants. Go to www.irs.gov/form990.

Web Required Filing (Form 990 Series) See The Form 990 Filing Thresholds Page To Determine Which Forms An Organization Must File.

Read the irs instructions for 990 forms. Instructions for form 990, return of organization exempt from income tax; Web no, unfortunately, turbotax does not support form 990 and its variants. Additional information see form 990 resources and tools for more information on annual filing requirements

Web Form 990 Is An Annual Information Return Required To Be Filed With The Irs By Most Organizations Exempt From Income Tax Under Section 501(A), And Certain Political Organizations And Nonexempt Charitable Trusts.

I would recommend contacting a local professional. Web claim credit from form 8941. Web the irs requires all u.s. Return of organization exempt from income tax

Web Information About Form 990, Return Of Organization Exempt From Income Tax, Including Recent Updates, Related Forms And Instructions On How To File.

You can download the fillable pdf form from the irs. Web updated may 25, 2023. Web form 990 resources and tools. If this organization has filed.

Ceo, Board Chair, And Board Of Directors Information;

Form 990 also includes a section for the organization to outline its accomplishments in the previous year to justify. For a look at what you'll find on these documents, view these samples: Sponsoring organizations of donor advised funds organizations that operate a hospital facility Responses to frequently asked questions about 990s can be found in our knowledge portal.