Turbotax Form 3921

Turbotax Form 3921 - Although this information is not taxable unless. Edit, sign and print tax forms on any device with uslegalforms. Form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. Web form 3921 walkthrough. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web 3921 is an informational form only. The form has to be. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d.

Form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). A preparer must determine if an entry is needed based on the facts of the transfer. Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web in drake tax, there is no specific data entry screen for form 3921. I went online to my. It is generally not entered on your tax return unless you then sold the stock, or if you could be subject to alternative minimum. This makes it easier for the irs to hold.

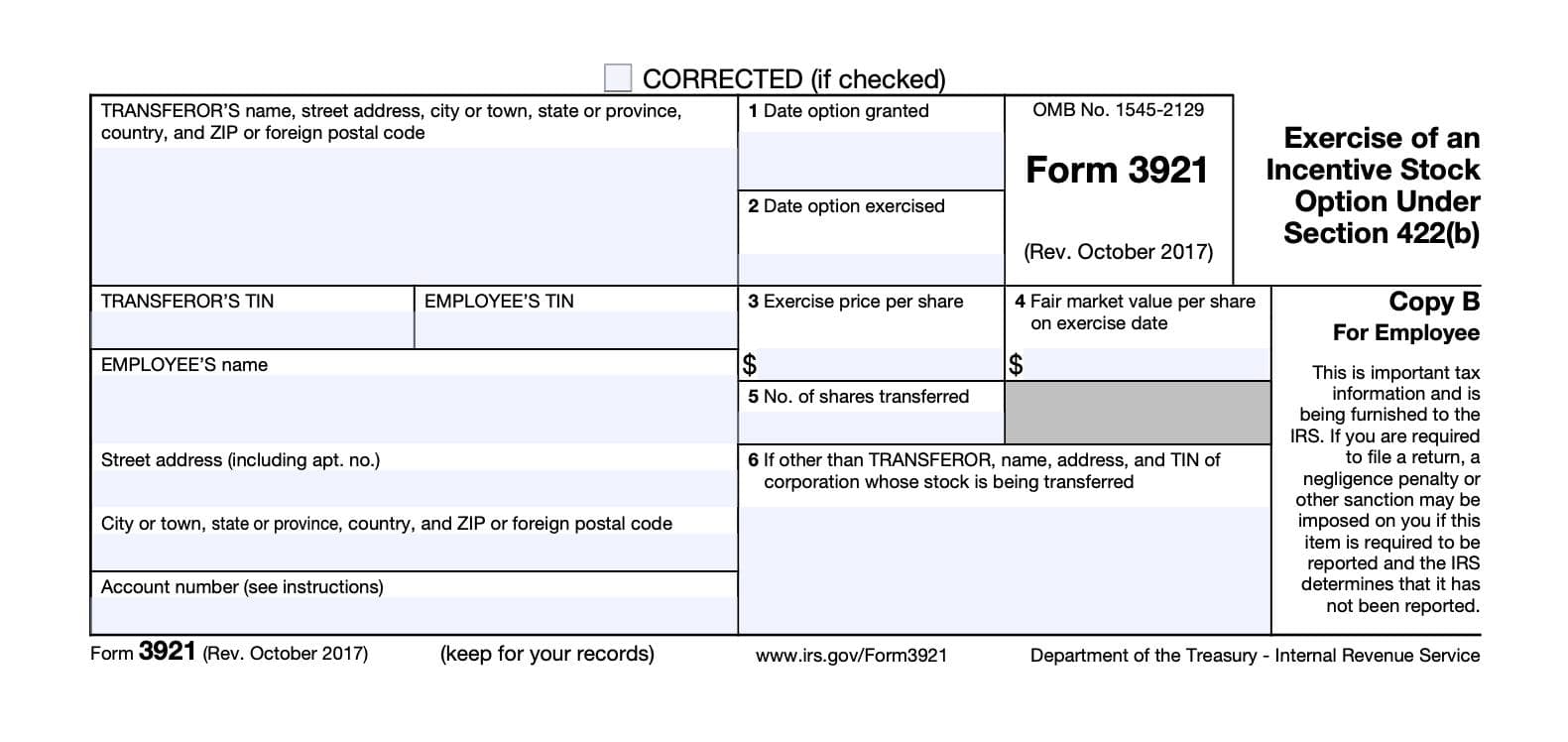

Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web february 26, 2022 3:49 pm 0 reply bookmark icon cfchase returning member this does apply to me, i have a 1099b but no form 3921. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Edit, sign and print tax forms on any device with uslegalforms. Solved • by intuit • 283 • updated july 19, 2022. Web what is form 3921? Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an incentive stock option (iso). Create a blank & editable 3921 form,. Web form 3921 walkthrough.

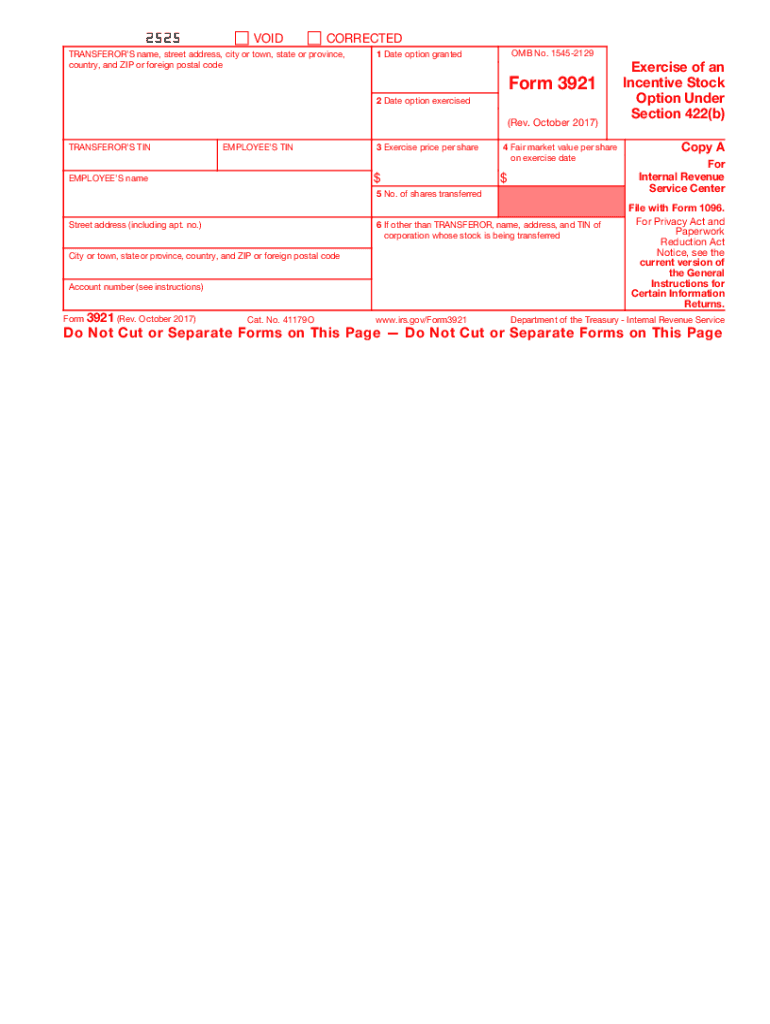

IRS 3921 20172021 Fill out Tax Template Online US Legal Forms

Although this information is not taxable unless. Form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). Web what is form 3921? Edit, sign and print tax forms on any device with uslegalforms. I went online to my.

TurboTax makes filing (almost) fun Inside Design Blog Turbotax

This makes it easier for the irs to hold. Web form 3921 walkthrough. Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Create a blank & editable 3921 form,. Solved • by intuit • 283 • updated july 19, 2022. Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. Web corporations file this form for each transfer of stock to.

form 2106 turbotax Fill Online, Printable, Fillable Blank

This article will help you enter. A startup is required to file one. Create a blank & editable 3921 form,. The form has to be. Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

This article will help you enter. Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of.

Where do i enter form 3921 information? (Turbotax 2019)

Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. It is generally not entered on your tax return unless you then sold the stock, or if you could be subject to alternative minimum. This article will help you.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web what is form 3921? This makes it easier for the irs to hold. Web who must file. Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in. Web 3921 is an informational form only.

Form 3921 Everything you need to know

Create a blank & editable 3921 form,. Web who must file. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Get ready for this year's.

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

I went online to my. It is generally not entered on your tax return unless you then sold the stock, or if you could be subject to alternative minimum. Web who must file. Web form 3921 walkthrough. Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. Create a blank & editable 3921 form,. A preparer must determine if an entry is needed based on the facts of the transfer. Web corporations file this form for.

Web Specific Instructions For Form 3921 Who Must File Every Corporation Which In Any Calendar Year Transfers To Any Person A Share Of Stock Pursuant To That Person's Exercise Of An.

Web do i need to file form 3921 even if i didn't sell? It is generally not entered on your tax return unless you then sold the stock, or if you could be subject to alternative minimum. Web form 3921 walkthrough. Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an incentive stock option (iso).

Web Form 3921 Is Generally Informational Unless Stock Acquired Through An Incentive Stock Option Is Sold Or Otherwise Disposed.

A preparer must determine if an entry is needed based on the facts of the transfer. This makes it easier for the irs to hold. This article will help you enter. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option.

Web Who Must File.

A startup is required to file one. Create a blank & editable 3921 form,. Get ready for this year's tax season quickly and safely with pdffiller! Form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso).

Edit, Sign And Print Tax Forms On Any Device With Uslegalforms.

I went online to my. Web up to $40 cash back easily complete a printable irs 3921 form 2017 online. Although this information is not taxable unless. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso).