Trustee To Trustee Transfer Form

Trustee To Trustee Transfer Form - Web there is a direct question for a transfer situation. Decide on what kind of signature to create. Web trustee transfer/direct rollover request 1. Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Create your signature and click. Office of the new york state comptroller subject: No taxes will be withheld from your transfer amount. It will request the funds from the current trustee, who will send a check to the new. Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return. Select the document you want to sign and click upload.

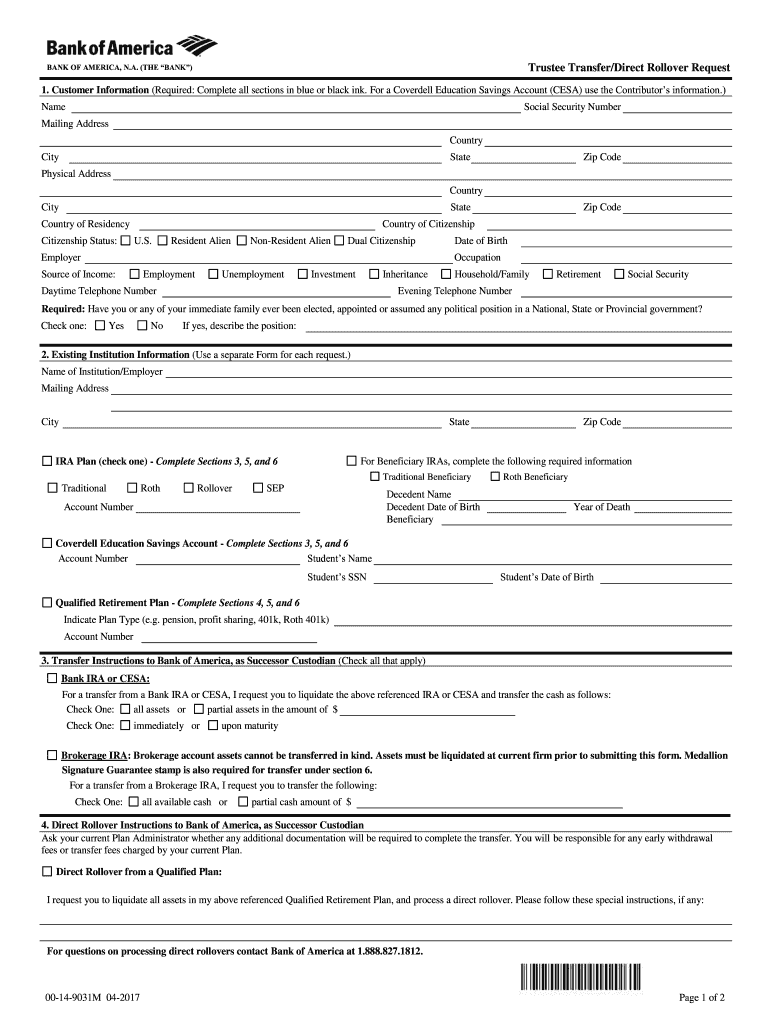

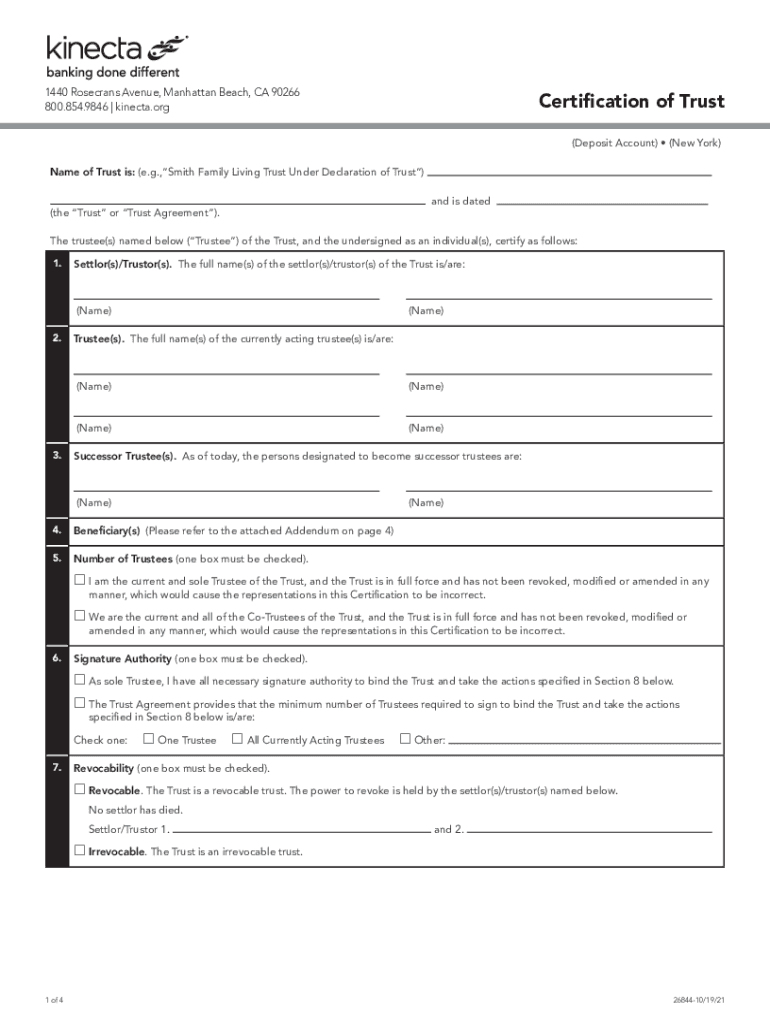

Web trustee transfer/direct rollover request 1. For a coverdell education savings account (cesa) use the contributor’s information.) Complete all sections in blue or black ink. Complete this form to transfer funds from another health savings account (hsa) or archer medical savings account (msa) trustee to your hsa held by optum financial. It will request the funds from the current trustee, who will send a check to the new. Web attached trustee transfer letter use this form to complete the movement of assets directly between ira trustees/custodians without distribution to the participant. Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return. Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Office of the new york state comptroller subject: A typed, drawn or uploaded signature.

Create your signature and click. Complete all sections in blue or black ink. No taxes will be withheld from your transfer amount. A typed, drawn or uploaded signature. Complete this form to transfer funds from another health savings account (hsa) or archer medical savings account (msa) trustee to your hsa held by optum financial. Select the document you want to sign and click upload. Office of the new york state comptroller subject: Decide on what kind of signature to create. Web attached trustee transfer letter use this form to complete the movement of assets directly between ira trustees/custodians without distribution to the participant. Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return.

Transfer of the Trust Assets YouTube

A typed, drawn or uploaded signature. Create your signature and click. Web trustee transfer/direct rollover request 1. Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return. It will request the funds from the current trustee, who will send a check to the new.

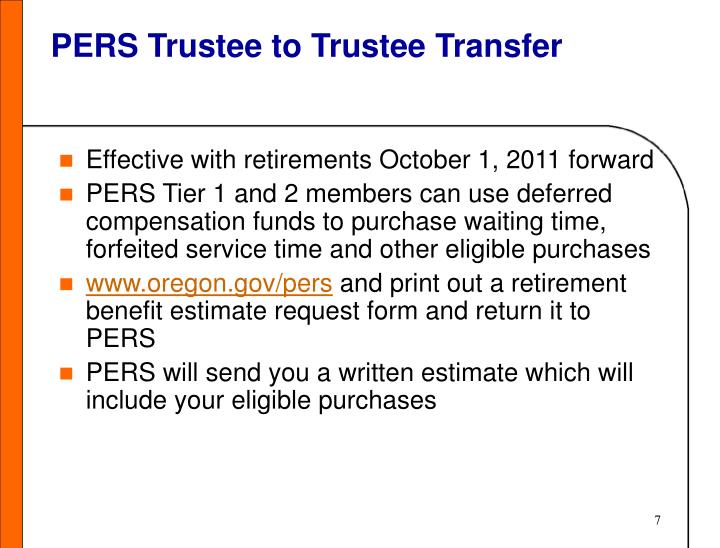

PPT City of Portland 457 Deferred Compensation Plan PowerPoint

Complete all sections in blue or black ink. A typed, drawn or uploaded signature. No taxes will be withheld from your transfer amount. Web attached trustee transfer letter use this form to complete the movement of assets directly between ira trustees/custodians without distribution to the participant. Web the ira trustee at the receiving institution should be able to handle the.

sample letter to close trust account Doc Template pdfFiller

It will request the funds from the current trustee, who will send a check to the new. Create your signature and click. Select the document you want to sign and click upload. Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Web attached trustee transfer letter use this form.

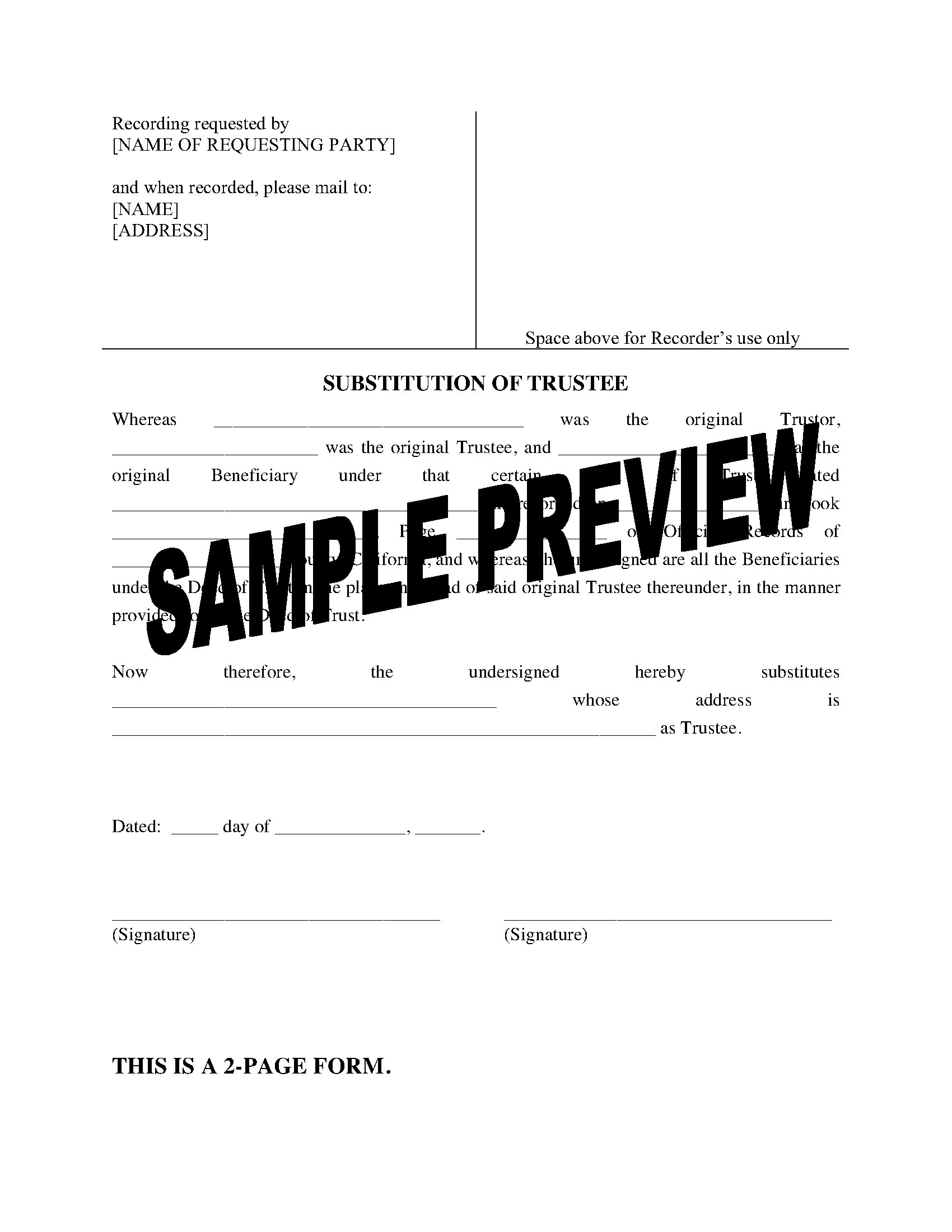

California Substitution of Trustee Legal Forms and Business Templates

Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return. Create your signature and click. It will request the funds from the current trustee, who will send a check to the new. Select the document you want to sign and click upload. Decide on what kind of signature to create.

Consent of Successor Trustee to Appointment Following Resignation of

Complete all sections in blue or black ink. A typed, drawn or uploaded signature. Office of the new york state comptroller subject: Decide on what kind of signature to create. Web attached trustee transfer letter use this form to complete the movement of assets directly between ira trustees/custodians without distribution to the participant.

Change of Trustee Form 2 Free Templates in PDF, Word, Excel Download

Web attached trustee transfer letter use this form to complete the movement of assets directly between ira trustees/custodians without distribution to the participant. Select the document you want to sign and click upload. For a coverdell education savings account (cesa) use the contributor’s information.) No taxes will be withheld from your transfer amount. A typed, drawn or uploaded signature.

What are Trustee Fees? (with pictures)

No taxes will be withheld from your transfer amount. Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return. It will request the funds from the current trustee, who will send a check to the new. Decide on what kind of signature to create. For a coverdell education savings account (cesa) use the.

Ira Trustee Transfer Form Fill Out and Sign Printable PDF Template

Select the document you want to sign and click upload. Decide on what kind of signature to create. It will request the funds from the current trustee, who will send a check to the new. Web there is a direct question for a transfer situation. Web the ira trustee at the receiving institution should be able to handle the details.

Wells Fargo Living Trust Forms Fill Out and Sign Printable PDF

Complete this form to transfer funds from another health savings account (hsa) or archer medical savings account (msa) trustee to your hsa held by optum financial. Decide on what kind of signature to create. No taxes will be withheld from your transfer amount. Web the ira trustee at the receiving institution should be able to handle the details of the.

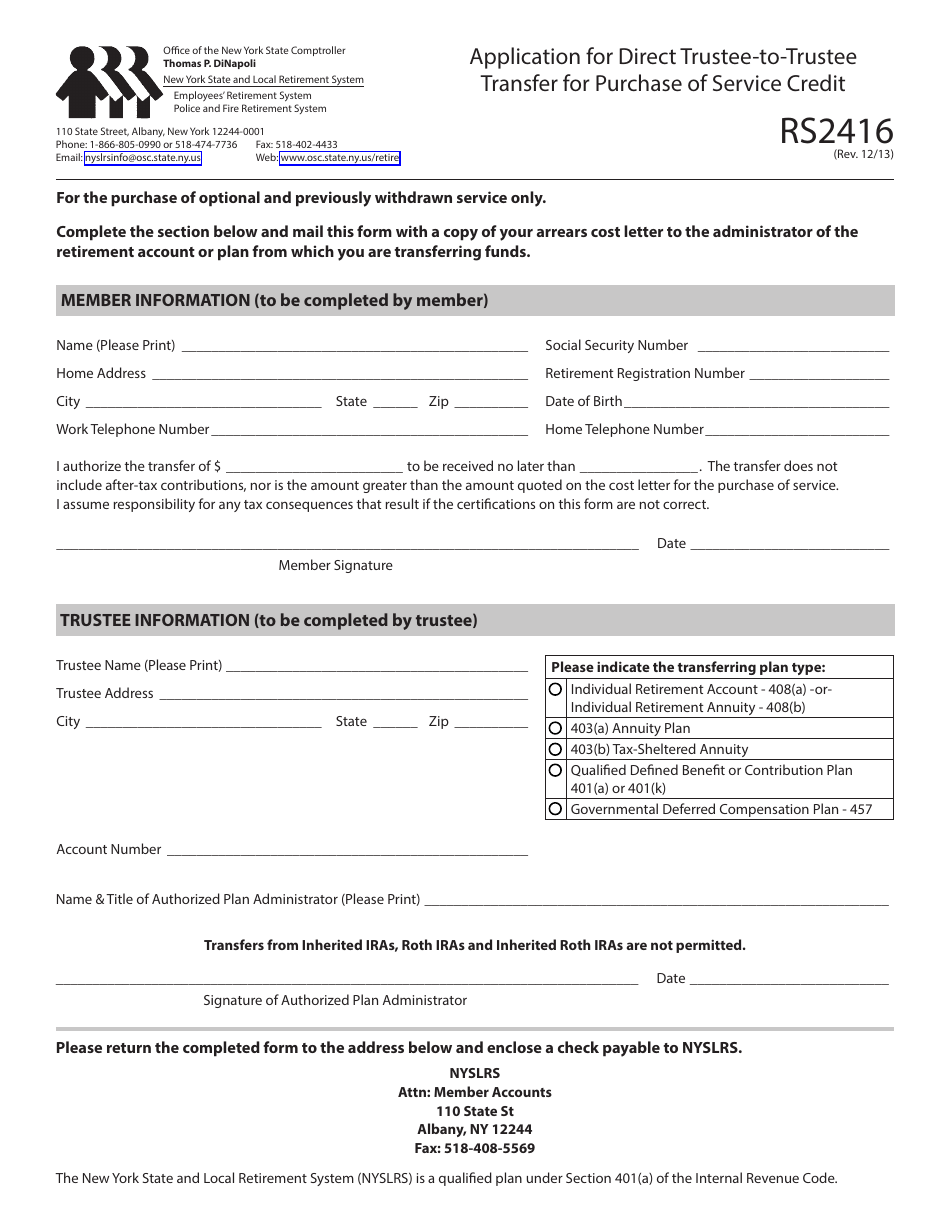

Form RS2416 Download Fillable PDF or Fill Online Application for Direct

Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. Complete this form to transfer funds from another health savings account (hsa) or archer medical savings account (msa) trustee to your hsa held by optum financial. Web attached trustee transfer letter use this form to complete the movement of assets.

Office Of The New York State Comptroller Subject:

Web trustee transfer/direct rollover request 1. Web the ira trustee at the receiving institution should be able to handle the details of the transfer for you. A typed, drawn or uploaded signature. It will request the funds from the current trustee, who will send a check to the new.

Decide On What Kind Of Signature To Create.

Complete all sections in blue or black ink. No taxes will be withheld from your transfer amount. Web there is a direct question for a transfer situation. Nontaxable distributions from cesas and qtps are not required to be reported on your income tax return.

For A Coverdell Education Savings Account (Cesa) Use The Contributor’s Information.)

Web attached trustee transfer letter use this form to complete the movement of assets directly between ira trustees/custodians without distribution to the participant. Select the document you want to sign and click upload. Create your signature and click. Complete this form to transfer funds from another health savings account (hsa) or archer medical savings account (msa) trustee to your hsa held by optum financial.