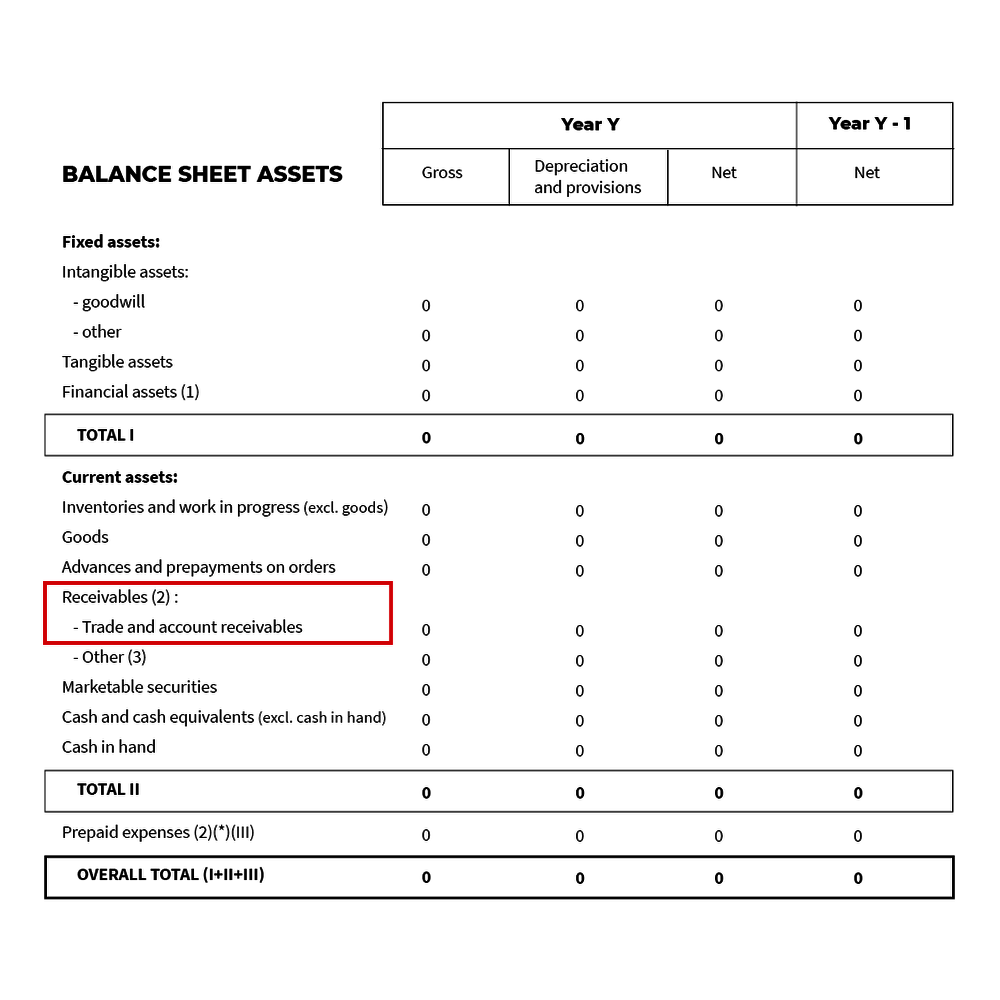

Trade Receivables Balance Sheet

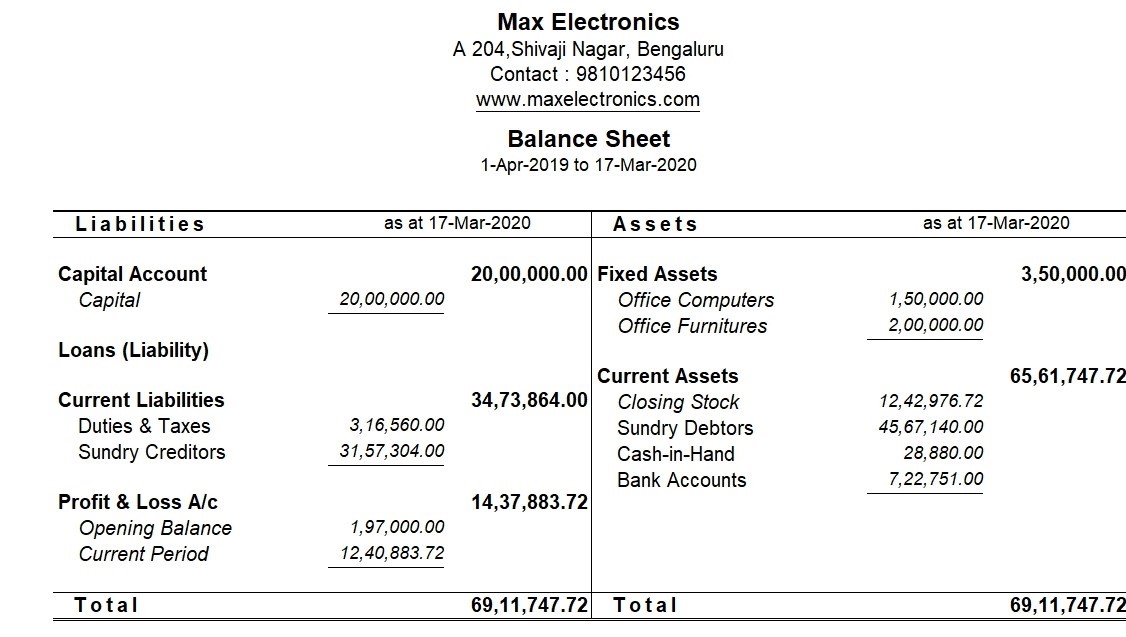

Trade Receivables Balance Sheet - Learn how to read one and why it matters. Trade receivables = 6000 (sundry debtors) + 9000 (bills receivable) = 15,000. Since an entity has a legal claim over its customer for this amount and the. Web a company's balance sheet shows an account receivable when a business is owed money by its customers. Web trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. Web trade receivables is the accounting entry in an entity’s balance sheet, which arises due to the selling of the goods and services on credit. Web trade receivables is the amount that customers owe a business for the goods or services provided. Debtors are people or entities to whom goods have been sold or services. These amounts are expected to be settled in less than 12. Web calculate trade receivables from the below balance sheet.

These amounts are expected to be settled in less than 12. It is the same as accounts receivable and comes under the current asset category on a. Trade receivables = 6000 (sundry debtors) + 9000 (bills receivable) = 15,000. Web calculate trade receivables from the below balance sheet. Web trade receivables is the accounting entry in an entity’s balance sheet, which arises due to the selling of the goods and services on credit. Since an entity has a legal claim over its customer for this amount and the. Debtors are people or entities to whom goods have been sold or services. Web trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. Learn how to read one and why it matters. Web trade receivables is the amount that customers owe a business for the goods or services provided.

Since an entity has a legal claim over its customer for this amount and the. Learn how to read one and why it matters. Web trade receivables is the amount that customers owe a business for the goods or services provided. These amounts are expected to be settled in less than 12. Web trade receivables is the accounting entry in an entity’s balance sheet, which arises due to the selling of the goods and services on credit. Web trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. It is the same as accounts receivable and comes under the current asset category on a. Trade receivables = 6000 (sundry debtors) + 9000 (bills receivable) = 15,000. Debtors are people or entities to whom goods have been sold or services. Web a company's balance sheet shows an account receivable when a business is owed money by its customers.

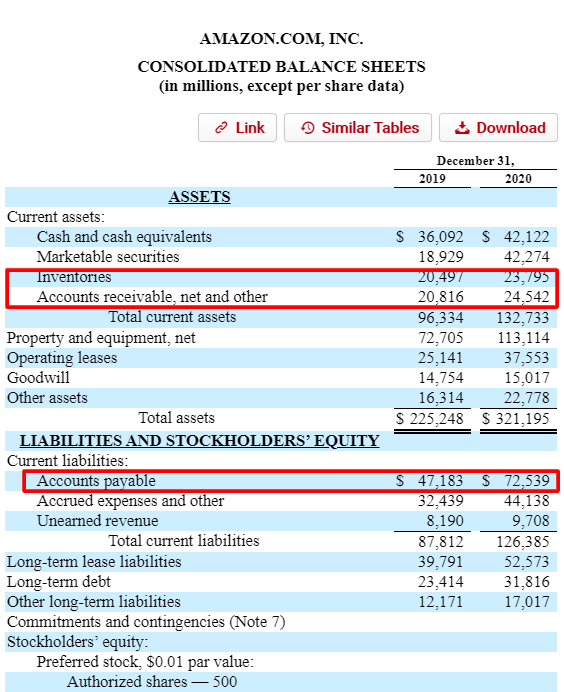

Accounts Receivable Vs. Accounts Payable and the Working Capital Cycle

Web trade receivables is the accounting entry in an entity’s balance sheet, which arises due to the selling of the goods and services on credit. Web calculate trade receivables from the below balance sheet. Web a company's balance sheet shows an account receivable when a business is owed money by its customers. Learn how to read one and why it.

Is credit balance an asset? Leia aqui Is credit balance an asset or

These amounts are expected to be settled in less than 12. Web trade receivables is the amount that customers owe a business for the goods or services provided. Web calculate trade receivables from the below balance sheet. Learn how to read one and why it matters. Web a company's balance sheet shows an account receivable when a business is owed.

Accounts Receivable (AR) What They Are and How to Interpret Pareto Labs

Web trade receivables is the amount that customers owe a business for the goods or services provided. Debtors are people or entities to whom goods have been sold or services. Web a company's balance sheet shows an account receivable when a business is owed money by its customers. Since an entity has a legal claim over its customer for this.

Consolidated Financial Statements Definition & Examples Tally Solutions

Web trade receivables is the accounting entry in an entity’s balance sheet, which arises due to the selling of the goods and services on credit. Web trade receivables is the amount that customers owe a business for the goods or services provided. Trade receivables = 6000 (sundry debtors) + 9000 (bills receivable) = 15,000. Web calculate trade receivables from the.

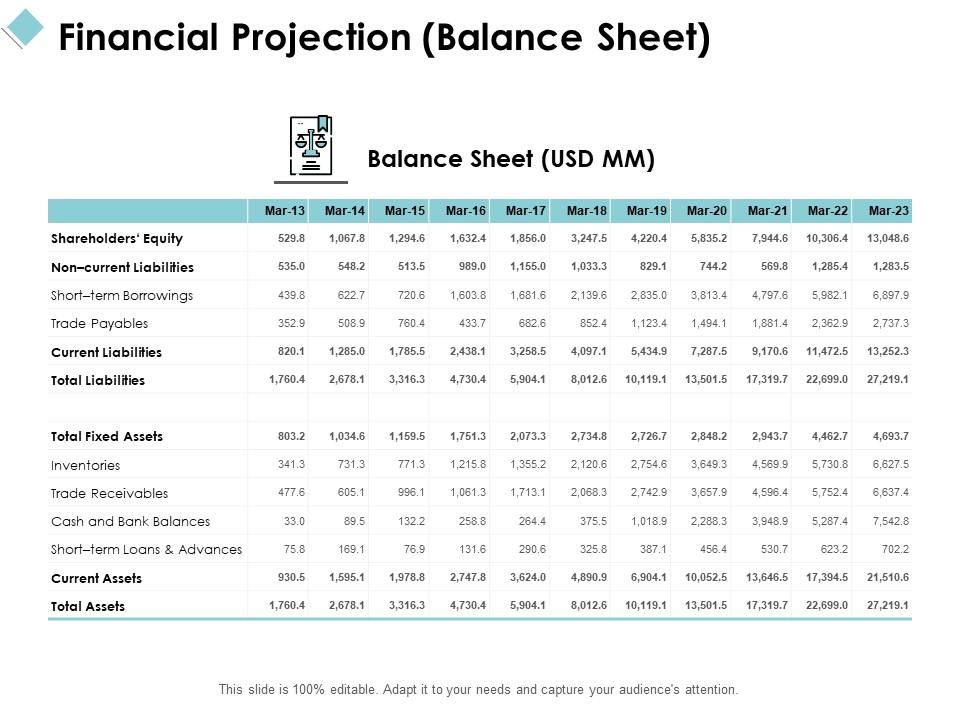

Financial Projection Balance Sheet Trade Receivables Ppt Powerpoint

Web trade receivables is the amount that customers owe a business for the goods or services provided. Since an entity has a legal claim over its customer for this amount and the. Web trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. Trade receivables = 6000 (sundry debtors).

SERIOUS Investing EAH Don't fall into the bad assets trap

Web calculate trade receivables from the below balance sheet. Web trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. Web trade receivables is the amount that customers owe a business for the goods or services provided. It is the same as accounts receivable and comes under the current.

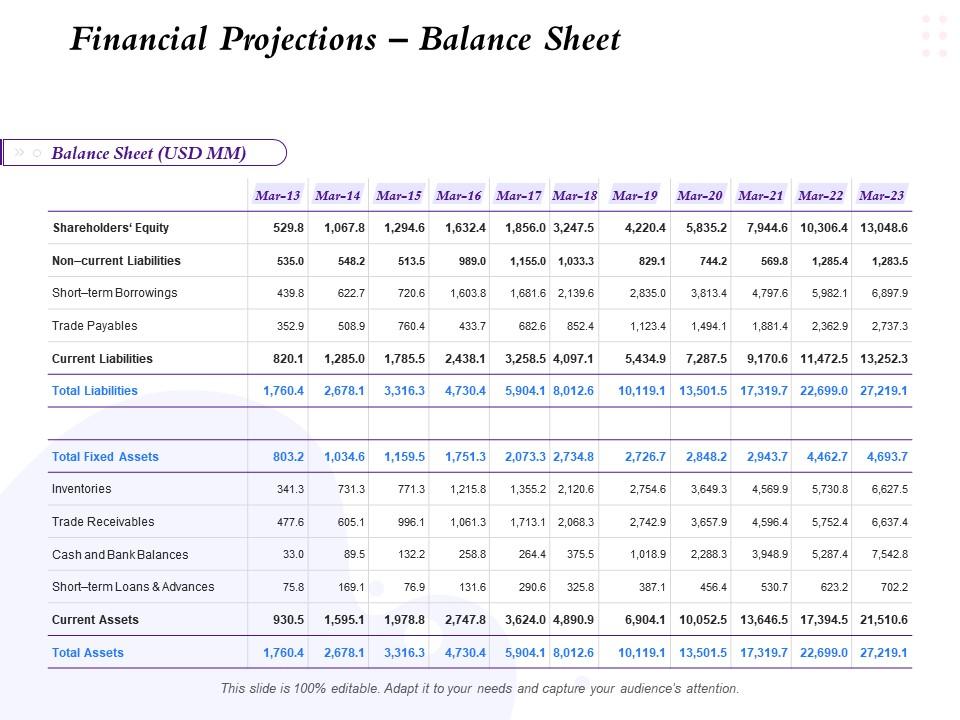

Financial Projections Balance Sheet Trade Receivables Ppt Powerpoint

Since an entity has a legal claim over its customer for this amount and the. Web a company's balance sheet shows an account receivable when a business is owed money by its customers. Web calculate trade receivables from the below balance sheet. Trade receivables = 6000 (sundry debtors) + 9000 (bills receivable) = 15,000. Learn how to read one and.

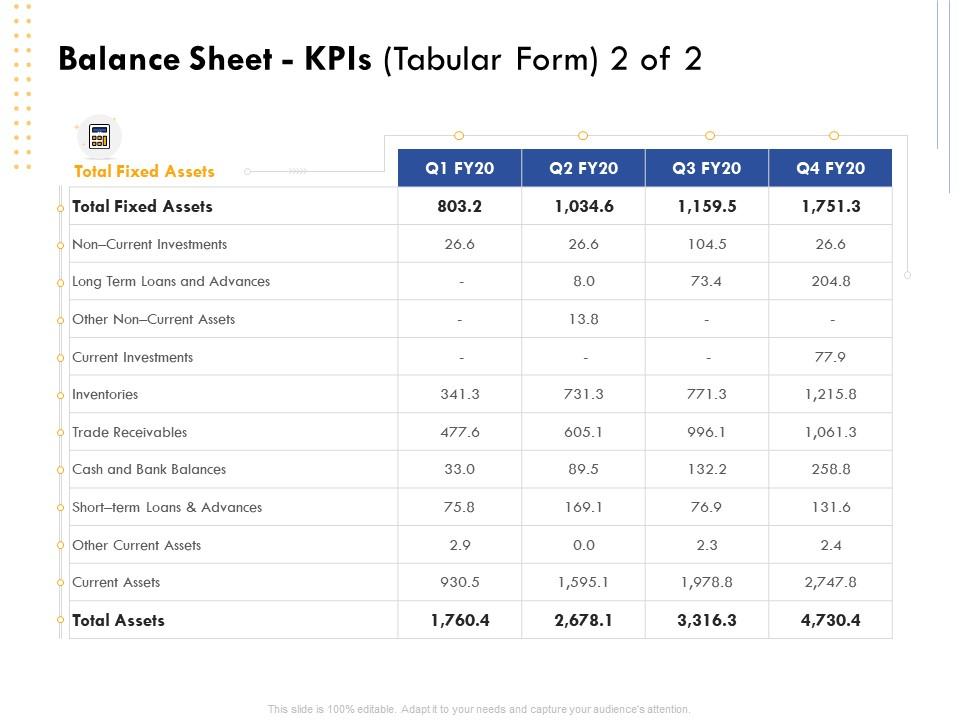

Balance Sheet Kpis Tabular Form Trade Receivables Ppt Powerpoint Images

It is the same as accounts receivable and comes under the current asset category on a. Web trade receivables is the amount that customers owe a business for the goods or services provided. Web trade receivables is the accounting entry in an entity’s balance sheet, which arises due to the selling of the goods and services on credit. Learn how.

How Do Accounts Payable Show on the Balance Sheet?

Learn how to read one and why it matters. Since an entity has a legal claim over its customer for this amount and the. Trade receivables = 6000 (sundry debtors) + 9000 (bills receivable) = 15,000. Debtors are people or entities to whom goods have been sold or services. Web calculate trade receivables from the below balance sheet.

Trade receivables

Web trade receivables is the amount that customers owe a business for the goods or services provided. Web calculate trade receivables from the below balance sheet. Web trade receivables is the accounting entry in an entity’s balance sheet, which arises due to the selling of the goods and services on credit. Debtors are people or entities to whom goods have.

Web A Company's Balance Sheet Shows An Account Receivable When A Business Is Owed Money By Its Customers.

Web trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period. Learn how to read one and why it matters. Web trade receivables is the amount that customers owe a business for the goods or services provided. Debtors are people or entities to whom goods have been sold or services.

Trade Receivables = 6000 (Sundry Debtors) + 9000 (Bills Receivable) = 15,000.

It is the same as accounts receivable and comes under the current asset category on a. Web trade receivables is the accounting entry in an entity’s balance sheet, which arises due to the selling of the goods and services on credit. These amounts are expected to be settled in less than 12. Web calculate trade receivables from the below balance sheet.

:max_bytes(150000):strip_icc()/accounts-receivables-on-the-balance-sheet-357263-final-911167a5515b4facb2d39d25e4e5bf3d.jpg)