Texas Small Estate Affidavit Form

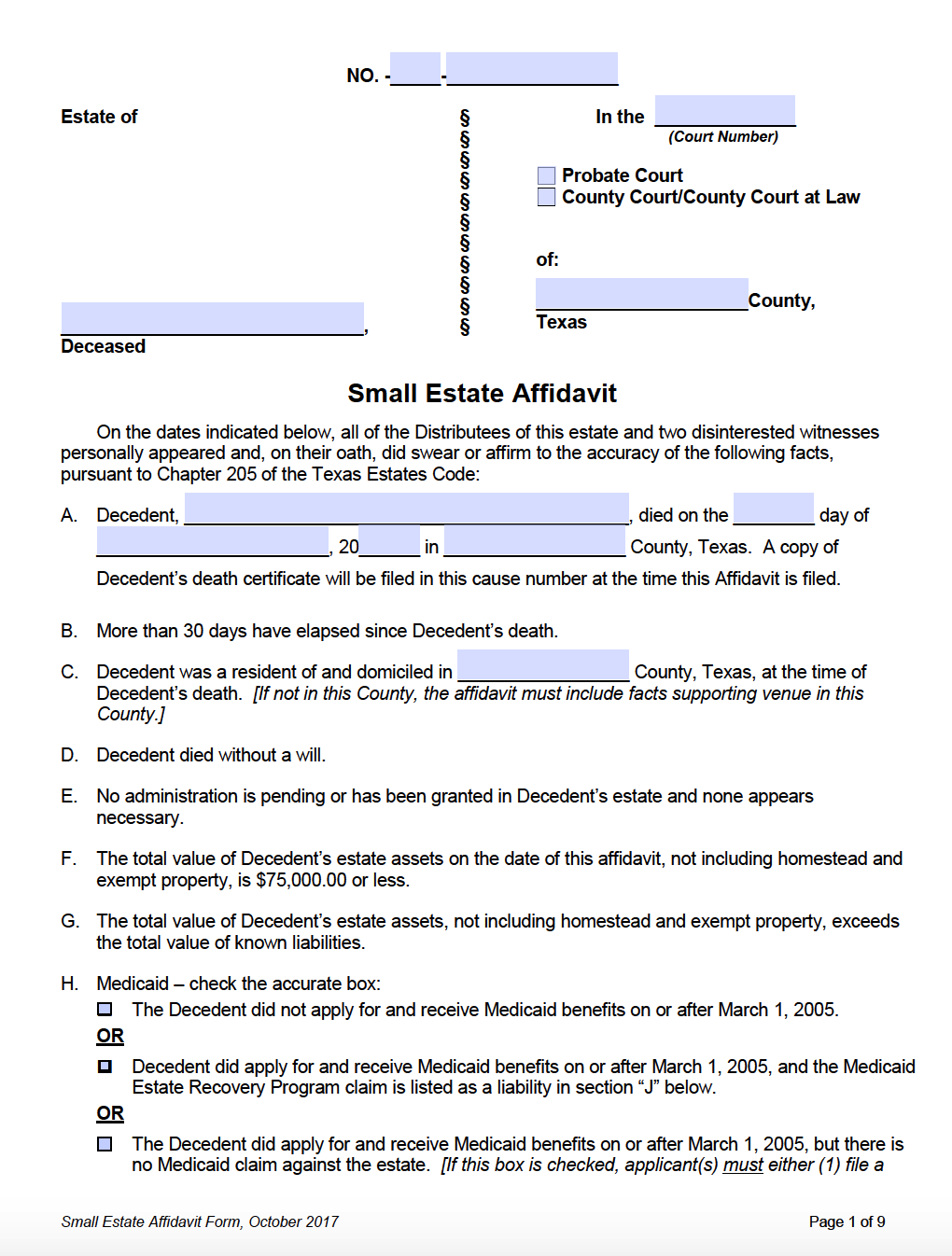

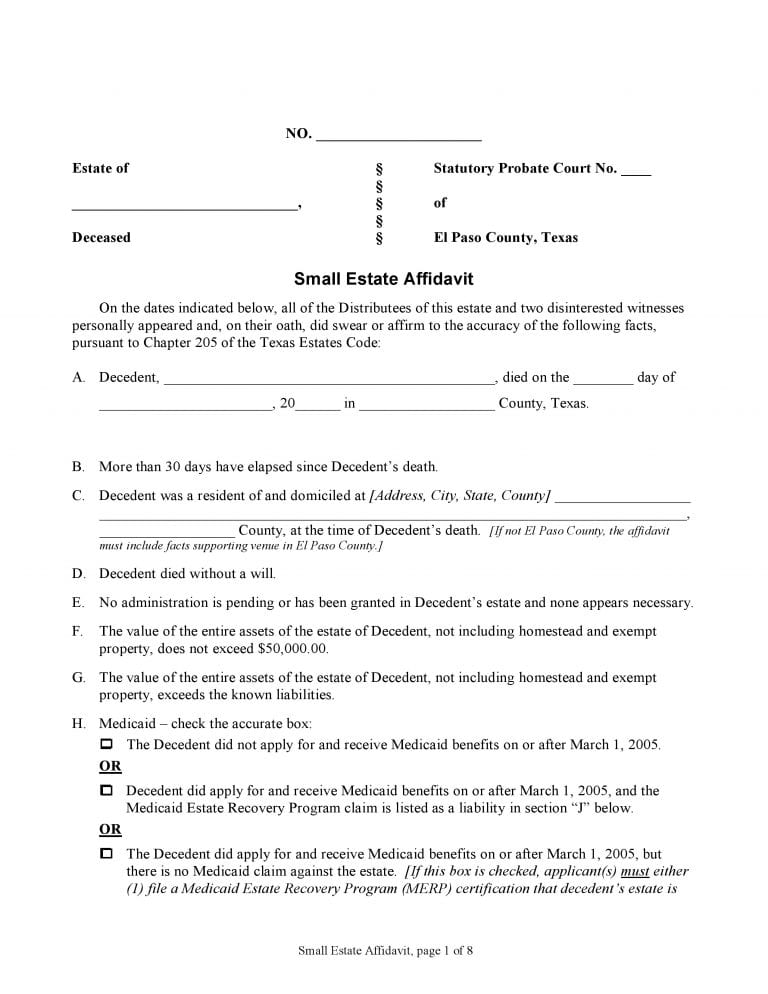

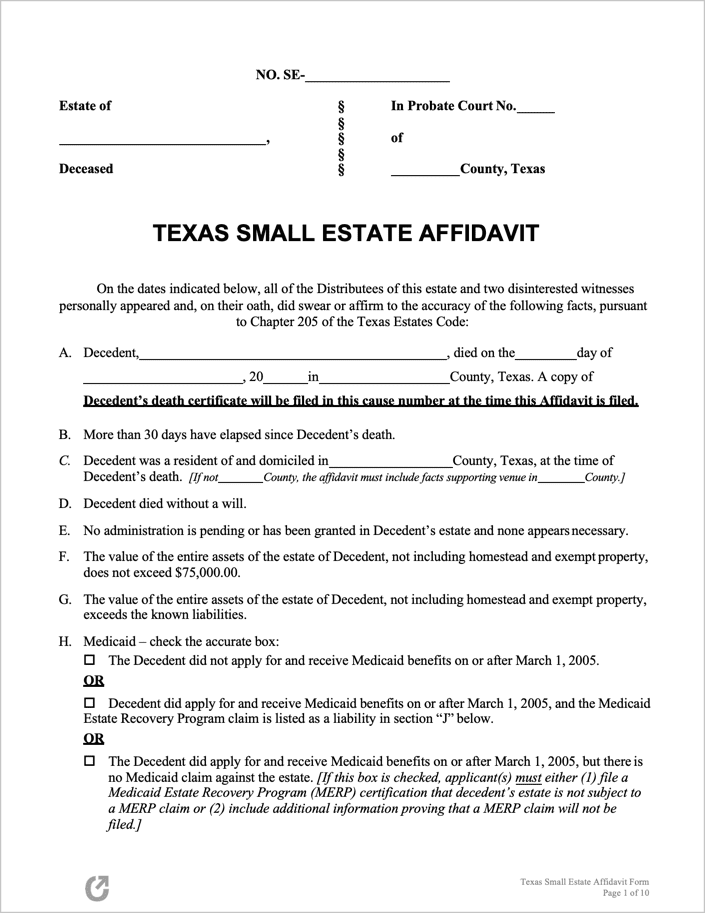

Texas Small Estate Affidavit Form - Web these instructions explain the basic steps to use a small estate affidavit (sea) to probate an estate in texas. The judge may approve the affidavit if the judge determines that the affidavit conforms to the requirements of this chapter. Web small estate affidavits are a fast and affordable way to transfer property after someone has died, when the decedent died without a will and the other requirements set out in the texas estates code are satisfied. A texas small estate affidavit can be used to expedite the distribution of the assets of a person who has died (known as a decedent) when the estate is worth $75,000 or less and lacks a will. Web the small estate affidavit must be sworn to by two disinterested witnesses (that is, people over age 18 who are it also must include a list of all known estate assets and liabilities, including which assets are exempt, and contain the relevant family history that shows each person’s right as an estate heir to receive estate assets. The judge shall examine an affidavit filed under section 205.001. Chapter 205 of the texas estates code. Web small estate affidavit small estate affidavit (texaslawhelp.org) transfer property to a deceased person’s heirs. Affidavit of distributees small estate with judge's order of approval. Web to be able to file a small estate affidavit in texas for a loved one, when no will was executed, you must be a person who would inherit under texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or.

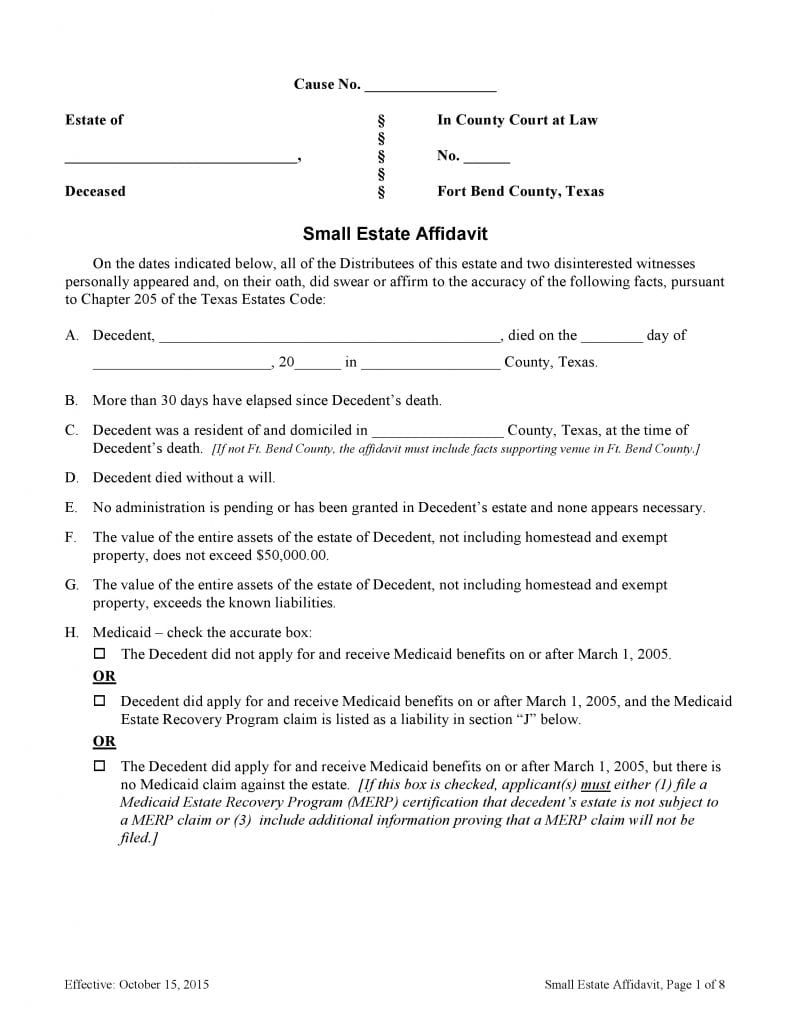

The judge shall examine an affidavit filed under section 205.001. All assets of the decedent’s estate and their values are listed here. Transfer on death deed (efiletexas.gov) The county where the decedent resided; Web small estate affidavit form, october 2017 page 1 of 9 medicaid estate recovery program (merp) certification that decedent’s estate is not subject to a merp claim or (2) include additional information proving that a merp claim will not be filed.] i. Web county clerk, harris county, texas. Web the small estate affidavit must be sworn to by two disinterested witnesses (that is, people over age 18 who are it also must include a list of all known estate assets and liabilities, including which assets are exempt, and contain the relevant family history that shows each person’s right as an estate heir to receive estate assets. Each item below corresponds to a section of the form. Each step includes a link to the form or forms needed for that step. Web small estate affidavit small estate affidavit (texaslawhelp.org) transfer property to a deceased person’s heirs.

The decedent died without a will, and the decedent’s total assets were less than $75,000 (not including homestead and exempt property). Examination and approval of affidavit. Each step includes a link to the form or forms needed for that step. Affidavit of distributees small estate with judge's order of approval. That the decedent died without a will; In matters of probate § docket no. Each item below corresponds to a section of the form. § style of harris county, texas § estate: Web to be able to file a small estate affidavit in texas for a loved one, when no will was executed, you must be a person who would inherit under texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or. That 30 days have passed since the decedent died;

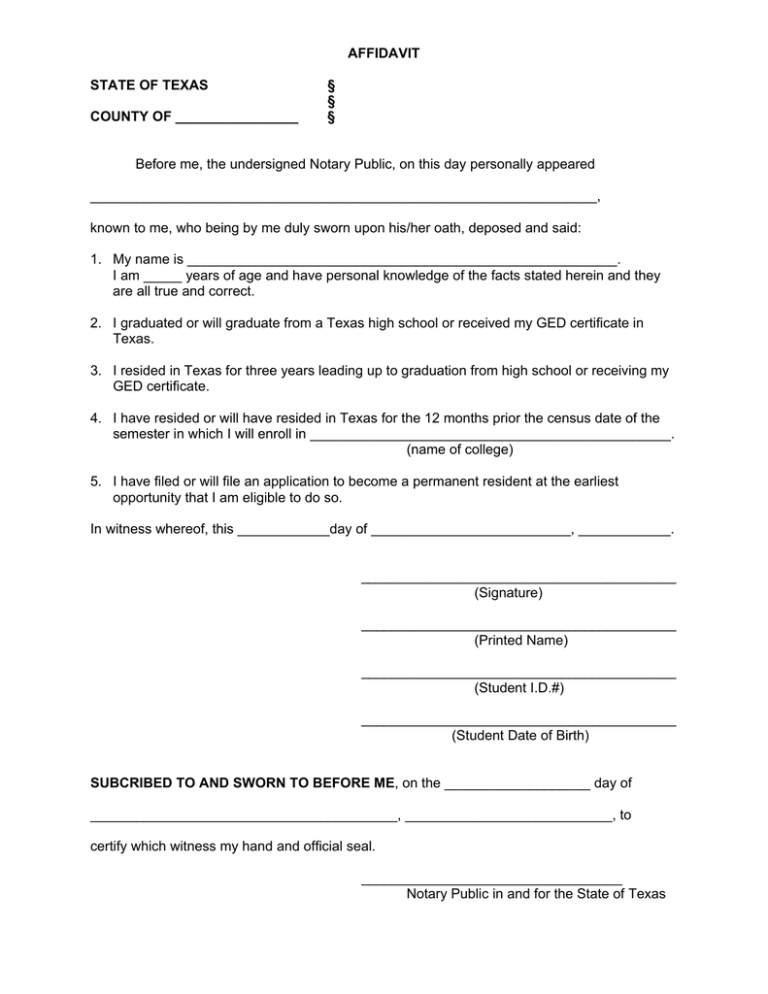

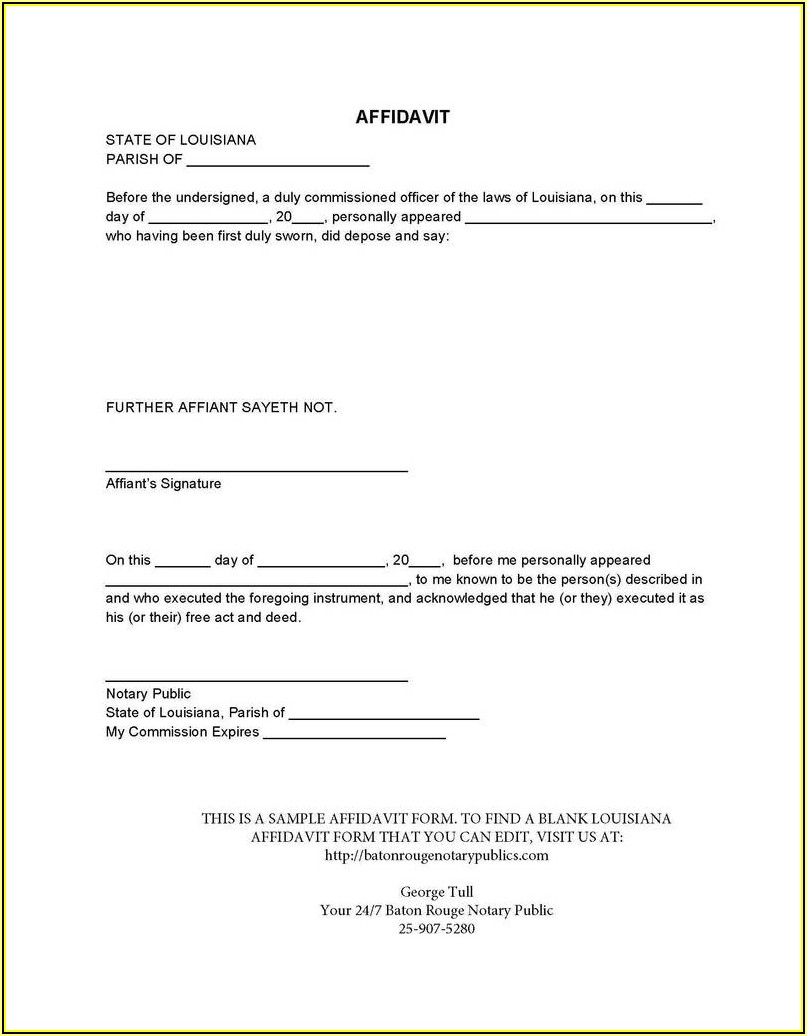

AFFIDAVIT STATE OF TEXAS

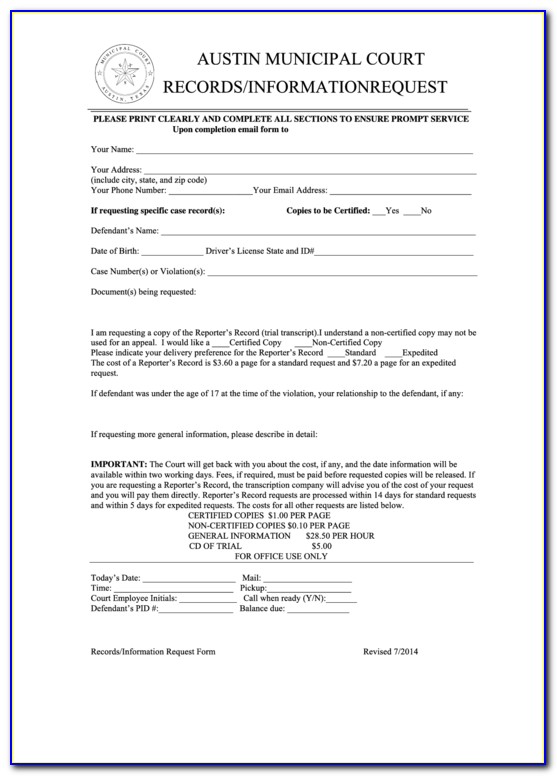

Web county clerk, harris county, texas. In matters of probate § docket no. A texas small estate affidavit can be used to expedite the distribution of the assets of a person who has died (known as a decedent) when the estate is worth $75,000 or less and lacks a will. All assets of the decedent’s estate and their values are.

Dba Form Texas Harris County Form Resume Examples qlkmlEROaj

That 30 days have passed since the decedent died; Web the small estate affidavit must be sworn to by two disinterested witnesses (that is, people over age 18 who are it also must include a list of all known estate assets and liabilities, including which assets are exempt, and contain the relevant family history that shows each person’s right as.

Texas Small Estate Affidavit Form Travis County Form Resume

The decedent died without a will, and the decedent’s total assets were less than $75,000 (not including homestead and exempt property). Web small estate affidavit small estate affidavit (texaslawhelp.org) transfer property to a deceased person’s heirs. Web county clerk, harris county, texas. That 30 days have passed since the decedent died; Learn about using a small estate affidavit probate procedure.

Free Texas Small Estate Affidavit Form PDF Word

Web small estate affidavit small estate affidavit (texaslawhelp.org) transfer property to a deceased person’s heirs. Web county clerk, harris county, texas. Affidavit of distributees small estate with judge's order of approval. Examination and approval of affidavit. Each item below corresponds to a section of the form.

Download Free El Paso County Texas Small State Affidavit Form Form

Web these instructions explain the basic steps to use a small estate affidavit (sea) to probate an estate in texas. Each step includes a link to the form or forms needed for that step. The judge may approve the affidavit if the judge determines that the affidavit conforms to the requirements of this chapter. Transfer property after death transfer on.

Probate Form 13100 Affidavit For Small Estates Universal Network

Affidavit of distributees small estate with judge's order of approval. Learn about using a small estate affidavit probate procedure in this article. Web small estate affidavits are a fast and affordable way to transfer property after someone has died, when the decedent died without a will and the other requirements set out in the texas estates code are satisfied. That.

Download Free Fort Bend County Texas Small Estate Affidavit Form Form

Chapter 205 of the texas estates code. The decedent died without a will, and the decedent’s total assets were less than $75,000 (not including homestead and exempt property). Web county clerk, harris county, texas. A texas small estate affidavit can be used to expedite the distribution of the assets of a person who has died (known as a decedent) when.

Small Estate Affidavit Form Bexar County Texas Universal Network

Each step includes a link to the form or forms needed for that step. Web small estate affidavit small estate affidavit (texaslawhelp.org) transfer property to a deceased person’s heirs. Web to be able to file a small estate affidavit in texas for a loved one, when no will was executed, you must be a person who would inherit under texas.

Where Can I Get A Small Estate Affidavit Form Form Resume Examples

Learn about using a small estate affidavit probate procedure in this article. Web small estate affidavit small estate affidavit (texaslawhelp.org) transfer property to a deceased person’s heirs. Web updated april 14, 2023. The county where the decedent resided; In matters of probate § docket no.

Free Texas Small Estate Affidavit Form PDF WORD

Each step includes a link to the form or forms needed for that step. Web small estate affidavits are a fast and affordable way to transfer property after someone has died, when the decedent died without a will and the other requirements set out in the texas estates code are satisfied. The name of, and facts about, the decedent; Learn.

The County Where The Decedent Resided;

A texas small estate affidavit can be used to expedite the distribution of the assets of a person who has died (known as a decedent) when the estate is worth $75,000 or less and lacks a will. All assets of the decedent’s estate and their values are listed here. That 30 days have passed since the decedent died; § style of harris county, texas § estate:

Web Small Estate Affidavit Form, October 2017 Page 1 Of 9 Medicaid Estate Recovery Program (Merp) Certification That Decedent’s Estate Is Not Subject To A Merp Claim Or (2) Include Additional Information Proving That A Merp Claim Will Not Be Filed.] I.

A successor can use the form to claim assets without undergoing a complicated court proceeding. Each step includes a link to the form or forms needed for that step. The decedent died without a will, and the decedent’s total assets were less than $75,000 (not including homestead and exempt property). Transfer on death deed (efiletexas.gov)

Web Small Estate Affidavits Are A Fast And Affordable Way To Transfer Property After Someone Has Died, When The Decedent Died Without A Will And The Other Requirements Set Out In The Texas Estates Code Are Satisfied.

Chapter 205 of the texas estates code. Transfer property after death transfer on death deed kit (texaslawhelp.org) pass on your house or land without a will. Affidavit of distributees small estate with judge's order of approval. The name of, and facts about, the decedent;

Examination And Approval Of Affidavit.

Web the small estate affidavit must be sworn to by two disinterested witnesses (that is, people over age 18 who are it also must include a list of all known estate assets and liabilities, including which assets are exempt, and contain the relevant family history that shows each person’s right as an estate heir to receive estate assets. In matters of probate § docket no. Each item below corresponds to a section of the form. Web to be able to file a small estate affidavit in texas for a loved one, when no will was executed, you must be a person who would inherit under texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or.