Texas Deed Transfer Form

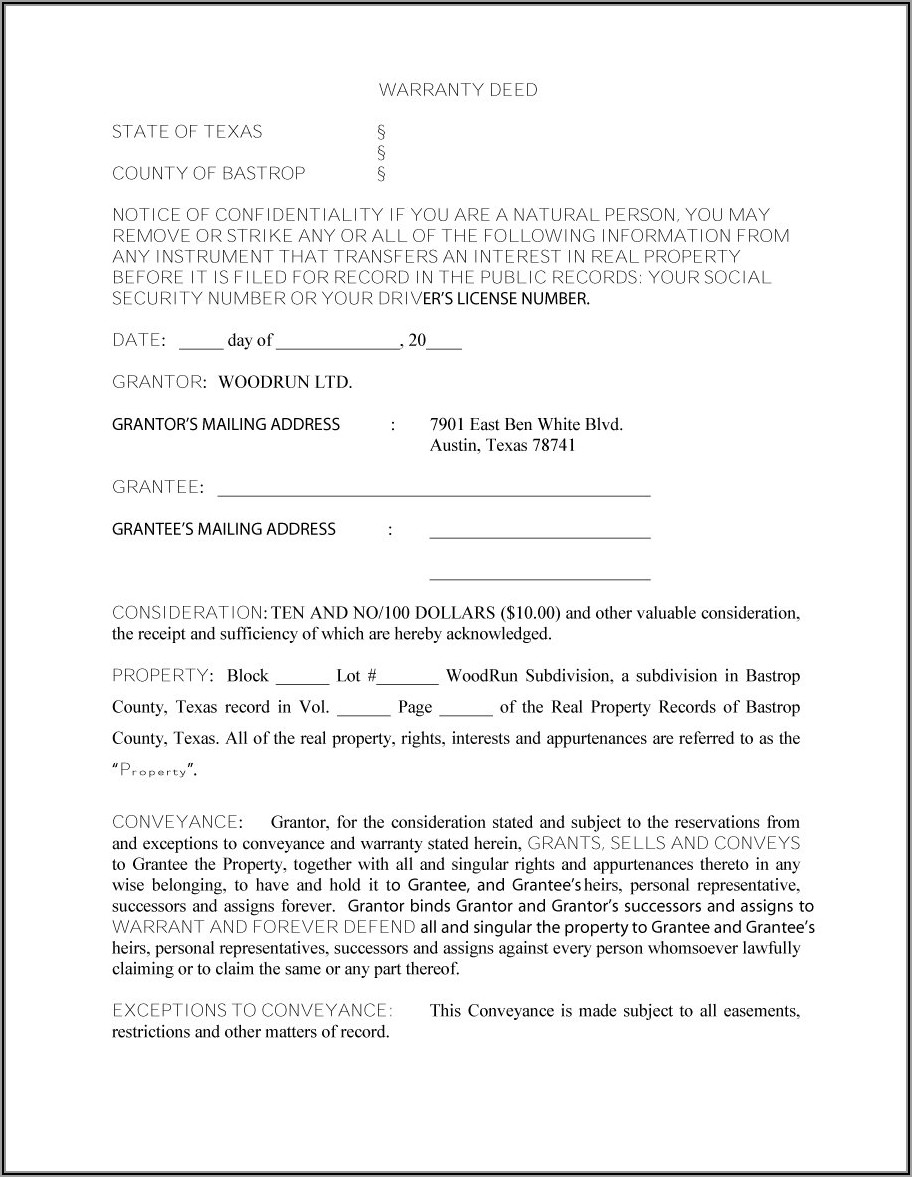

Texas Deed Transfer Form - Property owner(s) (transferors) making this deed. Using this deed allows the beneficiary to skip the lengthy probate process. Deeds are used to transfer property title between living owners only. Web instruments that are transferring an interest in real property to or from an individual must include a confidentiality notice, as required by texas statutes sec. Web updated may 14, 2022 a texas general warranty deed is a form that transfers real estate ownership in the clearest possible manner and promises the new owner that there are no title defects such as liens or encumbrances. Web to transfer a deed in texas will cost roughly $195. You must record (file) this deed before your death with the county clerk where the property is located or it will not be effective. There is not technically a standard form for a deed in this state; Click here for instructions on opening this form. It may cost more if the person who is preparing the deed charges more.

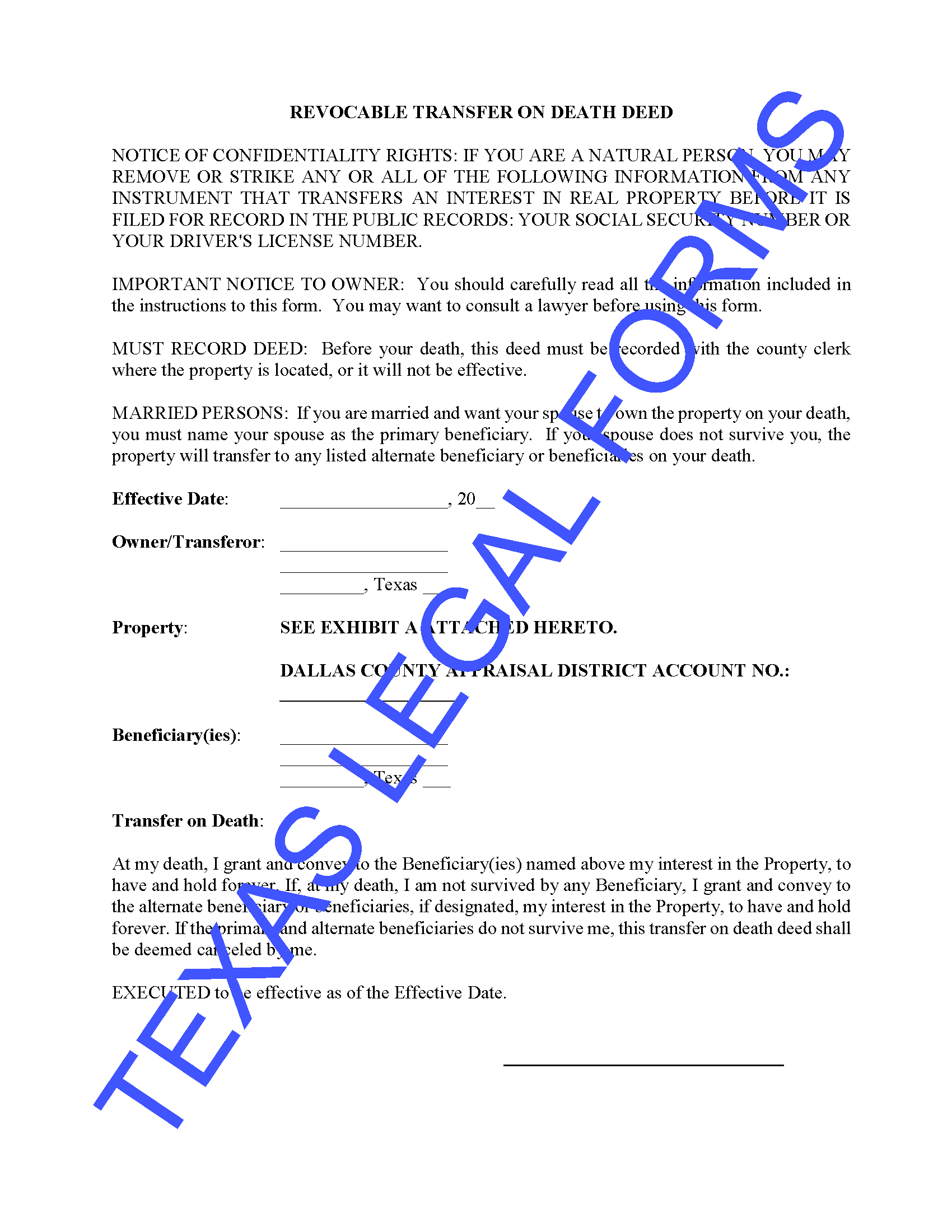

The most common type of deed is a general warranty deed. Web a transfer on death deed needs to be signed by the owner before he or she dies, and it must be filed before he or she dies. You will have to check the laws in the other states to determine if they have a similar deed. You no not need the mortgage company’s permission for a transfer on death deed. Web a texas transfer on death deed is a document that allows the owner of real property to transfer their ownership to a designated beneficiary at the time of their death. You must record (file) this deed before your death with the county clerk where the property is located or it will not be effective. Web instruments that are transferring an interest in real property to or from an individual must include a confidentiality notice, as required by texas statutes sec. Deeds are used to transfer property title between living owners only. Web the most common document which allows a property deed transfer between living owners to take place is called a deed. Web form 1092, change of ownership transfer affidavit form 1092, change of ownership transfer affidavit instructions for opening a form some forms cannot be viewed in a web browser and must be opened in adobe acrobat reader on your desktop system.

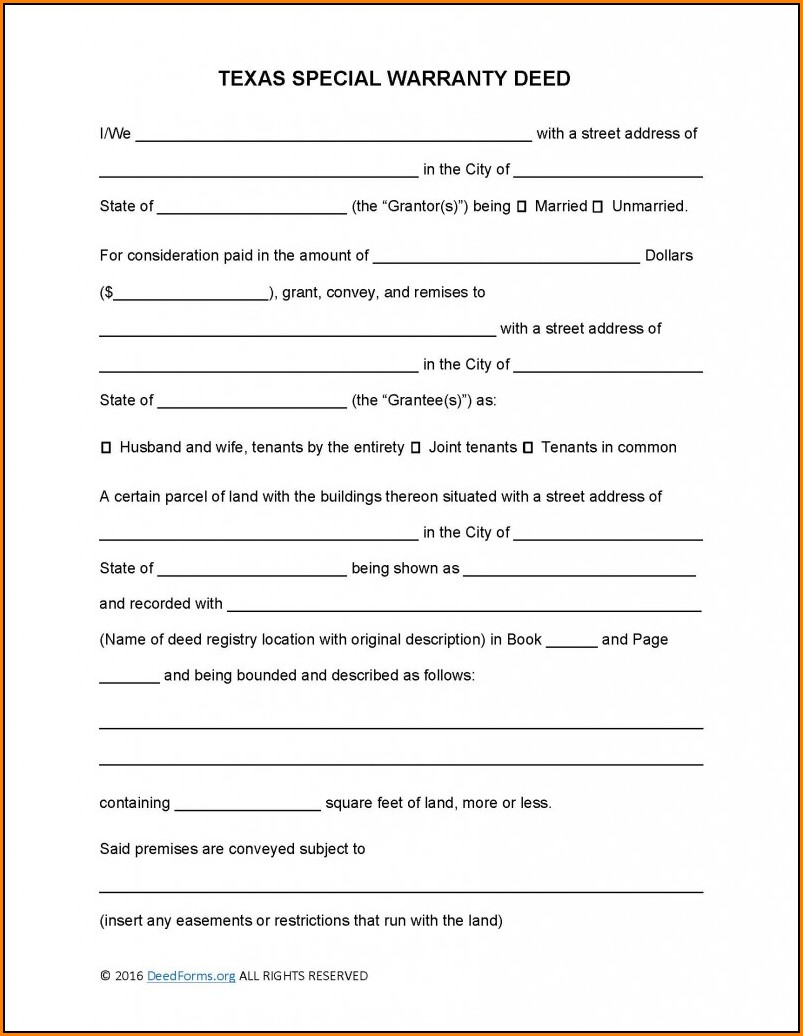

It may cost more if the person who is preparing the deed charges more. You must record (file) this deed before your death with the county clerk where the property is located or it will not be effective. You will have to check the laws in the other states to determine if they have a similar deed. Have some form of transfer on death deed, the texas transfer on death deed law and its related forms can only be used for real property located in texas. Now, this doesn’t include any filing fees that the county clerk’s office may charge. Enter your first, middle (if any), and last name here, alongwith your mailing address. For example, in dallas county, the filing fee is $26 for one page and an additional $4 for every other page. I already have a will. A deed is usually prepared after a purchase and sale agreement has been signed. Web a texas deed form allows for the transfer of real estate from one party (the grantor) to another (the grantee).

Free Property Deed Transfer Form Texas Form Resume Examples G28BpGlKgE

You no not need the mortgage company’s permission for a transfer on death deed. Click here for instructions on opening this form. Web to transfer a deed in texas will cost roughly $195. Another good reason to use a transfer on death deed is if there is a mortgage on the property. Now, this doesn’t include any filing fees that.

Free Oregon Transfer On Death Deed Form Form Resume Examples

Web instruments that are transferring an interest in real property to or from an individual must include a confidentiality notice, as required by texas statutes sec. Web must record transfer on death deed before your death: Deeds are used to transfer property title between living owners only. The most common type of deed is a general warranty deed. However, certain.

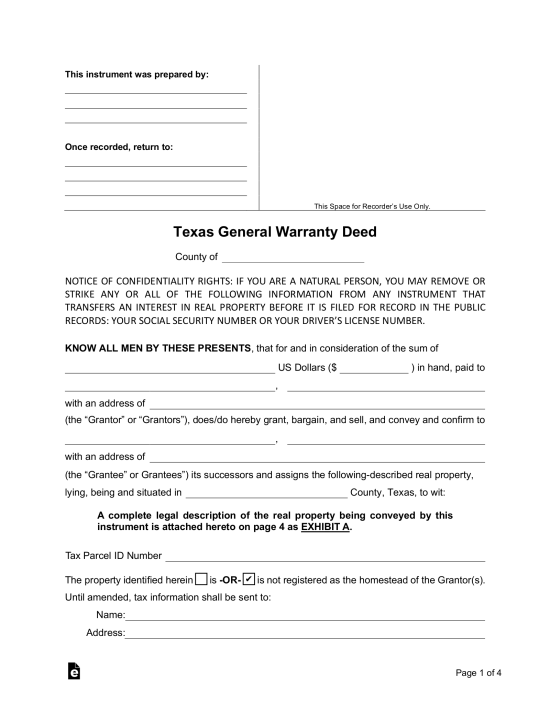

Free Texas General Warranty Deed Form PDF Word eForms

For example, in dallas county, the filing fee is $26 for one page and an additional $4 for every other page. A deed is usually prepared after a purchase and sale agreement has been signed. Web form 1092, change of ownership transfer affidavit form 1092, change of ownership transfer affidavit instructions for opening a form some forms cannot be viewed.

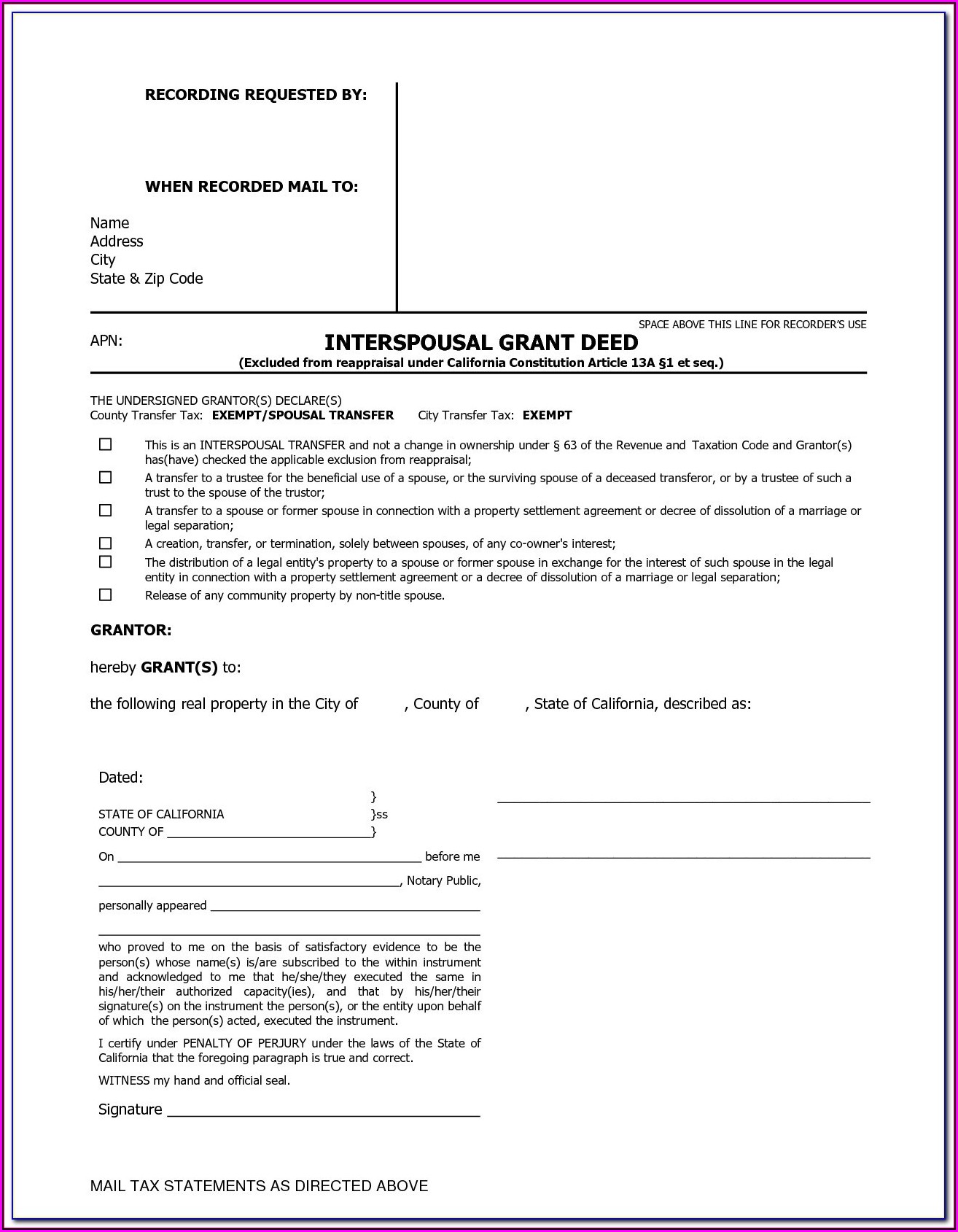

interspousal transfer deed form in texas Fill Online, Printable

Another good reason to use a transfer on death deed is if there is a mortgage on the property. Property owner(s) (transferors) making this deed. It may cost more if the person who is preparing the deed charges more. Web a texas transfer on death deed is a document that allows the owner of real property to transfer their ownership.

Interspousal Transfer Deed Form Texas Form Resume Examples AjYdPPWYl0

However, certain rules apply if a. Web must record transfer on death deed before your death: You no not need the mortgage company’s permission for a transfer on death deed. Another good reason to use a transfer on death deed is if there is a mortgage on the property. Deeds are used to transfer property title between living owners only.

Revocable Transfer on Death Deed Texas Legal Forms by David Goodhart

The transfer is completed by filling in one of the deed types whilst entering the names of the parties, the consideration (or “purchase price”), and the legal description. You no not need the mortgage company’s permission for a transfer on death deed. Web must record transfer on death deed before your death: However, certain rules apply if a. Web instruments.

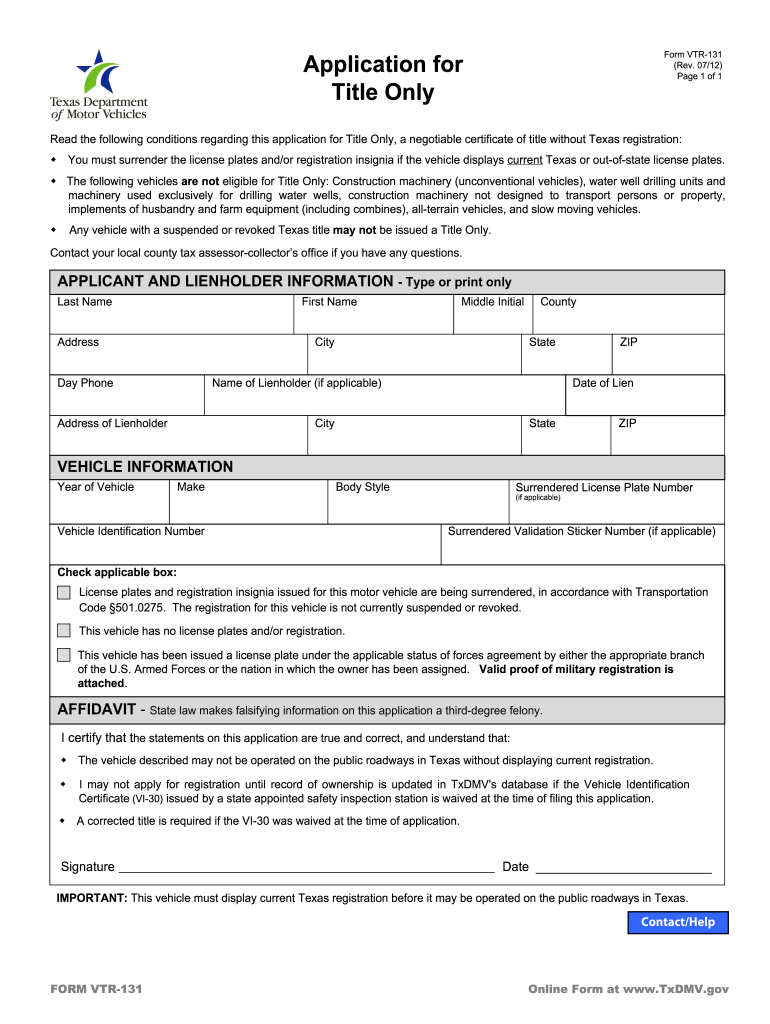

2012 Form TX VTR131 Fill Online, Printable, Fillable, Blank pdfFiller

Have some form of transfer on death deed, the texas transfer on death deed law and its related forms can only be used for real property located in texas. However, certain rules apply if a. For example, in dallas county, the filing fee is $26 for one page and an additional $4 for every other page. Title is the legal.

Interspousal Transfer Deed Form Massachusetts Form Resume Examples

Web must record transfer on death deed before your death: Web form 1092, change of ownership transfer affidavit form 1092, change of ownership transfer affidavit instructions for opening a form some forms cannot be viewed in a web browser and must be opened in adobe acrobat reader on your desktop system. Title is the legal right of ownership to property..

Transfer on Death Deed Texas Form 2022 Fill Out and Sign Printable

Property owner(s) (transferors) making this deed. The most common type of deed is a general warranty deed. The transfer is completed by filling in one of the deed types whilst entering the names of the parties, the consideration (or “purchase price”), and the legal description. There is not technically a standard form for a deed in this state; Web updated.

Interspousal Transfer Deed Form Massachusetts Form Resume Examples

Web to transfer a deed in texas will cost roughly $195. Web form 1092, change of ownership transfer affidavit form 1092, change of ownership transfer affidavit instructions for opening a form some forms cannot be viewed in a web browser and must be opened in adobe acrobat reader on your desktop system. Web updated may 14, 2022 a texas general.

Web To Transfer A Deed In Texas Will Cost Roughly $195.

Click here for instructions on opening this form. You will have to check the laws in the other states to determine if they have a similar deed. Enter your first, middle (if any), and last name here, alongwith your mailing address. You must record (file) this deed before your death with the county clerk where the property is located or it will not be effective.

Property Owner(S) (Transferors) Making This Deed.

Title is the legal right of ownership to property. Web the most common document which allows a property deed transfer between living owners to take place is called a deed. Another good reason to use a transfer on death deed is if there is a mortgage on the property. Web a transfer on death deed needs to be signed by the owner before he or she dies, and it must be filed before he or she dies.

However, Certain Rules Apply If A.

For example, in dallas county, the filing fee is $26 for one page and an additional $4 for every other page. Have some form of transfer on death deed, the texas transfer on death deed law and its related forms can only be used for real property located in texas. Web updated may 14, 2022 a texas general warranty deed is a form that transfers real estate ownership in the clearest possible manner and promises the new owner that there are no title defects such as liens or encumbrances. Using this deed allows the beneficiary to skip the lengthy probate process.

Now, This Doesn’t Include Any Filing Fees That The County Clerk’s Office May Charge.

You no not need the mortgage company’s permission for a transfer on death deed. The most common type of deed is a general warranty deed. Web must record transfer on death deed before your death: It may cost more if the person who is preparing the deed charges more.