Tennessee Form Fae 170 Instructions

Tennessee Form Fae 170 Instructions - Web tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of $100 is computed. Do not report payments you made to satisfy the liability of. Fae 183 return types not accepted: Web tennessee requires captive reit affiliated groups (crags) and unitary groups of financial institutions to file on a combined basis on tennessee form fae 174,. Enter the amount of any tennessee income tax (hall income tax) paid during the period covered by this return. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. Web thinking of filing tennessee form fae 170? Web computed in accordance with the above instructions. Enter franchise tax apportionment ratio as computed on schedule 170nc, 170sf, or 170sc. Cannot exceed excise tax due listed on schedule b, line 5.

Edit your fae170 online type text, add images, blackout confidential details, add comments, highlights and more. Web tennessee requires captive reit affiliated groups (crags) and unitary groups of financial institutions to file on a combined basis on tennessee form fae 174,. Do not report payments you made to satisfy the liability of. Web tennessee fae 170 instructions. Learn how to fill in the tennessee form fae 170 instructions to increase your efficiency. Web instructions for completing the franchise, excise tax return in the top portion of the front page of the tax return, the following items must be completed by the. Filing a business tax return;. Web how it works open the tennessee fae 170 instructions and follow the instructions easily sign the tennessee form fae 170 instructions with your finger send filled & signed tn. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Enter the amount of any tennessee income tax (hall income tax) paid during the period covered by this return.

Filing a business tax return;. Web file a franchise and excise tax return (form fae170). Fae 183 return types not accepted: Edit your fae170 online type text, add images, blackout confidential details, add comments, highlights and more. Web form fae170 returns, schedules and instructions for prior years. Federal input notes and features for fae 170 and fae 174 fs codes. Ad register and subscribe now to work on your tn dor form fae 170 & more fillable forms. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21.

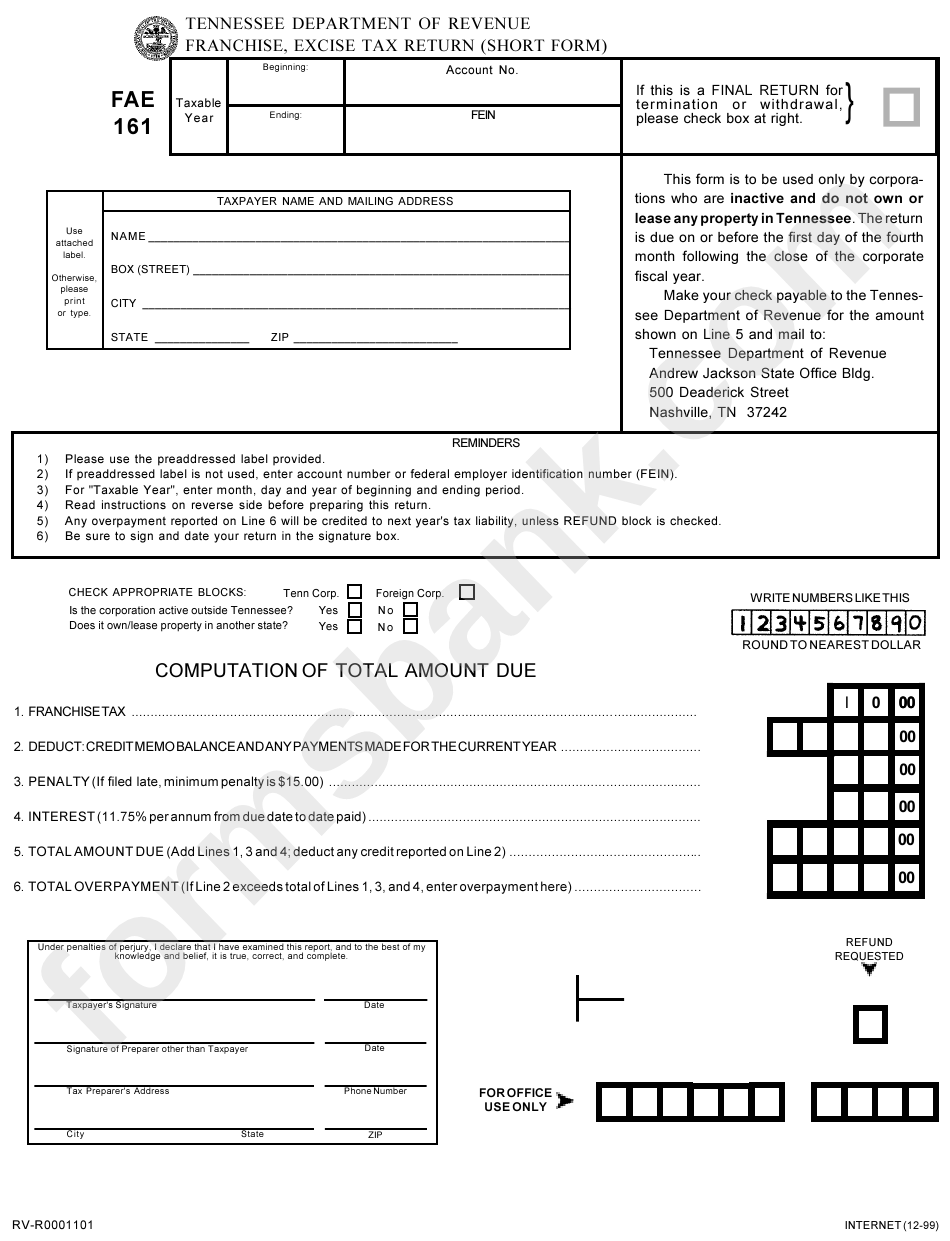

Form Fae 161 Franchise, Excise Tax Return (Short Form) printable pdf

Enter the amount of any tennessee income tax paid during the period covered by this return. Web computed in accordance with the above instructions. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Do not report payments you made to satisfy the liability of. This form is for income earned.

Fae 170 Instructions 2020 Fill Out and Sign Printable PDF Template

Web use this screen to enter information for form fae 170, franchise excise tax return. Fae 183 return types not accepted: Web tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of $100 is computed. Web instructions for completing the franchise, excise tax return in the top portion of the front page of the tax.

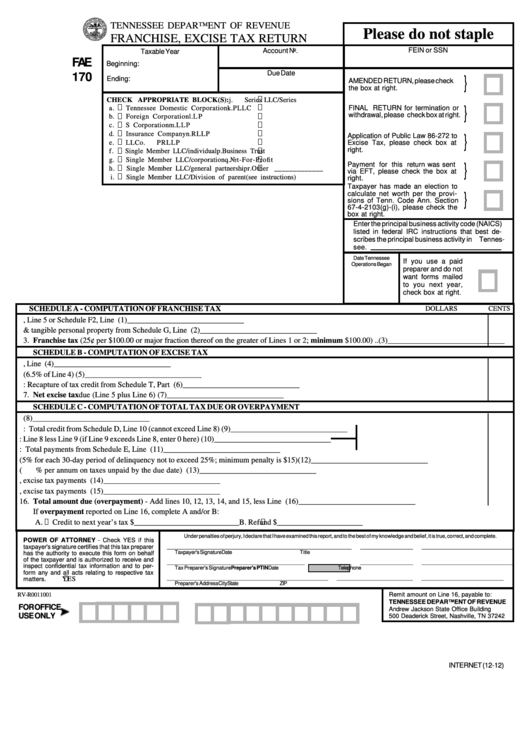

Form Fae 170 Franchise, Excise Tax Return printable pdf download

Web use this screen to enter information for form fae 170, franchise excise tax return. Web video instructions and help with filling out and completing tn fae 170 instructions 2021. Enter franchise tax apportionment ratio as computed on schedule 170nc, 170sf, or 170sc. Federal input notes and features for fae 170 and fae 174 fs codes. Edit your fae170 online.

tn franchise and excise tax manual Regretful Weblog Frame Store

File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Learn how to fill in the tennessee form fae 170 instructions to increase your efficiency. Enter the amount of any tennessee income tax (hall income tax) paid during the period covered by this return. Web how it works open the tennessee fae.

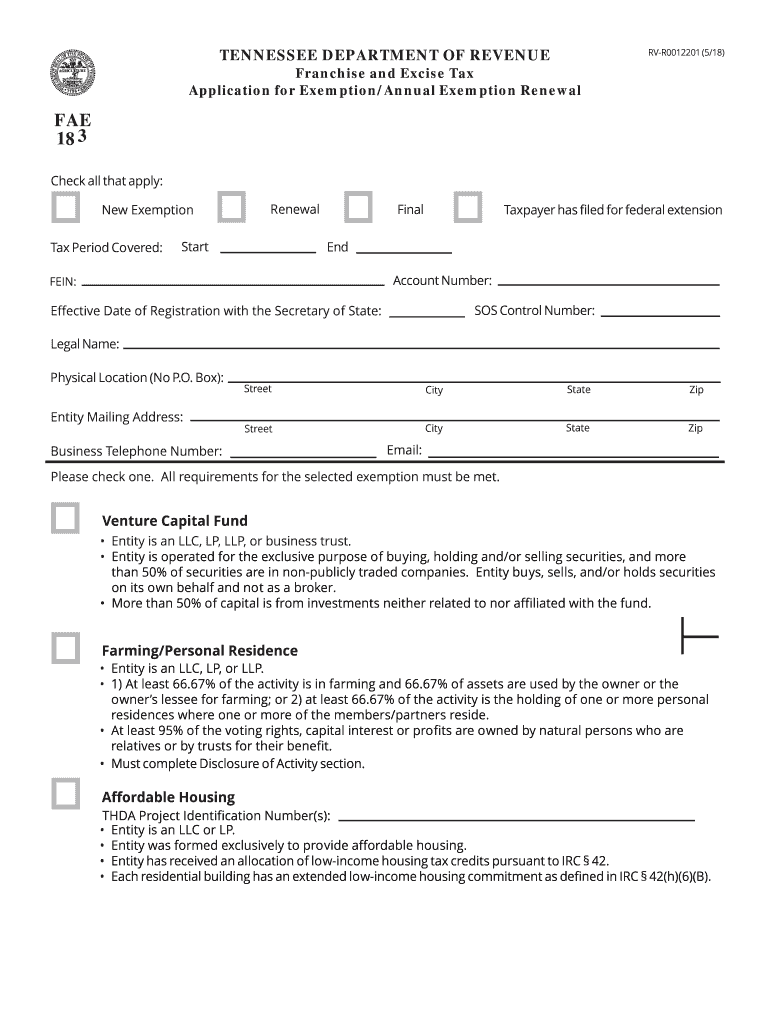

Fae 183 Tennessee Fill Out and Sign Printable PDF Template signNow

Sign it in a few clicks draw your signature, type it,. Web tennessee requires captive reit affiliated groups (crags) and unitary groups of financial institutions to file on a combined basis on tennessee form fae 174,. Ad register and subscribe now to work on your tn dor form fae 170 & more fillable forms. Web thinking of filing tennessee form.

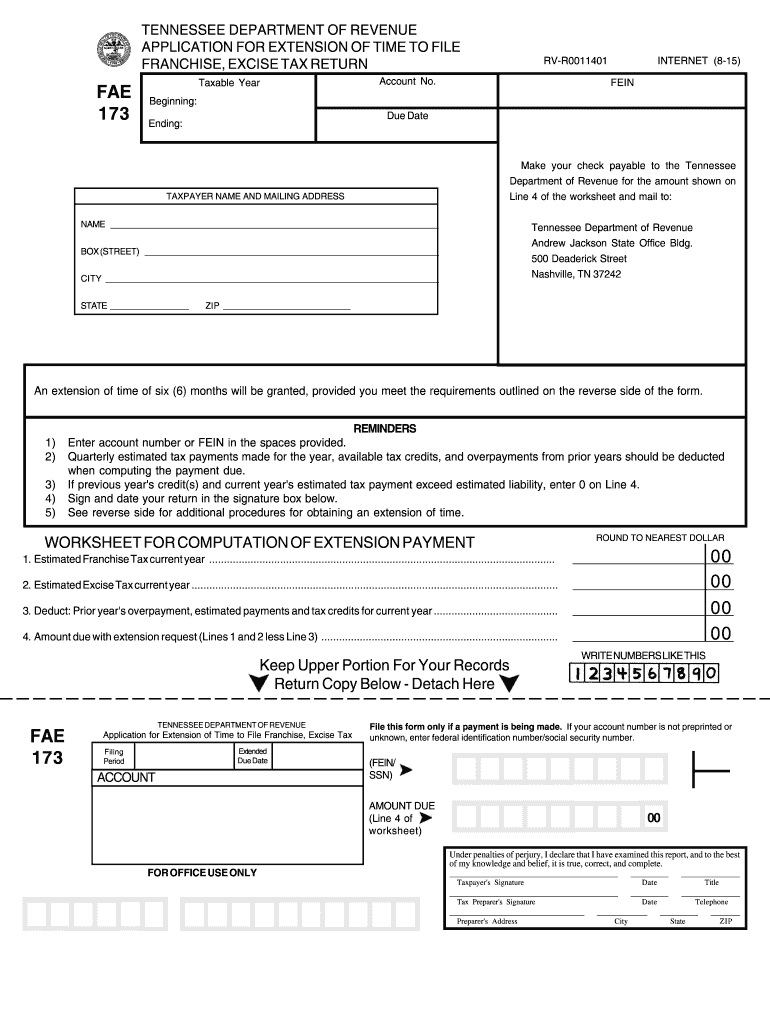

2015 Form TN DoR FAE 173 Fill Online, Printable, Fillable, Blank

Cannot exceed excise tax due listed on schedule b, line 5. Web use this screen to enter information for form fae 170, franchise excise tax return. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. Get your online template and fill it in using progressive features. Web tennessee requires captive reit affiliated groups (crags) and.

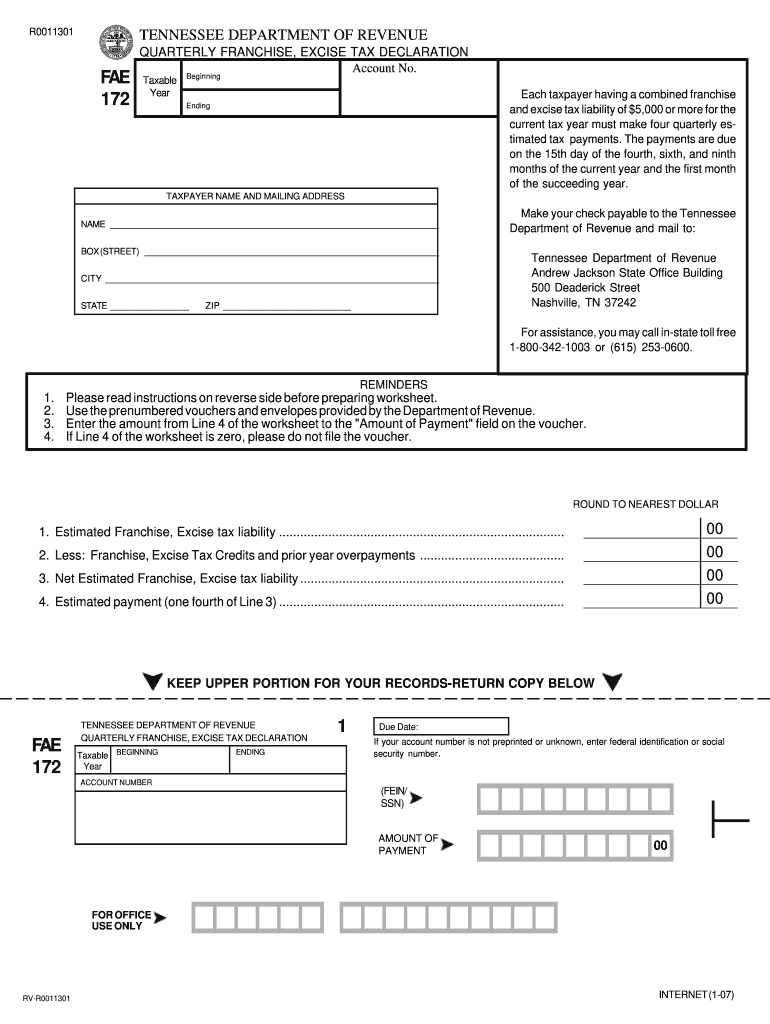

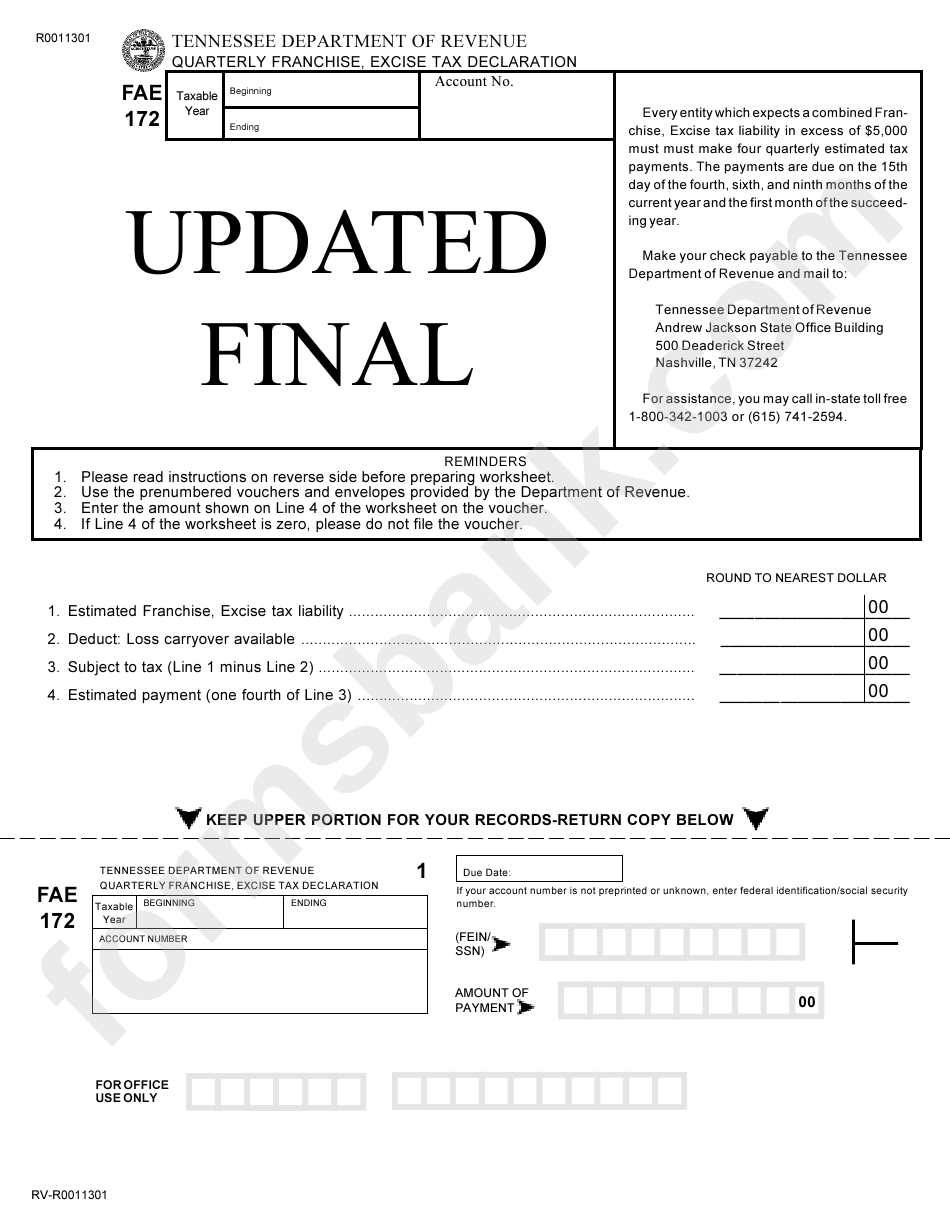

Form Fae 172 Quarterly Franchise, Excise Tax Declaration printable

Web use this screen to enter information for form fae 170, franchise excise tax return. Enter the amount of any tennessee income tax paid during the period covered by this return. Federal input notes and features for fae 170 and fae 174 fs codes. Web instructions for completing the franchise, excise tax return in the top portion of the front.

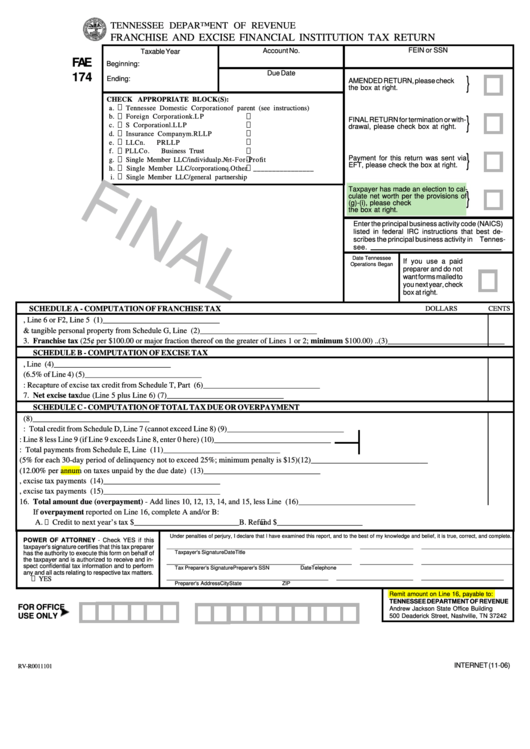

Form Fae 174 Franchise And Excise Financial Institution Tax Return

File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Edit your fae170 online type text, add images, blackout confidential details, add comments, highlights and more. Ad register and subscribe now to work on your tn dor form fae 170 & more fillable forms. Check out how easy it is to complete.

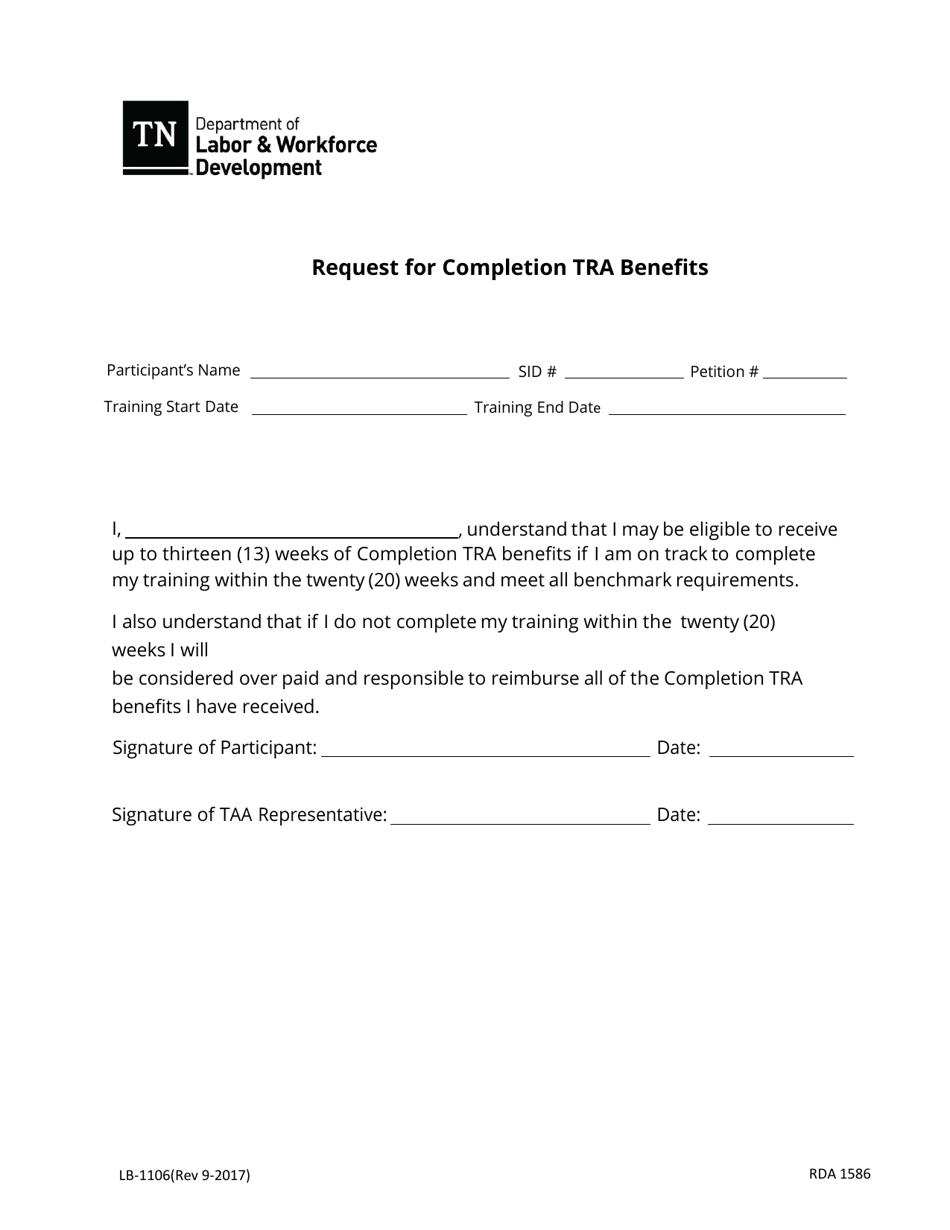

Form LB1106 Download Fillable PDF or Fill Online Request for

Federal input notes and features for fae 170 and fae 174 fs codes. Enjoy smart fillable fields and interactivity. Ad register and subscribe now to work on your tn dor form fae 170 & more fillable forms. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Filing a business tax.

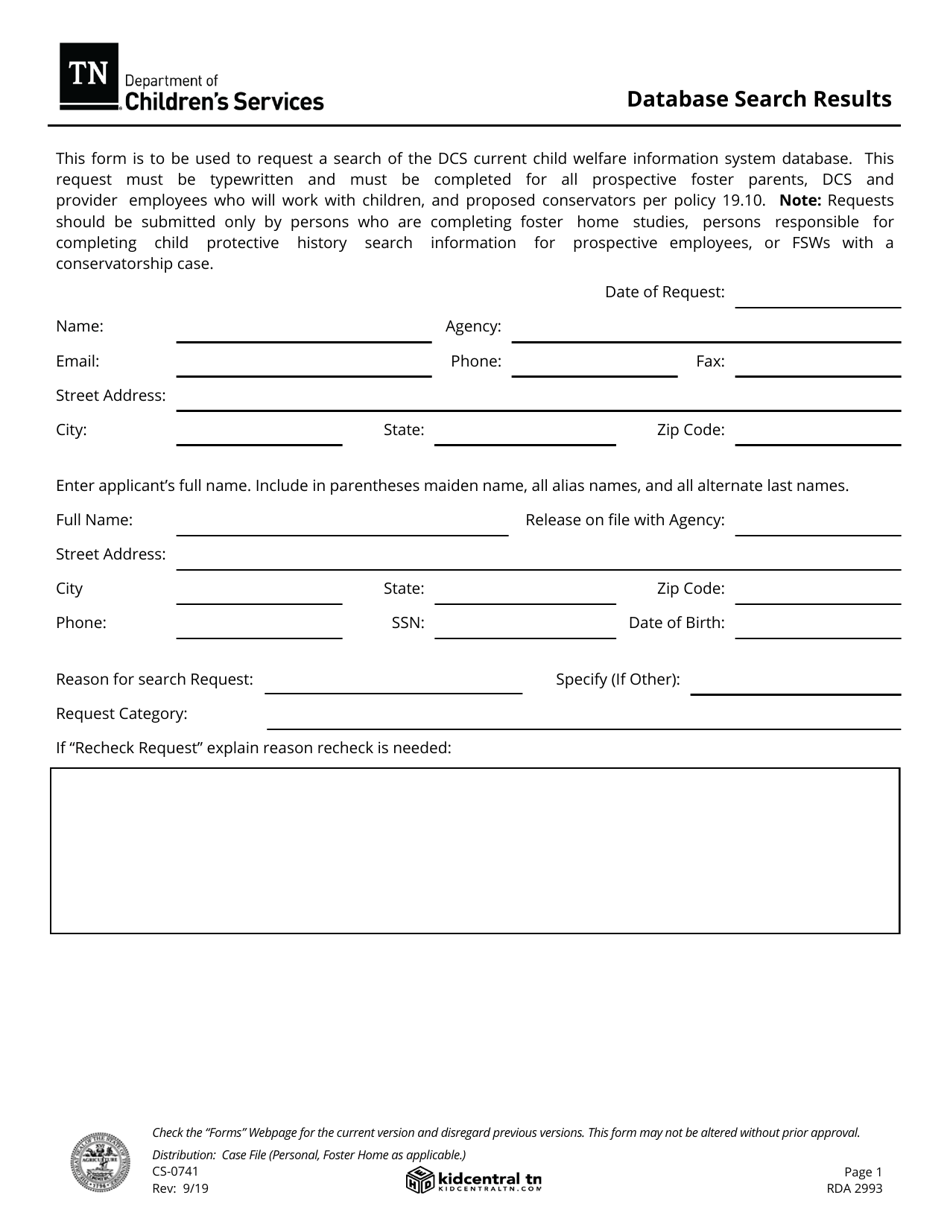

Form CS0741 Download Fillable PDF or Fill Online Database Search

Enjoy smart fillable fields and interactivity. Web tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of $100 is computed. Cannot exceed excise tax due listed on schedule b, line 5. Get your online template and fill it in using progressive features. Web video instructions and help with filling out and completing tn fae 170.

Enter The Amount Of Any Tennessee Income Tax (Hall Income Tax) Paid During The Period Covered By This Return.

Cannot exceed excise tax due listed on schedule b, line 5. Learn how to fill in the tennessee form fae 170 instructions to increase your efficiency. Filing a business tax return;. Enter franchise tax apportionment ratio as computed on schedule 170nc, 170sf, or 170sc.

Web Tennessee Fae 170 Instructions.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Fae 183 return types not accepted: Web thinking of filing tennessee form fae 170?

For Detailed Information On Creating Llc Activities, Click The Processing 1040 Tennessee.

Web computed in accordance with the above instructions. Ad register and subscribe now to work on your tn dor form fae 170 & more fillable forms. Web use this screen to enter information for form fae 170, franchise excise tax return. Enjoy smart fillable fields and interactivity.

For Tax Years Beginning On Or After 1/1/21, And Ending On Or Before 12/31/21.

Web file a franchise and excise tax return (form fae170). Web how to fill out and sign tn form fae 170 online? Web tennessee requires captive reit affiliated groups (crags) and unitary groups of financial institutions to file on a combined basis on tennessee form fae 174,. Web form fae170 returns, schedules and instructions for prior years.