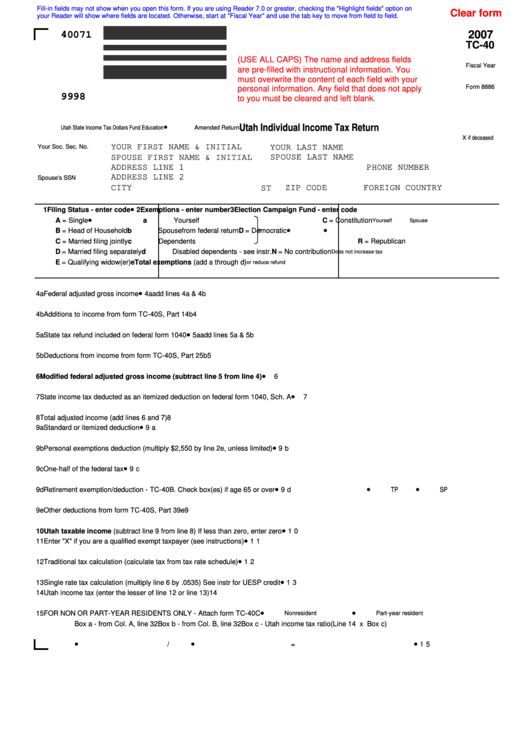

Tc 40 Form

Tc 40 Form - State refund on federal return. Do not enter a number greater than 1.0000. Web follow these steps to calculate your utah tax: First state.00 1 enter federal adjusted gross income taxed by both utah and state of: Name, address, ssn, & residency. To learn more, go to tap.utah.gov 9999 9 999999999. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Submit page only if data entered. Web what are the latest claims? How to obtain income tax and related forms.

State refund on federal return. Do not enter a number greater than 1.0000. Attach completed schedule to your utah income tax. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Name, address, ssn, & residency. Submit page only if data entered. First state.00 1 enter federal adjusted gross income taxed by both utah and state of: How to obtain income tax and related forms. Web what are the latest claims? To learn more, go to tap.utah.gov 9999 9 999999999.

How to obtain income tax and related forms. Attach completed schedule to your utah income tax. Name, address, ssn, & residency. Do not enter a number greater than 1.0000. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Web follow these steps to calculate your utah tax: Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. First state.00 1 enter federal adjusted gross income taxed by both utah and state of: Round to 4 decimal places. State refund on federal return.

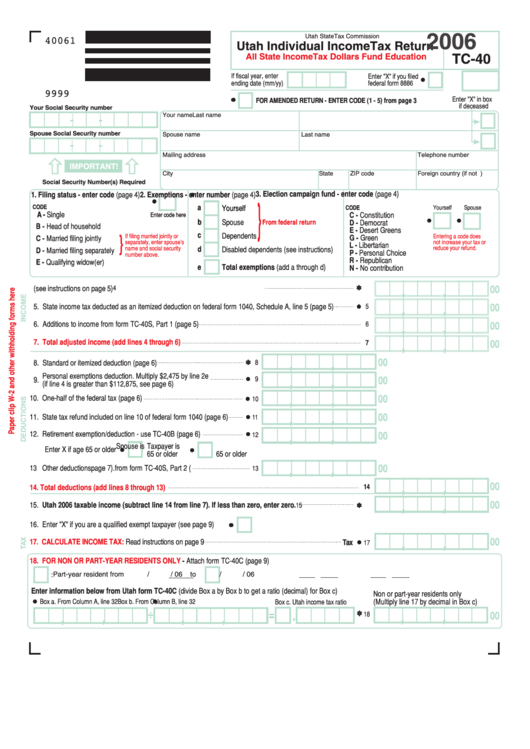

Form Tc40 Utah Individual Tax Return 2006 printable pdf

Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Attach completed schedule to your utah income tax. Web follow these steps to calculate your utah tax: State refund on federal return. Web what are the latest.

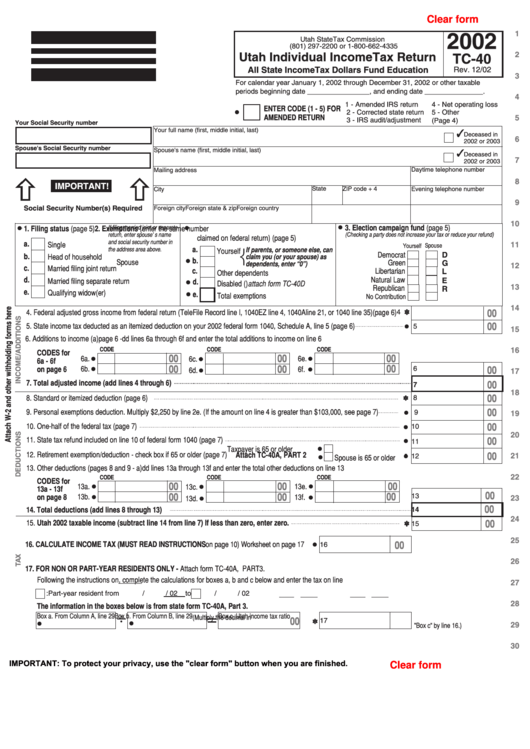

Fillable Form Tc40 Utah Individual Tax Return 2002

Attach completed schedule to your utah income tax. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by.

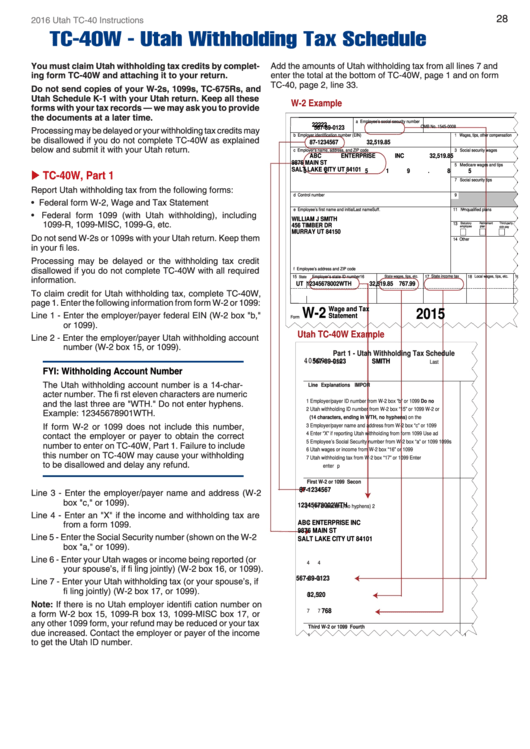

Form Tc40 Individual Tax Instructions 2016 printable pdf download

Attach completed schedule to your utah income tax. State refund on federal return. First state.00 1 enter federal adjusted gross income taxed by both utah and state of: Web what are the latest claims? Web follow these steps to calculate your utah tax:

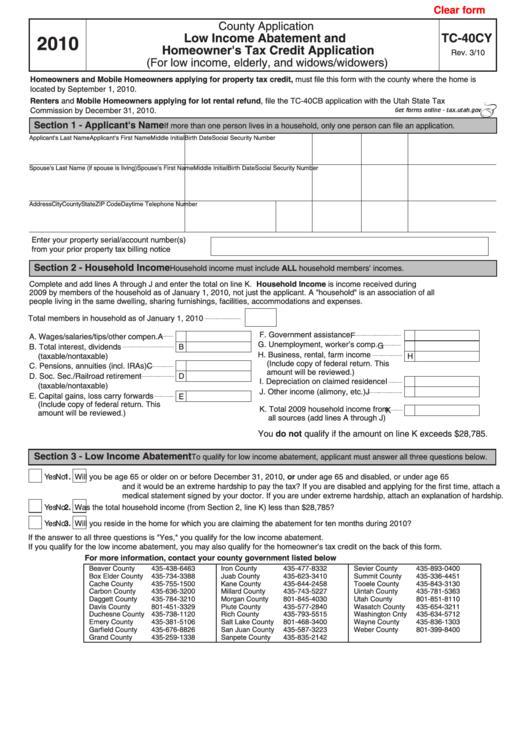

Fillable Form Tc40cy Low Abatement And Homeowner'S Tax Credit

Web what are the latest claims? Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Do not enter a number greater than 1.0000. To learn more, go to tap.utah.gov 9999 9 999999999. How to obtain income.

Fillable Form Tc40 Utah Individual Tax Return 2007

How to obtain income tax and related forms. Web follow these steps to calculate your utah tax: Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Are filing for a deceased taxpayer, are filing a fiscal.

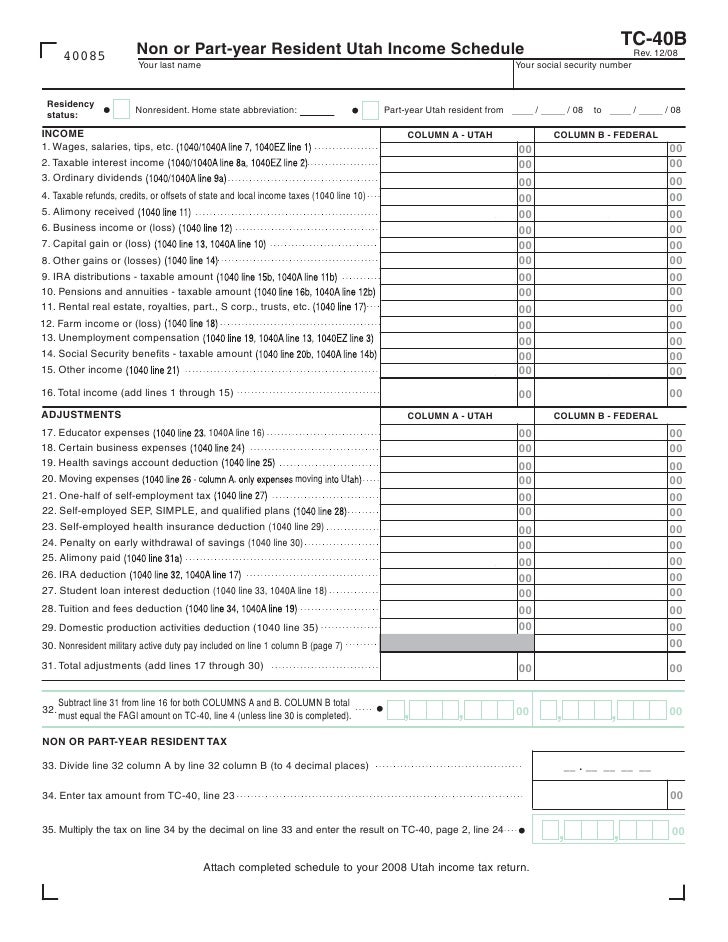

tax.utah.gov forms current tc tc40bplain

State refund on federal return. To learn more, go to tap.utah.gov 9999 9 999999999. Do not enter a number greater than 1.0000. First state.00 1 enter federal adjusted gross income taxed by both utah and state of: Submit page only if data entered.

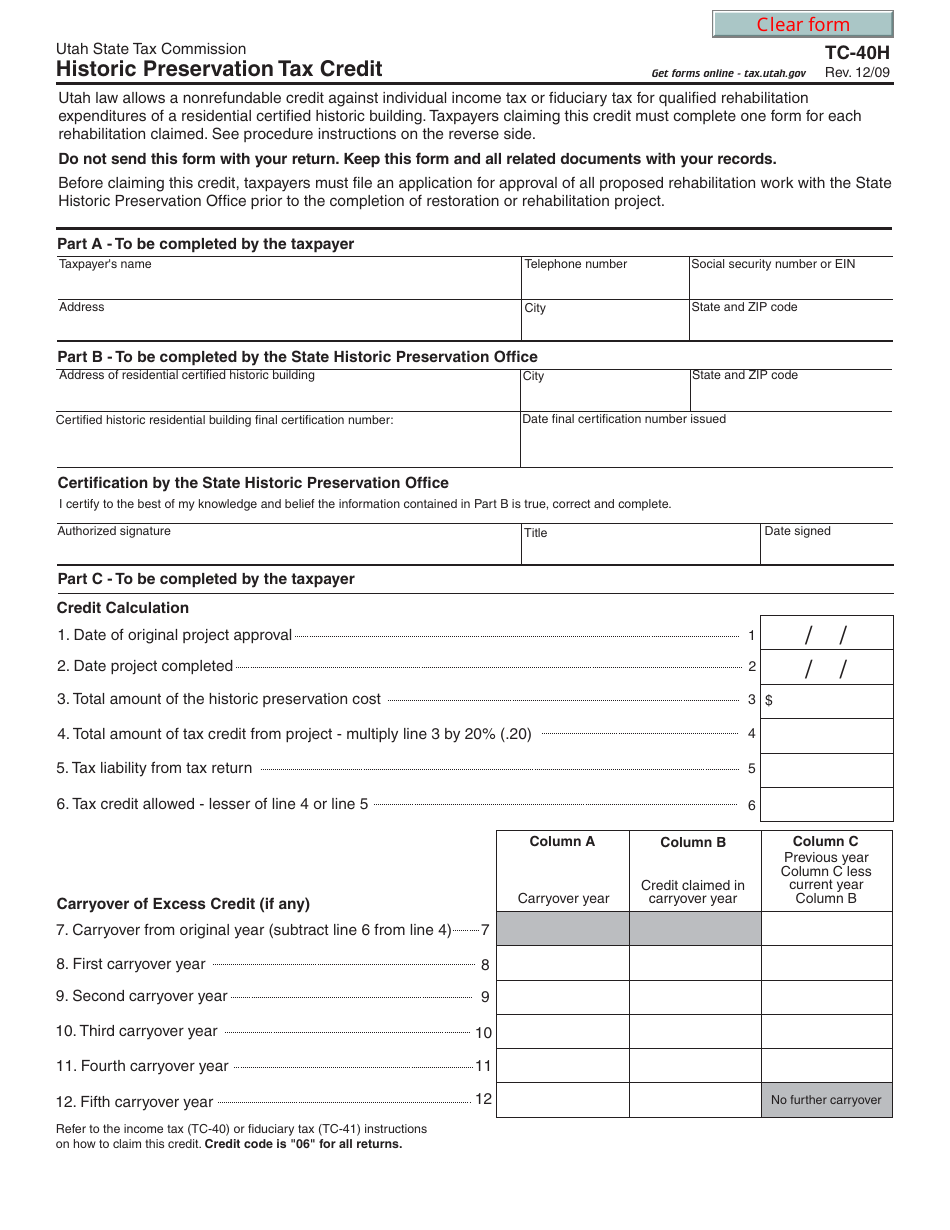

Form TC40H Download Fillable PDF or Fill Online Historic Preservation

How to obtain income tax and related forms. State refund on federal return. Do not enter a number greater than 1.0000. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Web follow these steps to calculate your utah tax:

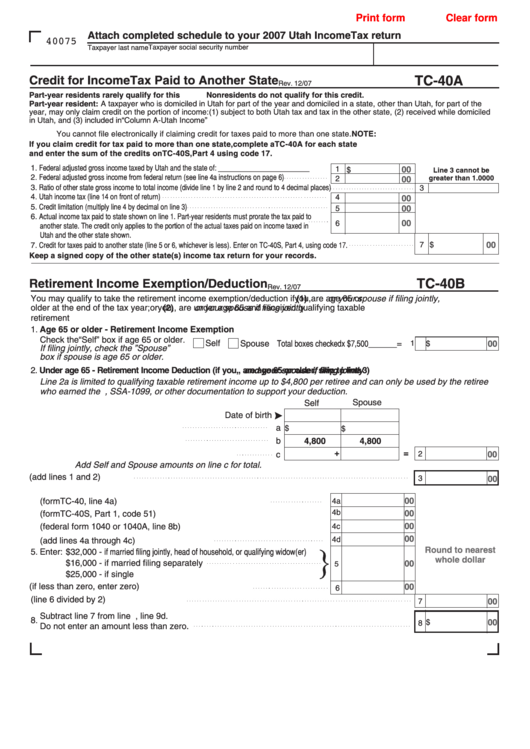

Fillable Form Tc40a Credit For Tax Paid To Another State

To learn more, go to tap.utah.gov 9999 9 999999999. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Round to 4 decimal places. Attach completed schedule to your utah income tax. State refund on federal return.

Utah Tc 40 2011 Form 2011 Fill out Tax Template Online US Legal Forms

Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Attach.

Sony TC40 Wiring

Name, address, ssn, & residency. How to obtain income tax and related forms. To learn more, go to tap.utah.gov 9999 9 999999999. Round to 4 decimal places. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529.

Name, Address, Ssn, & Residency.

To learn more, go to tap.utah.gov 9999 9 999999999. First state.00 1 enter federal adjusted gross income taxed by both utah and state of: Round to 4 decimal places. Do not enter a number greater than 1.0000.

How To Obtain Income Tax And Related Forms.

Web follow these steps to calculate your utah tax: State refund on federal return. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent.

Attach Completed Schedule To Your Utah Income Tax.

Submit page only if data entered. Web what are the latest claims?