Tax Form For Charitable Donations

Tax Form For Charitable Donations - To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use tax exempt organization search. Web updated june 03, 2022 a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Qualified contributions are not subject to this limitation. Web to claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing schedule a of irs form 1040. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Key takeaways the irs allows taxpayers to deduct donations of cash and property to. Some organizations, such as churches or. The irs requires donors that donated at least $250 must file include bank records or written receipts from the nonprofit. Web in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (agi). Taxpayers who have a specific charity in mind can make sure that it is an eligible charity by doing a search on irs.gov.

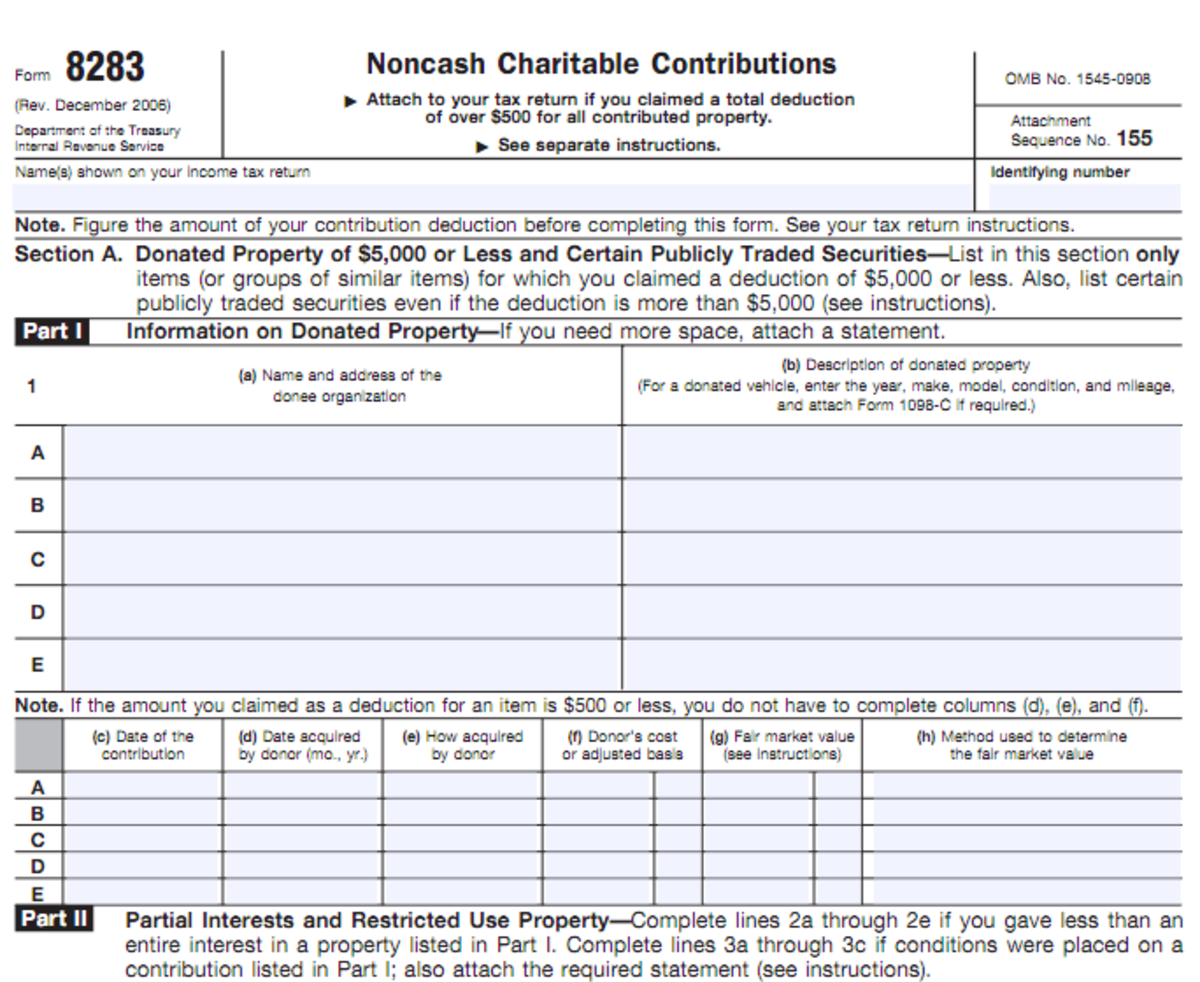

Web updated june 03, 2022 a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Taxpayers who have a specific charity in mind can make sure that it is an eligible charity by doing a search on irs.gov. Web what charitable donation tax forms do your donors need? Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions pdf. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of. Key takeaways the irs allows taxpayers to deduct donations of cash and property to. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Qualified contributions are not subject to this limitation. If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form 8283, section a. Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their.

To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use tax exempt organization search. Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of. Taxpayers who have a specific charity in mind can make sure that it is an eligible charity by doing a search on irs.gov. Web to claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing schedule a of irs form 1040. Qualified contributions are not subject to this limitation. If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form 8283, section a. Web updated june 03, 2022 a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Donors must receive these receipts by the time they file their taxes or the due date of their return.

Charitable Donation Spreadsheet throughout Charitable Donation

Web you must fill out one or more forms 8283, noncash charitable contributions and attach them to your return, if your deduction for each noncash contribution is more than $500. Web to claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by.

Charitable Donation Spreadsheet within Charitable Donation Worksheet

Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form 8283, section a. Web you must fill out one or more forms 8283, noncash charitable.

Addictionary

Qualified contributions are not subject to this limitation. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of. Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions pdf. Web you must fill out one or more.

Tax Deductions Tip Charitable Donations Small Business Accounting Blog

Key takeaways the irs allows taxpayers to deduct donations of cash and property to. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of. The irs requires donors that donated at least $250 must file include bank records or written receipts from the nonprofit. Web charitable contributions.

Charitable Donation Worksheet Irs MBM Legal

If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form 8283, section a. Web what charitable donation tax forms do your donors need? Taxpayers who have a specific charity in mind can make sure that it is an eligible charity by doing a.

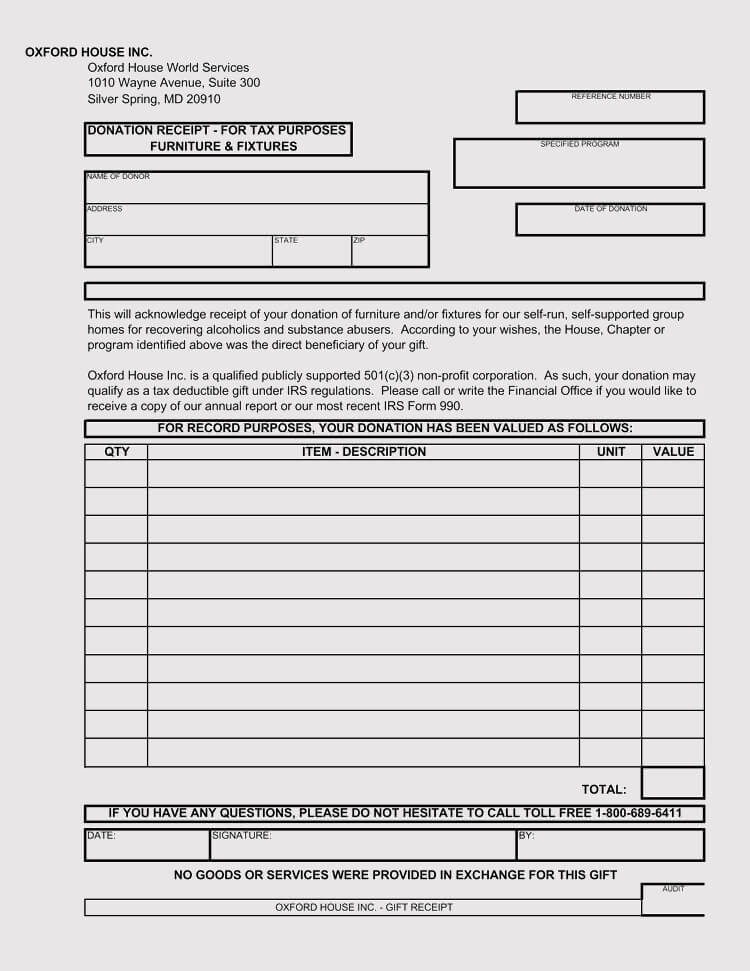

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form 8283, section a. Web to claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by.

How to Get a Clothing Donation Tax Deduction hubpages

Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. Web updated june 03, 2022 a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Key takeaways the irs allows taxpayers to deduct donations of cash and property.

Donation Receipt Template Download Printable PDF Templateroller

Each donation type requires different information. Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions pdf. Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. Qualified contributions are not subject to this limitation. Taxpayers who have a specific charity in.

Charitable Contributions and How to Handle the Tax Deductions

Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Qualified contributions are not subject to this limitation. Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions pdf. Taxpayers who have a specific charity in mind can make sure that.

Donation Tax Receipt Template Inspirational 10 Donation Receipt

Donors must receive these receipts by the time they file their taxes or the due date of their return. The irs requires donors that donated at least $250 must file include bank records or written receipts from the nonprofit. Web to claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift,.

If You Claim A Deduction Of More Than $500, But Not More Than $5,000 Per Item (Or A Group Of Similar Items), You Must Fill Out Form 8283, Section A.

Some organizations, such as churches or. Donors must receive these receipts by the time they file their taxes or the due date of their return. To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use tax exempt organization search. Web updated june 03, 2022 a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more.

Web You Must Fill Out One Or More Forms 8283, Noncash Charitable Contributions And Attach Them To Your Return, If Your Deduction For Each Noncash Contribution Is More Than $500.

Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. Key takeaways the irs allows taxpayers to deduct donations of cash and property to. Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions pdf. Web what charitable donation tax forms do your donors need?

Form 8283 Is Used To Claim A Deduction For A Charitable Contribution Of Property Or Similar Items Of Property, The Claimed Value Of.

It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Each donation type requires different information. The irs requires donors that donated at least $250 must file include bank records or written receipts from the nonprofit. Qualified contributions are not subject to this limitation.

Web In Most Cases, The Amount Of Charitable Cash Contributions Taxpayers Can Deduct On Schedule A As An Itemized Deduction Is Limited To A Percentage (Usually 60 Percent) Of The Taxpayer’s Adjusted Gross Income (Agi).

Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Web to claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing schedule a of irs form 1040. Taxpayers who have a specific charity in mind can make sure that it is an eligible charity by doing a search on irs.gov.