Tax Form 8959

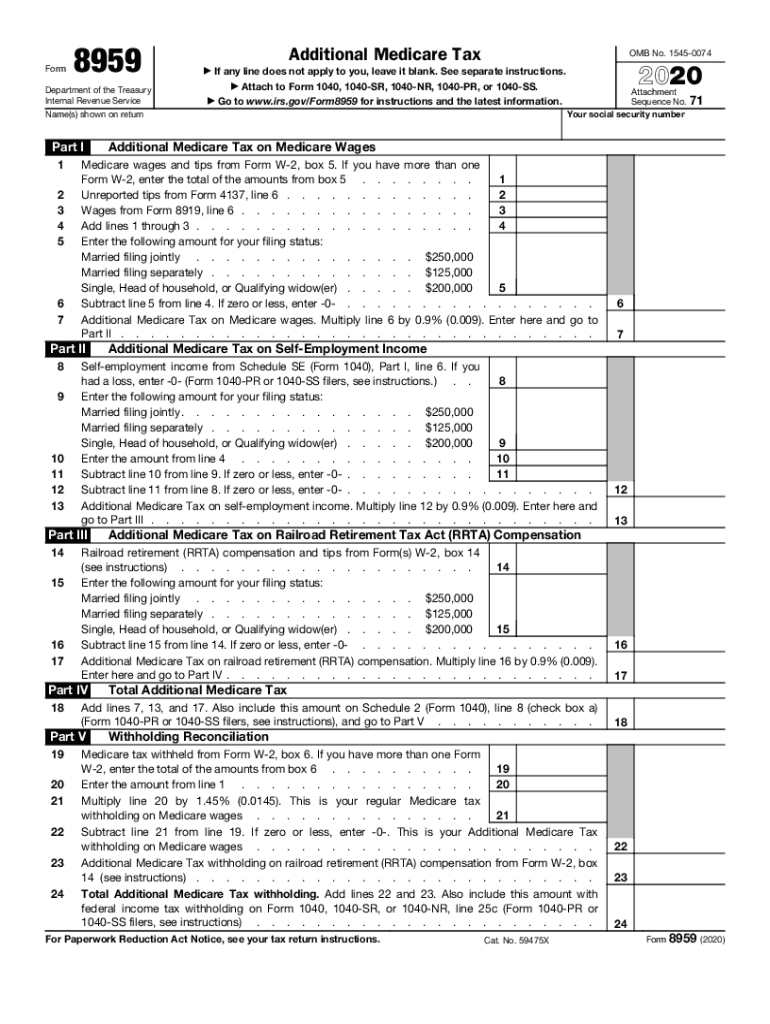

Tax Form 8959 - Then just send it to the irs! Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. File your taxes for free. Solved•by turbotax•869•updated january 13, 2023. Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. If filing jointly, you’ll need to add medicare wages,. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Sign in to your account. Get irs approved instant schedule 1 copy. Web how can we help you?

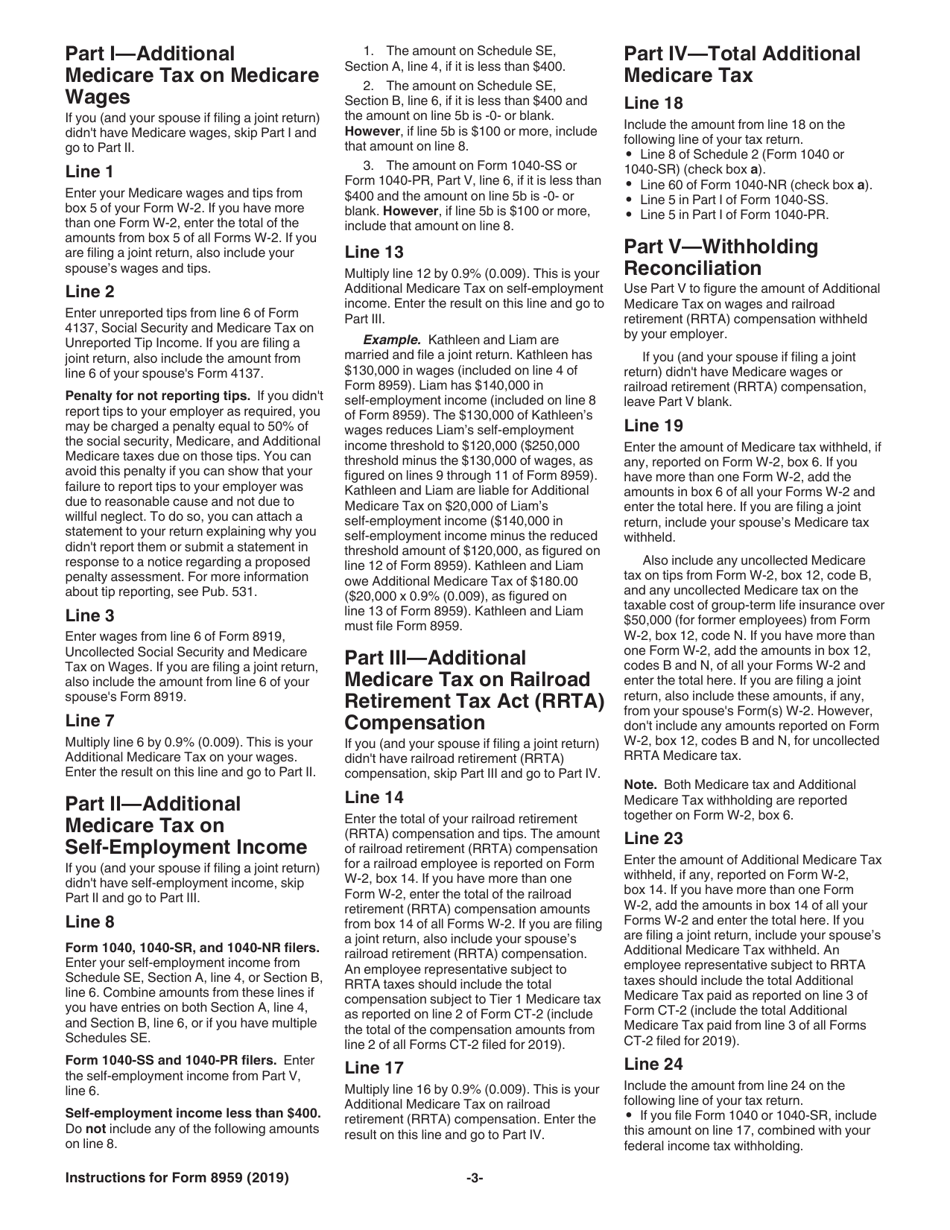

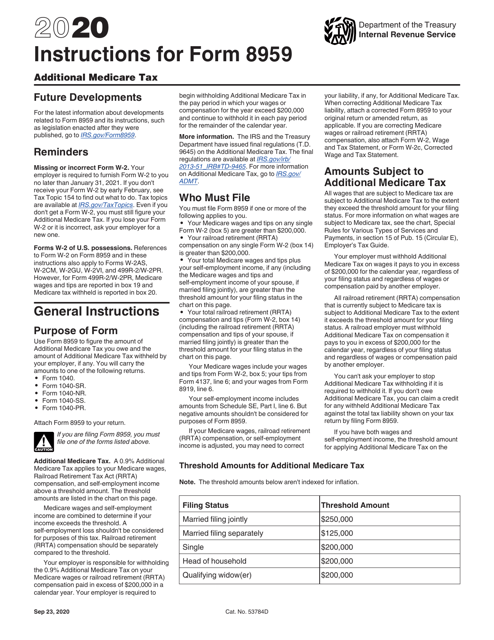

Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. You will carry the amounts to. Web medicare tax has been withheld, you must file irs form 8959 with your tax return, both to ensure enough tax has been paid and to see whether you are eligible for a refund or a. 63rd st.) using cash, check or credit card. Web water bills can be paid online or in person at city hall (414 e. Web how can we help you? Web instructions for form 8959: Threshold amounts for additional medicare tax. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Use this form to figure the.

Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Ad don't leave it to the last minute. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Then just send it to the irs! Get irs approved instant schedule 1 copy. Form 8959, additional medicare tax, is used to figure the additional 0.9% percent. File your taxes for free. Starting in tax year 2022 the qualified widow (er) filing status has been renamed to. You will carry the amounts to.

Forms Needed To File Self Employment Employment Form

You will carry the amounts to. Web how can we help you? Ad download or email irs 8959 & more fillable forms, register and subscribe now! You will carry the amounts to. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any.

Form 8959 Additional Medicare Tax (2014) Free Download

File your form 2290 online & efile with the irs. Web how can we help you? 12th st.) or at the water services department (4800 e. Web instructions for form 8959: Web what is irs form 8959?

2014 federal form 8962 instructions

Ad download or email irs 8959 & more fillable forms, register and subscribe now! Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web level 1 why is turbotax telling me i need to file form 8959 when i am below the.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Web medicare tax has been withheld, you must file irs form 8959 with your tax return, both to ensure enough tax has been paid and to see whether you are eligible for a refund or a. Web how can we help you? Sign in to your account. Web level 1 why is turbotax telling me i need to file form.

Form 8959 Additional Medicare Tax (2014) Free Download

File your form 2290 online & efile with the irs. File your form 2290 today avoid the rush. File your taxes for free. Web water bills can be paid online or in person at city hall (414 e. Web who must pay the additional medicare taxes how to complete and file irs form 8959 where to find this tax form.

1099 Misc Fillable Form Free amulette

Modify the pdf form template to get a document required in your city. 63rd st.) using cash, check or credit card. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Web who must pay the additional medicare taxes how to complete and file irs form 8959 where to find this tax form let’s start by walking through this tax form, step. Web how can we help you? Use this form to figure the. File your taxes for free. Then just send it to the irs!

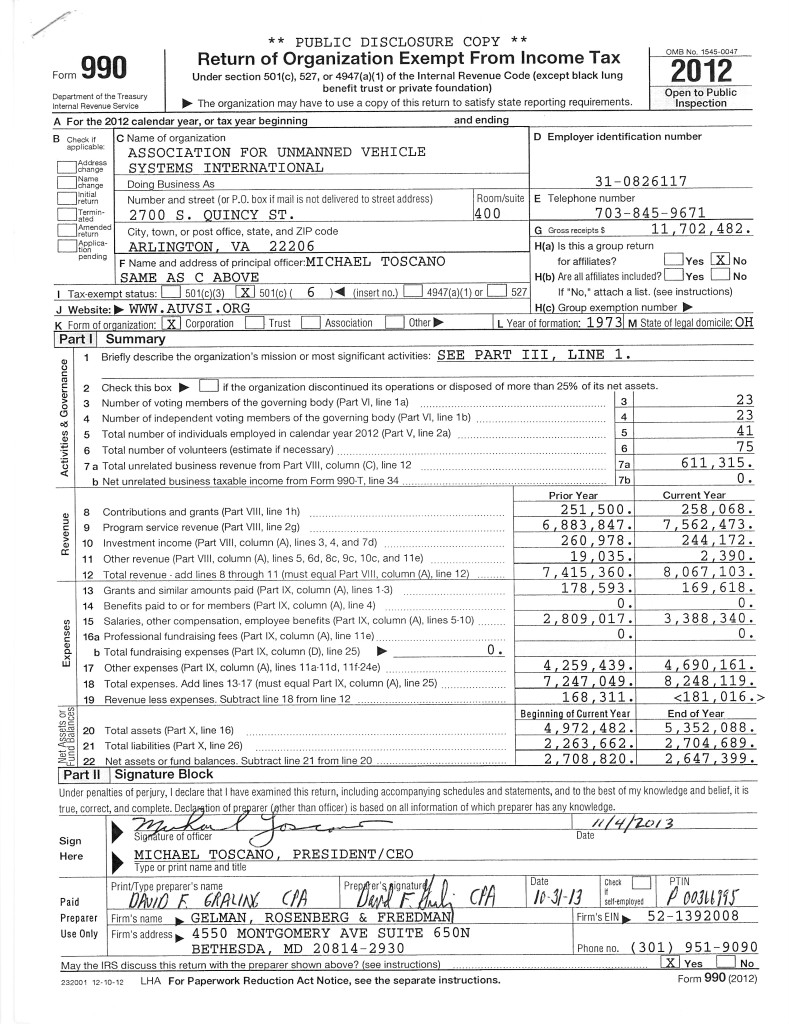

IRS Tax Return Calls AUVSI’s Advocacy and Effectiveness into Question

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Use this form to figure the. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web use form 8959 to figure the amount of additional medicare tax you owe.

Form 8959 Fill Out and Sign Printable PDF Template signNow

Web what is irs form 8959? 63rd st.) using cash, check or credit card. Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Get irs approved instant schedule 1 copy. Form 8959, additional medicare tax, is used to figure the additional 0.9% percent.

What Is Form 8959 Additional Medicare Tax TurboTax Tax Tips & Videos

Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Web who must pay the additional medicare taxes how to complete and file irs form 8959 where to find this tax form let’s start by walking through this tax form, step. Web what is irs form 8959?.

California, Connecticut, District Of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia.

Web what is irs form 8959? Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Ad don't leave it to the last minute. Get irs approved instant schedule 1 copy.

Web Medicare Tax Has Been Withheld, You Must File Irs Form 8959 With Your Tax Return, Both To Ensure Enough Tax Has Been Paid And To See Whether You Are Eligible For A Refund Or A.

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web what is form 8959? Threshold amounts for additional medicare tax. If filing jointly, you’ll need to add medicare wages,.

You Will Carry The Amounts To.

Use this form to figure the. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web form 8959 for kansas city missouri. File your taxes for free.

File Your Form 2290 Today Avoid The Rush.

63rd st.) using cash, check or credit card. You will carry the amounts to. Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Web instructions for form 8959: