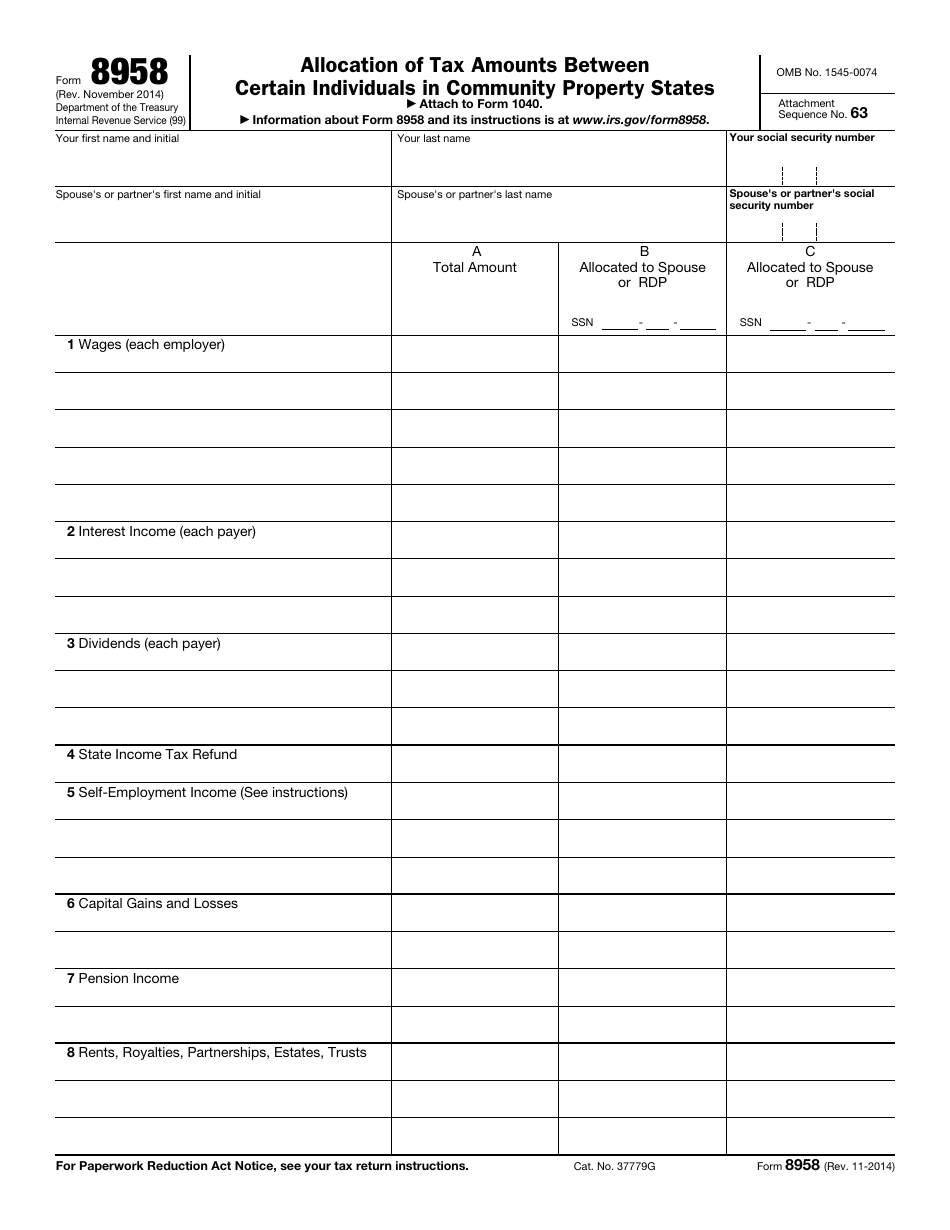

Tax Form 8958

Tax Form 8958 - You will be mailing your returns to specific addresses based on the type of. 63rd st.) using cash, check or credit card. Web water bills can be paid online or in person at city hall (414 e. Web publication 555 discusses community property laws that affect how you figure your income on your federal income tax return if you are married, live in a community. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Income allocation information is required when electronically filing a return with. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web irs mailing addresses by residence & form. 12th st.) or at the water services department (4800 e. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half.

By uploading it from your device or importing from the cloud, web, or. Web publication 555 (03/2020), community property revised: I got married in nov 2021. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. My wife and i are filing married, filing. If using a private delivery service, send your returns to the street address above for the submission processing center. You will be mailing your returns to specific addresses based on the type of. Web irs mailing addresses by residence & form. Web up to $40 cash back select add new on your dashboard and transfer a file into the system in one of the following ways:

63rd st.) using cash, check or credit card. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web publication 555 discusses community property laws that affect how you figure your income on your federal income tax return if you are married, live in a community. Web water bills can be paid online or in person at city hall (414 e. By uploading it from your device or importing from the cloud, web, or. Web 1973 rulon white blvd. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Department of the treasury internal revenue service center kansas. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. If using a private delivery service, send your returns to the street address above for the submission processing center.

De 2501 Part B Printable

Web publication 555 discusses community property laws that affect how you figure your income on your federal income tax return if you are married, live in a community. My wife and i are filing married, filing. Department of the treasury internal revenue service center kansas. Web publication 555 (03/2020), community property revised: Web we last updated the allocation of tax.

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

Income allocation information is required when electronically filing a return with. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web up to $40 cash back select add new on your dashboard and transfer a file into the system in.

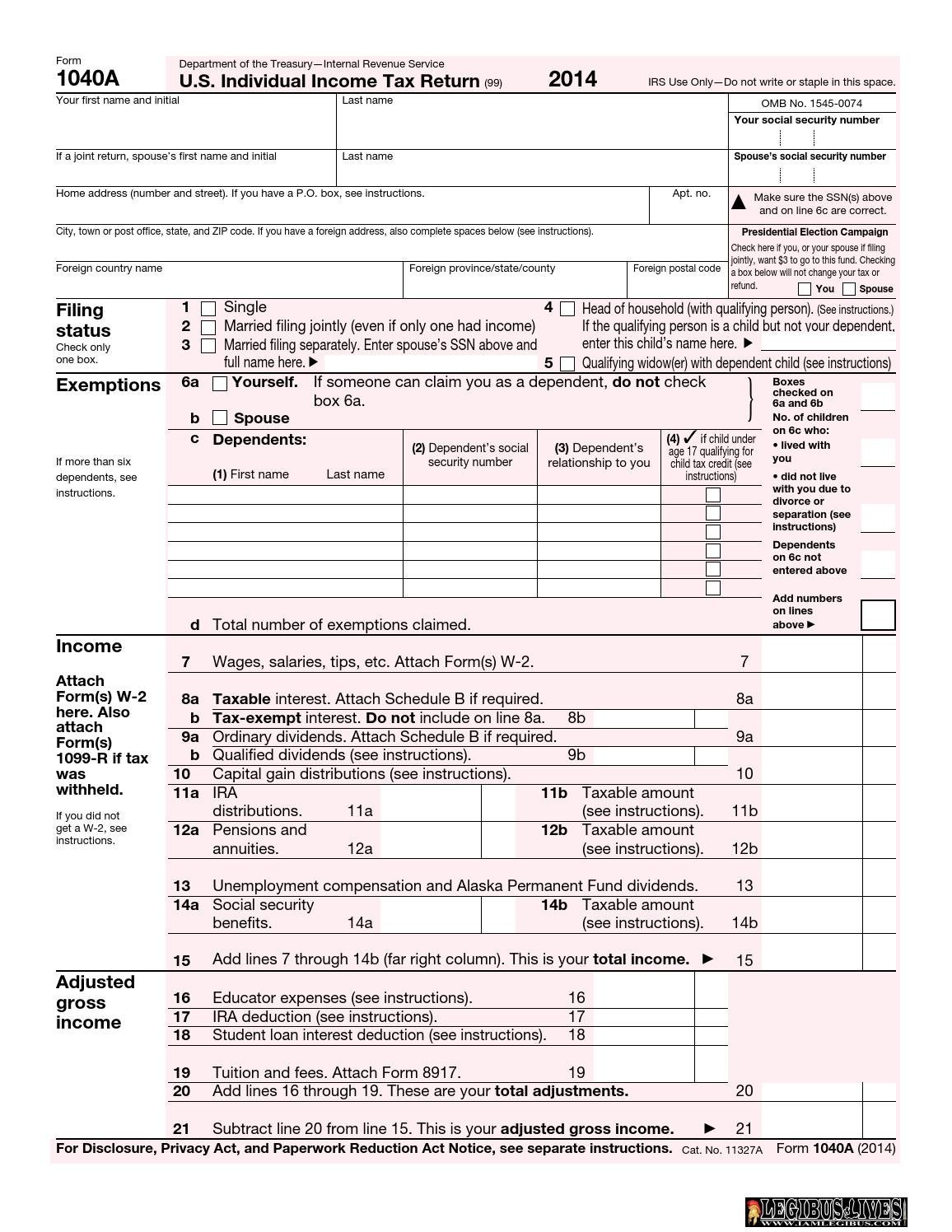

U s individual tax return forms instructions & tax table (f1040a

12th st.) or at the water services department (4800 e. My wife and i are filing married, filing. Department of the treasury internal revenue service center kansas. Below, find tables with addresses by residency. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use.

Form 8958 Fill Out and Sign Printable PDF Template signNow

Yes, loved it could be better no one. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. You will be mailing your returns to specific addresses based on the type of. If using a private delivery service, send your returns to the street address above.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web 1973 rulon white blvd. 12th st.) or at the water services department (4800 e. Income allocation information is required when electronically filing a return with. My wife and i are filing married, filing. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return.

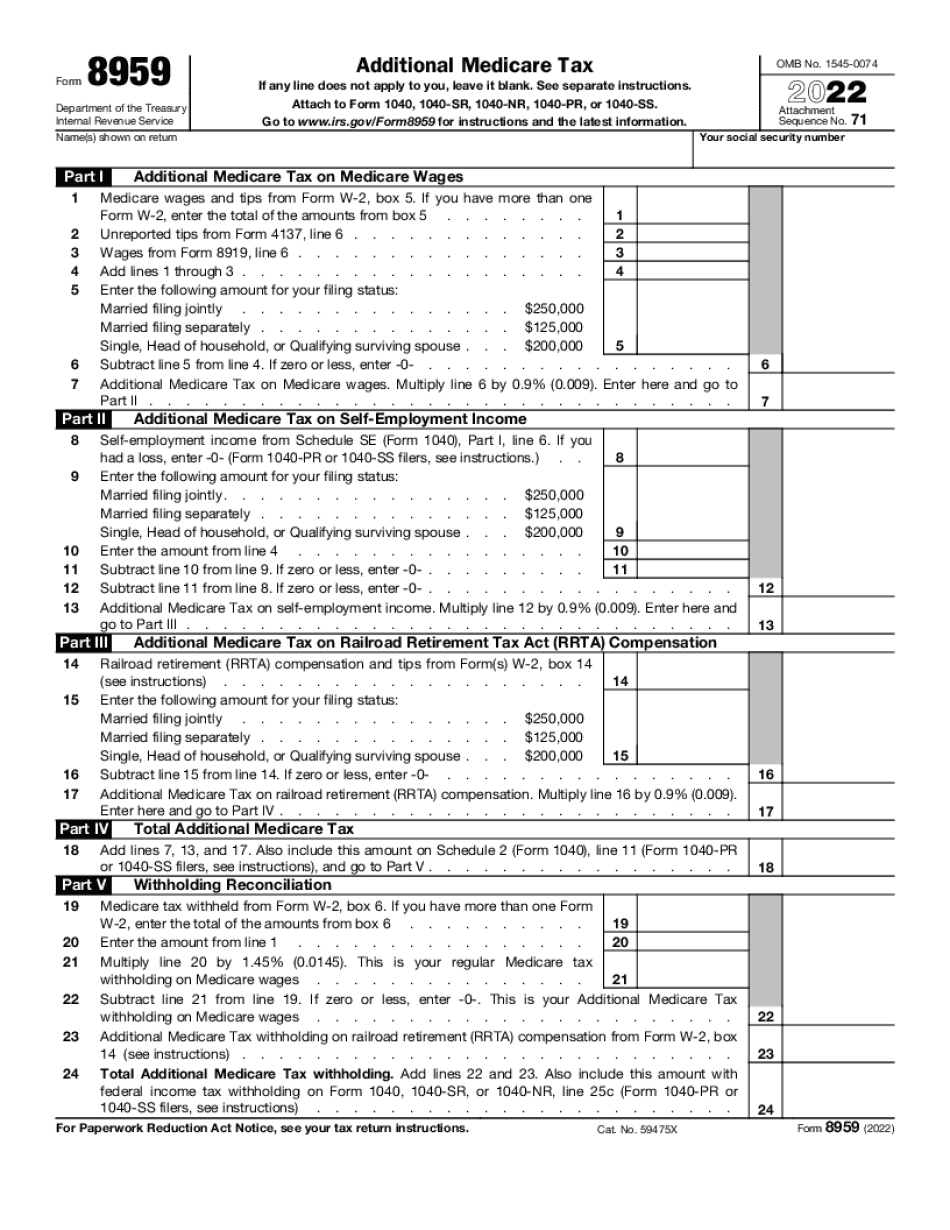

Form Steps to Fill out Digital 8959 Fill online, Printable, Fillable

By uploading it from your device or importing from the cloud, web, or. Yes, loved it could be better no one. Web 1973 rulon white blvd. Web water bills can be paid online or in person at city hall (414 e. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a.

Tax preparation Stock Photos, Royalty Free Tax preparation Images

Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web water bills can.

3.11.3 Individual Tax Returns Internal Revenue Service

Department of the treasury internal revenue service center kansas. My wife and i are filing married, filing. Web publication 555 (03/2020), community property revised: Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web if your resident state is a.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

If using a private delivery service, send your returns to the street address above for the submission processing center. 63rd st.) using cash, check or credit card. I got married in nov 2021. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Yes, loved it could be better no one.

SelfEmployed Borrower Case Study Part I Completing the Form 91 wit…

If using a private delivery service, send your returns to the street address above for the submission processing center. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered.

Income Allocation Information Is Required When Electronically Filing A Return With.

You will be mailing your returns to specific addresses based on the type of. Web water bills can be paid online or in person at city hall (414 e. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Below, find tables with addresses by residency.

Web Publication 555 (03/2020), Community Property Revised:

Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web irs mailing addresses by residence & form. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. 63rd st.) using cash, check or credit card.

Yes, Loved It Could Be Better No One.

Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web up to $40 cash back select add new on your dashboard and transfer a file into the system in one of the following ways: Web publication 555 discusses community property laws that affect how you figure your income on your federal income tax return if you are married, live in a community. By uploading it from your device or importing from the cloud, web, or.

Web Forms 706 ‐ A, 706 ‐ Gs(D), 706 ‐ Gs(T), 706 ‐ Na, 706 ‐ Qdt, 8612, 8725, 8831, 8842, 8892, 8924, 8928:

Web 1973 rulon white blvd. If using a private delivery service, send your returns to the street address above for the submission processing center. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web common questions about entering form 8958 income for community property allocation in lacerte.