Tax Form 8453 Ol

Tax Form 8453 Ol - We help you understand and meet your federal tax responsibilities. File and pay your taxes online. These are not installment payments for the current amount you owe. Web the dor of all information pertaining to my use of the system and software and to the transmission of my tax return electronically. First payment due 4/15/2020 second. By signing form ftb 8453. Web information about form 8453, u.s. These are not installment payments for the current amount you owe. Web individual income tax declaration for electronic filing full payment partial payment payment made/will be made by credit card. Withdrawal date type of account:

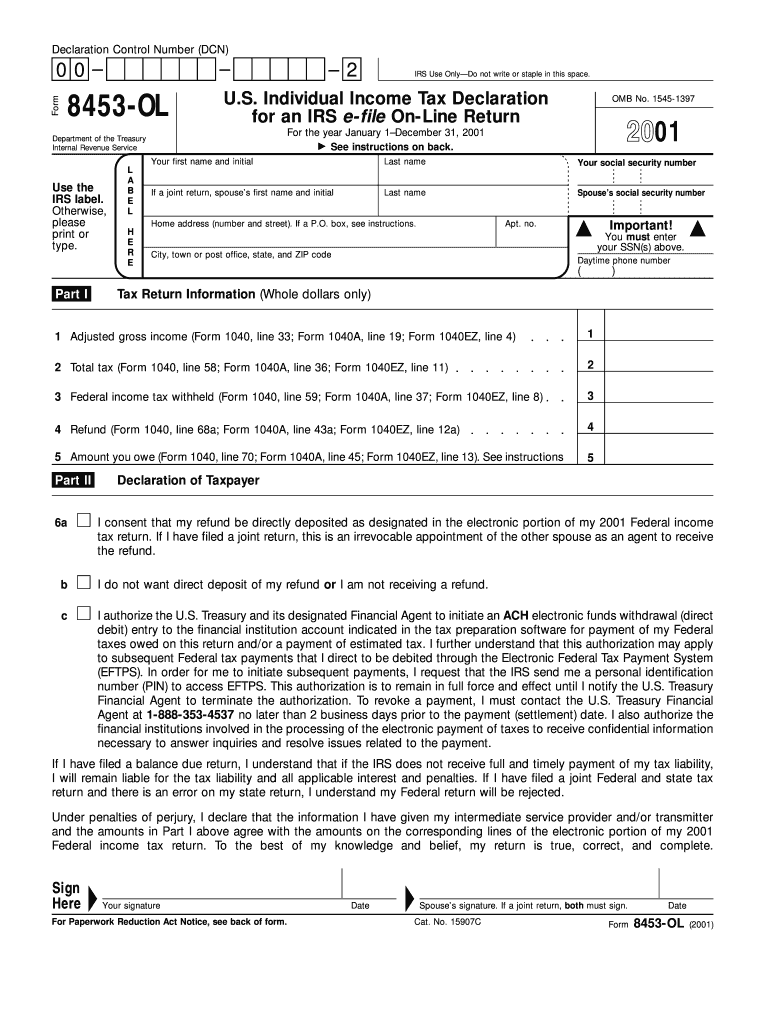

If i’m only a collector, i’m. Web if you received a request to submit form 8453 (u.s. File and pay your taxes online. Web the dor of all information pertaining to my use of the system and software and to the transmission of my tax return electronically. These are not installment payments for the current amount you owe. By signing this form, you. Web part iii make estimated tax payments for taxable year 2023. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. Web individual income tax declaration for electronic filing full payment partial payment payment made/will be made by credit card. This form is for income earned in tax year 2022, with tax returns due in.

File and pay your taxes online. Web part iii make estimated tax payments for taxable year 2020. Web if you received a request to submit form 8453 (u.s. Web form 843, claim for refund and request for abatement. Web part iii make estimated tax payments for taxable year 2023. Find irs forms and answers to tax questions. These are not installment payments for the current amount you owe. By signing form ftb 8453. These are not installment payments for the current amount you owe. First payment due 4/15/2020 second.

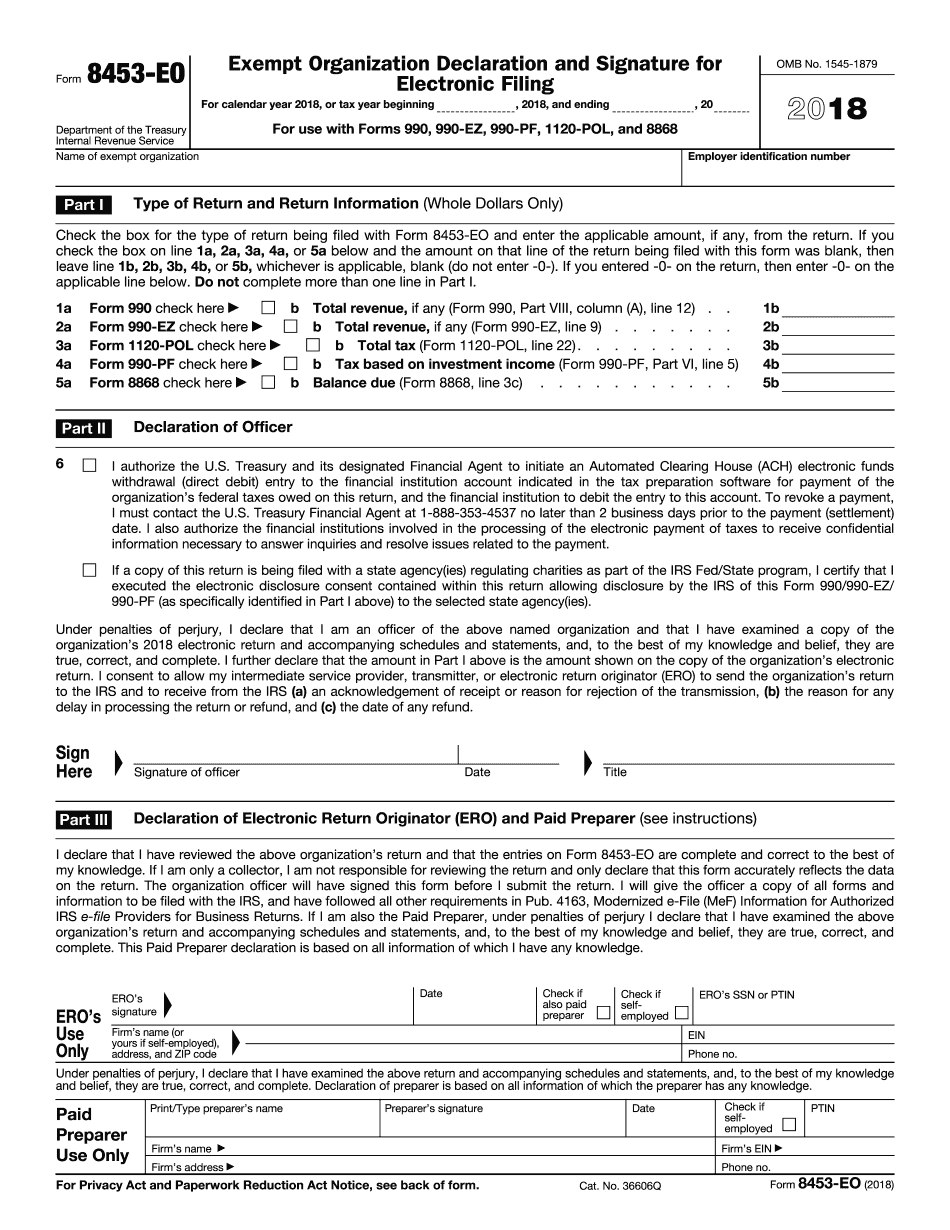

IRS Form 8453EO 2018 2019 Fill out and Edit Online PDF Template

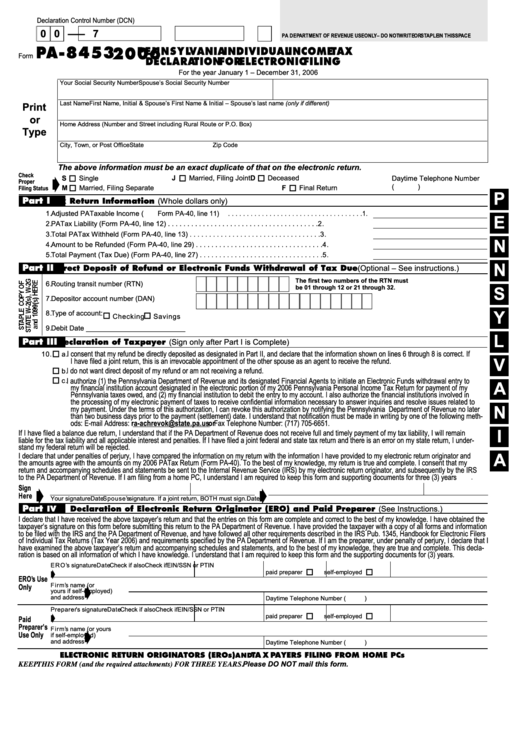

By signing this form, you. Web the dor of all information pertaining to my use of the system and software and to the transmission of my tax return electronically. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. Web individual income tax declaration for electronic filing.

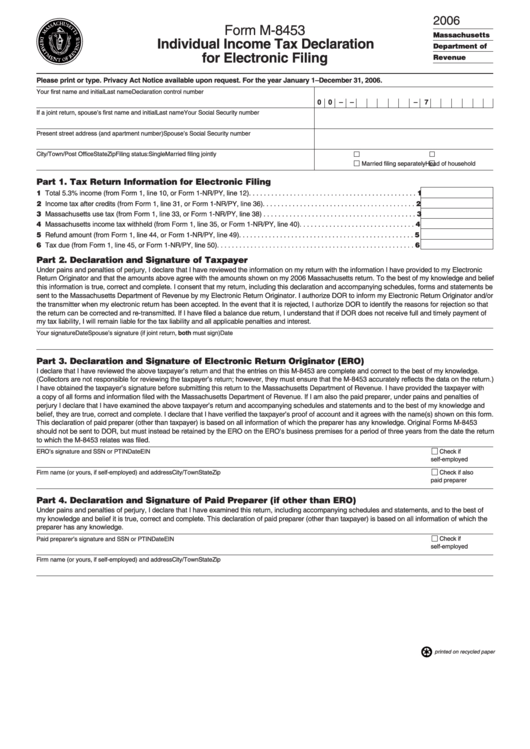

Form M8453 Individual Tax Declaration For Electronic Filing

These are not installment payments for the current amount you owe. Web part iii make estimated tax payments for taxable year 2023. Web if you received a request to submit form 8453 (u.s. File and pay your taxes online. First payment due 4/15/2020 second.

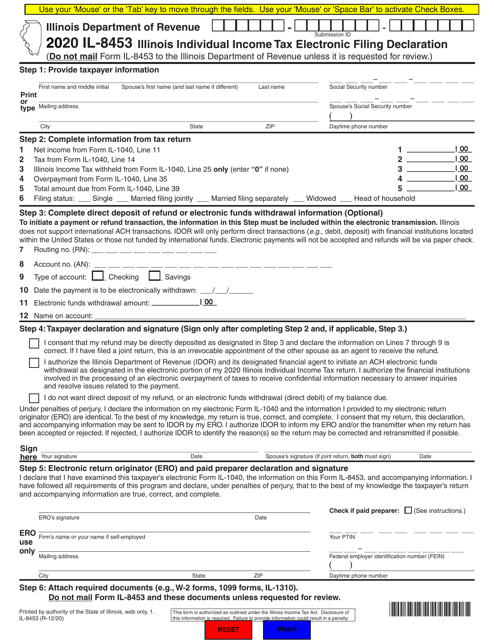

Form IL8453 Download Fillable PDF or Fill Online Illinois Individual

Web individual income tax forms. Web if you received a request to submit form 8453 (u.s. This form is for income earned in tax year 2022, with tax returns due in. By signing this form, you. These are not installment payments for the current amount you owe.

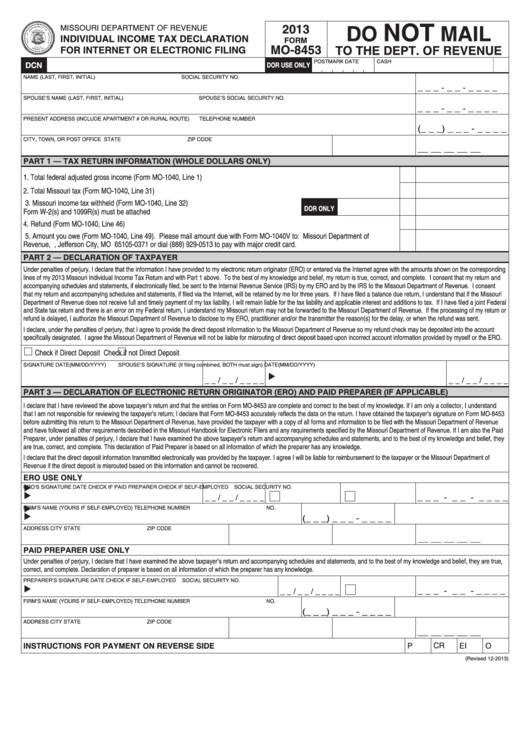

Form Mo8453 Individual Tax Declaration For Or

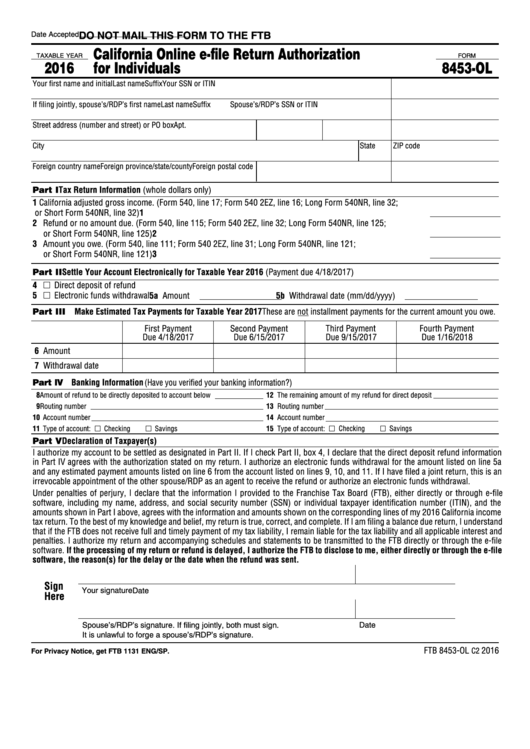

By signing form ftb 8453. _____ _____ _____ _____ taxpayer’s. We help you understand and meet your federal tax responsibilities. Web do not mail this form to the ftb. Web part iii make estimated tax payments for taxable year 2023.

Form Pa 8453 Pennsylvania Individual Tax Declaration For

By signing this form, you. This form is for income earned in tax year 2022, with tax returns due in. Web do not mail this form to the ftb. Withdrawal date type of account: We help you understand and meet your federal tax responsibilities.

Form 8453OL Fill out & sign online DocHub

We help you understand and meet your federal tax responsibilities. These are not installment payments for the current amount you owe. First payment due 4/15/2020 second. Web information about form 8453, u.s. Web do not mail this form to the ftb.

What Is IRS Form 8453OL? IRS Tax Attorney

Withdrawal date type of account: Find irs forms and answers to tax questions. _____ _____ _____ _____ taxpayer’s. Web the dor of all information pertaining to my use of the system and software and to the transmission of my tax return electronically. These are not installment payments for the current amount you owe.

Fillable Form 8453Ol California Online EFile Return Authorization

Web part iii make estimated tax payments for taxable year 2020. If i’m only a collector, i’m. Withdrawal date type of account: By signing this form, you. These are not installment payments for the current amount you owe.

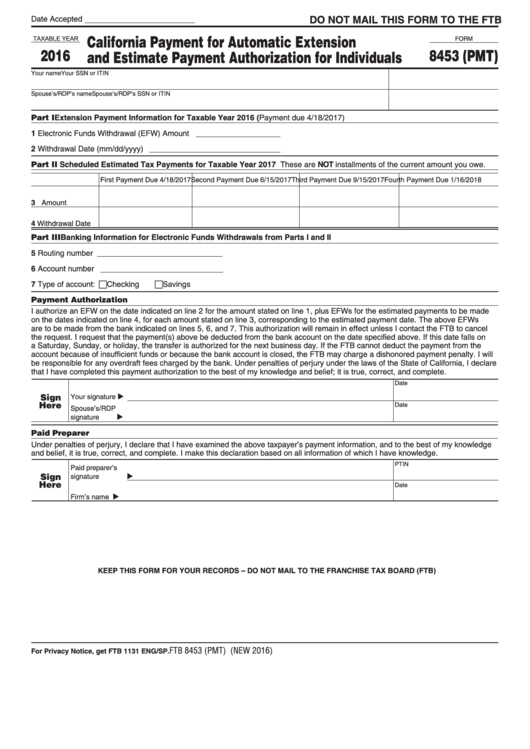

Form 8453 (Pmt) California Payment For Automatic Extension And

Part iv banking information (have you. By signing this form, you. By signing this form, you. If i’m only a collector, i’m. Web individual income tax forms.

EFiling with Form FTB 8453OL H&R Block

These are not installment payments for the current amount you owe. Web part iii make estimated tax payments for taxable year 2020. Form 8027, employer’s annual information return of tip income and. Find irs forms and answers to tax questions. Web individual income tax forms.

Find Irs Forms And Answers To Tax Questions.

Web the dor of all information pertaining to my use of the system and software and to the transmission of my tax return electronically. Web part iii make estimated tax payments for taxable year 2020. This form is for income earned in tax year 2022, with tax returns due in. These are not installment payments for the current amount you owe.

By Signing This Form, You.

These are not installment payments for the current amount you owe. By signing form ftb 8453. Part iv banking information (have you. Web if you received a request to submit form 8453 (u.s.

Form 8027, Employer’s Annual Information Return Of Tip Income And.

First payment due 4/15/2020 second. If i’m only a collector, i’m. _____ _____ _____ _____ taxpayer’s. File and pay your taxes online.

Web Form 843, Claim For Refund And Request For Abatement.

Withdrawal date type of account: Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. Web do not mail this form to the ftb. Web information about form 8453, u.s.