Tax Form 8233

Tax Form 8233 - Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien. Web employer's quarterly federal tax return. By filing form 8233, they are looking to claim an exemption from. Web form 8233 is valid for one year only and must be completed each calendar year. Form 8865, return of u.s. Web 314 rows this irm provides guidance to accounts management. Employers engaged in a trade or business who. Web caution:nonresident alien students, profesors/teachers, and researchers using form 8233 to claim exemption from withholding on compensation for personal services that is. Ad access irs tax forms. Web form 8233 to claim a tax treaty withholding exemption for part or all of that income.

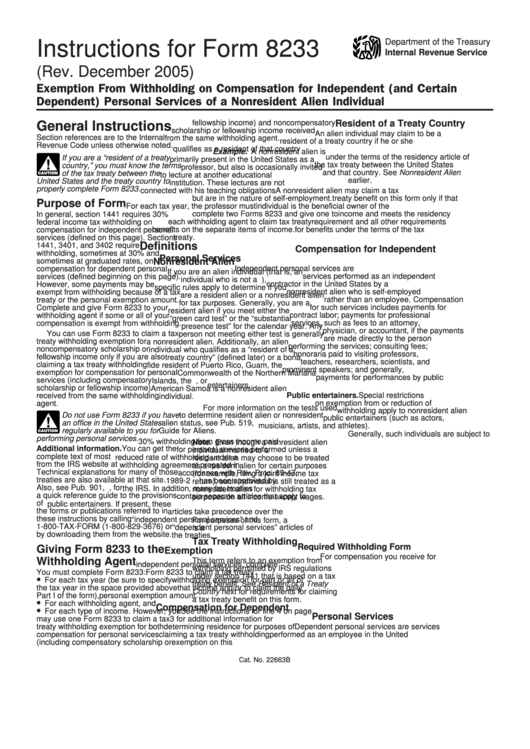

Download form | view sample. Web what is the form 8233 and what is its purpose? If an 8233 is not completed, wages will be subject to income tax being deducted from your paycheck. Without a valid 8233 form on file, federal and state taxes will be withheld at the highest rate of. Web complete form 8233 for compensation you receive for dependent personal services only if you are claiming a tax treaty withholding exemption for part or all of that. Web we last updated federal form 8233 in february 2023 from the federal internal revenue service. Ad access irs tax forms. The payee has a u.s. Web form 8233 to claim a tax treaty withholding exemption for part or all of that income. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual.

Web 314 rows this irm provides guidance to accounts management. By filing form 8233, they are looking to claim an exemption from. Ad access irs tax forms. The payee has a u.s. Employers engaged in a trade or business who. This form is for income earned in tax year 2022, with tax returns due in april. Taxpayer identification number on the form 8233. Do not use form 8233 to claim the daily personal exemption amount. Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien. Web form 8233 to claim a tax treaty withholding exemption for part or all of that income.

Form 8233 Exemption from Withholding on Compensation for Independent

Web form 8233 what is form 8233? Web a tax treaty withholding exemption for part all of that compensation. Web complete form 8233 for compensation you receive for dependent personal services only if you are claiming a tax treaty withholding exemption for part or all of that. Ad access irs tax forms. Employee's withholding certificate form 941;

Form 8233 Exemption from Withholding on Compensation for Independent

Web 314 rows this irm provides guidance to accounts management. Web caution:nonresident alien students, profesors/teachers, and researchers using form 8233 to claim exemption from withholding on compensation for personal services that is. Web employer's quarterly federal tax return. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual. The 8233 is an internal.

f8233 Withholding Tax Irs Tax Forms

Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual. Employers engaged in a trade or business who. This form is for income earned in tax year 2022, with tax returns due in april. Web a tax treaty withholding exemption for part all of that compensation. Complete, edit or print tax forms instantly.

IRS Form 8233 Download Fillable PDF or Fill Online Exemption From

Web complete form 8233 for compensation you receive for dependent personal services only if you are claiming a tax treaty withholding exemption for part or all of that. Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien. Do not use form 8233 to claim the daily personal exemption amount. Persons.

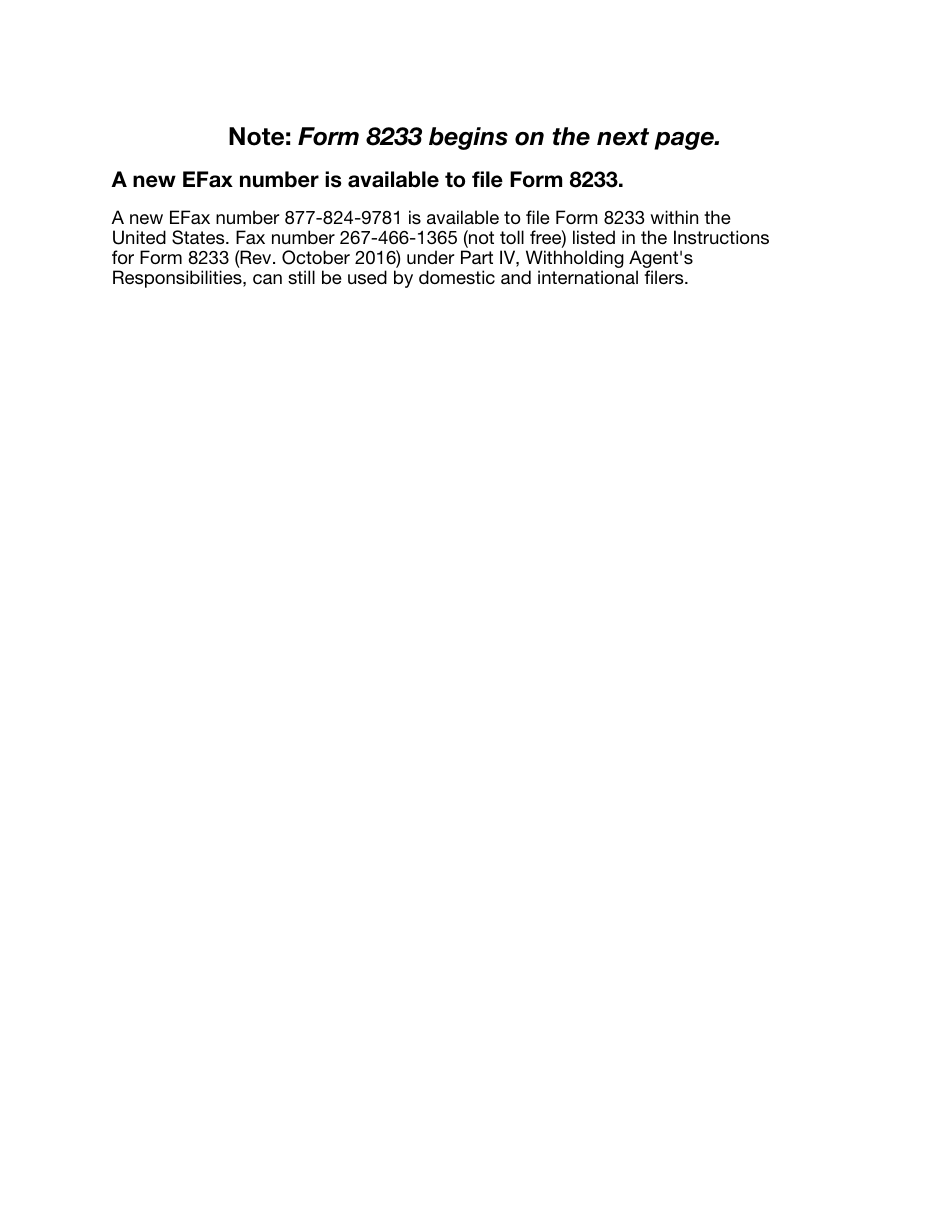

Instructions For Form 8233 printable pdf download

The 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Download form | view sample. Web form 8233 is valid for one year only and must be completed each calendar year. Employers engaged.

5 US Tax Documents Every International Student Should Know

Compensation for dependent personal services. Web caution:nonresident alien students, profesors/teachers, and researchers using form 8233 to claim exemption from withholding on compensation for personal services that is. Web form 8233 is valid for one year only and must be completed each calendar year. The payee has a u.s. This form is for income earned in tax year 2022, with tax.

irs form 8233 printable pdf file enter the appropriate calendar year

(if you have applied for, or will apply for, an itin through the payroll office leave blank) line 3. Web a tax treaty withholding exemption for part all of that compensation. By filing form 8233, they are looking to claim an exemption from. Web employer's quarterly federal tax return. Web what is the form 8233 and what is its purpose?

PPT Taxes & Treaties for International Student Employees PowerPoint

This form is for income earned in tax year 2022, with tax returns due in april. Web caution:nonresident alien students, profesors/teachers, and researchers using form 8233 to claim exemption from withholding on compensation for personal services that is. Ad access irs tax forms. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual..

International Tax Forms When to Use Form 8233 — Video Lorman

Web form 8233 is valid for one year only and must be completed each calendar year. The 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for. Ad access irs tax forms. Complete irs tax forms online or print government tax documents. Taxpayer identification number on the form 8233.

IRS 8233 2001 Fill out Tax Template Online US Legal Forms

Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual. The corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service. Web caution:nonresident alien students, profesors/teachers, and researchers using form 8233 to claim exemption from withholding on compensation for personal services that is. Who.

The 8233 Is An Internal Revenue Service (Irs) Mandated Form To Collect Correct Nonresident Alien (Nra) Taxpayer Information For.

Web we last updated federal form 8233 in february 2023 from the federal internal revenue service. Without a valid 8233 form on file, federal and state taxes will be withheld at the highest rate of. The payee has a u.s. Taxpayer identification number on the form 8233.

Web Form 8233 Is Valid For One Year Only And Must Be Completed Each Calendar Year.

If an 8233 is not completed, wages will be subject to income tax being deducted from your paycheck. Ad access irs tax forms. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly.

Persons With Respect To Certain Foreign Partnerships.

Web a tax treaty withholding exemption for part all of that compensation. Web complete form 8233 for compensation you receive for dependent personal services only if you are claiming a tax treaty withholding exemption for part or all of that. Web employer's quarterly federal tax return. Who should use this form?

Download Form | View Sample.

Complete irs tax forms online or print government tax documents. (if you have applied for, or will apply for, an itin through the payroll office leave blank) line 3. Form 8865, return of u.s. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay.