Tax Form 5695 Instructions

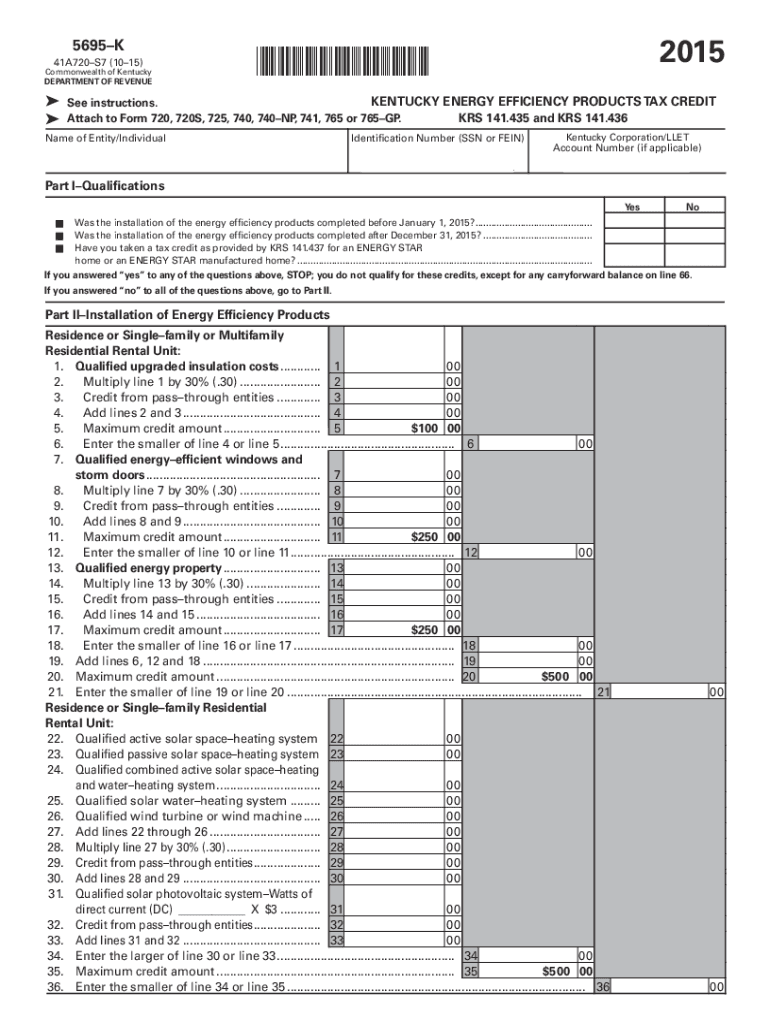

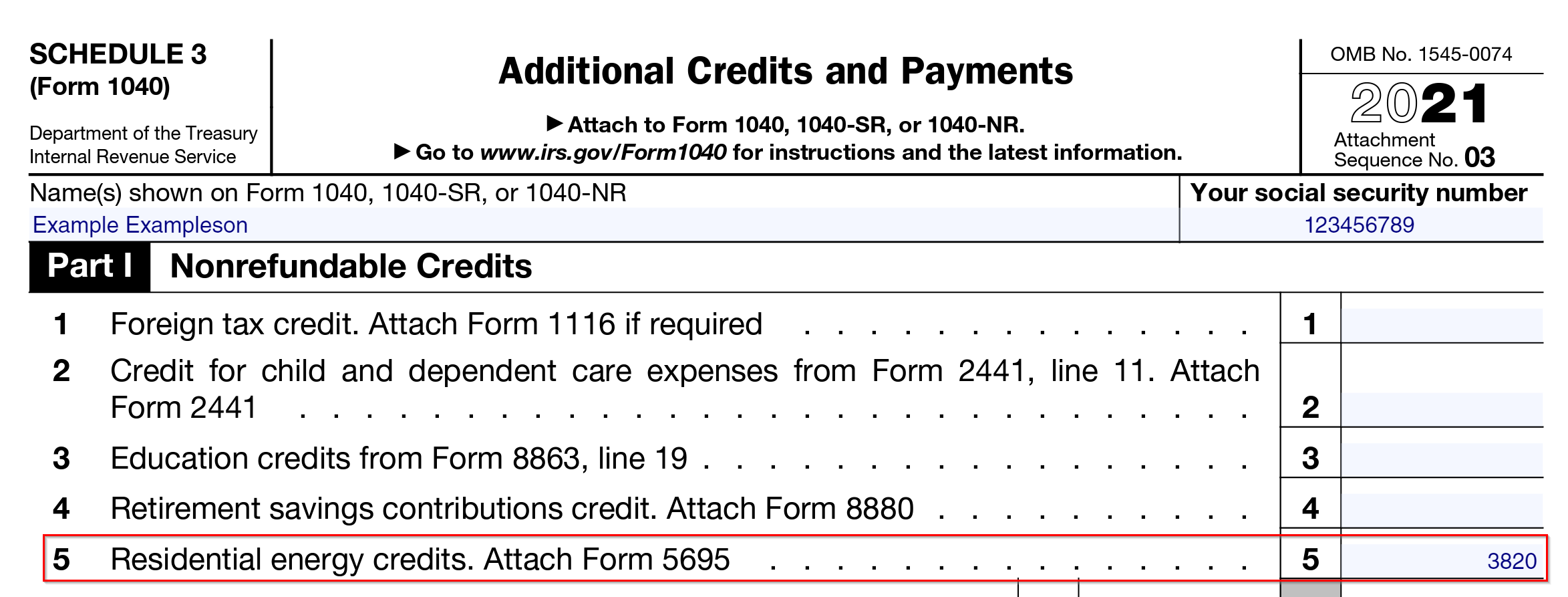

Tax Form 5695 Instructions - To add or remove this. Residential energy property credit (section 25d) through 2019, taxpayers. Web use form 5695 to figure and take your residential energy credits. Web purpose of form use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and • the. The residential energy credits are: Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. The residential energy credits are: We last updated federal form 5695 in december 2022 from the federal internal revenue service. The residential energy efficient property credit, and the.

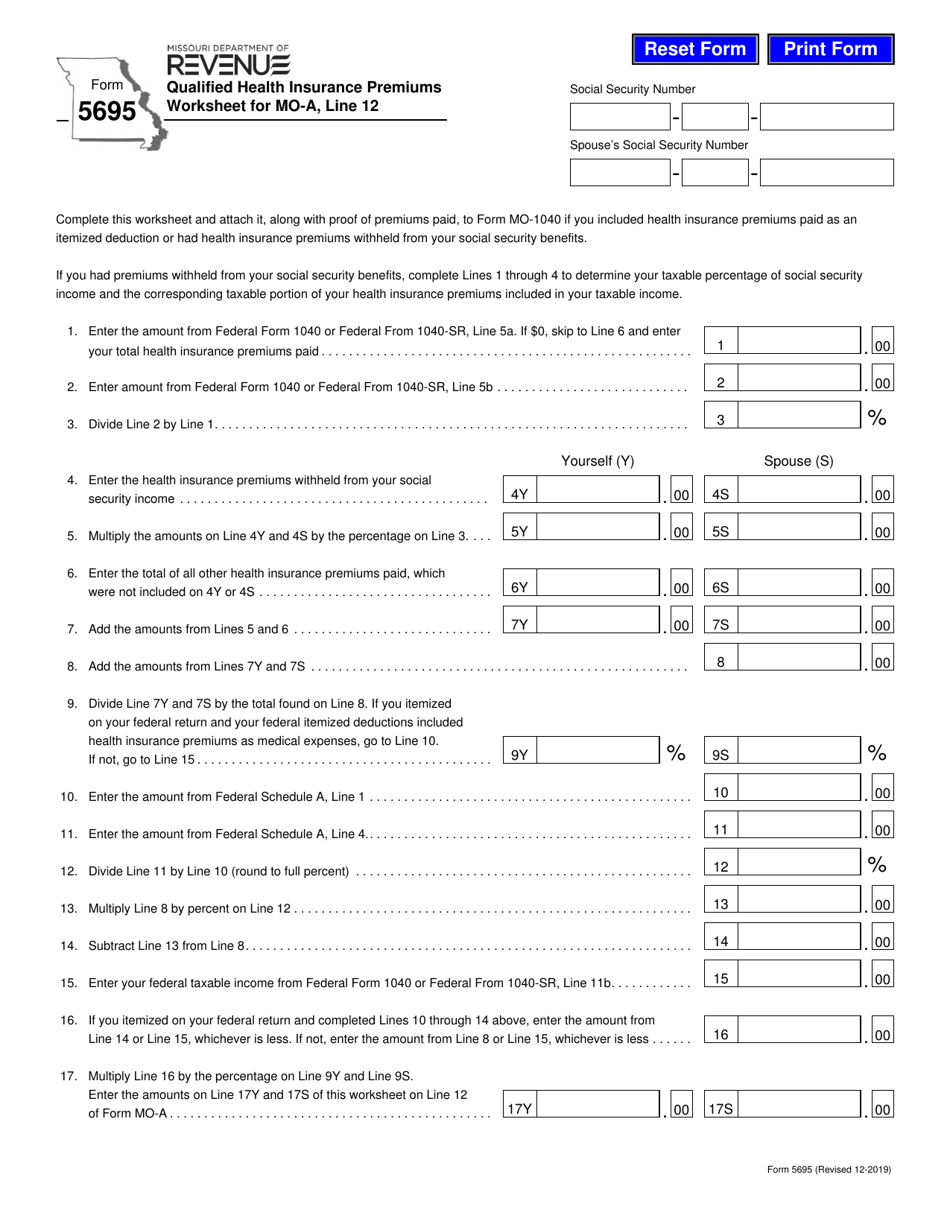

Web more about the federal form 5695 tax credit. Rate free missouri form 5695. Also use form 5695 to take any residential energy efficient property credit. Use form 5695 to figure and take your residential energy credits. Web up to $40 cash back сomplete the missouri tax form 5695 for free get started! Web on line 14, you will need to enter the credit limitation based on your tax liability. The residential energy efficient property credit, and the. This form is for income. To add or remove this. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water.

The residential energy credits are: Web we last updated the residential energy credits in december 2022, so this is the latest version of form 5695, fully updated for tax year 2022. Web on line 14, you will need to enter the credit limitation based on your tax liability. The residential energy efficient property credit, and the. Web more about the federal form 5695 tax credit. The residential energy credits are: We last updated federal form 5695 in december 2022 from the federal internal revenue service. Also use form 5695 to take any residential energy efficient property credit. • the residential clean energy credit, and • the. Rate free missouri form 5695.

Form 5695 Instructions & Information on IRS Form 5695

Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water. Web purpose of form use form 5695 to figure and take your residential energy credits. Purpose of form use form 5695 to figure and take your residential energy credits. The residential energy efficient property credit, and the. Web.

Tax 2022 Irs Latest News Update

The residential energy credits are: Keywords relevant to mo form 5695 missouri. Rate free missouri form 5695. Web on line 14, you will need to enter the credit limitation based on your tax liability. Web general instructions future developments for the latest information about developments related to form 5695 and its instructions, such as legislation enacted after they were.

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

Web up to $40 cash back сomplete the missouri tax form 5695 for free get started! Web more about the federal form 5695 tax credit. Purpose of form use form 5695 to figure and take your residential energy credits. This form is for income. Rate free missouri form 5695.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

• the residential energy efficient property credit, and • the. Web we last updated the residential energy credits in december 2022, so this is the latest version of form 5695, fully updated for tax year 2022. Web purpose of form use form 5695 to figure and take your residential energy credits. We last updated federal form 5695 in december 2022.

Form 5695 Download Fillable PDF or Fill Online Qualified Health

Keywords relevant to mo form 5695 missouri. • the residential energy efficient property credit, and • the. You can download or print current. Use form 5695 to figure and take your residential energy credits. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information.

Tax Form 5695 by AscendWorks Issuu

Rate free missouri form 5695. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. The form 5695 instructions include a worksheet on page 4 to help you make the necessary. Web use form 5695 to figure and take your residential energy credits. To add or remove this.

2020 Form 5695 Instructions Fill Out and Sign Printable PDF Template

Residential energy property credit (section 25d) through 2019, taxpayers. Web purpose of form use form 5695 to figure and take the residential energy efficient property credit. The residential energy credits are: Also use form 5695 to take any residential energy efficient property credit. Web purpose of form use form 5695 to figure and take your residential energy credits.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Web purpose of form use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and • the. The residential energy credits are: You can download or print current. Web on line 14, you will need to enter the credit limitation based on your tax liability.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Also use form 5695 to take any residential energy efficient property credit. Web purpose of form use form 5695 to figure and take your residential energy credits. Web more about the federal form 5695 tax credit. Web use form 5695 to figure and take your residential energy credits. We last updated federal form 5695 in december 2022 from the federal.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

The residential energy credits are: Use form 5695 to figure and take your residential energy credits. The residential energy credits are: Web more about the federal form 5695 tax credit. Web on line 14, you will need to enter the credit limitation based on your tax liability.

Web Purpose Of Form Use Form 5695 To Figure And Take Your Residential Energy Credits.

To add or remove this. Use form 5695 to figure and take your residential energy credits. Web purpose of form use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and • the.

Web Purpose Of Form Use Form 5695 To Figure And Take Your Residential Energy Credits.

Use form 5695 to figure and take. This form is for income. The form 5695 instructions include a worksheet on page 4 to help you make the necessary. We last updated federal form 5695 in december 2022 from the federal internal revenue service.

Residential Energy Property Credit (Section 25D) Through 2019, Taxpayers.

• the residential energy efficient property credit, and. Web purpose of form use form 5695 to figure and take the residential energy efficient property credit. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water.

The Residential Energy Efficient Property Credit, And The.

Web use form 5695 to figure and take your residential energy credits. Web per irs instructions for form 5695, page 1: Rate free missouri form 5695. You can download or print current.