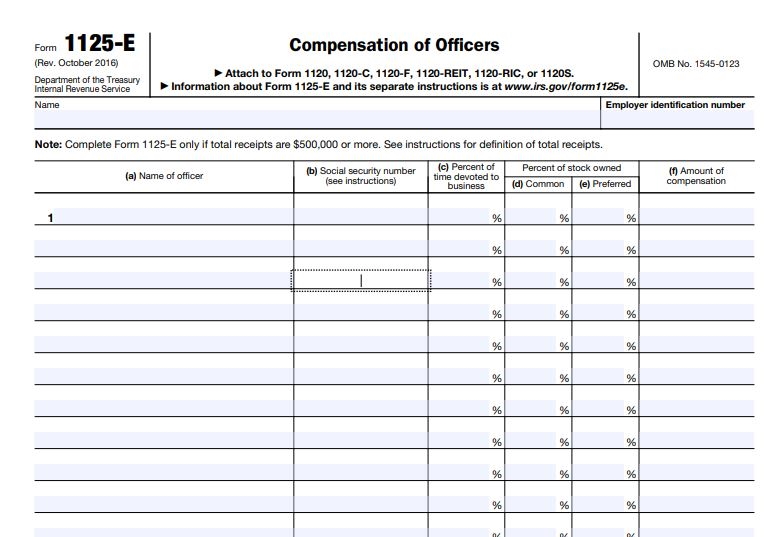

Tax Form 1125-E

Tax Form 1125-E - It is for separate entity business returns. Web prior year alternative minimum tax credit carryover as refundable. Web irs form 1125 e. Web abatement (form 843) to the address shown above. Also see the instructions for schedule j, part iii, line 20c. Do not include compensation deductible. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Can the officer social security numbers be. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000. Signnow allows users to edit, sign, fill and share all type of documents online.

Include fringe benefit expenditures made on behalf of officers and employees owning more than 2% of the. Sign in to your account. It is not a form provided an officer to prepare their own return. Also see the instructions for schedule j, part iii, line 20c. Can the officer social security numbers be. This form is for income earned in tax year 2022, with tax returns due in april. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web irs form 1125 e. It is for separate entity business returns. Web abatement (form 843) to the address shown above.

Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Sign in to your account. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000. Web irs form 1125 e. Web abatement (form 843) to the address shown above. Signnow allows users to edit, sign, fill and share all type of documents online. Get a fillable 1125 e instructions template online. It is not a form provided an officer to prepare their own return. It is for separate entity business returns. Also see the instructions for schedule j, part iii, line 20c.

IRS Form 1125E

Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. It is not a form provided an officer to prepare their own return. Get a fillable 1125 e instructions template online. Include fringe benefit expenditures made on behalf of officers and employees owning more than 2% of the. Do not include compensation deductible.

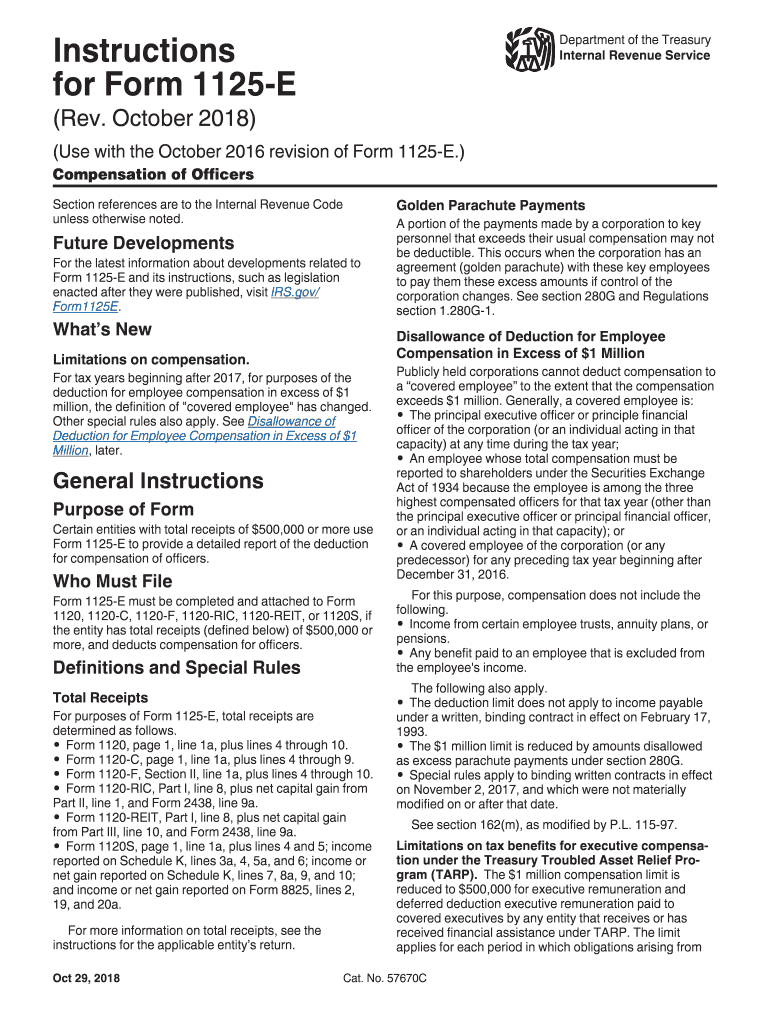

Form 1125e instructions 2016

Include fringe benefit expenditures made on behalf of officers and employees owning more than 2% of the. Web file your taxes for free. Signnow allows users to edit, sign, fill and share all type of documents online. Get a fillable 1125 e instructions template online. This form is for income earned in tax year 2022, with tax returns due in.

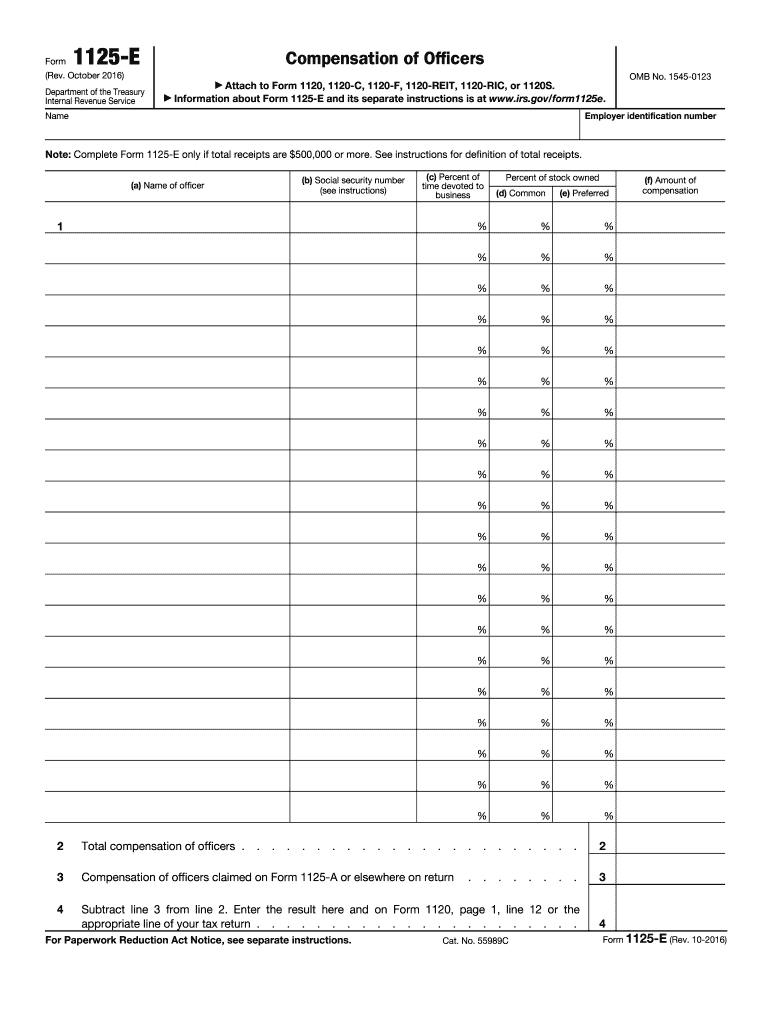

Form 1125E Compensation of Officers (2013) Free Download

Web prior year alternative minimum tax credit carryover as refundable. This form is for income earned in tax year 2022, with tax returns due in april. Include fringe benefit expenditures made on behalf of officers and employees owning more than 2% of the. Web abatement (form 843) to the address shown above. Total receipts (line 1a, plus lines 4 through.

Form 1125E2020 Compensation of Officers Nina's Soap

Web file your taxes for free. Also see the instructions for schedule j, part iii, line 20c. Signnow allows users to edit, sign, fill and share all type of documents online. Web prior year alternative minimum tax credit carryover as refundable. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000.

Simplified Tax Form? NESA

It is not a form provided an officer to prepare their own return. Sign in to your account. It is for separate entity business returns. Web prior year alternative minimum tax credit carryover as refundable. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000.

Form 1125 E Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april. It is for separate entity business returns. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000. Web file your taxes for free. Web abatement (form 843) to the address shown above.

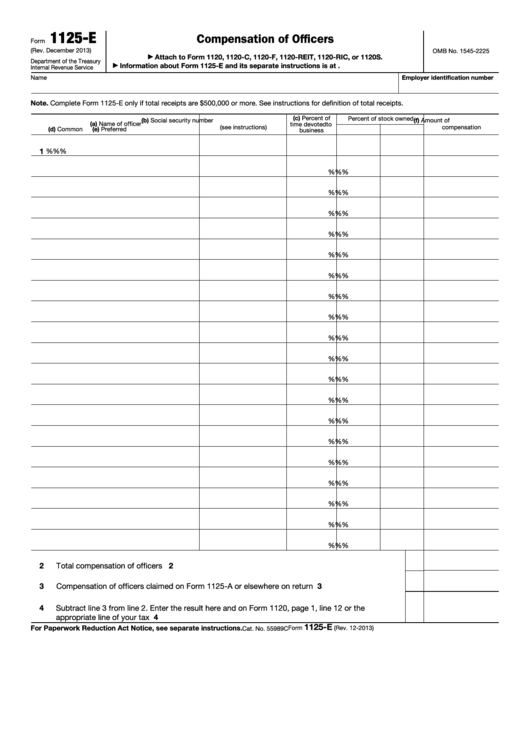

Form 1125E Compensation of Officers (2013) Free Download

Web file your taxes for free. It is not a form provided an officer to prepare their own return. Sign in to your account. Get a fillable 1125 e instructions template online. Also see the instructions for schedule j, part iii, line 20c.

1120 Tax Form The Different Variations And How To File Silver Tax Group

Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000. Do not include compensation deductible. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Signnow allows users to edit, sign, fill and share all type of documents online. It is not a form provided an officer to prepare their.

Form 1125 E Fill Out and Sign Printable PDF Template signNow

Get a fillable 1125 e instructions template online. Signnow allows users to edit, sign, fill and share all type of documents online. Also see the instructions for schedule j, part iii, line 20c. Do not include compensation deductible. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000.

Fillable Form 1125E Compensation Of Officers printable pdf download

Include fringe benefit expenditures made on behalf of officers and employees owning more than 2% of the. Do not include compensation deductible. Web prior year alternative minimum tax credit carryover as refundable. Sign in to your account. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000.

Signnow Allows Users To Edit, Sign, Fill And Share All Type Of Documents Online.

Sign in to your account. Do not include compensation deductible. This form is for income earned in tax year 2022, with tax returns due in april. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000.

Web Abatement (Form 843) To The Address Shown Above.

Web file your taxes for free. It is for separate entity business returns. Can the officer social security numbers be. Get a fillable 1125 e instructions template online.

Also See The Instructions For Schedule J, Part Iii, Line 20C.

Web prior year alternative minimum tax credit carryover as refundable. Web irs form 1125 e. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. It is not a form provided an officer to prepare their own return.