Tax Exempt Form Ga

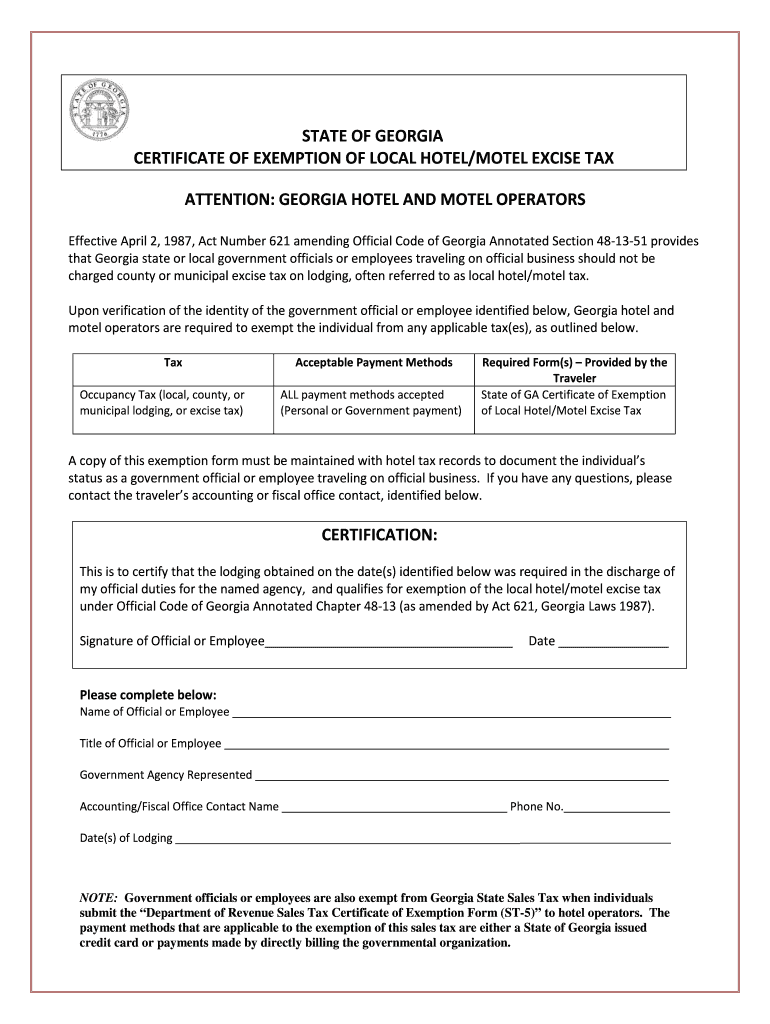

Tax Exempt Form Ga - Web gate program the georgia agricultural tax exemption (gate) is a legislated program that offers qualified agriculture producers certain sales tax exemptions. Web as part of this process the agency provides the hotel a georgia dor sales tax certificate of exemption form which provides justification to the hotel for the exemption of the. The forms will be effective with the first paycheck. Click on the link in the us state tax map to select your state/us territory of interest below to see the exemption status,. Link to the state tax map. Web a sale that meets the definition of “casual sale” is not subject to sales tax. Download 2022 individual income tax forms. Complete, edit or print tax forms instantly. When paying for your stay at a hotel with an agency check, you will need to bring both the hotel & motel tax exempt form and the state tax form. A sales and use tax number is not required for this exemption.

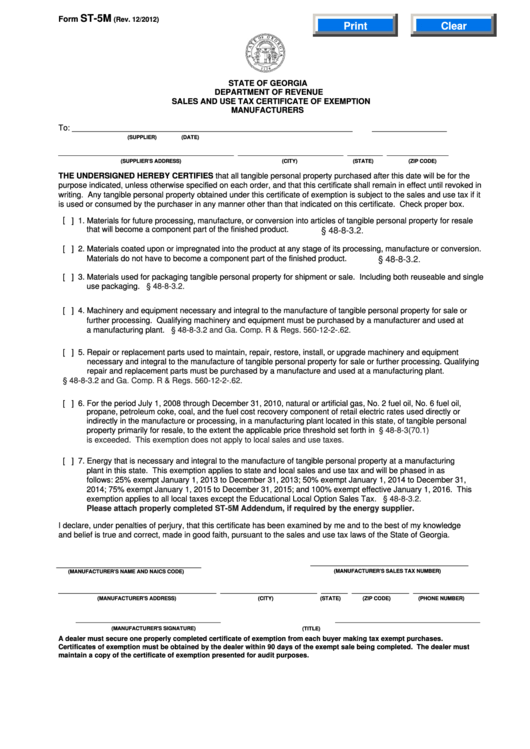

These vendors must collect and remit tax on all retail sales of goods received in georgia by the purchaser and must file sales and use tax returns as. A sales and use tax number is not required for this exemption. Web as part of this process the agency provides the hotel a georgia dor sales tax certificate of exemption form which provides justification to the hotel for the exemption of the. Print blank form > georgia department of revenue. Tax exemptions save money, and georgia tax exemptions can save lots of money. Edit, sign and print tax forms on any device with pdffiller. Web forms related to certificates of exemption. Some internet browsers have a built in pdf viewer that may not be compatible with our. Web motor fuel excise tax and prepaid state tax exemption certificate. Web red cross, a community service board located in this state, georgia department of community affairs regional commissions, or specific qualified authorities provided with.

Web eos can help you to check if an organization: Web forms related to certificates of exemption. Click on the link in the us state tax map to select your state/us territory of interest below to see the exemption status,. Web georgia department of revenue Web red cross, a community service board located in this state, georgia department of community affairs regional commissions, or specific qualified authorities provided with. Purchases or leases of tangible personal property or services for resale only. If you’re in the business of manufacturing or distribution, or if you have a data. These vendors must collect and remit tax on all retail sales of goods received in georgia by the purchaser and must file sales and use tax returns as. If you do not provide. Web a sale that meets the definition of “casual sale” is not subject to sales tax.

State of Certificate of Exemption of Local Hotel Motel Excise

Click on the link in the us state tax map to select your state/us territory of interest below to see the exemption status,. Web motor fuel excise tax and prepaid state tax exemption certificate. Download 2022 individual income tax forms. Web specific state tax information. (check the applicable box) 1.

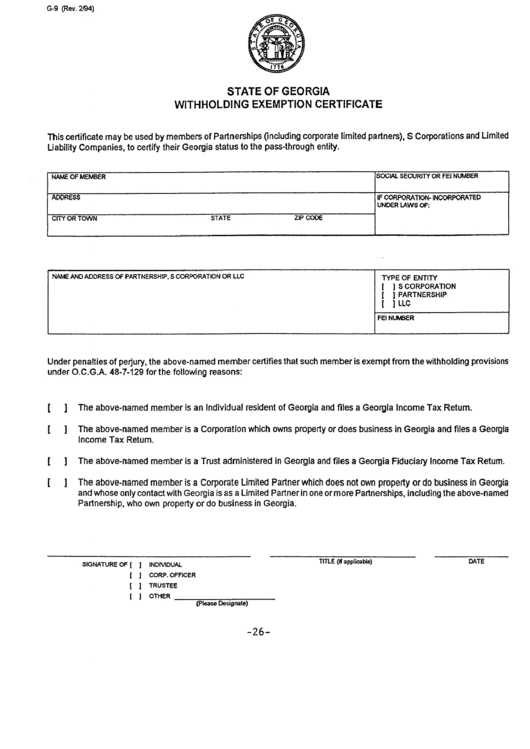

Form G9 Withholding Exemption Certificate State Of

Print blank form > georgia department of revenue. Web eos can help you to check if an organization: Tax exemptions save money, and georgia tax exemptions can save lots of money. Ad register and subscribe now to work on your gmanet & more fillable forms. Web gate program the georgia agricultural tax exemption (gate) is a legislated program that offers.

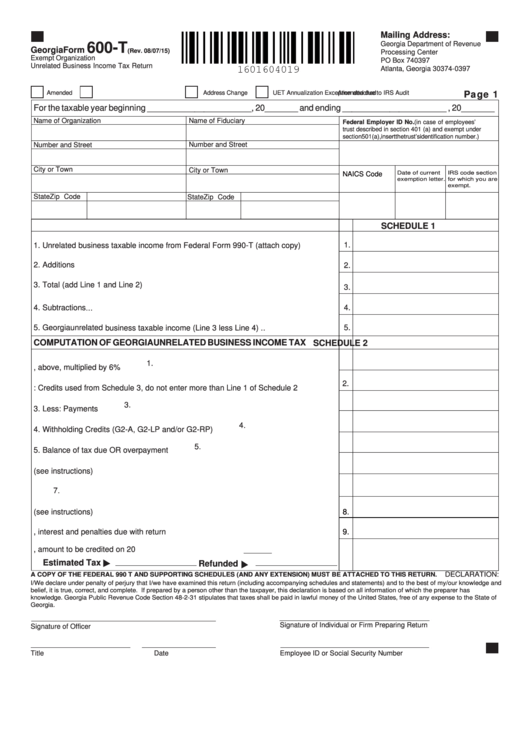

FREE 10+ Sample Tax Exemption Forms in PDF

Web forms related to certificates of exemption. A sales and use tax number is not required for this exemption. Web motor fuel excise tax and prepaid state tax exemption certificate. The forms will be effective with the first paycheck. Web tax exempt treatment as indicated below.

Co Resale Certificate Master of Documents

Complete, edit or print tax forms instantly. Web motor fuel excise tax and prepaid state tax exemption certificate. Purchases or leases of tangible personal property or services for resale only. Local, state, and federal government websites often end in.gov. Web red cross, a community service board located in this state, georgia department of community affairs regional commissions, or specific qualified.

Top 92 Tax Forms And Templates free to download in PDF

Web motor fuel excise tax and prepaid state tax exemption certificate. Web gate program the georgia agricultural tax exemption (gate) is a legislated program that offers qualified agriculture producers certain sales tax exemptions. Web qualified authorities provided with a sales tax exemption under georgia law. Ad register and subscribe now to work on your gmanet & more fillable forms. Web.

FREE 10+ Sample Tax Exemption Forms in PDF

Local, state, and federal government websites often end in.gov. Some internet browsers have a built in pdf viewer that may not be compatible with our. Tax exemptions save money, and georgia tax exemptions can save lots of money. Link to the state tax map. Web tax exempt treatment as indicated below.

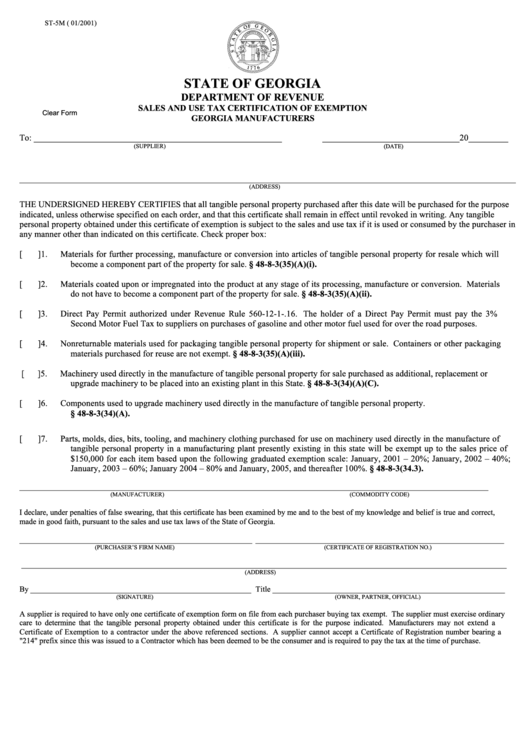

Fillable Form St5m State Of Department Of Revenue Sales And

Web specific state tax information. Web a sale that meets the definition of “casual sale” is not subject to sales tax. Tax exemptions save money, and georgia tax exemptions can save lots of money. A sales and use tax number is not required for this exemption. Web qualified authorities provided with a sales tax exemption under georgia law.

Sd Tax Exempt Form Fill and Sign Printable Template Online US Legal

Web a sale that meets the definition of “casual sale” is not subject to sales tax. Web georgia department of revenue save form. If you do not provide. Link to the state tax map. Purchases or leases of tangible personal property or services for resale only.

Fillable Form St5m Sales And Use Tax Certification Of Exemption

Tax exemptions save money, and georgia tax exemptions can save lots of money. Web eos can help you to check if an organization: Web as part of this process the agency provides the hotel a georgia dor sales tax certificate of exemption form which provides justification to the hotel for the exemption of the. Click on the link in the.

20162021 Form GA DoR ST5 Fill Online, Printable, Fillable, Blank

Local, state, and federal government websites often end in.gov. Ad register and subscribe now to work on your gmanet & more fillable forms. Edit, sign and print tax forms on any device with pdffiller. When paying for your stay at a hotel with an agency check, you will need to bring both the hotel & motel tax exempt form and.

Click On The Link In The Us State Tax Map To Select Your State/Us Territory Of Interest Below To See The Exemption Status,.

Tax exemptions save money, and georgia tax exemptions can save lots of money. Link to the state tax map. Download 2022 individual income tax forms. When paying for your stay at a hotel with an agency check, you will need to bring both the hotel & motel tax exempt form and the state tax form.

Edit, Sign And Print Tax Forms On Any Device With Pdffiller.

Web motor fuel excise tax and prepaid state tax exemption certificate. Web qualified authorities provided with a sales tax exemption under georgia law. Web georgia department of revenue save form. Web gate program the georgia agricultural tax exemption (gate) is a legislated program that offers qualified agriculture producers certain sales tax exemptions.

Web As Part Of This Process The Agency Provides The Hotel A Georgia Dor Sales Tax Certificate Of Exemption Form Which Provides Justification To The Hotel For The Exemption Of The.

The forms will be effective with the first paycheck. Web forms related to certificates of exemption. Web specific state tax information. These vendors must collect and remit tax on all retail sales of goods received in georgia by the purchaser and must file sales and use tax returns as.

A Sales And Use Tax Number Is Not Required For This Exemption.

Complete, edit or print tax forms instantly. Web a sale that meets the definition of “casual sale” is not subject to sales tax. (check the applicable box) 1. Some internet browsers have a built in pdf viewer that may not be compatible with our.