T2200 Tax Form

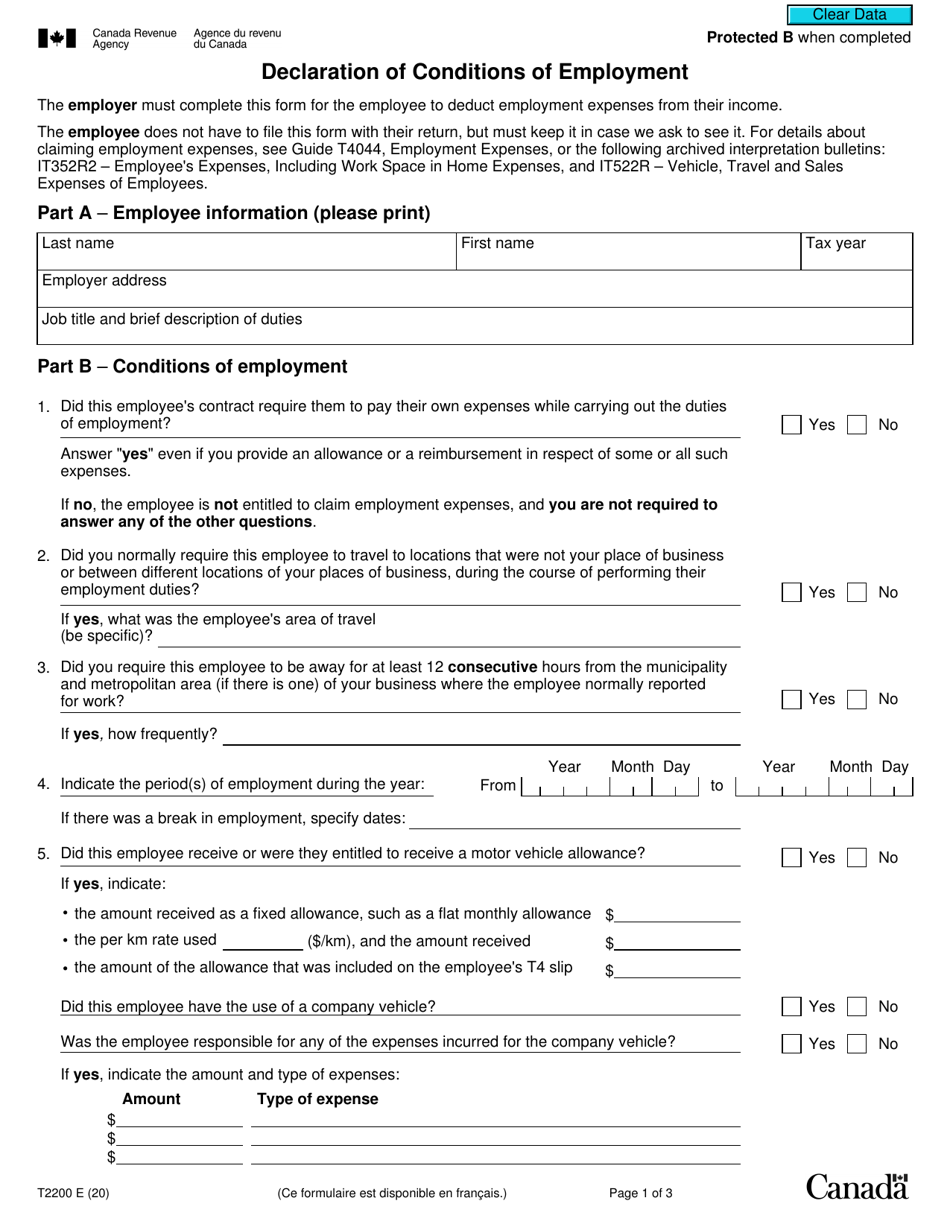

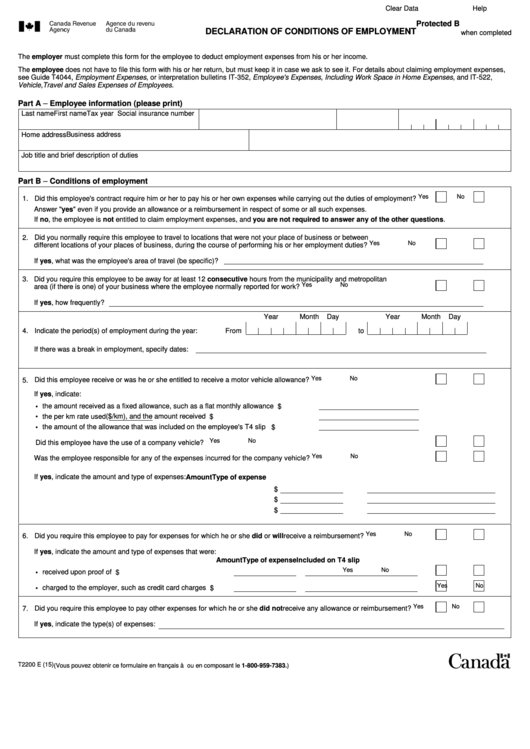

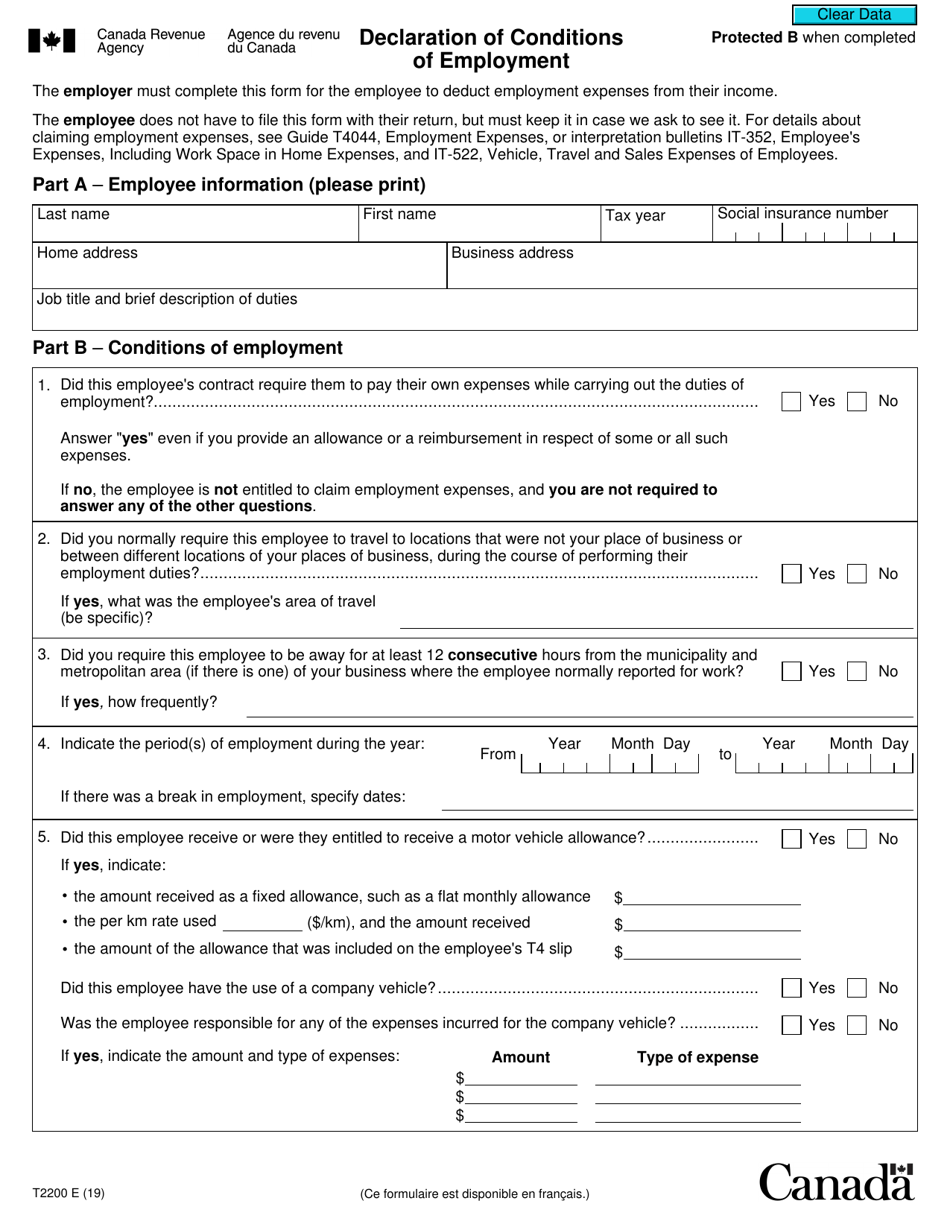

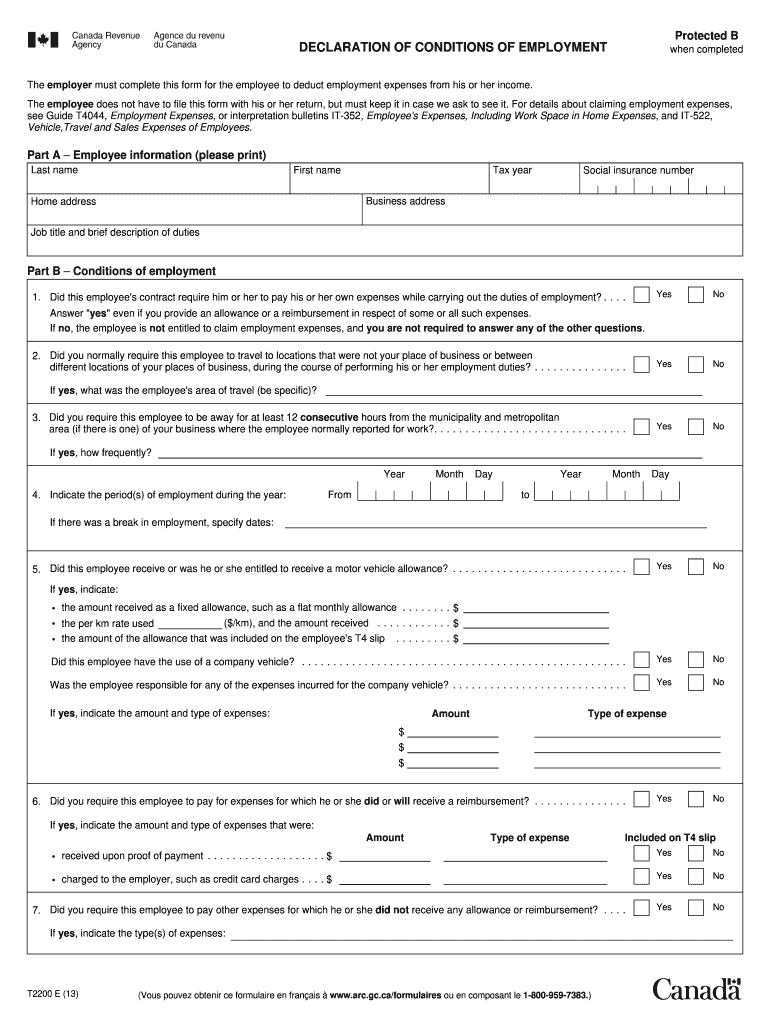

T2200 Tax Form - The matters affected by this form. Web the t2200 form is specifically designed for employees who are required to take on the financial burden of specific unreimbursed expenses through the course of. Web you have to fill out and sign form t2200, declaration of conditions of employment, and give it to your employee so they can deduct employment expenses. What is on a t2200 form? Web t2200, also called the declaration of conditions of employment, is a form issued by an employer to employees claiming tax credits from expenses incurred during. Web if you choose to mail your tax payment you should mail your payment to the address listed on the notice. It’s an abbreviated version of the. Employee's withholding certificate form 941; If you checked the box on line 2, send form 8822 to:. There are many expenses that you can deduct.

If you checked the box on line 2, send form 8822 to:. To spare you the long list, we've attached the actual form to give you a. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Web if you choose to mail your tax payment you should mail your payment to the address listed on the notice. Web for the 2020, 2021, and 2022 tax years, the cra will accept an electronic signature on form t2200s to reduce the need for employees and employers to meet in person. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015. Web for those with a history of working from home, the t2200 tax form is likely one that has become common practice to fill out. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web [anchor what can i deduct with the t2200 form? Things are a little different in the province of quebec.

If you checked the box on line 2, send form 8822 to:. Web a t2200 form helps employees maximize their tax deductions for unreimbursed employment expenses. Web [anchor what can i deduct with the t2200 form? Web for those with a history of working from home, the t2200 tax form is likely one that has become common practice to fill out. It’s an abbreviated version of the. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015. To spare you the long list, we've attached the actual form to give you a. Web t2200, also called the declaration of conditions of employment, is a form issued by an employer to employees claiming tax credits from expenses incurred during. Web we applied your 2016 form 1040 overpayment to an unpaid balance refund due: There are many expenses that you can deduct.

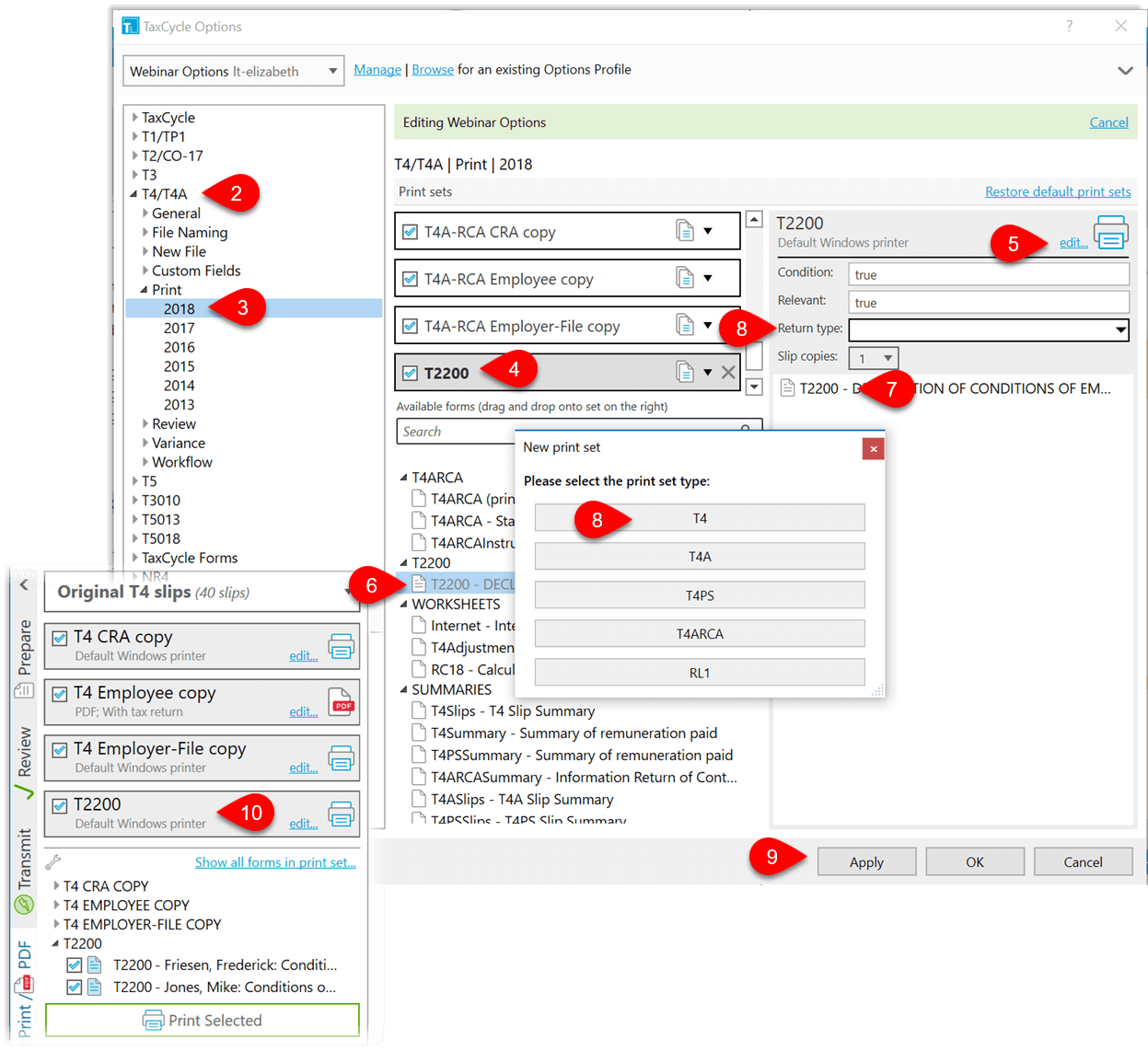

T2200 Conditions of Employment TaxCycle

Web for those with a history of working from home, the t2200 tax form is likely one that has become common practice to fill out. Web the t2200 form is specifically designed for employees who are required to take on the financial burden of specific unreimbursed expenses through the course of. The matters affected by this form. Web a new.

T2200 Form Fillable Fill Out and Sign Printable PDF Template signNow

Web for the 2020, 2021, and 2022 tax years, the cra will accept an electronic signature on form t2200s to reduce the need for employees and employers to meet in person. Web the t2200 form is specifically designed for employees who are required to take on the financial burden of specific unreimbursed expenses through the course of. Employee information in.

T2200 Forms What You Need to Know — Avanti Blog

To spare you the long list, we've attached the actual form to give you a. Employers engaged in a trade or business who. There are many expenses that you can deduct. Web a new t2200 form for the recipient appears in the t2200 section in the prepare sidebar. Employee's withholding certificate form 941;

Form T2200 Download Fillable PDF or Fill Online Declaration of

Things are a little different in the province of quebec. The matters affected by this form. To spare you the long list, we've attached the actual form to give you a. Web a t2200 form helps employees maximize their tax deductions for unreimbursed employment expenses. For those new to a work from the home arrangement.

Form T 2200 Download Printable PDF, Declaration of Conditions of

Web for the 2020, 2021, and 2022 tax years, the cra will accept an electronic signature on form t2200s to reduce the need for employees and employers to meet in person. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015. Web you have to fill out and sign form t2200, declaration of conditions.

Fillable Form T2200 E Declaration Of Conditions Of Employment

Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. To spare you the long list, we've attached the actual form to give you a. Web a new t2200 form for the recipient appears in the t2200 section in the prepare sidebar. It’s an abbreviated version of the. Web you have to fill out.

Everything You Need to Know about the T2200 Form

There are many expenses that you can deduct. What is on a t2200 form? Web a new t2200 form for the recipient appears in the t2200 section in the prepare sidebar. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,..

Form T2200 Download Fillable PDF or Fill Online Declaration of

Employers engaged in a trade or business who. Employee information in part a of the t2200 is automatically completed. If you don't have an address on the notice you can mail your. If you checked the box on line 2, send form 8822 to:. To spare you the long list, we've attached the actual form to give you a.

A Guide to the Canadian T2200 Form for Tax Time FreshBooks Blog

For those new to a work from the home arrangement. Web a t2200 form helps employees maximize their tax deductions for unreimbursed employment expenses. Web for those with a history of working from home, the t2200 tax form is likely one that has become common practice to fill out. Employee information in part a of the t2200 is automatically completed..

T2200 Form 2013 Fill Out and Sign Printable PDF Template signNow

Web if you choose to mail your tax payment you should mail your payment to the address listed on the notice. Employers engaged in a trade or business who. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015. Employee information in part a of the t2200 is automatically completed. If you checked the.

It’s An Abbreviated Version Of The.

Web if you choose to mail your tax payment you should mail your payment to the address listed on the notice. Web a new t2200 form for the recipient appears in the t2200 section in the prepare sidebar. Things are a little different in the province of quebec. Web a t2200 form helps employees maximize their tax deductions for unreimbursed employment expenses.

Web The Following Replaces The “Where To File” Addresses On Page 2 Of Form 8822 (Rev.

$250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015. To spare you the long list, we've attached the actual form to give you a. Employers engaged in a trade or business who. There are many expenses that you can deduct.

If You Don't Have An Address On The Notice You Can Mail Your.

For those new to a work from the home arrangement. Employee's withholding certificate form 941; Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web t2200, also called the declaration of conditions of employment, is a form issued by an employer to employees claiming tax credits from expenses incurred during.

The Matters Affected By This Form.

If you checked the box on line 2, send form 8822 to:. Web [anchor what can i deduct with the t2200 form? What is on a t2200 form? Web the t2200 form is specifically designed for employees who are required to take on the financial burden of specific unreimbursed expenses through the course of.