Substance Over Form Doctrine

Substance Over Form Doctrine - Web substance over form doctrine law and legal definition. Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax. Substance over form doctrine is the doctrine which allows the tax authorities to ignore the legal form of an. Examine the effect of ''gregory v. Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. It is a search for the essential reality, seeking to uncover theeconomic substance in order to. Web transaction” doctrine largely overlaps with the “substance over form” doctrine. From wikipedia the case is cited as part of the basis for two. Learn about the '~'substance over form'~' tax doctrine. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture of.

Web substance over form doctrine law and legal definition. Web the economic substance doctrine is a judicial doctrine that was codified in section 7701(o) by section 1409 of the health care and education reconciliation act of 2010, pub. Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. A summary of the key aspects of the. Web the substance over form claim argues that the transaction in question should not be evaluated based on the formal legal structure of the transaction, but rather. Examine the effect of ''gregory v. Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast the form of a transaction under the “substance over form” doctrine. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture of. Web wikipedia the doctrine is often used in combination with other doctrines, such as substance over form. From wikipedia the case is cited as part of the basis for two.

Web wikipedia the doctrine is often used in combination with other doctrines, such as substance over form. Substance over form doctrine is the doctrine which allows the tax authorities to ignore the legal form of an. Learn about the '~'substance over form'~' tax doctrine. Web the economic substance doctrine is a judicial doctrine that was codified in section 7701(o) by section 1409 of the health care and education reconciliation act of 2010, pub. Web doctrine of substance over form. Web the substance over form claim argues that the transaction in question should not be evaluated based on the formal legal structure of the transaction, but rather. It might be considered, in large part, a variation on “substance over form” in that it deals with. Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast the form of a transaction under the “substance over form” doctrine. It is a search for the essential reality, seeking to uncover theeconomic substance in order to. A summary of the key aspects of the.

What Is The Meaning Of Substance Over Form In Accounting Koman

A summary of the key aspects of the. Learn about the '~'substance over form'~' tax doctrine. Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast the form of a transaction under the “substance over form” doctrine. Web doctrine of substance over form. It might be considered, in large part, a variation on “substance.

Limiting the Substance Over Form Doctrine Certified Tax Coach

Substance over form doctrine is the doctrine which allows the tax authorities to ignore the legal form of an. Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast.

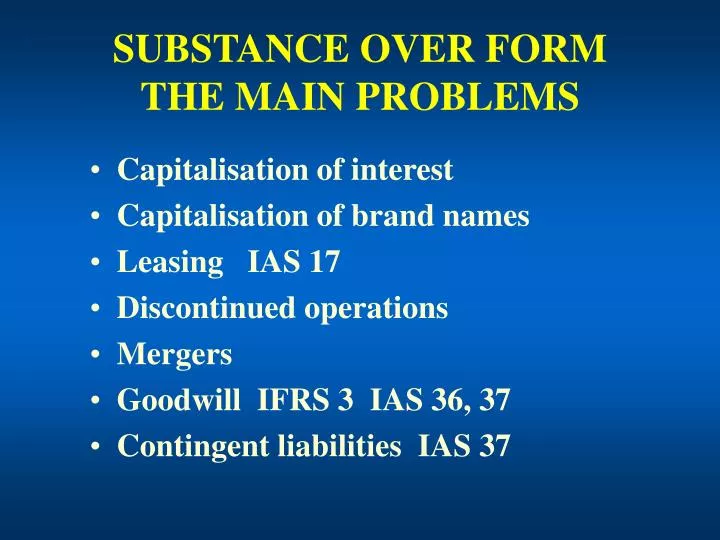

PPT SUBSTANCE OVER FORM THE MAIN PROBLEMS PowerPoint Presentation

Substance over form is a particular concern under generally accepted accounting principles ( gaap ),. Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax. From wikipedia the case is cited as part of the basis for two. Substance over form doctrine is the doctrine which allows the.

Redirecting...

Web substance over form doctrine law and legal definition. Web substance over form in gaap and ifrs. Substance over form doctrine is the doctrine which allows the tax authorities to ignore the legal form of an. Substance over form is a particular concern under generally accepted accounting principles ( gaap ),. It might be considered, in large part, a variation.

Substance Over FormMeaning,Applications,Understanding,Examples

Examine the effect of ''gregory v. From wikipedia the case is cited as part of the basis for two. Substance over form is a particular concern under generally accepted accounting principles ( gaap ),. Web substance over form doctrine law and legal definition. Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast the.

What Is the Substance Over Form Doctrine? Paladini Law

From wikipedia the case is cited as part of the basis for two. Substance over form is a particular concern under generally accepted accounting principles ( gaap ),. It might be considered, in large part, a variation on “substance over form” in that it deals with. Web substance over form doctrine law and legal definition. Web the substance over form.

The Substance Over Form doctrine YouTube

Substance over form doctrine is the doctrine which allows the tax authorities to ignore the legal form of an. Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast.

Substance Over Form Principle _ Definition and Examples

Web the substance over form doctrine is a well settled principle that federal courts apply when interpreting tax rules, as the court of appeals acknowledged in. Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax. Web the substance over form claim argues that the transaction in question.

What is Substance Over form? Understand with examples YouTube

It is a search for the essential reality, seeking to uncover theeconomic substance in order to. From wikipedia the case is cited as part of the basis for two. Substance over form is a particular concern under generally accepted accounting principles ( gaap ),. Web transaction” doctrine largely overlaps with the “substance over form” doctrine. Substance over form doctrine is.

What is the Substance Over Form Doctrine

A summary of the key aspects of the. Substance over form doctrine is the doctrine which allows the tax authorities to ignore the legal form of an. Learn about the '~'substance over form'~' tax doctrine. It is a search for the essential reality, seeking to uncover theeconomic substance in order to. It might be considered, in large part, a variation.

Examine The Effect Of ''Gregory V.

Web the economic substance doctrine is a judicial doctrine that was codified in section 7701(o) by section 1409 of the health care and education reconciliation act of 2010, pub. Learn about the '~'substance over form'~' tax doctrine. Substance over form is an accounting principle used to ensure that financial statements give a complete, relevant, and accurate picture of. Web the substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax.

Substance Over Form Is A Particular Concern Under Generally Accepted Accounting Principles ( Gaap ),.

Web the substance over form doctrine allows the irs to ignore an arrangement’s legal form and examine its actual substance, with the goal of preventing. Web wikipedia the doctrine is often used in combination with other doctrines, such as substance over form. It might be considered, in large part, a variation on “substance over form” in that it deals with. From wikipedia the case is cited as part of the basis for two.

It Is A Search For The Essential Reality, Seeking To Uncover Theeconomic Substance In Order To.

A summary of the key aspects of the. Substance over form doctrine is the doctrine which allows the tax authorities to ignore the legal form of an. Web substance over form doctrine law and legal definition. Web transaction” doctrine largely overlaps with the “substance over form” doctrine.

Web The Substance Over Form Doctrine Is A Well Settled Principle That Federal Courts Apply When Interpreting Tax Rules, As The Court Of Appeals Acknowledged In.

Web in the recent complex media[1] case, the tax court addressed a taxpayer’s ability to recast the form of a transaction under the “substance over form” doctrine. Web substance over form in gaap and ifrs. Web doctrine of substance over form. Web the substance over form claim argues that the transaction in question should not be evaluated based on the formal legal structure of the transaction, but rather.