Submit Form 2848 Online

Submit Form 2848 Online - The irs announced a new. Web march 3, 2021 the irs has rolled out a new online option for tax professionals to upload authorization forms with either electronic or handwritten. Submit forms 2848 and 8821 online. This form is completed by the representative,. Web tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. It also has friendly web addresses that can be bookmarked: Web form 2848 is a document provided to the irs to inform them that the taxpayer has someone representing them as a power of attorney. Web submit forms online. You must have a secure access account, including a. Web the submit forms 2848 and 8821 online tool is available from the irs.gov/taxpros page.

Does the irs accept durable power of attorney? Web after creating a secure access account, tax professionals can access the new “submit forms 2848 and 8821 online” option on the irs.gov/taxpro page. Web form 2848 is a document provided to the irs to inform them that the taxpayer has someone representing them as a power of attorney. Web the irs now allows taxpayer representatives to submit forms 2848 and 8821 online. It also has friendly web addresses that can be bookmarked: Web all form 2848 revisions. Web updated for tax year 2022 • october 18, 2022 04:30 am overview to protect your privacy, irs employees won't talk to just anyone about your taxes. Get ready for tax season deadlines by completing any required tax forms today. Web signatures below), you must submit your form 2848 online. Submit forms 2848 and 8821 online.

Web submitting the form: The irs announced a new. You will need to have a secure access. This form is completed by the representative,. About publication 1, your rights as a taxpayer. Submit your form 2848 securely at irs.gov/ submit2848. Web tax professionals can find the new “submit forms 2848 and 8821 online” tool on the irs.gov/taxpro page. Web irs announces option for tax professionals to upload forms 2848 and 8821 to the agency. It also has friendly web addresses that can be bookmarked: You must have a secure access account, including a.

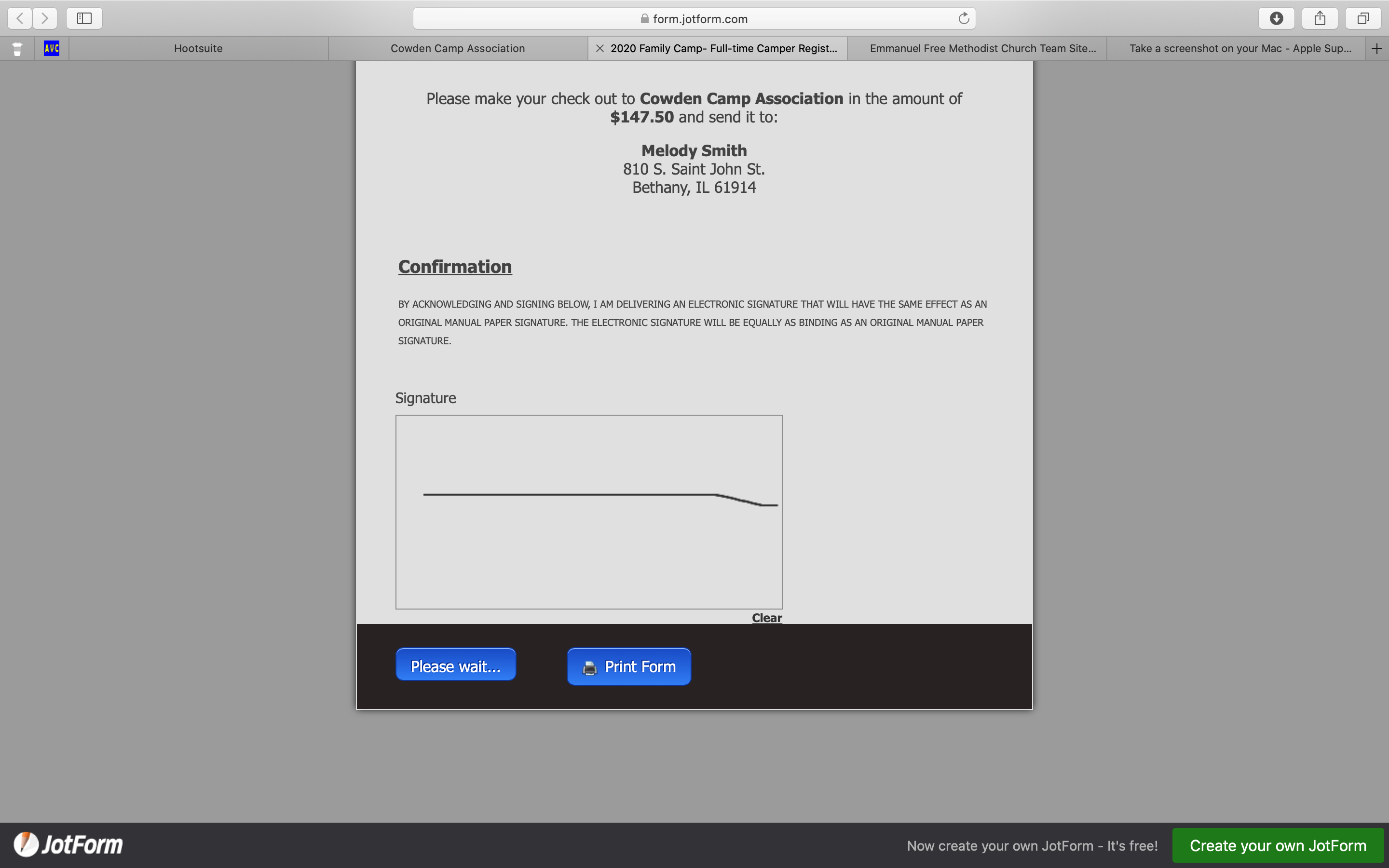

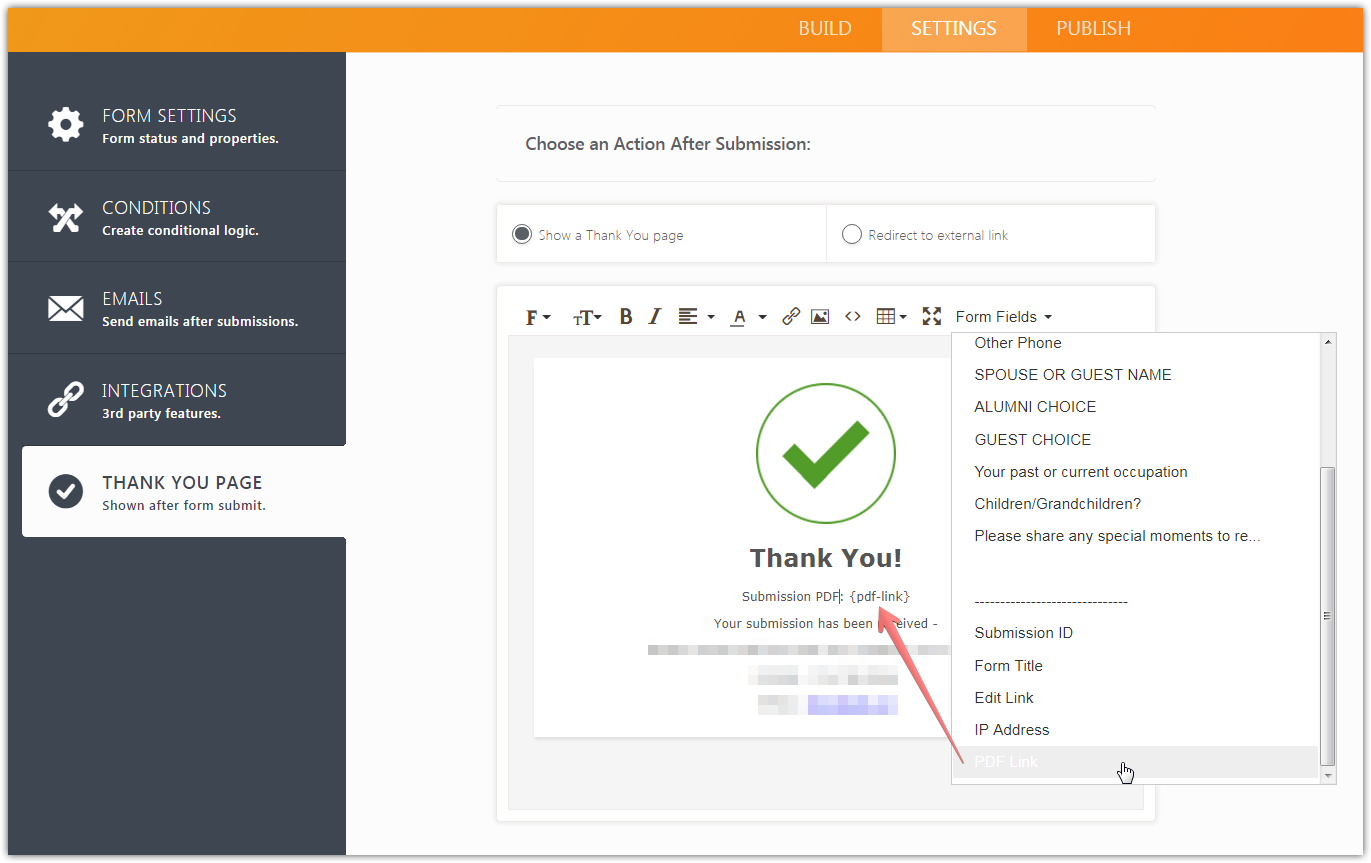

Submit form Form stuck in "Please wait..." when submitting

Web submitting the form: Web submitting a form 2848 or 8821, by mail, facsimile or online, depending on what kind of signature is on that form, or creating an online authorization on the tax pro account that. Web the submit forms 2848 and 8821 online tool is available from the irs.gov/taxpros page. Web tax professionals can find the new submit.

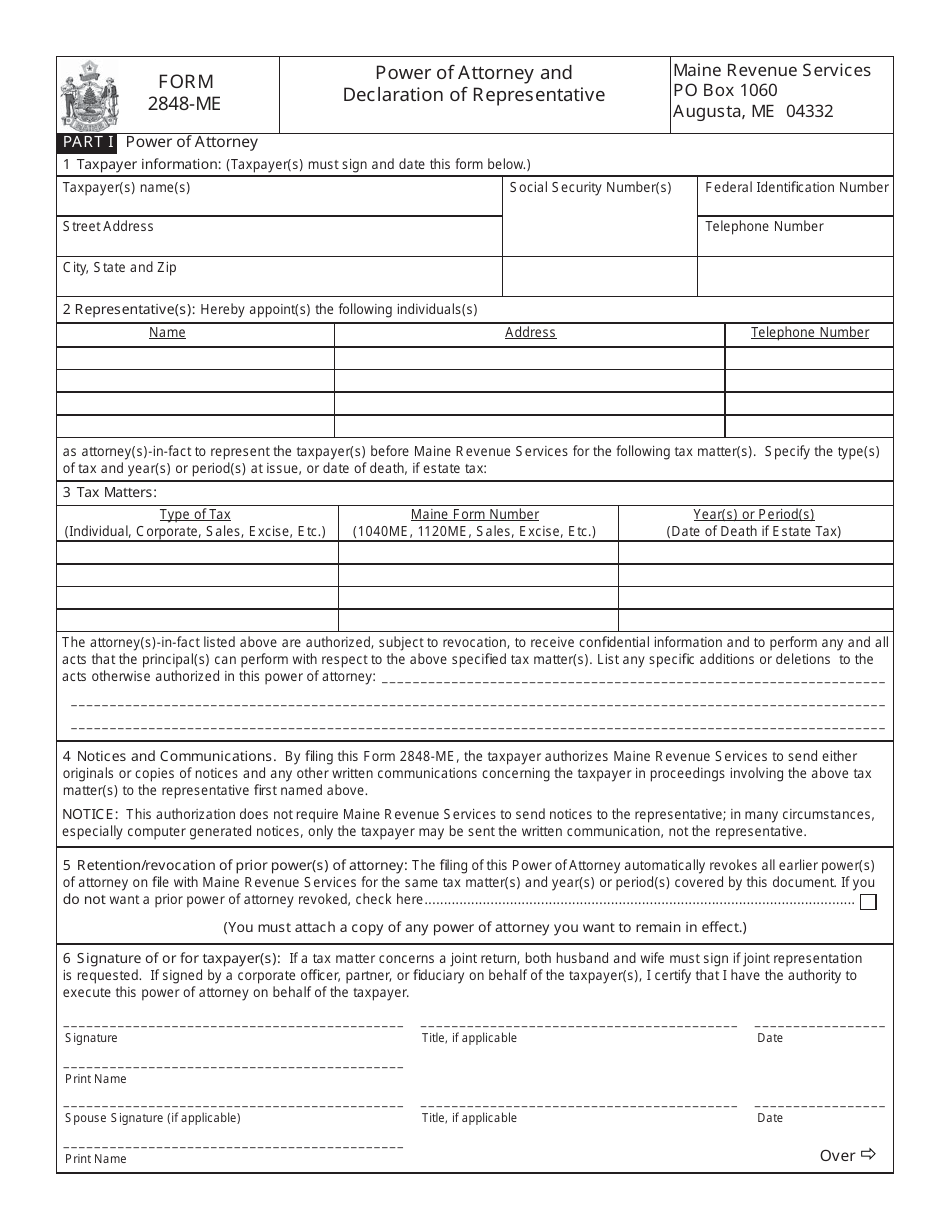

Form 2848ME Download Printable PDF or Fill Online Power of Attorney

Web the submit forms 2848 and 8821 online tool is available from the irs.gov/taxpros page. In part i, line 1 asks for your name, address and phone number. January 29, 2021 by ed zollars, cpa. Get ready for tax season deadlines by completing any required tax forms today. Web tax professionals can find the new “submit forms 2848 and 8821.

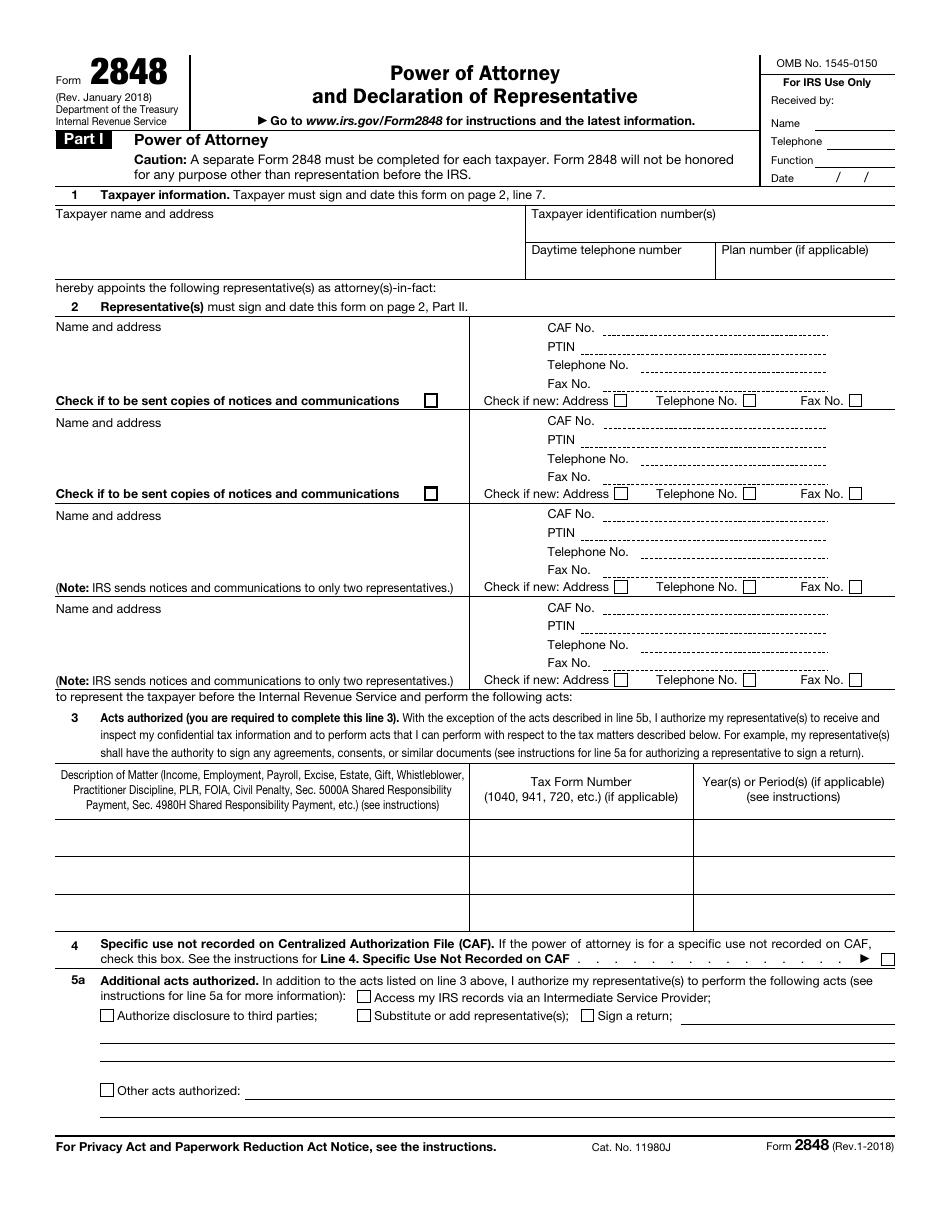

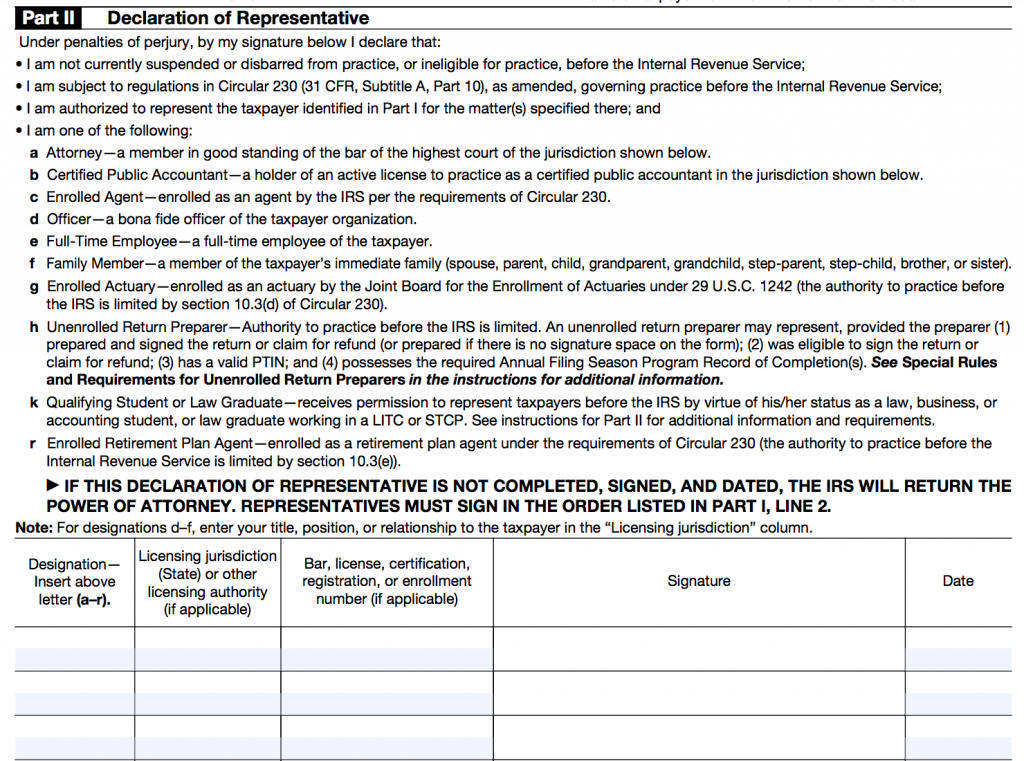

IRS Form 2848 Download Fillable PDF or Fill Online Power of Attorney

This form is completed by the representative,. Web tax professionals can find the new “submit forms 2848 and 8821 online” tool on the irs.gov/taxpro page. Web march 3, 2021 the irs has rolled out a new online option for tax professionals to upload authorization forms with either electronic or handwritten. Web tax professionals can find the new submit forms 2848.

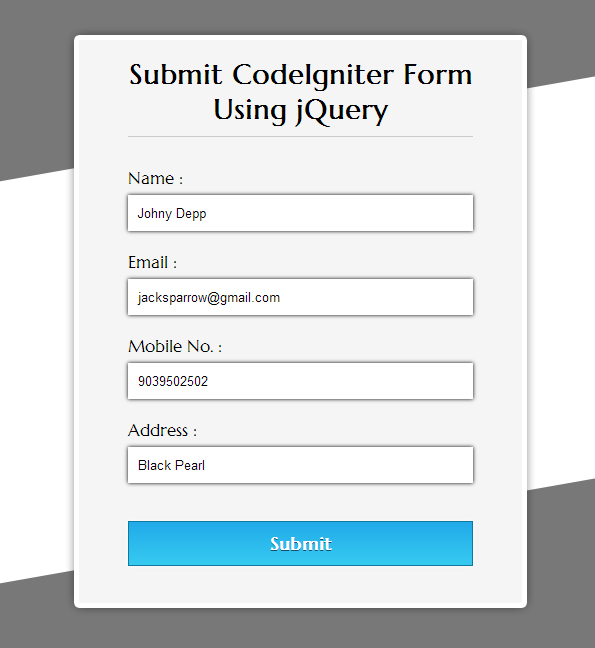

CodeIgniter Form Submission Using jQuery FormGet

The irs announced a new. You must have a secure access account, including a. Printable form 2848 form 2848 is printable used for authorizing a representative to act on your behalf with the internal revenue service. Web submitting the form: Under the new procedure, the forms may contain either.

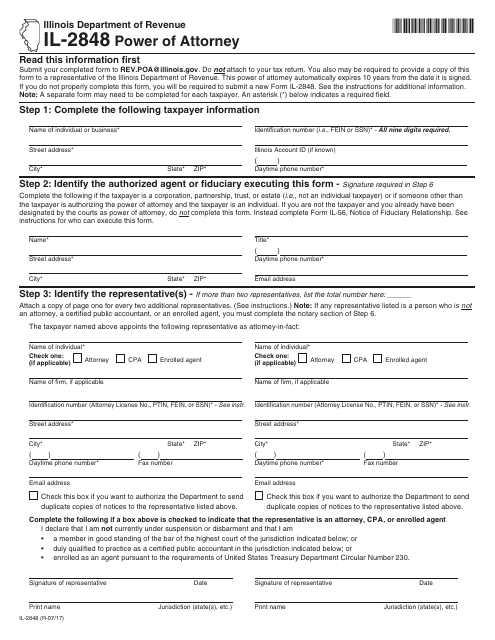

Form IL2848 Download Fillable PDF or Fill Online Power of Attorney

Web tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. The first step to upload the form after logging in to the “submit forms 2848 and 8821 online” portal is to start a session by inputting the. January 29, 2021 by ed zollars, cpa. Web how to complete form 2848: The irs announced.

All About IRS Form 2848 SmartAsset

Web submitting a form 2848 or 8821, by mail, facsimile or online, depending on what kind of signature is on that form, or creating an online authorization on the tax pro account that. Web signatures below), you must submit your form 2848 online. Get ready for tax season deadlines by completing any required tax forms today. Web form 2848 is.

Il 2848 Instructions Fill Online, Printable, Fillable, Blank pdfFiller

Web the irs now allows taxpayer representatives to submit forms 2848 and 8821 online. Get ready for tax season deadlines by completing any required tax forms today. It also has friendly web addresses that can be bookmarked: Complete, edit or print tax forms instantly. Web tax professionals can find the new “submit forms 2848 and 8821 online” option on the.

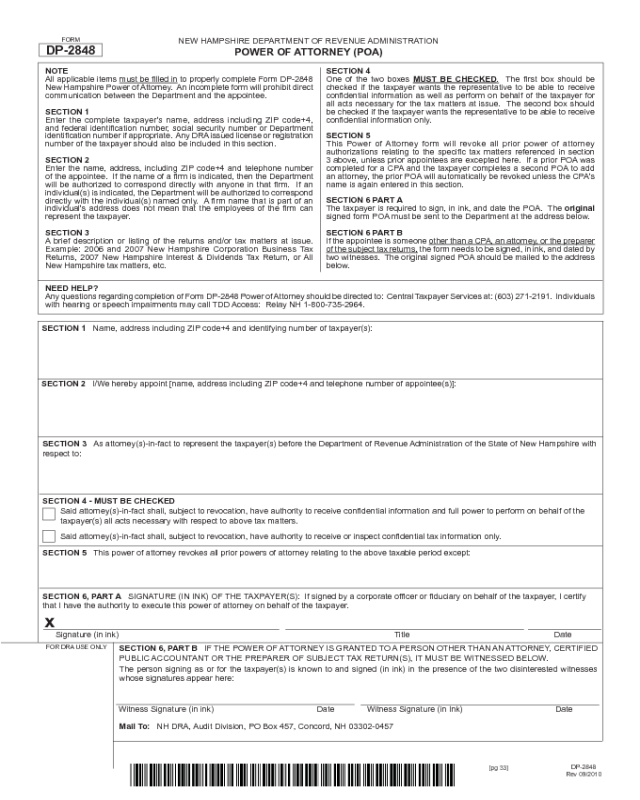

Form DP2848 Power of Attorney New Hampshire Edit, Fill, Sign

Under the new procedure, the forms may contain either. Tax professionals must have a secure access account,. Ad complete irs tax forms online or print government tax documents. Get ready for tax season deadlines by completing any required tax forms today. In part i, line 1 asks for your name, address and phone number.

Breanna Image Form Submit

Web the submit forms 2848 and 8821 online tool is available from the irs.gov/taxpros page. January 29, 2021 by ed zollars, cpa. Web submitting the form: Web how to complete form 2848: Does the irs accept durable power of attorney?

Web Irs Announces Option For Tax Professionals To Upload Forms 2848 And 8821 To The Agency.

About publication 1, your rights as a taxpayer. Submit your form 2848 securely at irs.gov/ submit2848. Web tax professionals can find the new “submit forms 2848 and 8821 online” tool on the irs.gov/taxpro page. In part i, line 1 asks for your name, address and phone number.

Under The New Procedure, The Forms May Contain Either.

Tax professionals must have a secure access account,. Web how to complete form 2848: Web tax professionals can find the new “submit forms 2848 and 8821 online” option on the www.irs.gov/taxpro website. Web submitting the form:

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web all form 2848 revisions. Web submit forms online. It also has friendly web addresses that can be bookmarked: Ad complete irs tax forms online or print government tax documents.

Web After Creating A Secure Access Account, Tax Professionals Can Access The New “Submit Forms 2848 And 8821 Online” Option On The Irs.gov/Taxpro Page.

You will need to have a secure access. Web signatures below), you must submit your form 2848 online. Web march 3, 2021 the irs has rolled out a new online option for tax professionals to upload authorization forms with either electronic or handwritten. Web the submit forms 2848 and 8821 online tool is available from the irs.gov/taxpros page.