Special Form Coverage

Special Form Coverage - Coverage for loss from any cause except those that are specifically excluded. In policies that use the special form type of coverage, instead of the perils covered being listed,. Leasehold interest coverage form (1) paragraph b.1.a. Web what is homeowners insurance? Broad form is not offered nearly as often, but we will cover it as well. This simply means your property will only. Web special form or open form coverage offers the most expansive protection because it covers all perils unless they are specifically excluded. Web special causes of loss eligibility requirements. Web the special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Web the most expansive form of insurance coverage is special form.

Like on the broad causes of loss form, the special causes of loss form requires that coinsurance be at least 80% for property. Perils that are not covered on most policies are: (2 ) we will not pay for any loss caused. Coverage for loss from any cause except those that are specifically excluded. Web what is homeowners insurance? / what are the different types of homeowners insurance policy forms? In policies that use the special form type of coverage, instead of the perils covered being listed, the. Web special causes of loss eligibility requirements. Web the most expansive form of insurance coverage is special form. Web the special causes of loss form (cp 10 30) provides what is referred to as all risks coverage:

Leasehold interest coverage form (1) paragraph b.1.a. Web what is homeowners insurance? Web special form coverage protects property against any source of loss that is not specifically excluded. Web the most expansive form of insurance coverage is special form. Web special causes of loss eligibility requirements. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. / what are the different types of homeowners insurance policy forms? Ordinance or law, does not apply to insurance under this coverage form. Flood (this coverage can be. In policies that use the special form type of coverage, instead of the perils covered being listed,.

Special Form Coverage Hitchings Insurance Agency

(2 ) we will not pay for any loss caused. Broad form is not offered nearly as often, but we will cover it as well. Perils that are not covered on most policies are: In policies that use the special form type of coverage, instead of the perils covered being listed, the. Web the most expansive form of insurance coverage.

Is It Covered? Burst Pipes RE Insurance Program

Broad form is not offered nearly as often, but we will cover it as well. Web the special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Special form is the form of coverage that offers the most protection, but it is important. (2 ) we will not pay for any loss caused..

Basic, Broad Form Coverage and Special Form Insurance Coverage

Perils that are not covered on most policies are: / what are the different types of homeowners insurance policy forms? (2 ) we will not pay for any loss caused. Web reinsurepro offers basic or special form coverage options. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

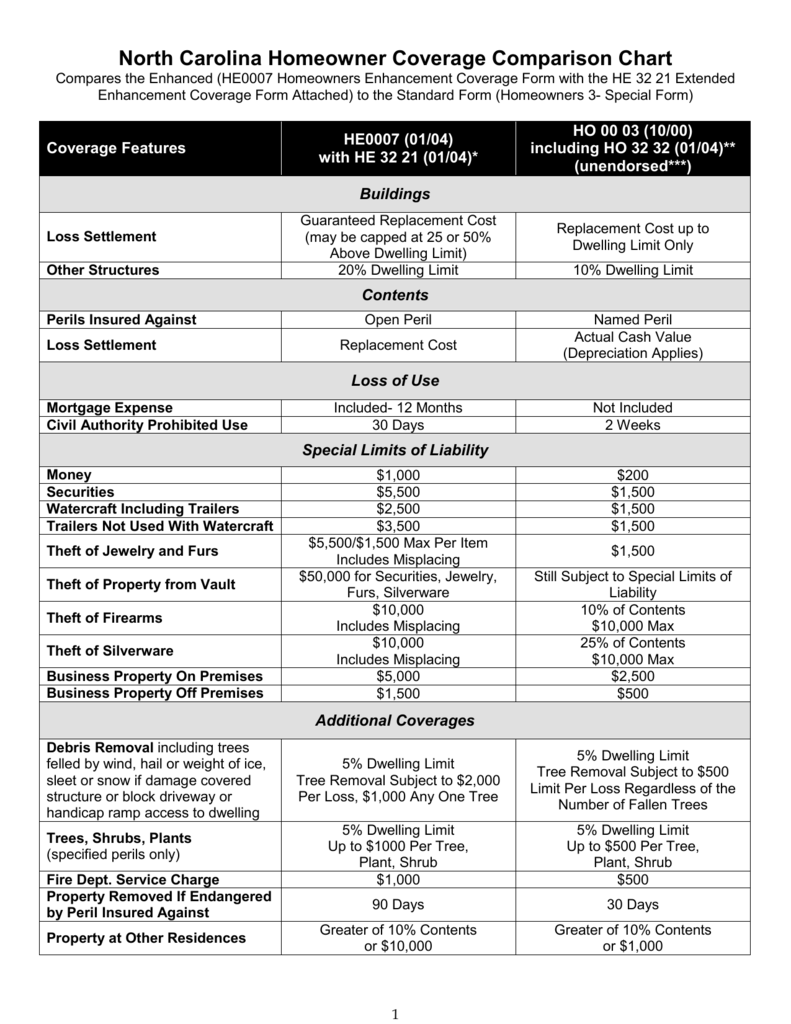

homeowner coverage comparison

(2 ) we will not pay for any loss caused. Web the special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Web what is homeowners insurance? Web special form coverage covers all risks except the listed exclusions. Web watch newsmax live for the latest news and analysis on today's top stories, right.

Basic vs Special Form Coverage Insurance Resources

Web basic form insurance coverage selecting the “basic” form of insurance coverage will only cover your property from named perils. Web special causes of loss eligibility requirements. Ordinance or law, does not apply to insurance under this coverage form. Web reinsurepro offers basic or special form coverage options. Coverage for loss from any cause except those that are specifically excluded.

Basic vs Special Form Coverage Insurance Resources

Web the most expansive form of insurance coverage is special form. Property insurance, including insurance against loss or damage by fire, vandalism and malicious mischief, terrorism (if available on commercially reasonable. In policies that use the special form type of coverage, instead of the perils covered being listed,. Leasehold interest coverage form (1) paragraph b.1.a. Perils that are not covered.

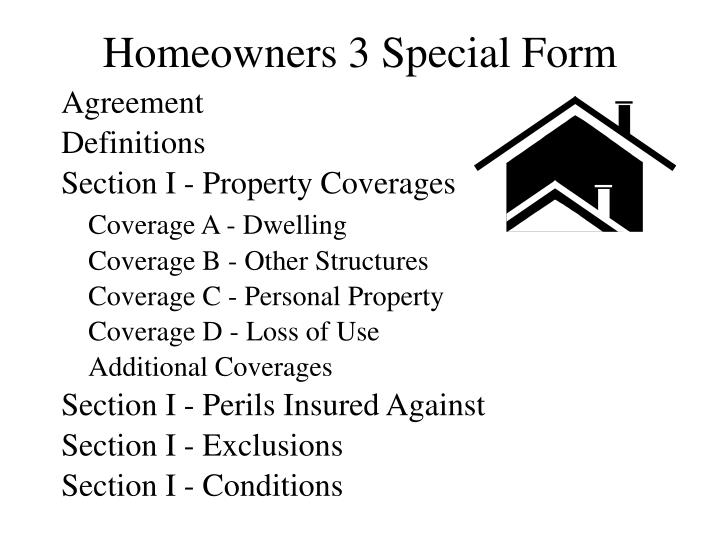

PPT Personal Lines Policies PowerPoint Presentation ID5442823

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web basic form insurance coverage selecting the “basic” form of insurance coverage will only cover your property from named perils. Web biden, by his own admission, was a crack cocaine user when he bought a colt cobra.38 special from starquest shooters, a.

Broad Homeowners Insurance

Ordinance or law, does not apply to insurance under this coverage form. Web biden, by his own admission, was a crack cocaine user when he bought a colt cobra.38 special from starquest shooters, a wilmington gun store, in 2018. Web special form coverage covers all risks except the listed exclusions. Property insurance, including insurance against loss or damage by fire,.

Actual Cash Value vs. Replacement Cost (Basic, Broad, & Special Form

Web reinsurepro offers basic or special form coverage options. There are eight different types of homeowners. Web special form coverage covers all risks except the listed exclusions. Ordinance or law, does not apply to insurance under this coverage form. Web the most expansive form of insurance coverage is special form.

Is It Covered? Burst Pipes • National Real Estate Insurance Group

Web the special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Property insurance, including insurance against loss or damage by fire, vandalism and malicious mischief, terrorism (if available on commercially reasonable. Like on the broad causes of loss form, the special causes of loss form requires that coinsurance be at least 80%.

In Policies That Use The Special Form Type Of Coverage, Instead Of The Perils Covered Being Listed, The.

Perils that are not covered on most policies are: Web the special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Web special form coverage protects property against any source of loss that is not specifically excluded. Web basic form insurance coverage selecting the “basic” form of insurance coverage will only cover your property from named perils.

In Policies That Use The Special Form Type Of Coverage, Instead Of The Perils Covered Being Listed,.

Leasehold interest coverage form (1) paragraph b.1.a. Web what is homeowners insurance? There are eight different types of homeowners. Ordinance or law, does not apply to insurance under this coverage form.

Web Special Form Coverage Covers All Risks Except The Listed Exclusions.

Property insurance, including insurance against loss or damage by fire, vandalism and malicious mischief, terrorism (if available on commercially reasonable. Web reinsurepro offers basic or special form coverage options. This simply means your property will only. Special form is the form of coverage that offers the most protection, but it is important.

Web Special Causes Of Loss Eligibility Requirements.

Web the most expansive form of insurance coverage is special form. Web special form or open form coverage offers the most expansive protection because it covers all perils unless they are specifically excluded. (2 ) we will not pay for any loss caused. Broad form is not offered nearly as often, but we will cover it as well.