South Carolina Property Tax Exemption Form

South Carolina Property Tax Exemption Form - Submit your application & required documents (listed in the form instructions) via email, fax, or mail to the scdor Most property tax exemptions are found in. Web to receive this exemption you must generally apply at your county auditor's office by july 15 of the year in which it is to be initially claimed. Personal property (vehicle) exemptions for individuals vehicles must be registered in south carolina. Web the scdor exempt property section determines if any property (real or personal) qualifies for exemption from ad valorem taxes in accordance with the constitution and general laws of south carolina. You will need to provide your file number when applying for an exemption listed below. If the vehicle is registered or purchased out of state, you must pay vehicle taxes up front. Visit mydorway.dor.sc.gov to get started. You must apply for most sales & use tax exemptions on mydorway. In 2007, legislation was passed that completely exempts school operating taxes for all owner occupied legal residences that qualify under sc.

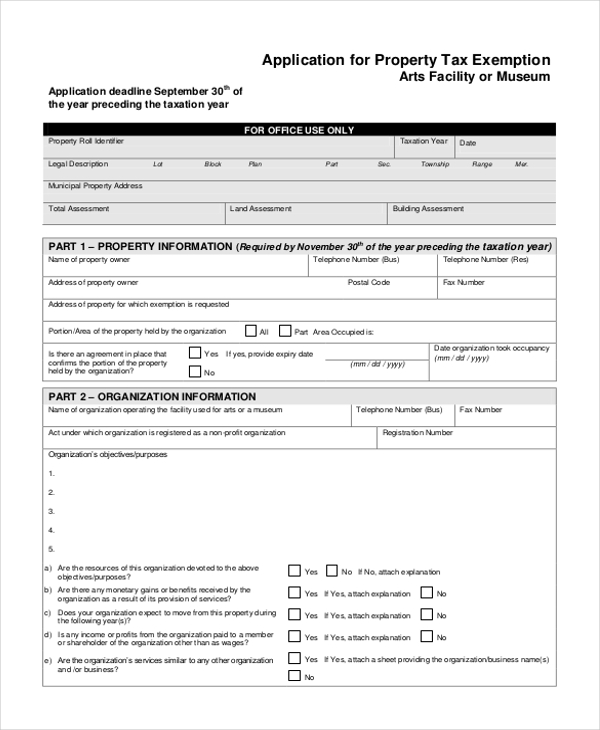

Web the homestead exemption is a complete exemption of taxes on the first $50,000 in fair market value of your legal residence for homeowners over age 65, totally and permanently disabled, or legally blind. Mobile home tax map number: You will need to provide your file number when applying for an exemption listed below. Web property tax exemption application for organizations land and building land building mobile home if you are applying for multiple parcels, each will require a separate application. Web the scdor exempt property section determines if any property (real or personal) qualifies for exemption from ad valorem taxes in accordance with the constitution and general laws of south carolina. Personal property (vehicle) exemptions for individuals vehicles must be registered in south carolina. In 2007, legislation was passed that completely exempts school operating taxes for all owner occupied legal residences that qualify under sc. There is a 45 day review period for exemption applications submitted to the scdor. Required documentation is listed for each exemption. If the vehicle is registered or purchased out of state, you must pay vehicle taxes up front.

You must apply for most sales & use tax exemptions on mydorway. If you are unable to go there yourself, you may authorize someone to make the application for you. In 2007, legislation was passed that completely exempts school operating taxes for all owner occupied legal residences that qualify under sc. Most property tax exemptions are found in. Property tax exemption application for individuals. Web the scdor exempt property section determines if any property (real or personal) qualifies for exemption from ad valorem taxes in accordance with the constitution and general laws of south carolina. Web mydorway is the fastest, easiest way to apply for property tax exemptions. Visit mydorway.dor.sc.gov to get started. Web local government reports accommodations tax allocations by county assessed property by county homestead exemption reimbursements manufacturers depreciation reimbursements merchants inventory reimbursements monthly gross and net sales report motor vehicle collections residential exemption reimbursements sale ratio. You will need to provide your file number when applying for an exemption listed below.

FREE 10+ Sample Tax Exemption Forms in PDF

Web local government reports accommodations tax allocations by county assessed property by county homestead exemption reimbursements manufacturers depreciation reimbursements merchants inventory reimbursements monthly gross and net sales report motor vehicle collections residential exemption reimbursements sale ratio. Personal property (vehicle) exemptions for individuals vehicles must be registered in south carolina. Web mydorway is the fastest, easiest way to apply for property.

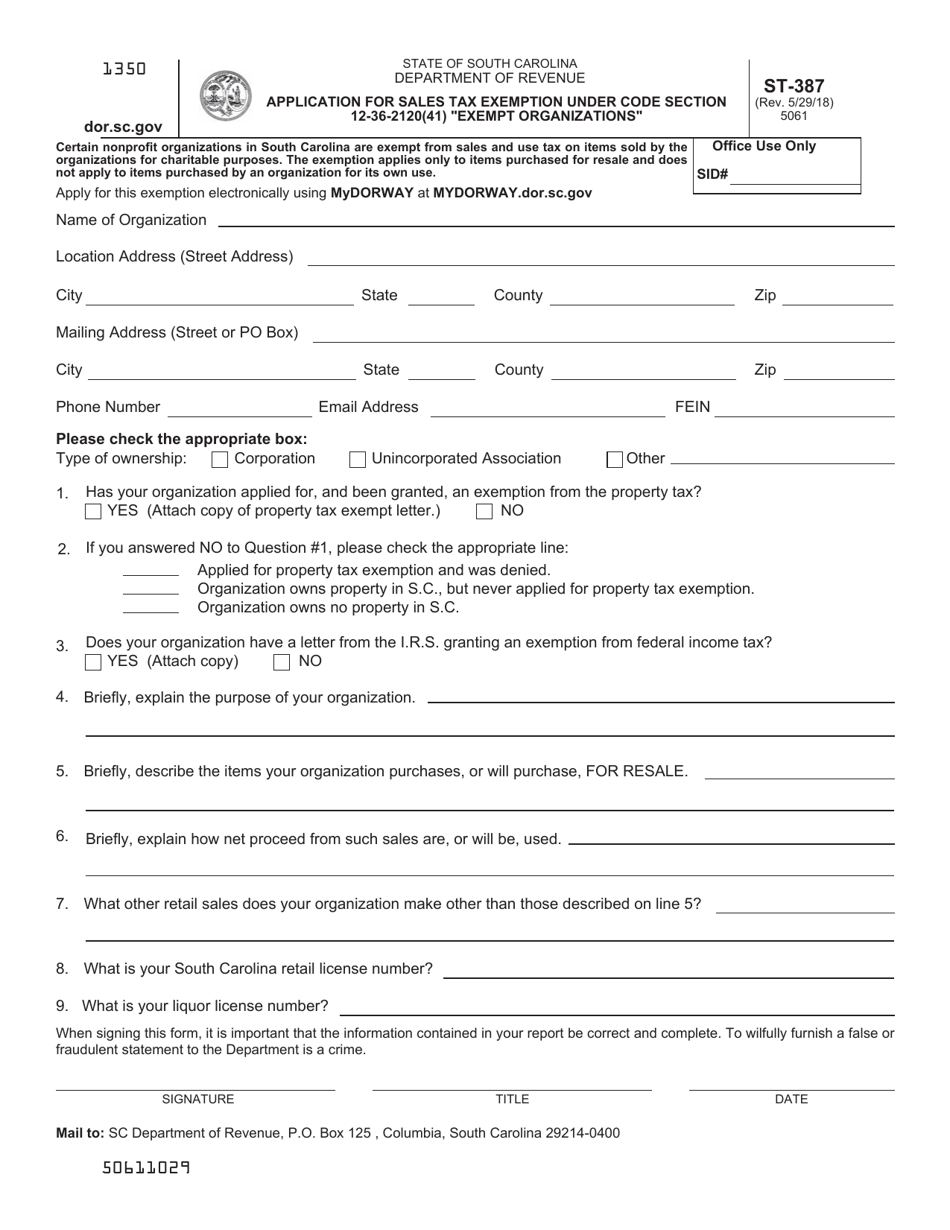

Form ST387 Download Printable PDF or Fill Online Application for Sales

If the vehicle is registered or purchased out of state, you must pay vehicle taxes up front. You will need to provide your file number when applying for an exemption listed below. Web local government reports accommodations tax allocations by county assessed property by county homestead exemption reimbursements manufacturers depreciation reimbursements merchants inventory reimbursements monthly gross and net sales report.

Getting the South Carolina 4 Tax and/or the Homestead Exemption Credit

Submit your application & required documents (listed in the form instructions) via email, fax, or mail to the scdor Review the table below for details about. Property tax exemption application for individuals. If you are unable to go there yourself, you may authorize someone to make the application for you. There is a 45 day review period for exemption applications.

Henry County Homestead Exemption 2020 Fill and Sign Printable

Review the table below for details about. Submit your application & required documents (listed in the form instructions) via email, fax, or mail to the scdor Web property tax exemption application for organizations land and building land building mobile home if you are applying for multiple parcels, each will require a separate application. Property tax exemption application for individuals. Web.

Louisiana Hotel Tax Exempt Form Fill Online, Printable, Fillable

Submit your application & required documents (listed in the form instructions) via email, fax, or mail to the scdor Personal property (vehicle) exemptions for individuals vehicles must be registered in south carolina. Web the homestead exemption is a complete exemption of taxes on the first $50,000 in fair market value of your legal residence for homeowners over age 65, totally.

homestead exemption Fill out & sign online DocHub

If the vehicle is registered or purchased out of state, you must pay vehicle taxes up front. Personal property (vehicle) exemptions for individuals vehicles must be registered in south carolina. There is a 45 day review period for exemption applications submitted to the scdor. Most property tax exemptions are found in. You will need to provide your file number when.

20192021 Form SC PT401I Fill Online, Printable, Fillable, Blank

Web the scdor offers sales & use tax exemptions to qualified taxpayers. Web mydorway is the fastest, easiest way to apply for property tax exemptions. Web local government reports accommodations tax allocations by county assessed property by county homestead exemption reimbursements manufacturers depreciation reimbursements merchants inventory reimbursements monthly gross and net sales report motor vehicle collections residential exemption reimbursements sale.

Property Tax Reports South Carolina Revenue and Fiscal Affairs Office

You will need to provide your file number when applying for an exemption listed below. There is a 45 day review period for exemption applications submitted to the scdor. If the vehicle is registered or purchased out of state, you must pay vehicle taxes up front. Web local government reports accommodations tax allocations by county assessed property by county homestead.

What Is Homestead Exemption Sc Fill Out and Sign Printable PDF

There is a 45 day review period for exemption applications submitted to the scdor. If you are unable to go there yourself, you may authorize someone to make the application for you. Submit your application & required documents (listed in the form instructions) via email, fax, or mail to the scdor Web the scdor exempt property section determines if any.

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

If the vehicle is registered or purchased out of state, you must pay vehicle taxes up front. Web the scdor offers sales & use tax exemptions to qualified taxpayers. Review the table below for details about. Web to receive this exemption you must generally apply at your county auditor's office by july 15 of the year in which it is.

Web To Receive This Exemption You Must Generally Apply At Your County Auditor's Office By July 15 Of The Year In Which It Is To Be Initially Claimed.

Web the scdor offers sales & use tax exemptions to qualified taxpayers. Required documentation is listed for each exemption. Web mydorway is the fastest, easiest way to apply for property tax exemptions. You will need to provide your file number when applying for an exemption listed below.

Web The Homestead Exemption Is A Complete Exemption Of Taxes On The First $50,000 In Fair Market Value Of Your Legal Residence For Homeowners Over Age 65, Totally And Permanently Disabled, Or Legally Blind.

You must apply for most sales & use tax exemptions on mydorway. If you are unable to go there yourself, you may authorize someone to make the application for you. Mobile home tax map number: If the vehicle is registered or purchased out of state, you must pay vehicle taxes up front.

Personal Property (Vehicle) Exemptions For Individuals Vehicles Must Be Registered In South Carolina.

Visit mydorway.dor.sc.gov to get started. Submit your application & required documents (listed in the form instructions) via email, fax, or mail to the scdor Web local government reports accommodations tax allocations by county assessed property by county homestead exemption reimbursements manufacturers depreciation reimbursements merchants inventory reimbursements monthly gross and net sales report motor vehicle collections residential exemption reimbursements sale ratio. Web the scdor exempt property section determines if any property (real or personal) qualifies for exemption from ad valorem taxes in accordance with the constitution and general laws of south carolina.

In 2007, Legislation Was Passed That Completely Exempts School Operating Taxes For All Owner Occupied Legal Residences That Qualify Under Sc.

Most property tax exemptions are found in. Property tax exemption application for individuals. Web property tax exemption application for organizations land and building land building mobile home if you are applying for multiple parcels, each will require a separate application. Review the table below for details about.