Short Put Calendar Spread

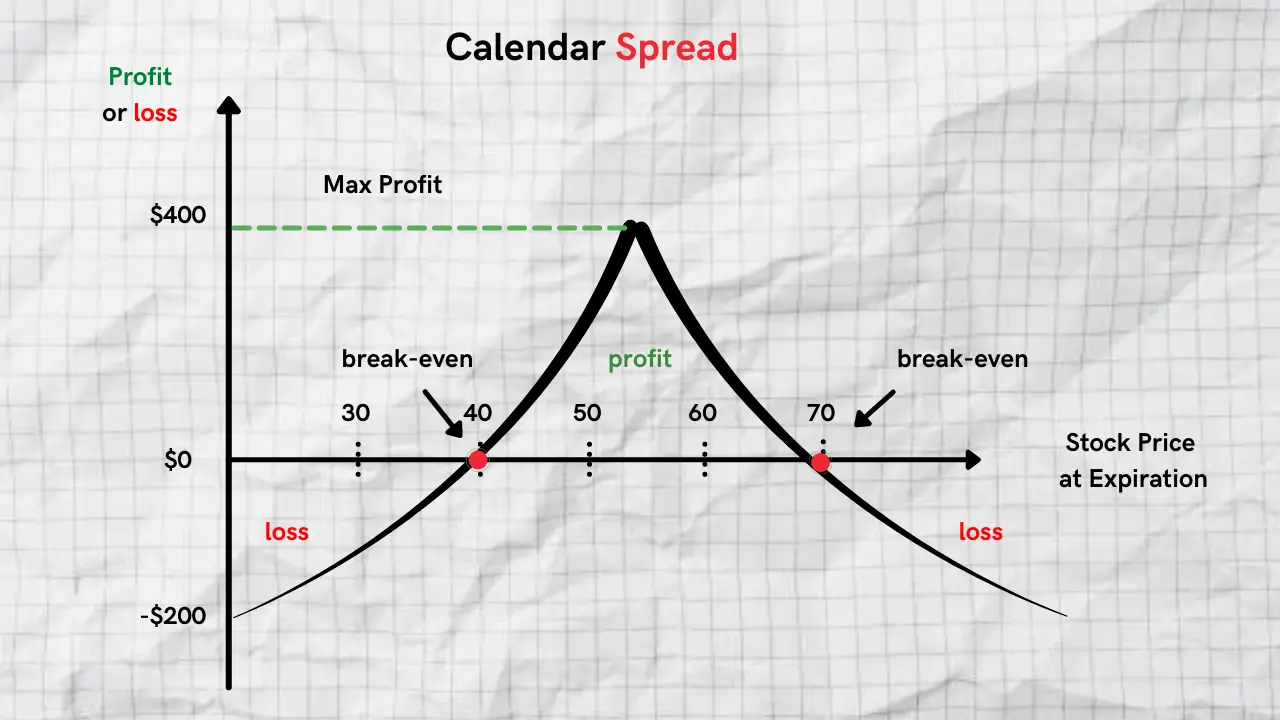

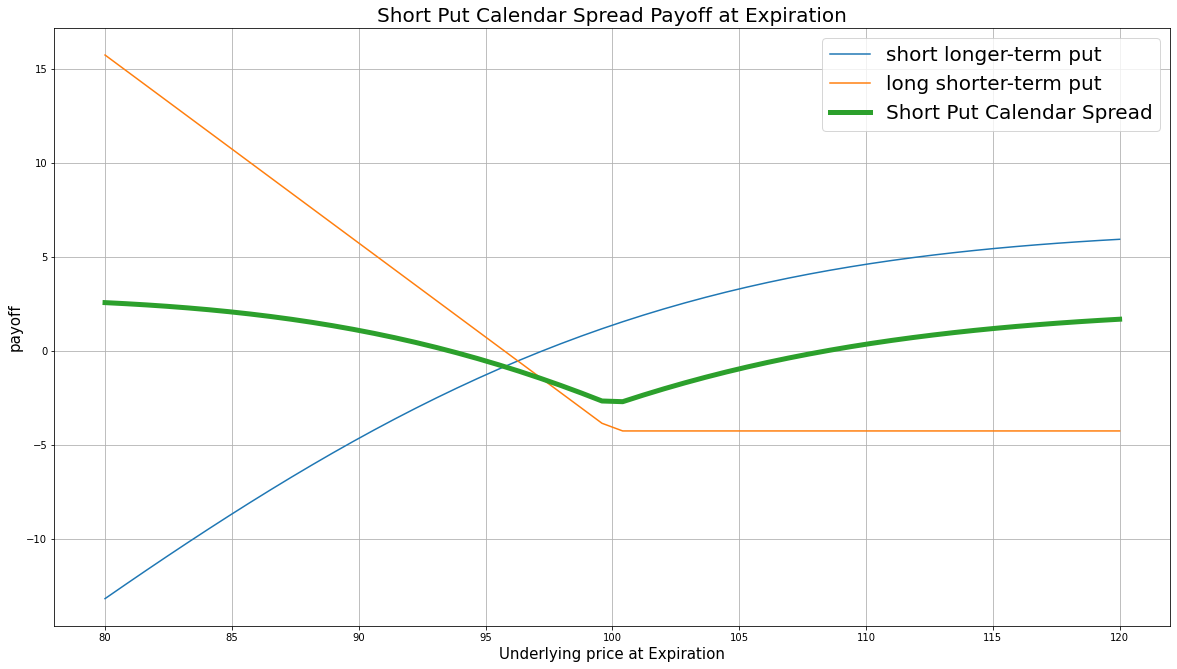

Short Put Calendar Spread - To profit from a large stock price move away from the strike price of the. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. In a short calendar spread, there are two positions with the same strike price:. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web short calendar spread with puts potential goals. Web short calendar spread with calls and puts. Web a short put calendar spread is another type of spread that uses two different put options. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web short calendar spread with puts potential goals. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. In a short calendar spread, there are two positions with the same strike price:. To profit from a large stock price move away from the strike price of the. Web short calendar spread with calls and puts. Web a short put calendar spread is another type of spread that uses two different put options. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer.

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. In a short calendar spread, there are two positions with the same strike price:. Web short calendar spread with puts potential goals. Web a short put calendar spread is another type of spread that uses two different put options. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short calendar spread with calls and puts. To profit from a large stock price move away from the strike price of the.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a short put calendar spread is another type of spread that uses two different put options. In a short calendar spread, there are two positions with the same strike price:. Web short calendar spread with puts potential goals. Web.

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web short calendar spread with puts potential goals. To profit from a large stock price move away from the strike.

Put Calendar Spread

To profit from a large stock price move away from the strike price of the. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. In a short calendar spread, there are two positions with the same strike price:. Web short calendar spread with calls and puts. Web.

Bearish Put Calendar Spread Option Strategy Guide

In a short calendar spread, there are two positions with the same strike price:. To profit from a large stock price move away from the strike price of the. Web short calendar spread with calls and puts. Web short calendar spread with puts potential goals. Web a short put calendar spread is another type of spread that uses two different.

Put Calendar Spread Option Alpha

Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a short put calendar spread is another type of spread that uses two different put options. Web short calendar spread with puts potential goals. Web a calendar spread is an options or futures strategy established by simultaneously entering a.

Short Put Spread

To profit from a large stock price move away from the strike price of the. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a short put calendar spread is another type of spread that uses two different put options. Web short calendar spread with calls and puts. In a.

Calendar Put Spread Options Edge

Web a short put calendar spread is another type of spread that uses two different put options. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short calendar.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

In a short calendar spread, there are two positions with the same strike price:. To profit from a large stock price move away from the strike price of the. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web short calendar spread with puts potential goals. Web short calendar.

Calendar Spread Explained InvestingFuse

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web short calendar spread with calls and puts. Web a short put calendar spread is another type of spread that uses two different put options. Web short calendar spread with puts potential goals. Web a calendar spread is.

Short Put Calendar Short put calendar Spread Reverse Calendar

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web short calendar spread with calls and puts. In a short calendar spread, there are two positions with the same strike price:. Web short calendar spread with puts potential goals. To profit from a large stock price move away from the strike.

Web A Short Put Calendar Spread Is Another Type Of Spread That Uses Two Different Put Options.

Web short calendar spread with puts potential goals. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer.

Web Short Calendar Spread With Calls And Puts.

In a short calendar spread, there are two positions with the same strike price:. To profit from a large stock price move away from the strike price of the.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)