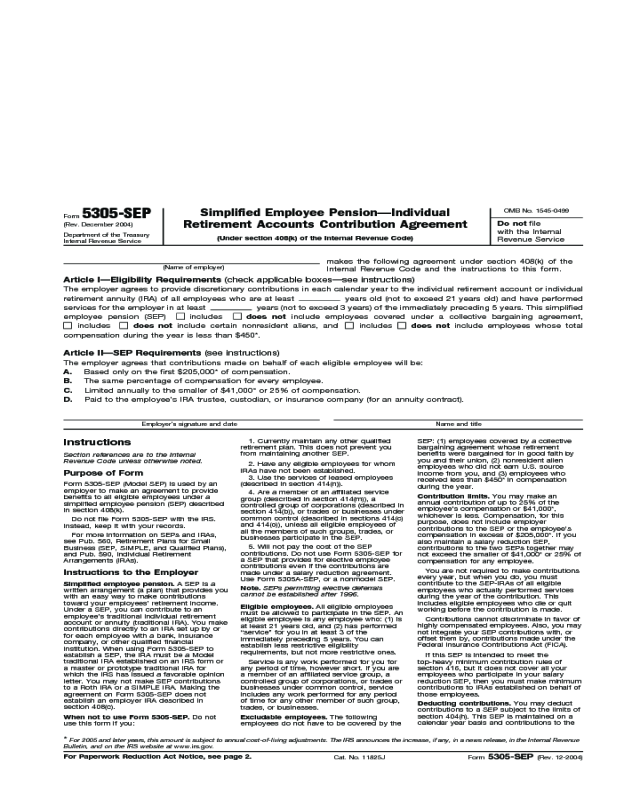

Sep Form 5305

Sep Form 5305 - Choosing a financial institution to maintain your sep is one of the most important decisions. Web there are three document format options for sep plans: Keep a copy for your files. Why not consider a sep? Instead, keep it with your records. A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Do not file this form with the irs. Forms and publications from the internal revenue service by u.s. Don’t file it with the irs. Web form 5500 schedules and instructions;

Forms and publications from the internal revenue service by u.s. Why not consider a sep? Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Keep a copy for your files. Instead, keep it with your records. Web there are three document format options for sep plans: Web form 5500 schedules and instructions; Do not file this form with the irs. Choosing a financial institution to maintain your sep is one of the most important decisions.

Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for. Instead, keep it with your records. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Do not file this form with the irs. A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Web there are three document format options for sep plans: Web form 5500 schedules and instructions; Why not consider a sep? Don’t file it with the irs. Keep a copy for your files.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Keep a copy for your files. Web there are three document format options for sep plans: Don’t file it with the irs. Forms and publications from the internal revenue service by u.s. Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Instead, keep it with your records. Keep a copy for your files. Web form 5500 schedules and instructions; Don’t file it with the irs. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps.

How a SEP IRA Works Contributions, Benefits, Obligations and IRS Form

Web form 5500 schedules and instructions; Web there are three document format options for sep plans: A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Keep a copy for your files. Forms and publications from the internal revenue service by u.s.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Forms and publications from the internal revenue service by u.s. Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for. Choosing a financial institution to maintain your sep is one of the most important decisions. Web the annual reporting required for qualified plans (form 5500,.

Form 5305E Coverdell Education Savings Trust Account (2012) Free

Web there are three document format options for sep plans: Instead, keep it with your records. Choosing a financial institution to maintain your sep is one of the most important decisions. Web form 5500 schedules and instructions; Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Do not file this form with the irs. Don’t file it with the irs. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts.

Form 5305SEP Simplified Employee PensionIndividual Retirement

Web form 5500 schedules and instructions; Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for. Why not consider a sep? Don’t file it with the irs. Choosing a financial institution to maintain your sep is one of the most important decisions.

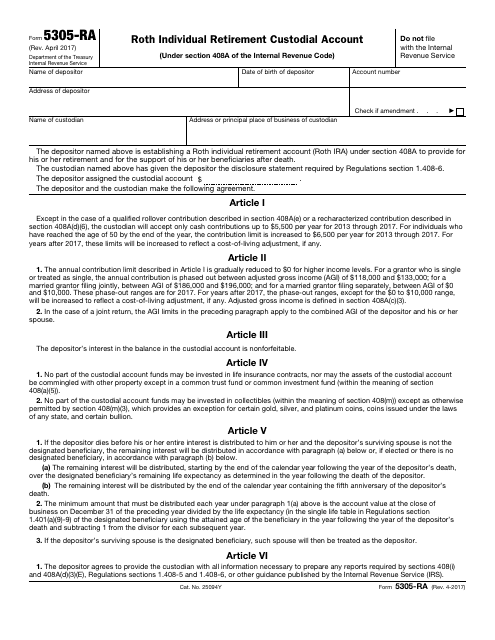

IRS Form 5305RA Download Fillable PDF or Fill Online Roth Individual

Web there are three document format options for sep plans: Choosing a financial institution to maintain your sep is one of the most important decisions. Forms and publications from the internal revenue service by u.s. Don’t file it with the irs. Why not consider a sep?

Form 5305SEP Edit, Fill, Sign Online Handypdf

Forms and publications from the internal revenue service by u.s. A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Choosing a financial institution to maintain your sep is one.

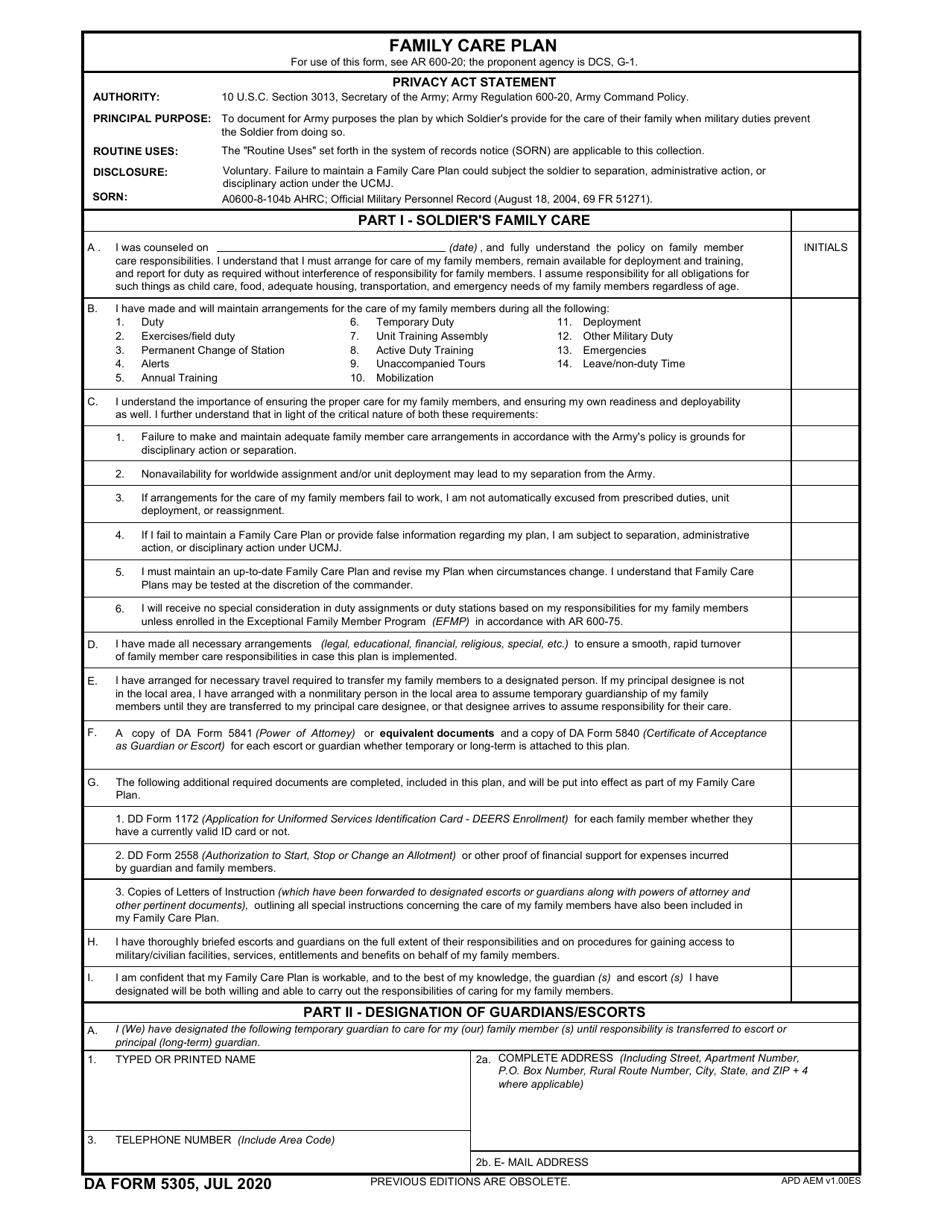

DA Form 5305 Download Fillable PDF or Fill Online Family Care Plan

Don’t file it with the irs. Do not file this form with the irs. Keep a copy for your files. Why not consider a sep? A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms.

Keep A Copy For Your Files.

A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Forms and publications from the internal revenue service by u.s. Don’t file it with the irs. Do not file this form with the irs.

Web There Are Three Document Format Options For Sep Plans:

Instead, keep it with your records. Choosing a financial institution to maintain your sep is one of the most important decisions. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Why not consider a sep?

Web Form 5500 Schedules And Instructions;

Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for.