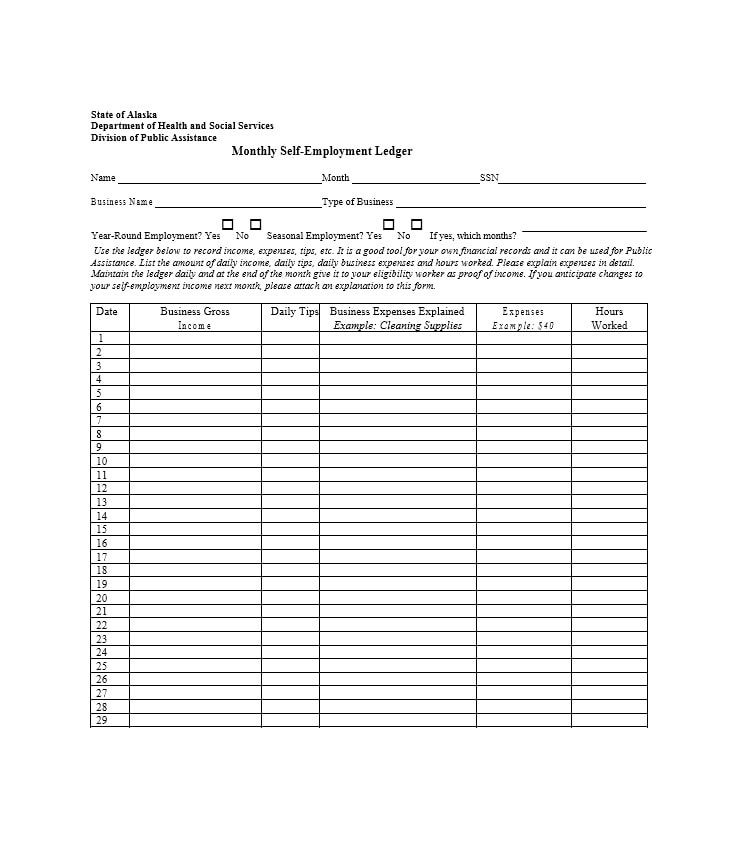

Self Employment Record Form

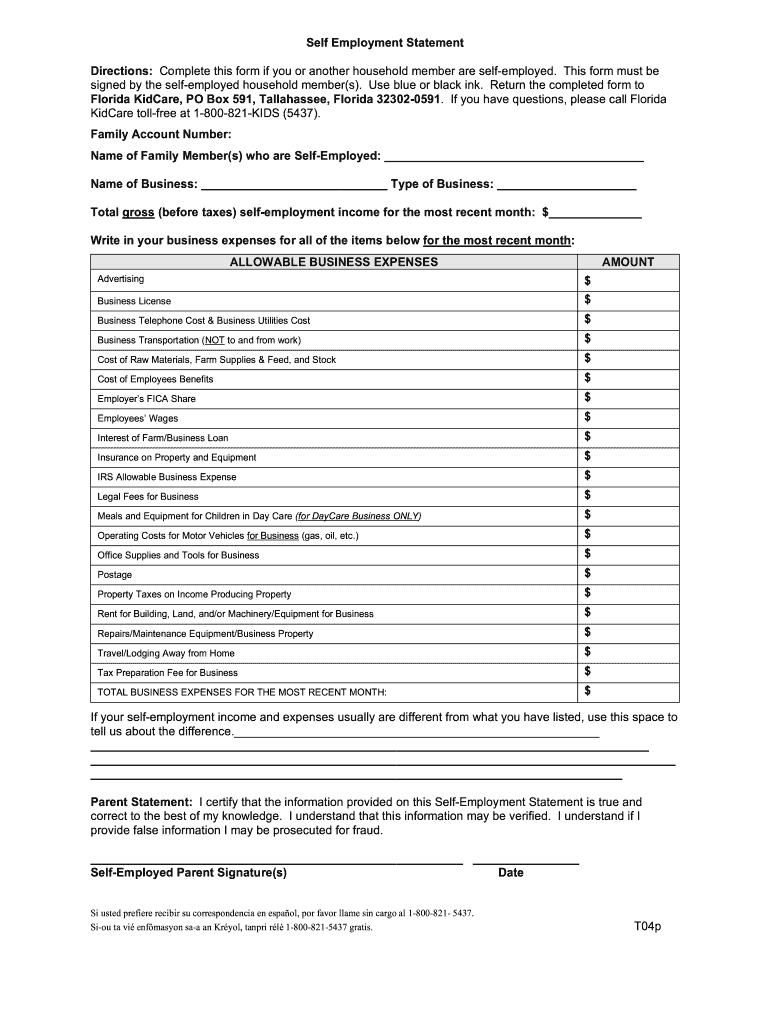

Self Employment Record Form - May be required if an unemployment claimant was employed by a school and has a reasonable assurance of returning to that employment in the next term. If you are applying for disability benefits, the information you provide will help us decide if you can receive benefits. Month # 1 month # 2 month # 3 $0 $0 $0 > expenses may only be deducted from income if a copy of the receipt is included. This information is to be supplied with your ei rede application. The cost of the long distance phone. If you need more space, attach a separate sheet. Web use a illinois self employment record form template to make your document workflow more streamlined. The following list of documents, are used to verify earned income. How it works browse for the illinois self employment form customize and esign all kids self employment records form The form must be completed regardless of whether or not taxes are owed on the income.

What documents will i need? The form must be completed regardless of whether or not taxes are owed on the income. The following list of documents, are used to verify earned income. Amounts of tips reported to you by your employees. These should be available for irs review. Amounts and dates of all wage, annuity, and pension payments. Web a collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Please make only one entry per calendar period employed. A client uses her home phone to run a business. How it works browse for the illinois self employment form customize and esign all kids self employment records form

Web use a illinois self employment record form template to make your document workflow more streamlined. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. Web a collection of relevant forms and publications related to understanding and fulfilling your filing requirements. How it works browse for the illinois self employment form customize and esign all kids self employment records form The cost of the long distance phone. What documents will i need? This form is used to notify the department when business operations change,. The form must be completed regardless of whether or not taxes are owed on the income. Web employment tax recordkeeping keep all records of employment taxes for at least four years after filing the 4th quarter for the year. Month # 1 month # 2 month # 3 $0 $0 $0 > expenses may only be deducted from income if a copy of the receipt is included.

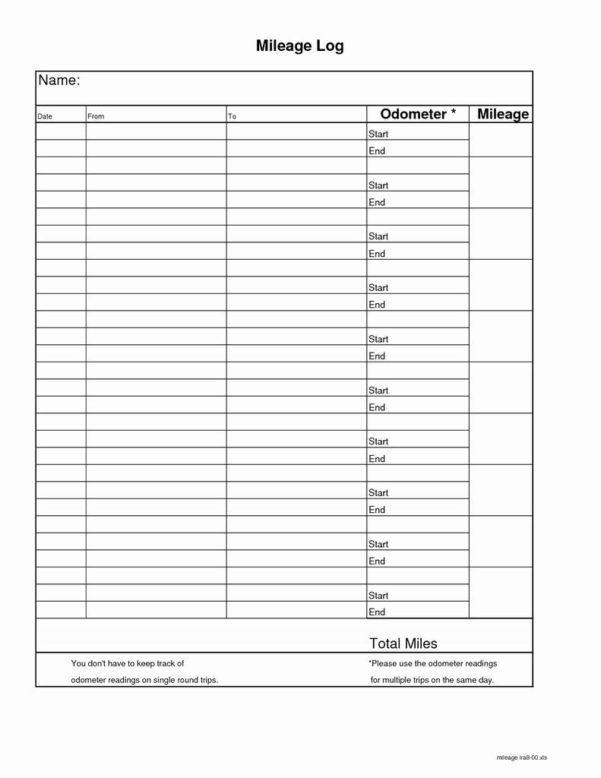

Self Employed Record Keeping Spreadsheet with Self Employment Record

How it works browse for the illinois self employment form customize and esign all kids self employment records form The cost of the long distance phone. What documents will i need? These should be available for irs review. The following list of documents, are used to verify earned income.

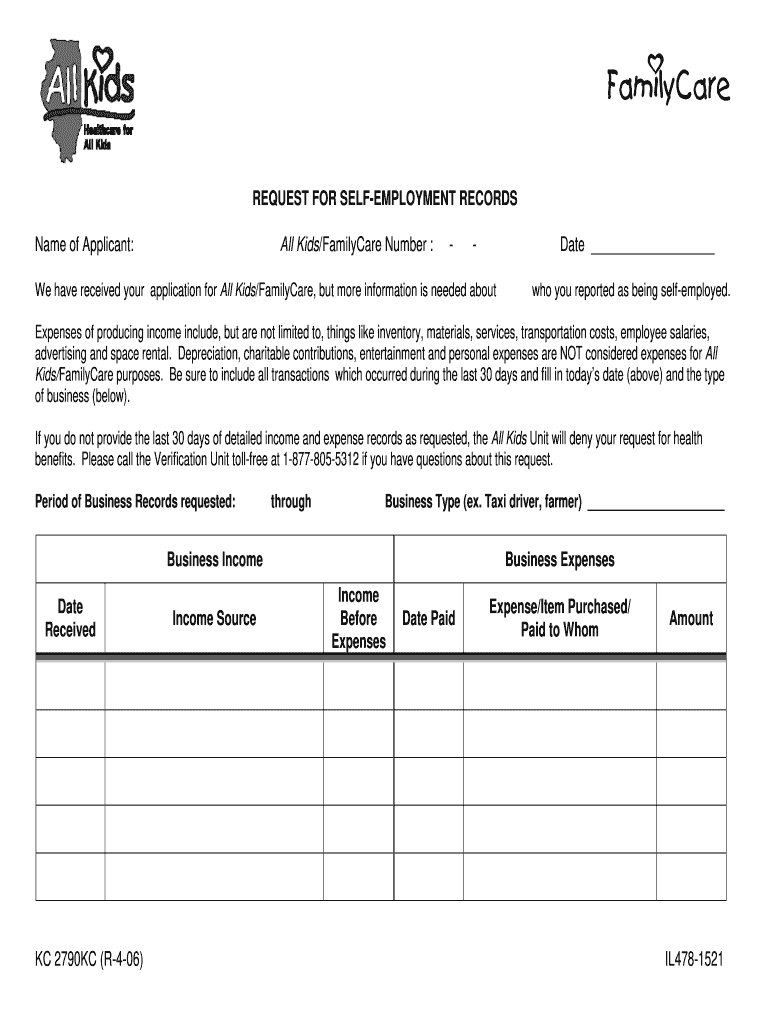

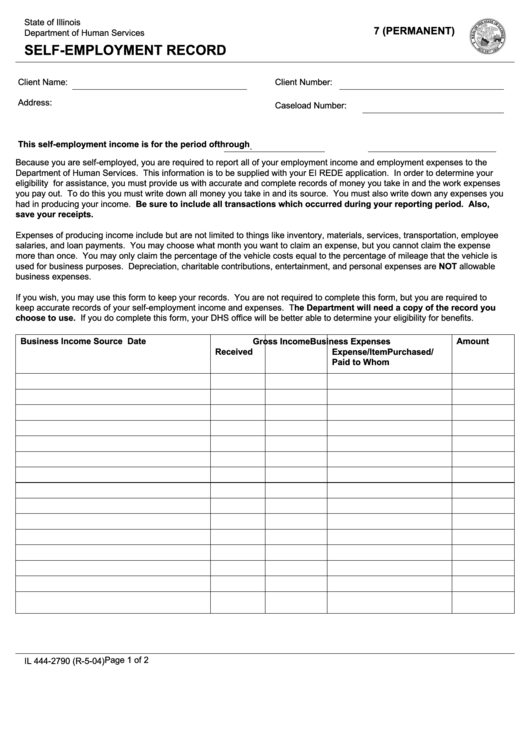

Illinois Self Employment Record Form Fill Out and Sign Printable PDF

What kinds of records should i. What documents will i need? Browse by state alabama al alaska ak arizona az arkansas ar california ca colorado co connecticut ct delaware de. Web why should i keep records? Use of form 2790 is not required.

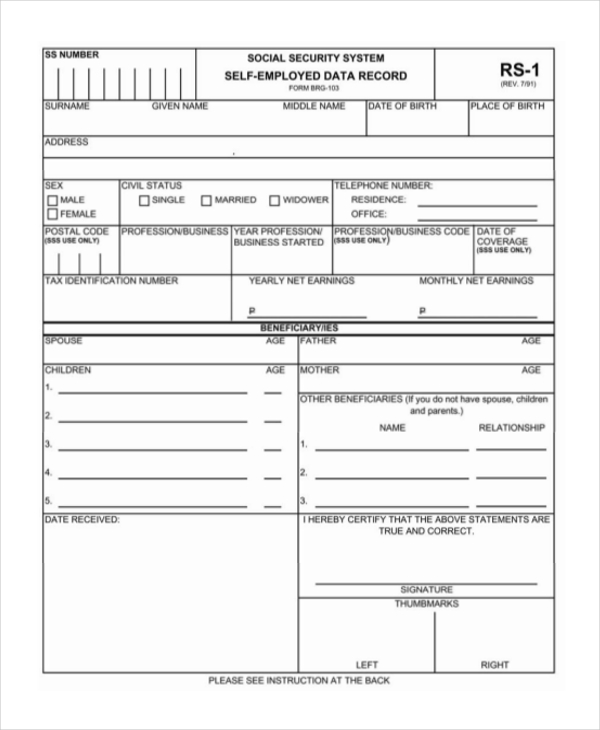

FREE 11+ Sample Self Employment Forms in PDF MS Word

Web a collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Show quarterly wage periods and amounts for years prior to 1978; Amounts of tips reported to you by your employees. Month # 1 month # 2 month # 3 $0 $0 $0 > expenses may only be deducted from income if a copy of.

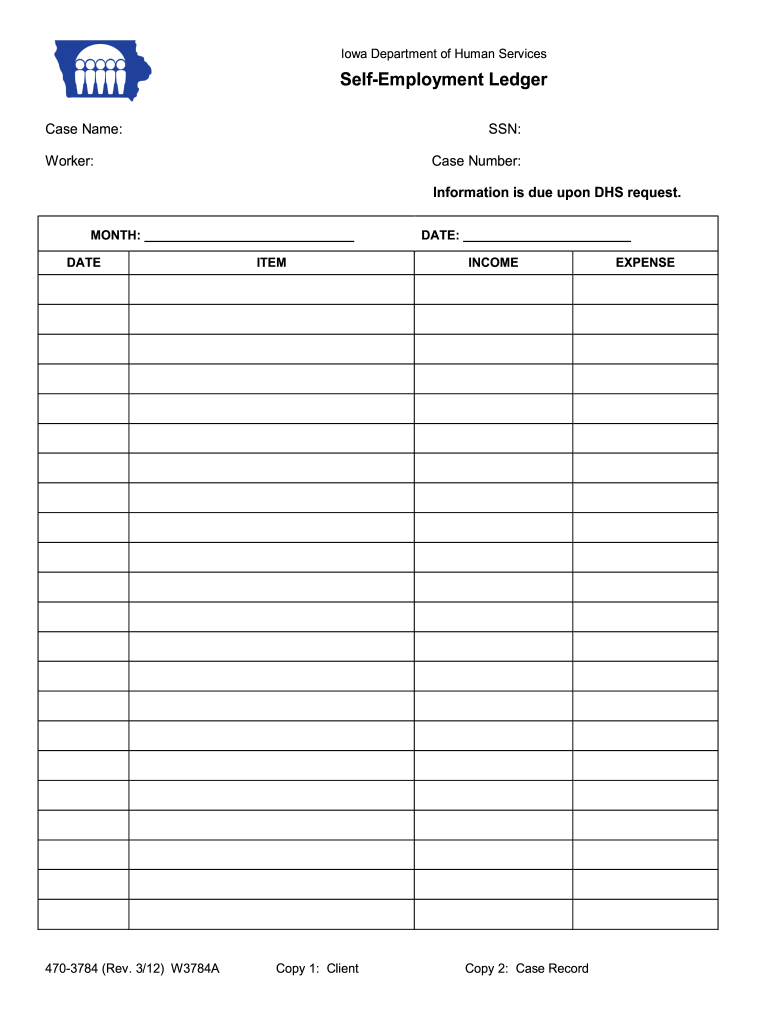

Self Employment Ledger Template Fill Out and Sign Printable PDF

The cost of the long distance phone. Web use a illinois self employment record form template to make your document workflow more streamlined. The form must be completed regardless of whether or not taxes are owed on the income. Browse by state alabama al alaska ak arizona az arkansas ar california ca colorado co connecticut ct delaware de. Month #.

Printable Self Employment Ledger Template Printable Templates

If you need more space, attach a separate sheet. Amounts of tips reported to you by your employees. Use of form 2790 is not required. May be required if an unemployment claimant was employed by a school and has a reasonable assurance of returning to that employment in the next term. This information is to be supplied with your ei.

Self Employment Il Get Printable Form

The cost of the long distance phone. Use of form 2790 is not required. The social security administration uses the information from schedule se to figure your benefits under the social security program. Show quarterly wage periods and amounts for years prior to 1978; Web why should i keep records?

SelfEmployment Ledger 40 FREE Templates & Examples

Browse by state alabama al alaska ak arizona az arkansas ar california ca colorado co connecticut ct delaware de. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. If you are applying for disability benefits, the information you provide will help us decide if you can receive benefits..

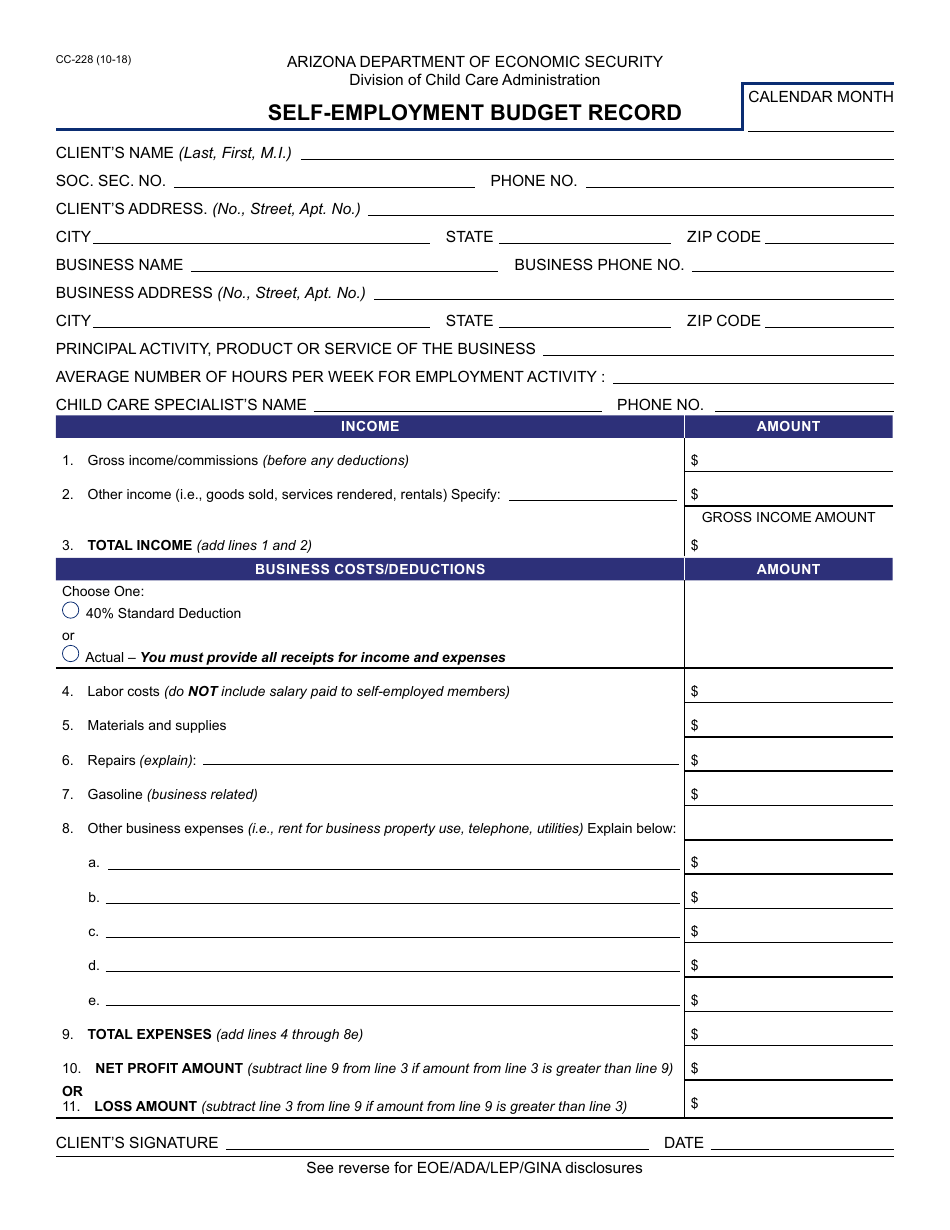

Form CC228 Download Fillable PDF or Fill Online Selfemployment Budget

This information is to be supplied with your ei rede application. > the low income home energy assistance program (liheap) does not allow the same business deductions as the irs federal income tax. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of income, keep track of deductible expenses, keep track of.

Self Employment Form Fill Out and Sign Printable PDF Template signNow

Use this template for verification. Amounts of tips reported to you by your employees. Web print below in date order your employment only for year(s) (or months) you believe our records are not correct. What kinds of records should i. These should be available for irs review.

Fillable Form Il 4442790 State Of Illinois Department Of Human

Month # 1 month # 2 month # 3 $0 $0 $0 > expenses may only be deducted from income if a copy of the receipt is included. A client uses her home phone to run a business. If you need more space, attach a separate sheet. What documents will i need? Amounts and dates of all wage, annuity, and.

Amounts And Dates Of All Wage, Annuity, And Pension Payments.

The cost of the long distance phone. > the low income home energy assistance program (liheap) does not allow the same business deductions as the irs federal income tax. Please make only one entry per calendar period employed. This information is to be supplied with your ei rede application.

Web A Collection Of Relevant Forms And Publications Related To Understanding And Fulfilling Your Filing Requirements.

This form is used to notify the department when business operations change,. What documents will i need? Show details we are not affiliated with any brand or entity on this form. Web use a illinois self employment record form template to make your document workflow more streamlined.

The Social Security Administration Uses The Information From Schedule Se To Figure Your Benefits Under The Social Security Program.

Web print below in date order your employment only for year(s) (or months) you believe our records are not correct. Show quarterly wage periods and amounts for years prior to 1978; How it works browse for the illinois self employment form customize and esign all kids self employment records form Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of income, keep track of deductible expenses, keep track of your basis in property, prepare your tax returns, and support items reported on your tax returns.

The Form Must Be Completed Regardless Of Whether Or Not Taxes Are Owed On The Income.

Amounts of tips reported to you by your employees. A means for calculating income for qualifying households with a farm loss. Web why should i keep records? Some common irs deductions not allowed for these purposes are: