Schedule J Tax Form

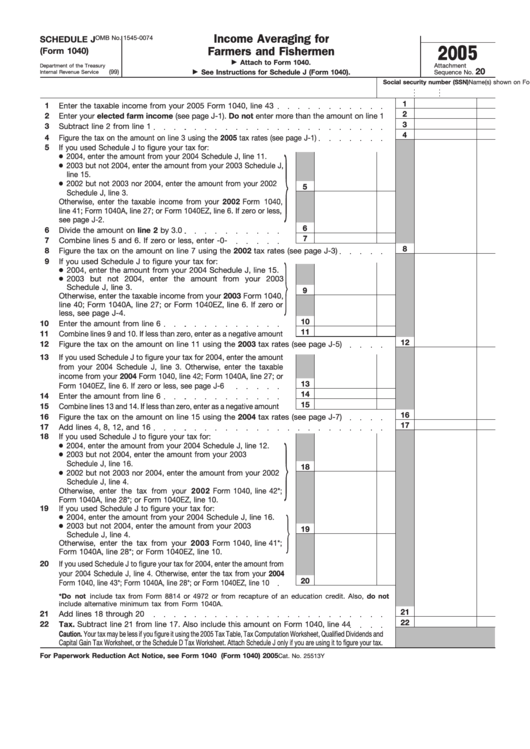

Schedule J Tax Form - This is tax before credits. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or business of farming or fishing. Web schedule j beneficiaries estate of: Your social security number note: Web use form 8902, alternative tax on qualifying shipping activities, to figure the tax. Include the alternative tax on schedule j, part i, line 9e. Go to www.irs.gov/schedulej for instructions and the latest information. Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. Web form 1040 schedule j allows farmers and fishermen to average an income against lower incomes from the previous three tax years.

Compute tax using the tax rate of 5% (.05). Web schedule j beneficiaries estate of: Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing. Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. Name(s) shown on return omb no. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or business of farming or fishing. Web use form 8902, alternative tax on qualifying shipping activities, to figure the tax. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization. Web form 1040 schedule j allows farmers and fishermen to average an income against lower incomes from the previous three tax years. Farmers and fishermen may elect to do this when it will lower their.

Name(s) shown on return omb no. Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing. Your social security number note: Compute tax using the tax rate of 5% (.05). Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. Web schedule j farm i k a 2022 k entucky f arm i ncome a veraging enclose with form 740 see federal instructions for schedule j. Go to www.irs.gov/schedulej for instructions and the latest information. See form 4506 for the fee amount. J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or business of farming or fishing.

Form 1118 (Schedule J) Adjustments to Separate Limitation

Include the alternative tax on schedule j, part i, line 9e. Web schedule j beneficiaries estate of: Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. Web form 1040 schedule j allows farmers and fishermen to average an income against lower incomes from the previous.

What Is Schedule J Averaging for Farmers and Fishermen

This is tax before credits. Table of contents when income averaging is beneficial farming businesses that qualify for income averaging fishing businesses and income averaging click to expand when income averaging is beneficial See form 4506 for the fee amount. Name(s) shown on return omb no. Farmers and fishermen may elect to do this when it will lower their.

Form 1118 (Schedule J) Adjustments to Separate Limitation

Farmers and fishermen may elect to do this when it will lower their. Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing. Web use form 8902, alternative tax on qualifying shipping activities, to figure the tax. Go to www.irs.gov/schedulej for instructions and the.

Fillable Schedule J (Form 1040) Averaging For Farmers And

Table of contents when income averaging is beneficial farming businesses that qualify for income averaging fishing businesses and income averaging click to expand when income averaging is beneficial Name(s) shown on return omb no. Farmers and fishermen may elect to do this when it will lower their. Include the alternative tax on schedule j, part i, line 9e. Web information.

Form 8615 Tax for Certain Children Who Have Unearned (2015

Web schedule j beneficiaries estate of: Include the alternative tax on schedule j, part i, line 9e. Web prior year tax returns you may need copies of your original or amended income tax returns for 2019, 2020, and 2021 to figure your tax on schedule j. Compute tax using the tax rate of 5% (.05). Web schedule j (form 990).

Form 1040 (Schedule J) Averaging Form for Farmers and

J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. There is a fee for each return requested. Web schedule j farm i k a 2022 k entucky f arm i ncome a veraging enclose with form 740 see federal instructions for schedule j. Web information about schedule j (form 1040), income averaging for farmers.

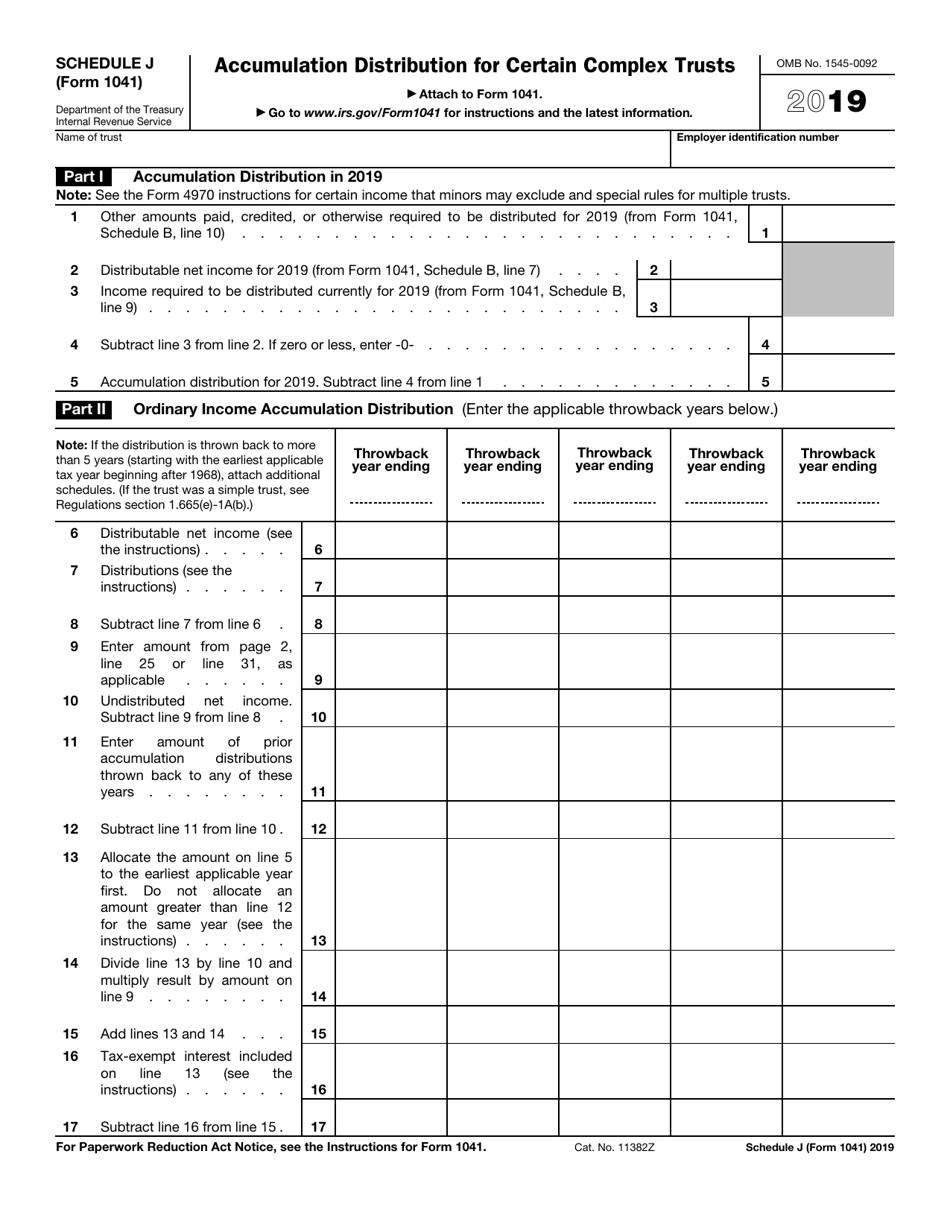

IRS Form 1041 Schedule J Download Fillable PDF or Fill Online

Include the alternative tax on schedule j, part i, line 9e. This is tax before credits. Web schedule j is the internal revenue service form used when you want to average your fishing or farming income. Go to www.irs.gov/schedulej for instructions and the latest information. Farmers and fishermen may elect to do this when it will lower their.

Solved Form 1120 (2018) Schedule J Tax Computation and

Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or business of farming or fishing. Web prior year tax returns you may need copies of your original or amended income tax returns for 2019, 2020,.

Form 1041 (Schedule J) Accumulation Distribution for Certain Complex

J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. Web prior year tax returns you may need copies of your original or amended income tax returns for 2019, 2020, and 2021 to figure your tax on schedule j. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging,.

Form 1041 (Schedule J) Accumulation Distribution for Certain Complex

Web schedule j is the internal revenue service form used when you want to average your fishing or farming income. Go to www.irs.gov/schedulej for instructions and the latest information. Farmers and fishermen may elect to do this when it will lower their. Compute tax using the tax rate of 5% (.05). See form 4506 for the fee amount.

Web Schedule J (Form 990) Is Used By An Organization That Files Form 990 To Report Compensation Information For Certain Officers, Directors, Individual Trustees, Key Employees, And Highest Compensated Employees, And Information On Certain Compensation Practices Of The Organization.

Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. Web use form 8902, alternative tax on qualifying shipping activities, to figure the tax. J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. Include the alternative tax on schedule j, part i, line 9e.

Table Of Contents When Income Averaging Is Beneficial Farming Businesses That Qualify For Income Averaging Fishing Businesses And Income Averaging Click To Expand When Income Averaging Is Beneficial

Web form 1040 schedule j allows farmers and fishermen to average an income against lower incomes from the previous three tax years. Name(s) shown on return omb no. Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing. Farmers and fishermen may elect to do this when it will lower their.

There Is A Fee For Each Return Requested.

Go to www.irs.gov/schedulej for instructions and the latest information. Web prior year tax returns you may need copies of your original or amended income tax returns for 2019, 2020, and 2021 to figure your tax on schedule j. Web schedule j farm i k a 2022 k entucky f arm i ncome a veraging enclose with form 740 see federal instructions for schedule j. Web schedule j beneficiaries estate of:

See Form 4506 For The Fee Amount.

This is tax before credits. Web schedule j is the internal revenue service form used when you want to average your fishing or farming income. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or business of farming or fishing. Compute tax using the tax rate of 5% (.05).