Schedule H Tax Form

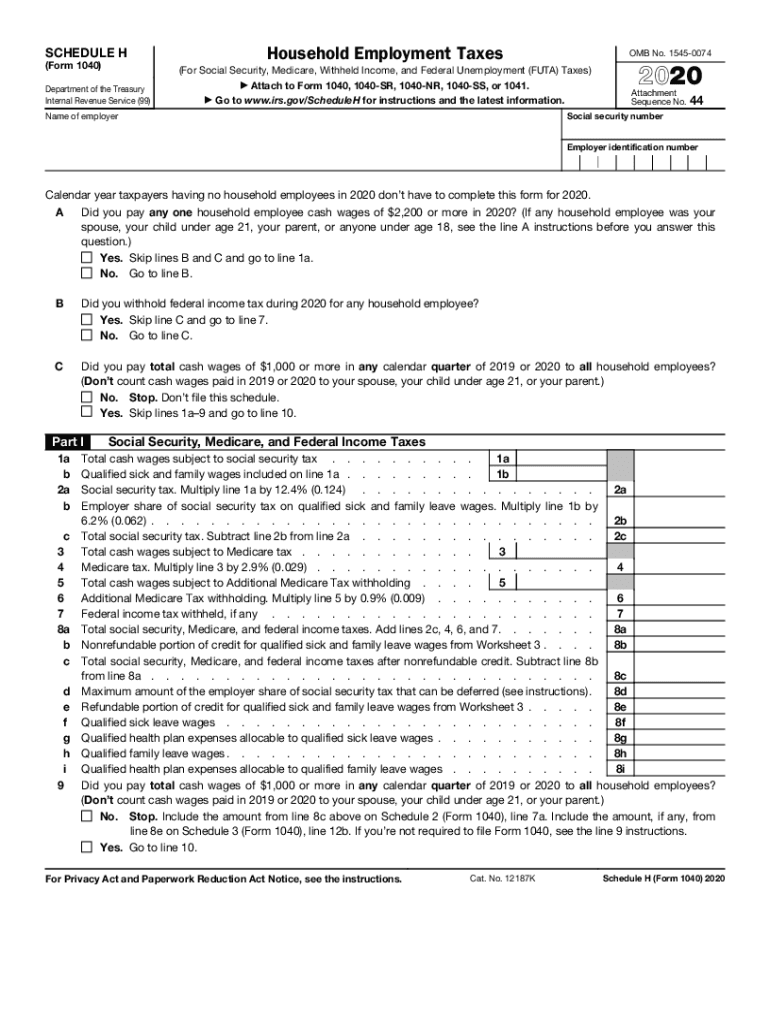

Schedule H Tax Form - (if any household employee was your spouse, your child under age 21, your parent, or anyone under age 18, see the line a instructions before you answer this question.) These free pdf files are unaltered and are sourced directly from the publisher. Web when schedule h must be filed. Web schedule h is used by household employers to report household employment taxes. Web here is a list of forms that household employers need to complete. You pay at least one household employee cash. You pay both income and employment taxes to the united states treasury when you file schedule h with your return. For instructions and the latest information. Click any of the irs schedule h form links below to download, save, view, and print the file for the corresponding year. Per irs schedule h (form 1040):

Solved • by turbotax • 1023 • updated january 25, 2023 if you hired a household employee to work in your home during 2022, you may be required to pay employment taxes, including. These free pdf files are unaltered and are sourced directly from the publisher. Per irs schedule h (form 1040): You pay both income and employment taxes to the united states treasury when you file schedule h with your return. Web how do i file schedule h? You must file an irs schedule h if one or more of the following is true: Web when schedule h must be filed. Web printable form 1040 schedule h. A did you pay any one household employee cash wages of $2,400 or more in 2022? Click any of the irs schedule h form links below to download, save, view, and print the file for the corresponding year.

Web schedule h, household employment taxes, is a form that household employers use to report household employment taxes to the irs. Web when schedule h must be filed. Do i make a separate payment? Web printable form 1040 schedule h. (if any household employee was your spouse, your child under age 21, your parent, or anyone under age 18, see the line a instructions before you answer this question.) Web how do i file schedule h? Web schedule h is the form the irs requires you to use to report your federal household employment tax liability for the year. Use schedule h (form 1040) to report household employment taxes if you paid cash wages to a household employee and the wages were subject to social security, medicare, or futa taxes, or if you withheld federal income tax. If you’re not filing a 2020 tax return, file schedule h by itself. Per irs schedule h (form 1040):

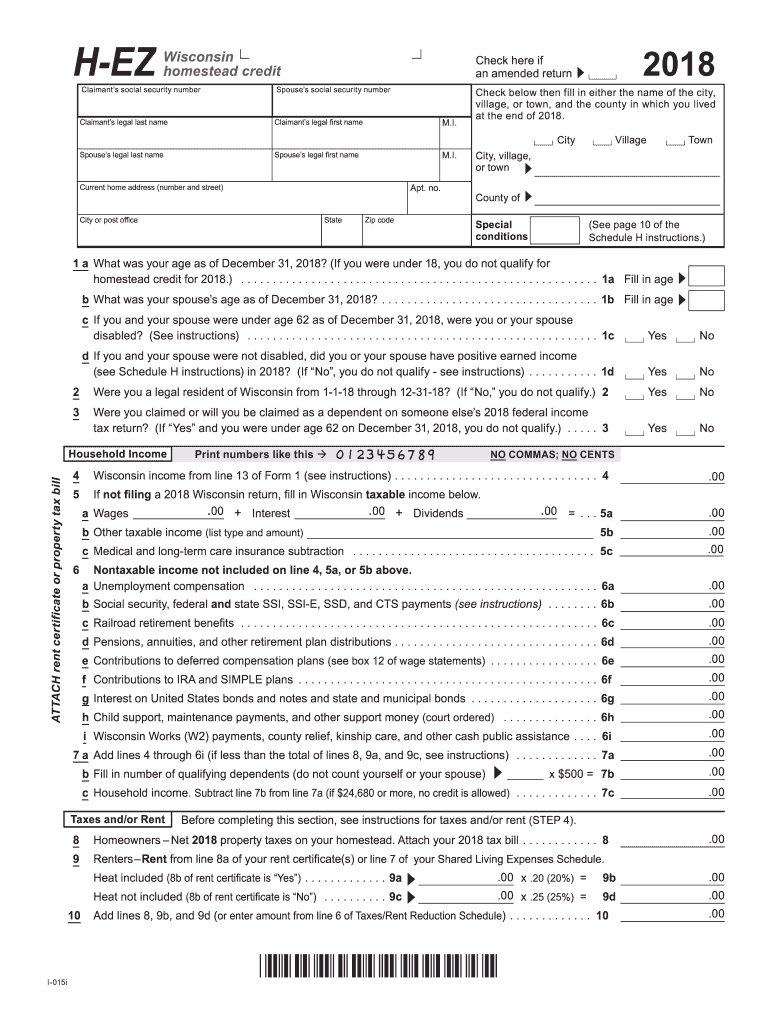

Wisconsin Homestead Credit Fill Out and Sign Printable PDF Template

You pay at least one household employee cash. If you’re not filing a 2020 tax return, file schedule h by itself. Use schedule h (form 1040) to report household employment taxes if you paid cash wages to a household employee and the wages were subject to social security, medicare, or futa taxes, or if you withheld federal income tax. A.

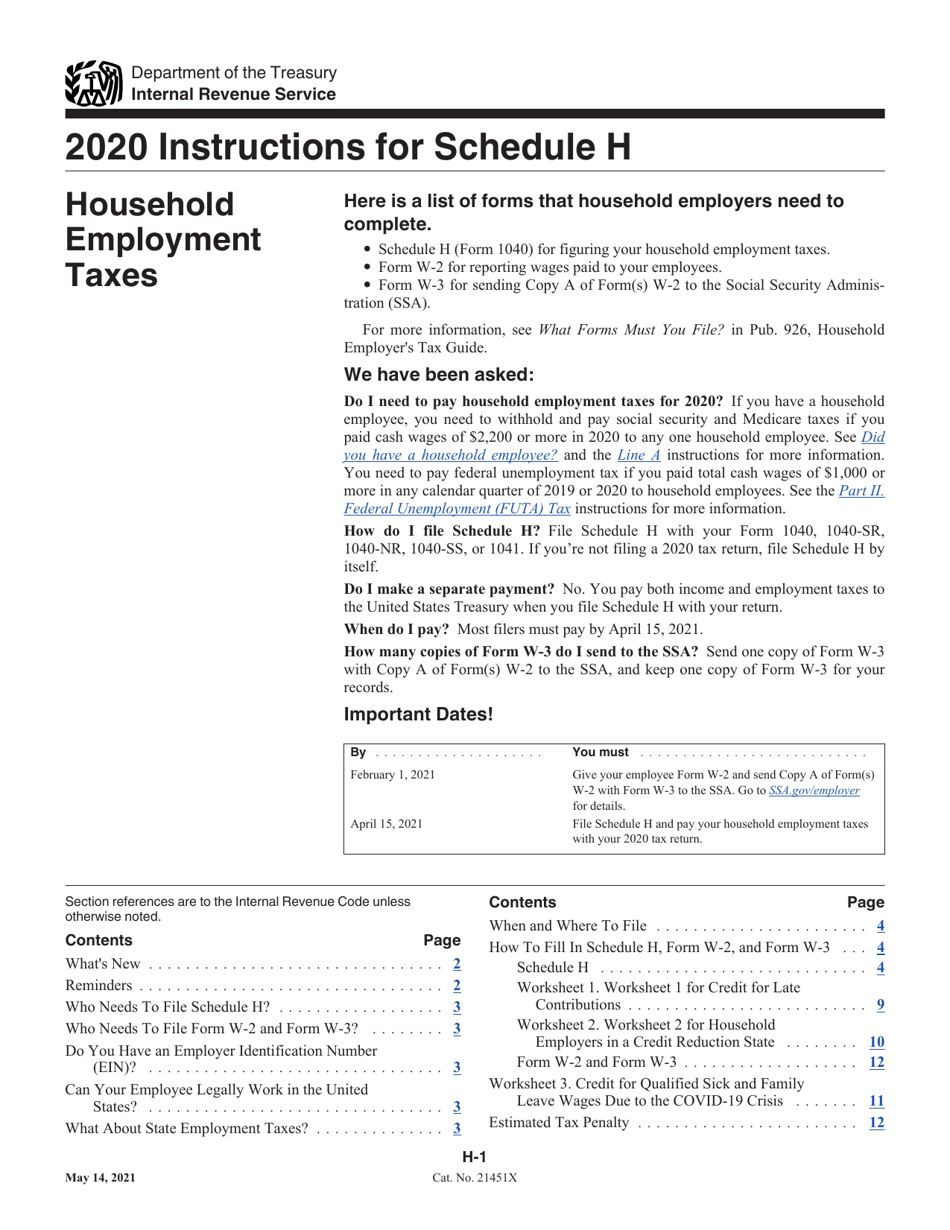

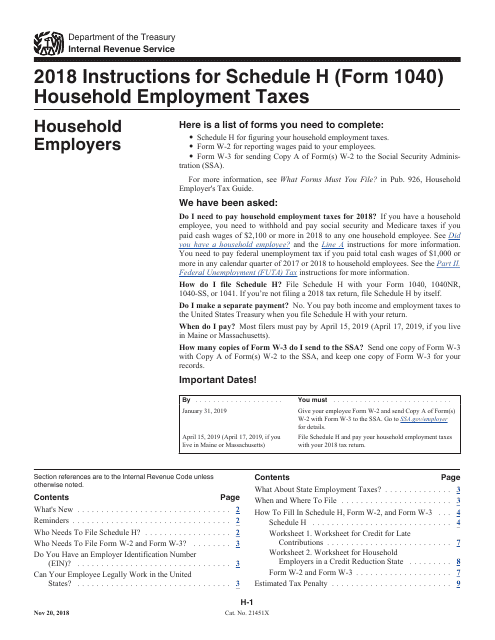

Download Instructions for IRS Form 1040 Schedule H Household Employment

Web when schedule h must be filed. You pay both income and employment taxes to the united states treasury when you file schedule h with your return. If you’re not filing a 2020 tax return, file schedule h by itself. Web here is a list of forms that household employers need to complete. (if any household employee was your spouse,.

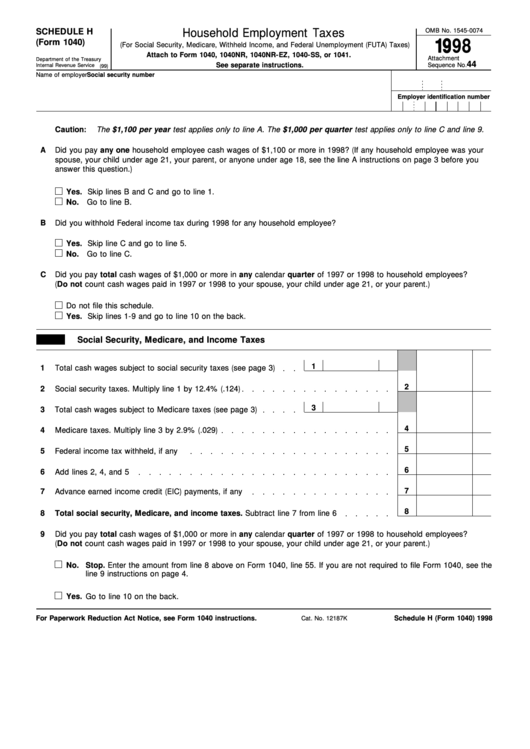

Fillable Schedule H (Form 1040) Household Employment Taxes 1998

Web here is a list of forms that household employers need to complete. These free pdf files are unaltered and are sourced directly from the publisher. Web when schedule h must be filed. A schedule h breaks down household employee payment and tax information. Web schedule h is used by household employers to report household employment taxes.

2016 Instructions for Schedule H (Form 1040) Household Employment Taxes

You pay both income and employment taxes to the united states treasury when you file schedule h with your return. Web printable form 1040 schedule h. Do i make a separate payment? Schedule h (form 1040) for figuring your household employment taxes. Web here is a list of forms that household employers need to complete.

Solved Please complete the required federal individual

Web here is a list of forms that household employers need to complete. You pay both income and employment taxes to the united states treasury when you file schedule h with your return. A did you pay any one household employee cash wages of $2,400 or more in 2022? Per irs schedule h (form 1040): These free pdf files are.

Schedule h form Fill out & sign online DocHub

Web when schedule h must be filed. Web do i need to file irs schedule h? A schedule h breaks down household employee payment and tax information. Click any of the irs schedule h form links below to download, save, view, and print the file for the corresponding year. Per irs schedule h (form 1040):

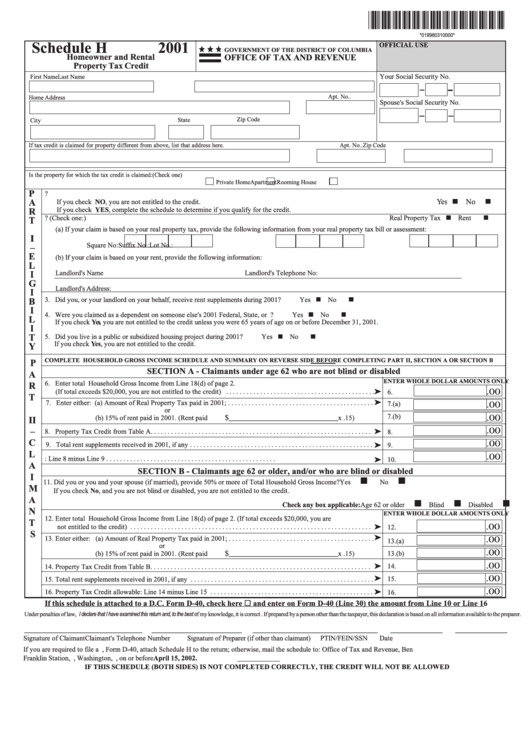

Schedule H Form Homeowner And Rental Property Tax Credit 2001

A schedule h breaks down household employee payment and tax information. (if any household employee was your spouse, your child under age 21, your parent, or anyone under age 18, see the line a instructions before you answer this question.) Do i make a separate payment? You pay both income and employment taxes to the united states treasury when you.

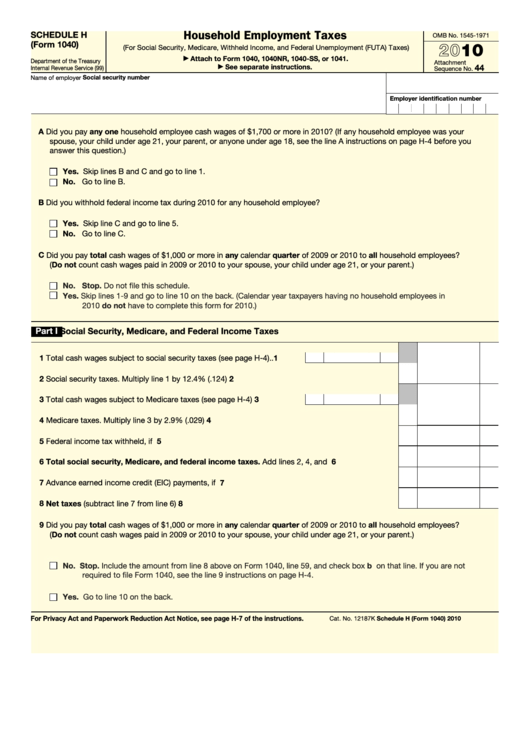

Fillable Schedule H (Form 1040) Household Employment Taxes 2010

You pay both income and employment taxes to the united states treasury when you file schedule h with your return. You pay at least one household employee cash. Do i make a separate payment? Web schedule h, household employment taxes, is a form that household employers use to report household employment taxes to the irs. Web printable form 1040 schedule.

Download Instructions for IRS Form 1040 Schedule H Household Employment

You must file an irs schedule h if one or more of the following is true: (if any household employee was your spouse, your child under age 21, your parent, or anyone under age 18, see the line a instructions before you answer this question.) Per irs schedule h (form 1040): Do i make a separate payment? Schedule h (form.

What Is Schedule H Form slidesharedocs

Do i make a separate payment? Web when schedule h must be filed. Web schedule h is used by household employers to report household employment taxes. Solved • by turbotax • 1023 • updated january 25, 2023 if you hired a household employee to work in your home during 2022, you may be required to pay employment taxes, including. If.

A Did You Pay Any One Household Employee Cash Wages Of $2,400 Or More In 2022?

If you’re not filing a 2020 tax return, file schedule h by itself. Per irs schedule h (form 1040): A schedule h breaks down household employee payment and tax information. Web printable form 1040 schedule h.

Web Here Is A List Of Forms That Household Employers Need To Complete.

You must file an irs schedule h if one or more of the following is true: You pay at least one household employee cash. Do i make a separate payment? Web schedule h, household employment taxes, is a form that household employers use to report household employment taxes to the irs.

Solved • By Turbotax • 1023 • Updated January 25, 2023 If You Hired A Household Employee To Work In Your Home During 2022, You May Be Required To Pay Employment Taxes, Including.

Click any of the irs schedule h form links below to download, save, view, and print the file for the corresponding year. These free pdf files are unaltered and are sourced directly from the publisher. You pay both income and employment taxes to the united states treasury when you file schedule h with your return. Web when schedule h must be filed.

Web Schedule H Is Used By Household Employers To Report Household Employment Taxes.

Web schedule h is the form the irs requires you to use to report your federal household employment tax liability for the year. Web how do i file schedule h? Use schedule h (form 1040) to report household employment taxes if you paid cash wages to a household employee and the wages were subject to social security, medicare, or futa taxes, or if you withheld federal income tax. Web do i need to file irs schedule h?