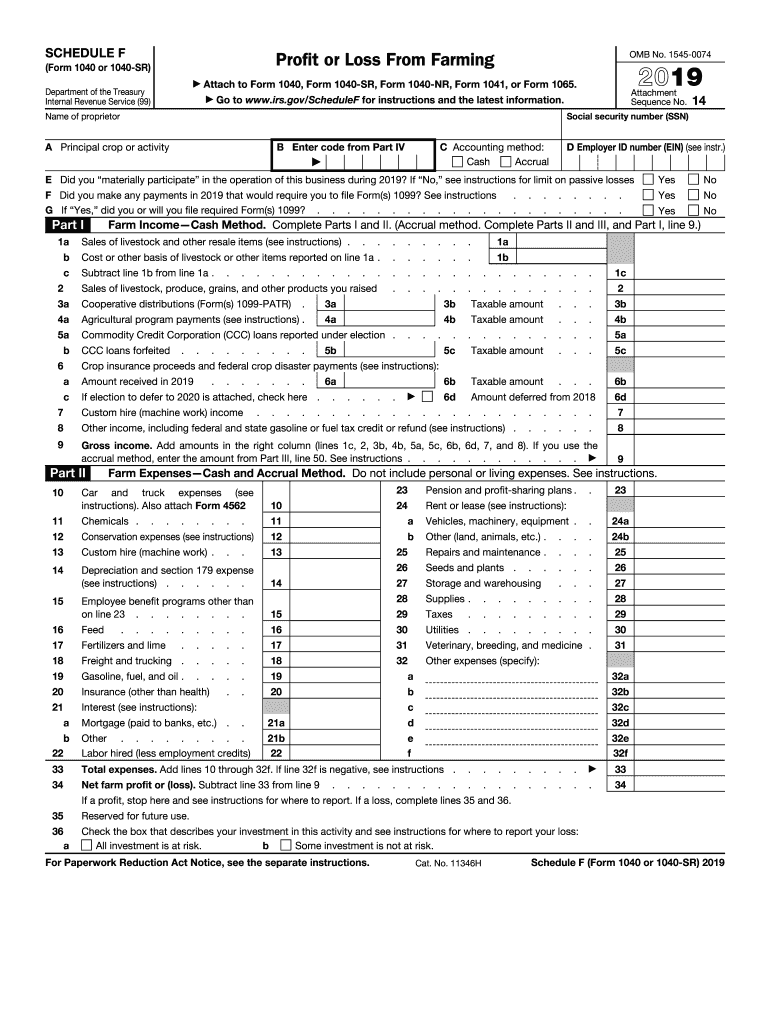

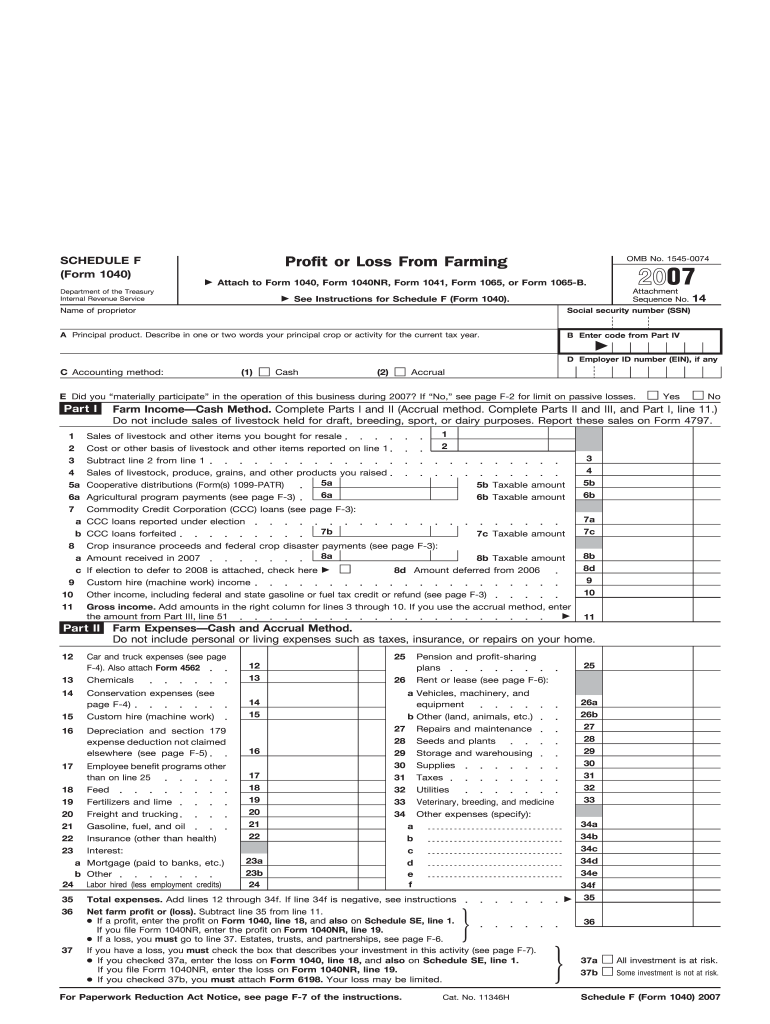

Schedule F Tax Form 2022

Schedule F Tax Form 2022 - Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule (s) c, e, or f, should mail their form 9465 to. Your farming activity may subject you to state and. Web 2022 form 1040 form 1040 u.s. 14 name of proprietor social security number. The due date (with extensions) for filing the donor's. Web among the various components of tax return filing, schedule fa often emerges as the tougher nut to crack. Web 2022 instructions for schedule f profit or loss use schedule f (form 1040) to report farm income and expenses. From the main menu of the tax return (form 1040) select: Web the golden eagles schedule includes opponents, date, time, and tv.

Ad access irs tax forms. You can download or print. If the prior year return includes. Web 2022 form 1040 form 1040 u.s. Ad discover 2290 form due dates for heavy use vehicles placed into service. Get ready for tax season deadlines by completing any required tax forms today. 14 name of proprietor social security number. Web among the various components of tax return filing, schedule fa often emerges as the tougher nut to crack. Ad irs schedule f form 1040 & more fillable forms, register and subscribe now! Web schedule f (form 990) department of the treasury internal revenue service statement of activities outside the united states complete if the organization answered “yes” on.

14 name of proprietor social security number. Web use schedule f (form 1040) to report farm income and expenses. Web creating schedule f. Your farming activity may subject you to state and. Web among the various components of tax return filing, schedule fa often emerges as the tougher nut to crack. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web schedule f (form 990) department of the treasury internal revenue service statement of activities outside the united states complete if the organization answered “yes” on. Find deals and low prices on tax forms 2022 at amazon.com If the prior year return includes. Ad access irs tax forms.

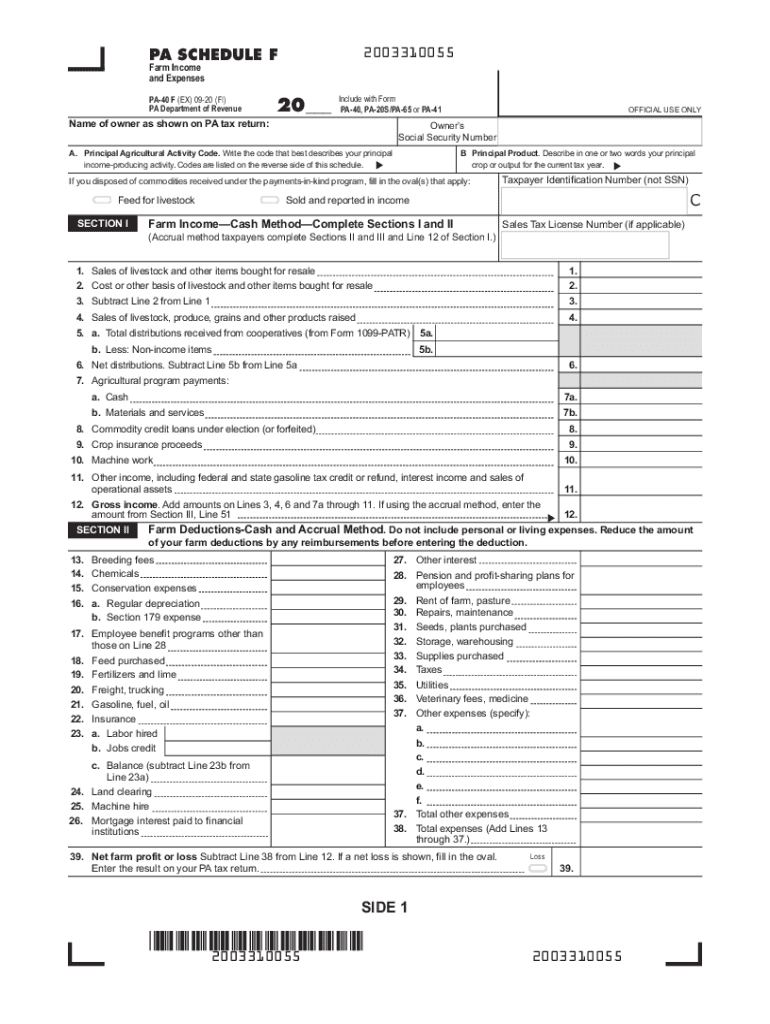

PA DoR PA40 F Schedule F 20202022 Fill and Sign Printable

Ad free shipping on qualified orders. Web we last updated federal 1040 (schedule f) in december 2022 from the federal internal revenue service. Web creating schedule f. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

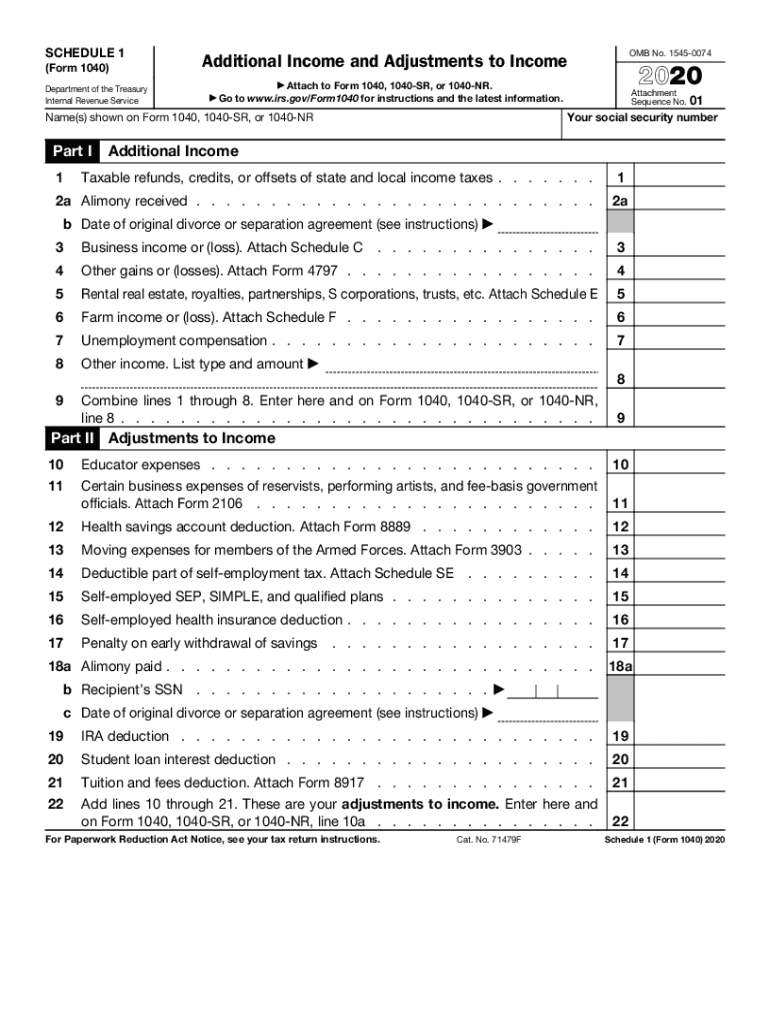

Irs 1040 Form Line 14 FAFSA Tutorial

Ad discover 2290 form due dates for heavy use vehicles placed into service. Get ready for tax season deadlines by completing any required tax forms today. Web 2022 form 1040 form 1040 u.s. • txp bank project is offered for withholding tax, declaration of estimated. This form is for income earned in tax year 2022, with tax returns due in.

Form Fillable Schedule Printable Forms Free Online

Taxpayers must disclose any foreign assets or. Free, easy returns on millions of items. Web 2022 form 1040 form 1040 u.s. Web the golden eagles schedule includes opponents, date, time, and tv. Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule (s) c, e, or f, should.

Tcrs Payment Schedule 2022 Softball Schedule 2022

Get ready for tax season deadlines by completing any required tax forms today. Web schedule f (form 990) department of the treasury internal revenue service statement of activities outside the united states complete if the organization answered “yes” on. • txp bank project is offered for withholding tax, declaration of estimated. Web 2022 instructions for schedule f profit or loss.

2019 1040 Schedule F Tax Forms Organizer 2021 Tax Forms 1040 Printable

Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule (s) c, e, or f, should mail their form 9465 to. Web among the various components of tax return filing, schedule fa often emerges as the tougher nut to crack. Web 2022 instructions for schedule f profit or.

Determining Schedule F in FINPACK FINPACK

If the donor died during 2022, the executor must file the donor's 2022 form 709 not later than the earlier of: Find deals and low prices on tax forms 2022 at amazon.com You can download or print. Taxpayers must disclose any foreign assets or. If the prior year return includes.

Irs 1040 Form 2020 Printable What Is IRS Form 1040? How It Works in

Web we last updated federal 1040 (schedule f) in december 2022 from the federal internal revenue service. Web 2022 instructions for schedule f profit or loss use schedule f (form 1040) to report farm income and expenses. From the main menu of the tax return (form 1040) select: Web all individual taxpayers who mail form 9465 separate from their returns.

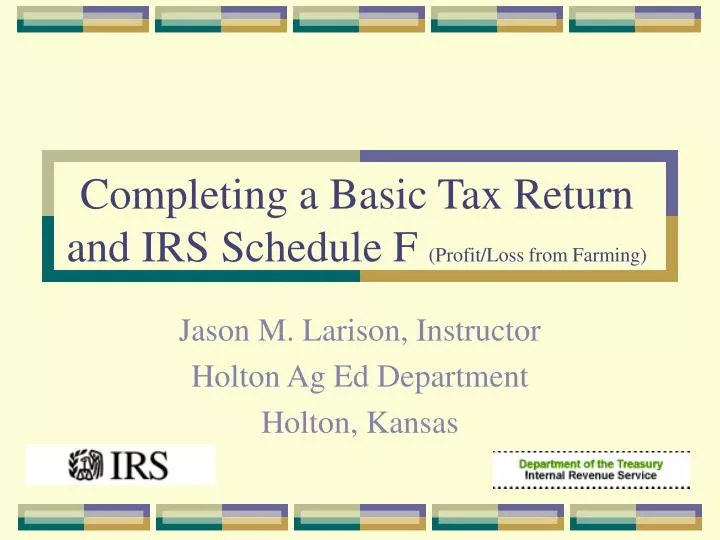

PPT Completing a Basic Tax Return and IRS Schedule F (Profit/Loss

Web go to www.irs.gov/schedulef for instructions and the latest information. The due date (with extensions) for filing the donor's. Free, easy returns on millions of items. Web we last updated federal 1040 (schedule f) in december 2022 from the federal internal revenue service. Web 2022 instructions for schedule f profit or loss use schedule f (form 1040) to report farm.

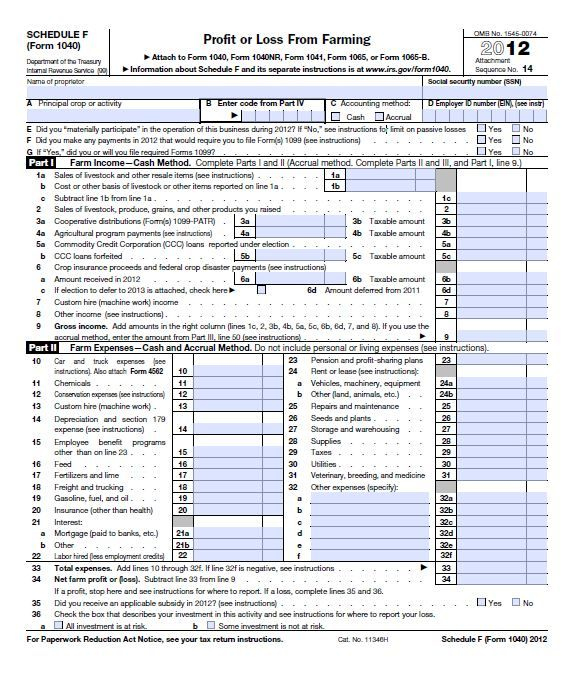

2019 Form IRS 1040 Schedule F Fill Online, Printable, Fillable, Blank

Web we last updated the profit or loss from farming in december 2022, so this is the latest version of 1040 (schedule f), fully updated for tax year 2022. Taxpayers must disclose any foreign assets or. Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule (s) c,.

Form 1040 Schedule F Fill in Capable Profit or Loss from Farming Fill

Get ready for tax season deadlines by completing any required tax forms today. Individual income tax return 2022 department of the treasury—internal revenue service omb no. If the donor died during 2022, the executor must file the donor's 2022 form 709 not later than the earlier of: Web among the various components of tax return filing, schedule fa often emerges.

Ad Access Irs Tax Forms.

If the prior year return includes. Ad discover 2290 form due dates for heavy use vehicles placed into service. Get ready for tax season deadlines by completing any required tax forms today. Web use schedule f (form 1040) to report farm income and expenses.

Web All Individual Taxpayers Who Mail Form 9465 Separate From Their Returns And Who Do Not File A Form 1040 With Schedule (S) C, E, Or F, Should Mail Their Form 9465 To.

You can download or print. Web go to www.irs.gov/schedulef for instructions and the latest information. Taxpayers must disclose any foreign assets or. Get ready for tax season deadlines by completing any required tax forms today.

For Optimal Functionality, Save The Form To Your Computer Before Completing Or.

Web creating schedule f. Web the golden eagles schedule includes opponents, date, time, and tv. The due date (with extensions) for filing the donor's. Complete, edit or print tax forms instantly.

• Txp Bank Project Is Offered For Withholding Tax, Declaration Of Estimated.

Web among the various components of tax return filing, schedule fa often emerges as the tougher nut to crack. 14 name of proprietor social security number. Ad free shipping on qualified orders. Web 2022 instructions for schedule f profit or loss use schedule f (form 1040) to report farm income and expenses.