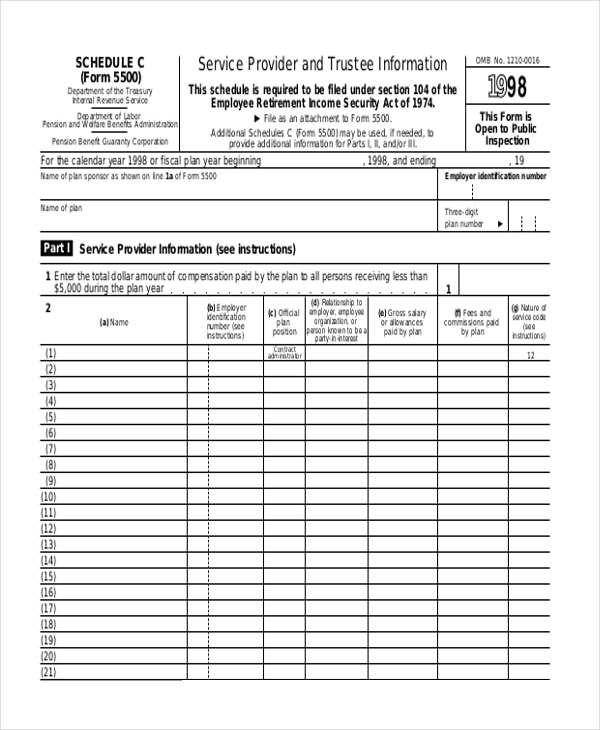

Schedule C Form 5500

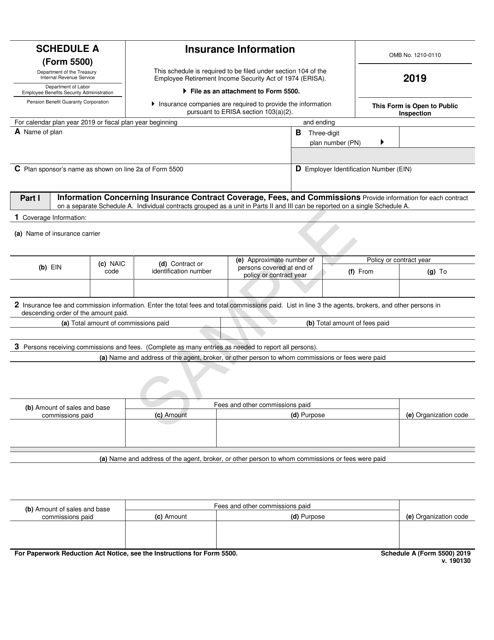

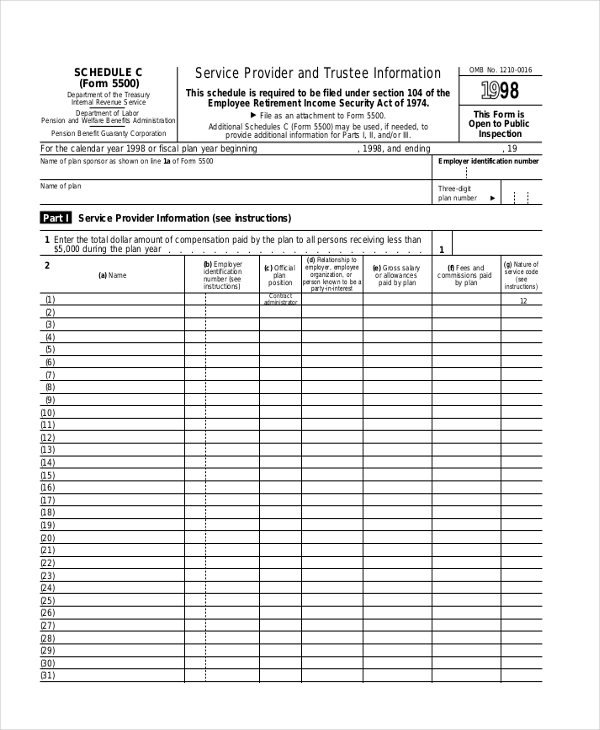

Schedule C Form 5500 - Information on other service providers receiving direct or indirect compensation. Web schedule c (form 5500) 1995 page 2 enter the name and address of all trustees who served during the plan year. Eligible indirect compensation disclosure guide. This is effective for plan. This form is open to public inspection. Is this reported in the form 5500? Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report, any “direct” and. Web file as an attachment to form 5500. It contains information regarding eligible indirect compensation received by vanguard and others from. Web schedule c (form 5500) 2019 v.

It contains information regarding eligible indirect compensation received by vanguard and others from. No, neither the aetna administrative fees nor commissions to brokers are reported since the. Web form 5500 schedule c: Web completing form 5500 schedule c (service provider information). Web aetna sends a schedule c. For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than $5,000. Web schedule c (form 5500) service provider and trustee information omb no. Web schedule c provides details on the fees associated with the plan and is typically only provided in the event the reportable fees exceed $5,000. In this issue brief, we will briefly discuss. If more trustee informationspace is required to supply this.

It contains information regarding eligible indirect compensation received by vanguard and others from. If more trustee informationspace is required to supply this. This guide is designed to help plan sponsors complete form 5500 schedule c (service. Web aetna sends a schedule c. For calendar plan year 2022 or fiscal plan year beginning and ending. Web schedule c (form 5500) 1995 page 2 enter the name and address of all trustees who served during the plan year. For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than $5,000. Eligible indirect compensation disclosure guide. In this issue brief, we will briefly discuss. Web schedule c provides details on the fees associated with the plan and is typically only provided in the event the reportable fees exceed $5,000.

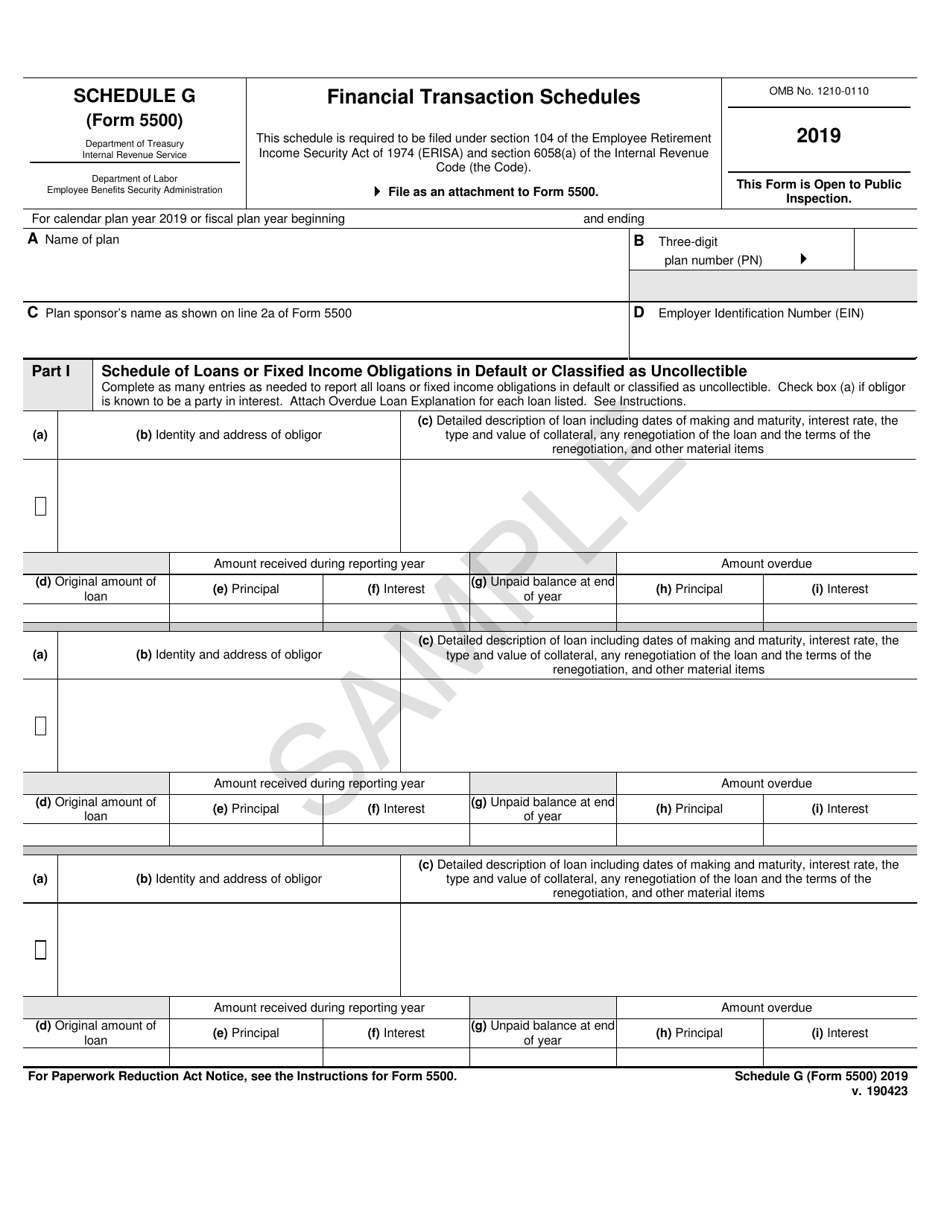

IRS Form 5500 Schedule G Download Fillable PDF or Fill Online Financial

Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report, any “direct” and. This form is open to public inspection. Web what is form 5500 schedule c? Top 1⁄ 2, center sides. Web schedule c (form 5500) 1995 page 2 enter the name.

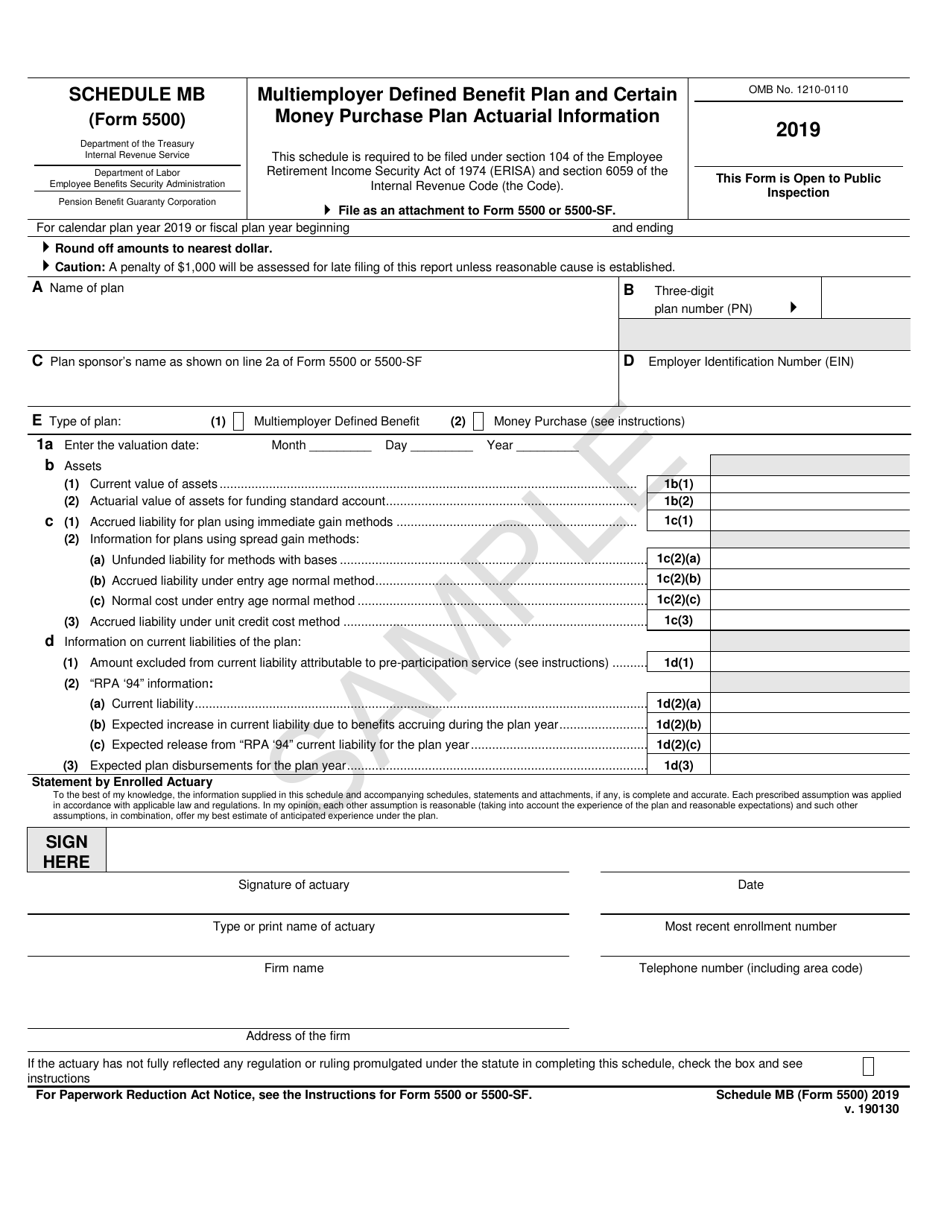

IRS Form 5500 Schedule MB Download Fillable PDF or Fill Online

No, neither the aetna administrative fees nor commissions to brokers are reported since the. Web schedule c (form 5500) service provider and trustee information omb no. It contains information regarding eligible indirect compensation received by vanguard and others from. Web schedule c (form 5500) 2019 v. This form is open to public inspection.

FREE 9+ Sample Schedule C Forms in PDF MS Word

If more trustee informationspace is required to supply this. Web what is form 5500 schedule c? It contains information regarding eligible indirect compensation received by vanguard and others from. If more trustee informationspace is required to supply this. Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected.

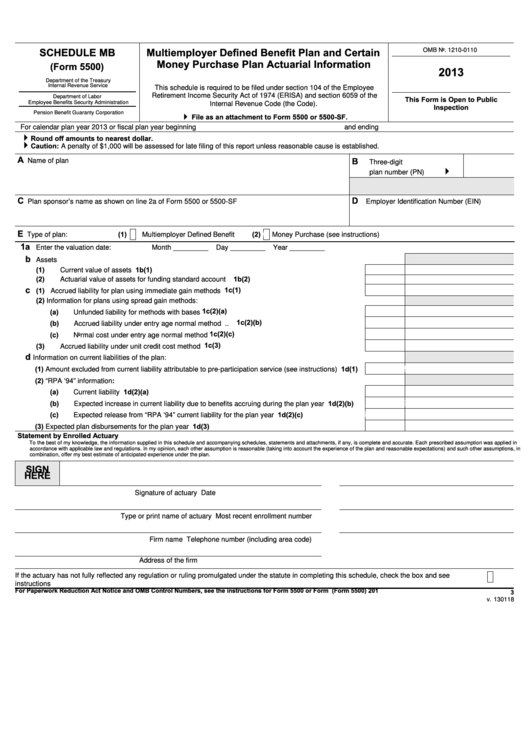

Schedule Mb (Form 5500) Multiemployer Defined Benefit Plan And

Web what is form 5500 schedule c? In this issue brief, we will briefly discuss. Web form 5500 schedule c eligible indirect compensation disclosure guide this guide is being provided to assist plan administrators (usually the plan sponsor) in completing form. Is this reported in the form 5500? Web the 2009 form 5500 instructions provide that persons who provide investment.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web form 5500 schedule c: Web schedule c (form 5500) service provider and trustee information omb no. It contains information regarding eligible indirect compensation received by vanguard and others from. In this issue brief, we will briefly discuss. The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation.

5500 and Schedule C

This form is open to public inspection. Top 1⁄ 2, center sides. Web what is form 5500 schedule c? If more trustee informationspace is required to supply this. Web schedules a & c are attached to form 5500 and used to report insurance and service provider information, respectively.

IRS Form 5500 Schedule A Download Fillable PDF or Fill Online Insurance

The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Web form 5500 schedule c eligible indirect compensation disclosure guide this guide is being provided to assist plan administrators (usually the plan sponsor) in completing form. Web form 5500 schedule c: Web the schedule c instructions state that “eligible indirect compensation”.

PPT Form 5500 Schedule C Why is it not the correct way to compare

Except for those persons for whom you. Web aetna sends a schedule c. Web schedule c (form 5500) 1997 page 2 enter the name and address of all trustees who served during the plan year. Web completing form 5500 schedule c (service provider information). It contains information regarding eligible indirect compensation received by vanguard and others from.

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Web schedules a & c are attached to form 5500 and used to report insurance and service provider information, respectively. Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report, any “direct” and. If more trustee informationspace is required to supply this. Web.

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Web schedule c (form 5500) service provider and trustee information omb no. Web aetna sends a schedule c. Web schedule c (form 5500), page 3 of 4 (page 4 is blank) margins: Top 1⁄ 2, center sides. Information on other service providers receiving direct or indirect compensation.

Web Schedule C (Form 5500) 1997 Page 2 Enter The Name And Address Of All Trustees Who Served During The Plan Year.

Web schedule c (form 5500), page 3 of 4 (page 4 is blank) margins: Web form 5500 schedule c eligible indirect compensation disclosure guide this guide is being provided to assist plan administrators (usually the plan sponsor) in completing form. Web schedule c (form 5500) service provider and trustee information omb no. Top 1⁄ 2, center sides.

Eligible Indirect Compensation Disclosure Guide.

Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report, any “direct” and. If more trustee informationspace is required to supply this. The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. It contains information regarding eligible indirect compensation received by vanguard and others from.

In This Issue Brief, We Will Briefly Discuss.

Web form 5500 schedule c: If more trustee informationspace is required to supply this. Web what is form 5500 schedule c? This guide is designed to help plan sponsors complete form 5500 schedule c (service.

Is This Reported In The Form 5500?

No, neither the aetna administrative fees nor commissions to brokers are reported since the. Web schedule c provides details on the fees associated with the plan and is typically only provided in the event the reportable fees exceed $5,000. Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the. Web aetna sends a schedule c.