Schedule 8812 Form 2022

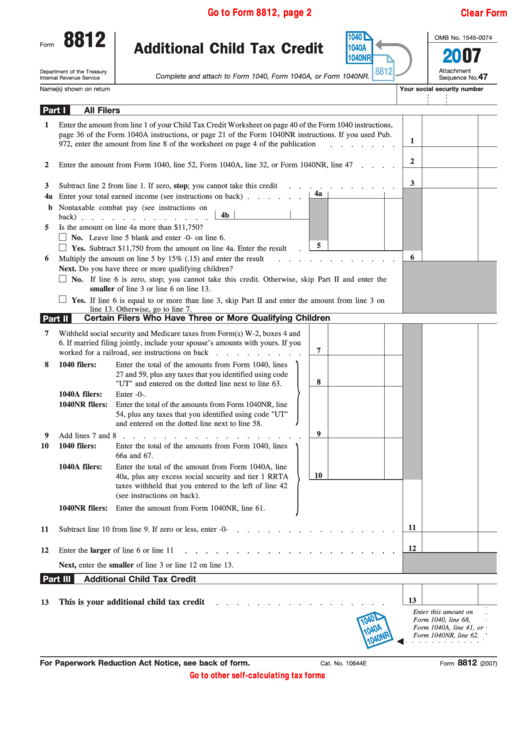

Schedule 8812 Form 2022 - If you file form 2555, stop here; Child tax credit and credit for other dependents. In part i, you'll enter information from your form. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. Form 1040 (first 2 pages) is processed as a. Web we last updated federal 1040 (schedule 8812) in december 2022 from the federal internal revenue service. Web 🚧 schedule 8812 the form type a_1040_schedule_8812_2022 supports data capture from the irs 1040 schedule 8812 only. Web for 2022, there are two parts to this form: Complete, edit or print tax forms instantly. Irs instructions for form 8812.

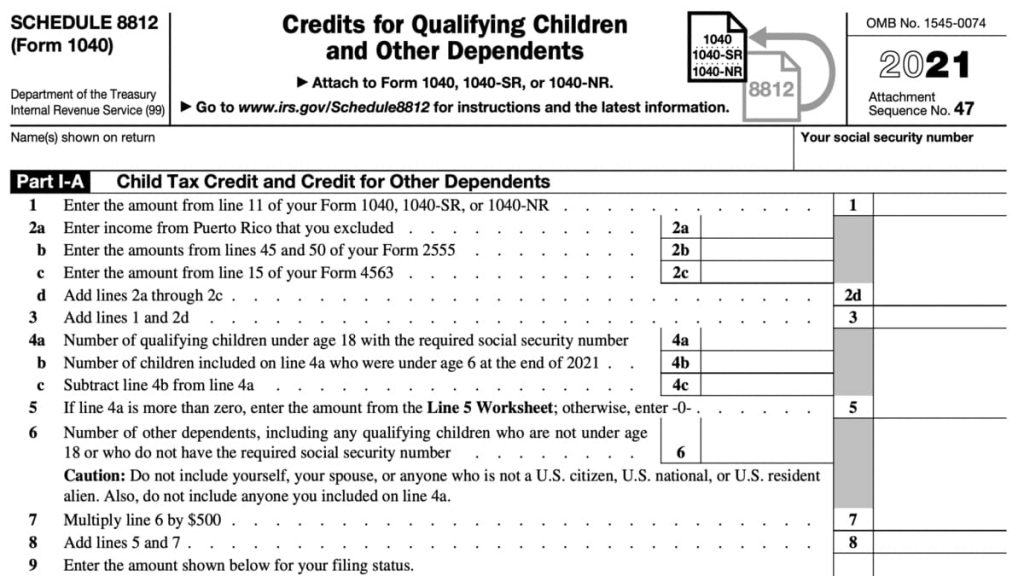

Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. Web 8812 name(s) shown on return your social security number part i all filers caution: Web we last updated federal 1040 (schedule 8812) in december 2022 from the federal internal revenue service. In part i, you'll enter information from your form. If you file form 2555, stop here; Web solved • by turbotax • 3264 • updated january 25, 2023. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Web for tax year 2021 only: Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022.

Should be completed by all filers to claim the basic child tax credit. Form 1040 (first 2 pages) is processed as a. You can download or print current or. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web solved • by turbotax • 3264 • updated january 25, 2023. Complete, edit or print tax forms instantly. If you file form 2555, stop here; Web for 2022, there are two parts to this form: Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax.

8812 Worksheet

I discuss the 3,600 and 3,000 child tax credit. You cannot claim the additional child tax credit. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule.

2022 Form IRS 1040 Schedule 8812 Instructions Fill Online, Printable

If you file form 2555, stop here; Ad access irs tax forms. Irs instructions for form 8812. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the.

Schedule 8812 Instructions for Credits for Qualifying Children and

You can download or print current or. I discuss the 3,600 and 3,000 child tax credit. Complete, edit or print tax forms instantly. Web we last updated federal 1040 (schedule 8812) in december 2022 from the federal internal revenue service. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the.

️Form 8812 Worksheet 2013 Free Download Goodimg.co

If you file form 2555, stop here; Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. You can download or print current or. Web below are answers to.

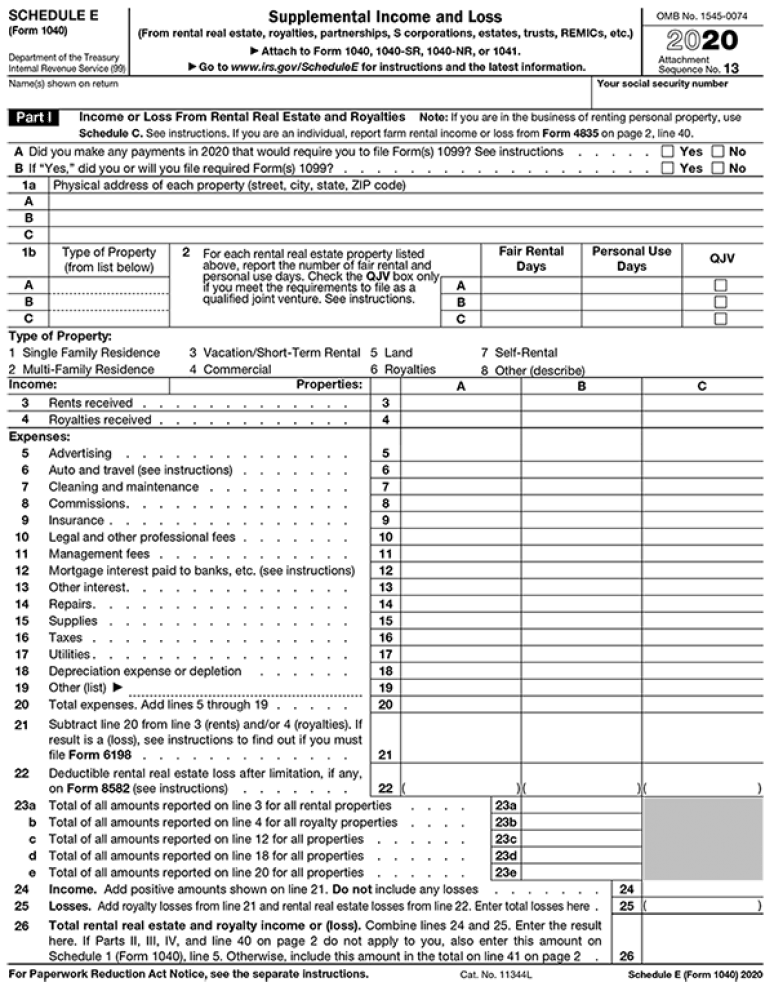

2020 Tax Form Schedule E U.S. Government Bookstore

Choose the correct version of the editable pdf. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax. Web solved • by turbotax • 3264 • updated january 25, 2023. You cannot claim the additional child tax credit. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of.

Download Instructions for IRS Form 1040 Schedule 8812 Additional Child

In part i, you'll enter information from your form. Claim your child tax credit along with your other credits for. Web for tax year 2021 only: I discuss the 3,600 and 3,000 child tax credit. This form is for income earned in tax year 2022, with tax returns due.

Schedule 8812 Credit Limit Worksheet A

Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Irs instructions for form 8812. I discuss the 3,600 and 3,000 child tax credit. This form is for income earned in tax year 2022, with tax returns due. Child tax credit and credit for other dependents.

Top 8 Form 8812 Templates free to download in PDF format

Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. You cannot claim the additional child tax credit. Web for tax year 2021 only: Child tax credit and credit for other dependents. In part i, you'll enter information from your form.

What Is The Credit Limit Worksheet A For Form 8812

Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. In part i, you'll enter information from your form. Child tax credit and credit for other dependents. I discuss the 3,600 and 3,000 child tax credit. Complete, edit or print tax forms instantly.

2023 Schedule 3 2022 Online File PDF Schedules TaxUni

Web for tax year 2021 only: Complete, edit or print tax forms instantly. In part i, you'll enter information from your form. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Web we last updated federal 1040 (schedule 8812) in december 2022 from the federal internal revenue.

From July 2021 To December 2021, Taxpayers May Have Received An Advance Payment Of The Child Tax.

Choose the correct version of the editable pdf. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. In part i, you'll enter information from your form. Web solved • by turbotax • 3264 • updated january 25, 2023.

Schedule 8812 (Child Tax Credit) Is Used To Claim The Child Tax Credit (Ctc), Credit For Other Dependents.

You can download or print current or. Complete, edit or print tax forms instantly. Irs instructions for form 8812. I discuss the 3,600 and 3,000 child tax credit.

If You File Form 2555, Stop Here;

Should be completed by all filers to claim the basic child tax credit. This form is for income earned in tax year 2022, with tax returns due. Form 1040 (first 2 pages) is processed as a. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to.

Web For Tax Year 2021 Only:

Web 8812 name(s) shown on return your social security number part i all filers caution: Web for 2022, there are two parts to this form: Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. You cannot claim the additional child tax credit.