Rental Unit Business Tax Exemption Form

Rental Unit Business Tax Exemption Form - Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease. Web typically, rent can be deducted as a business expense when the rent is for property the taxpayer uses for the business. 159 the leasing of apartments and the operation of a dining hall by an exempt organization constitute unrelated trades or businesses where. Tangible property purchased to be given away or donated. Web your property, or one portion of, may be eligible for exemption from and rental unit business taxation. Business provides lodging and food. Web your property, or a serve including, may be eligibility for exemption from the rental unit business tax. You must include $10,000 in your income in the first. 11/15) this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as sellers. Web available for rent or lease, the rental unit business tax applies.

The tax is imposed annually upon anyone who owns, operates, or manages the rental of any residential real estate. Tangible property purchased to be given away or donated. This includes fuel for which the motor fuel tax (road tax) has been refunded to you. The days of frightening complex tax and legal forms are over. The ordinance says the following, however it isn’t been enforced: Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease. 11/15) this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as sellers. Exemptions represent a legislative decision that a taxable item. Web rental unit business tax is imposed annually upon anyone who owns, operates, or manages the rental of residential real estate located within the city of san diego. Here are some things small business.

Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web rental unit business tax general information. The days of frightening complex tax and legal forms are over. For eligibility, please pertain to that exemption form. This includes fuel for which the motor fuel tax (road tax) has been refunded to you. Web rental businesses must be registered and licensed to do business in kansas city, missouri. Web rental unit business tax is imposed annually upon anyone who owns, operates, or manages the rental of residential real estate located within the city of san diego. Web typically, rent can be deducted as a business expense when the rent is for property the taxpayer uses for the business. Exemptions are specific provisions of law eliminating the tax due on an item ordinarily subject to tax. Web your property, or one portion of, may be eligible for exemption from and rental unit business taxation.

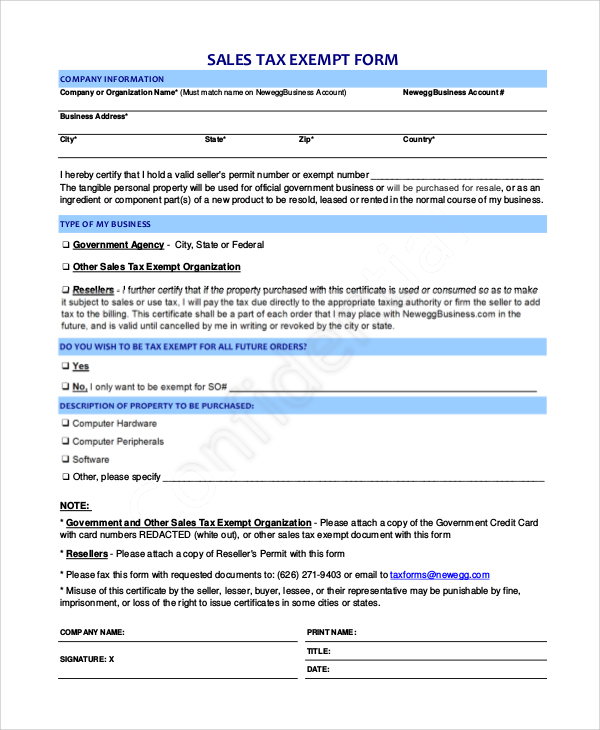

FREE 10+ Sample Tax Exemption Forms in PDF

The ordinance says the following, however it isn’t been enforced: This includes fuel for which the motor fuel tax (road tax) has been refunded to you. Web rental businesses must be registered and licensed to do business in kansas city, missouri. You must include $10,000 in your income in the first. Tangible property purchased to be given away or donated.

Mismanaged idle SSS assets justifies tax exemption, says BMP The

Here are some things small business. 159 the leasing of apartments and the operation of a dining hall by an exempt organization constitute unrelated trades or businesses where. The tax is imposed annually upon anyone who owns, operates, or manages the rental of any residential real estate. Web follow the simple instructions below: Business provides lodging and food.

California Tax Exempt Certificate Fill Online, Printable, Fillable

Web rental businesses must be registered and licensed to do business in kansas city, missouri. Web rental unit business tax general information. The tax is imposed annually upon anyone who owns, operates, or manages the rental of any residential real estate. The days of frightening complex tax and legal forms are over. This includes fuel for which the motor fuel.

REV571 Schedule CSB Small Business Exemption Free Download

Tangible property purchased to be given away or donated. Web available for rent or lease, the rental unit business tax applies. 159 the leasing of apartments and the operation of a dining hall by an exempt organization constitute unrelated trades or businesses where. Web your property, or a serve including, may be eligibility for exemption from the rental unit business.

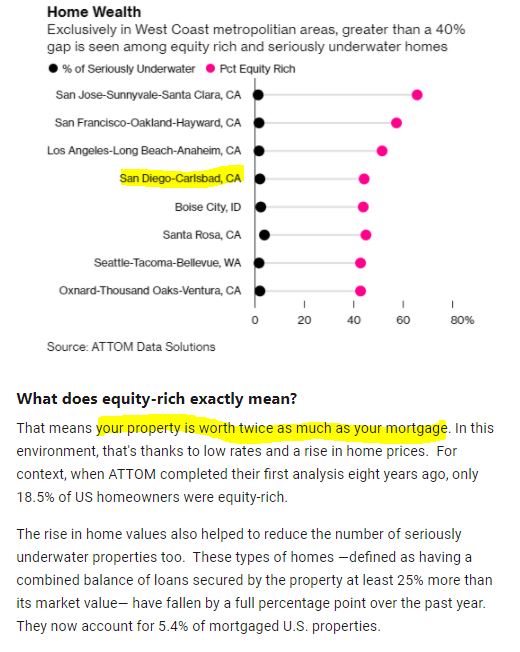

Property Tax Exemption San Diego PRORFETY

Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease. 159 the leasing of apartments and the operation of a.

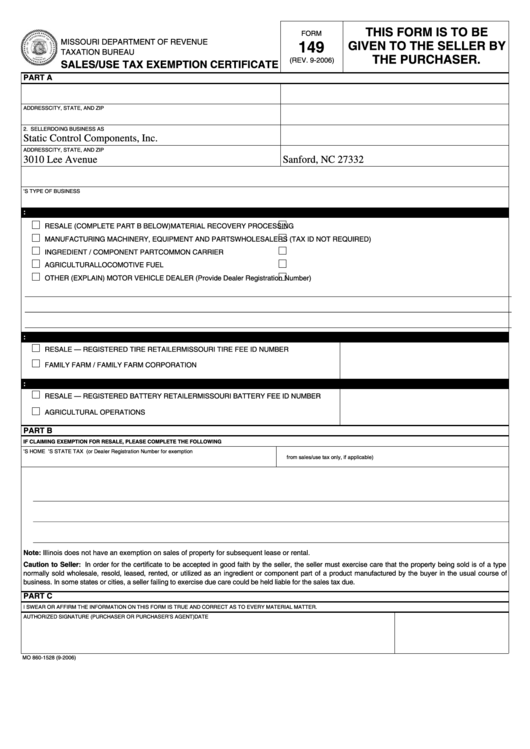

Fillable Form 149, 2006, Sales/use Tax Exemption Certificate printable

Web your property, or a serve including, may be eligibility for exemption from the rental unit business tax. Exemptions represent a legislative decision that a taxable item. Web follow the simple instructions below: The days of frightening complex tax and legal forms are over. The tax is imposed annually upon anyone who owns, operates, or manages the rental of any.

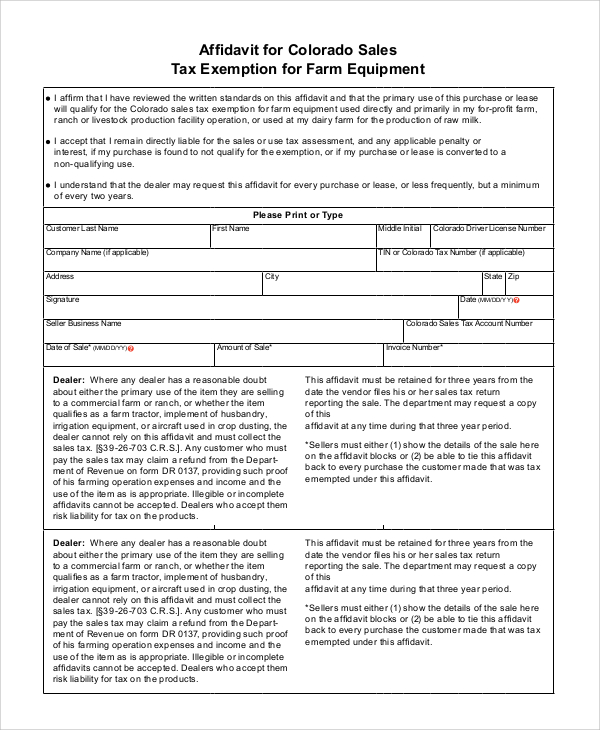

How to get a Sales Tax Exemption Certificate in Colorado

Web your property, or a serve including, may be eligibility for exemption from the rental unit business tax. Web typically, rent can be deducted as a business expense when the rent is for property the taxpayer uses for the business. 11/15) this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and.

How To Qualify For Business Tax Exemption Armando Friend's Template

Here are some things small business. Business provides lodging and food. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. This includes fuel for which the motor fuel tax (road tax) has been refunded to you. Exemptions represent a legislative decision that a.

How To Qualify For Business Tax Exemption Armando Friend's Template

Business provides lodging and food. Exemptions represent a legislative decision that a taxable item. For eligibility, please pertain to that exemption form. The days of frightening complex tax and legal forms are over. You must include $10,000 in your income in the first.

Exemption Certificate Format Master of Documents

Web typically, rent can be deducted as a business expense when the rent is for property the taxpayer uses for the business. Web airbnb / short term rental regulation summary. Web rental businesses must be registered and licensed to do business in kansas city, missouri. For eligibility, charm recommendation to the exemption form. Web in the first year, you receive.

Web Rental Businesses Must Be Registered And Licensed To Do Business In Kansas City, Missouri.

Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease. Web the department of revenue has issued an exemption certificate to each and every tax exempt entity that contains the exempt entity’s name, address and exemption number. Web rental unit business tax general information. Web airbnb / short term rental regulation summary.

Business Provides Lodging And Food.

This includes fuel for which the motor fuel tax (road tax) has been refunded to you. Web typically, rent can be deducted as a business expense when the rent is for property the taxpayer uses for the business. 159 the leasing of apartments and the operation of a dining hall by an exempt organization constitute unrelated trades or businesses where. Web your property, or a serve including, may be eligibility for exemption from the rental unit business tax.

Web Your Property, Or One Portion Of, May Be Eligible For Exemption From And Rental Unit Business Taxation.

11/15) this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as sellers. The ordinance says the following, however it isn’t been enforced: Web follow the simple instructions below: Web rental unit business tax is imposed annually upon anyone who owns, operates, or manages the rental of residential real estate located within the city of san diego.

Web Available For Rent Or Lease, The Rental Unit Business Tax Applies.

Exemptions represent a legislative decision that a taxable item. Here are some things small business. Tangible property purchased to be given away or donated. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax.