Printable Tax Extension Form

Printable Tax Extension Form - Can't file your income taxes by today? Either a company officer, or a professional firm representing the company, may apply for an eot as follows: To get an automatic extension, fill out form 4868. You can only request for a maximum of 2 months extension from the current due date to submit certificate of residence (cor). Current revision form 4868 pdf recent. Note that you should also pay your tax due. Filing this form gives you until october 15 to file a return. Web the application costs $200. If you are requesting for extension. Web you can get an extension of time to file your tax return by filing form 2350 electronically.

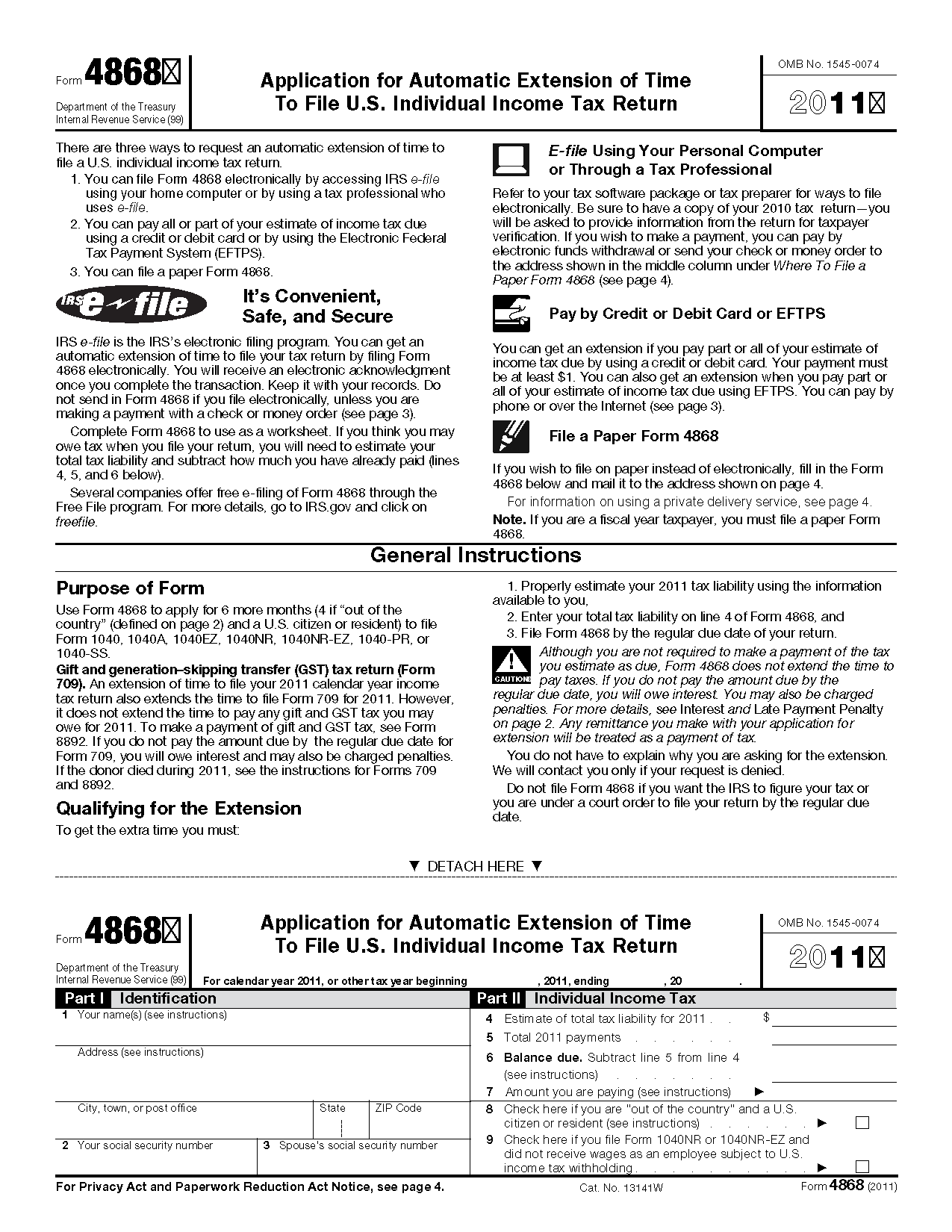

Select ar or/and agm to apply for extension of time. You can find our most popular forms listed here, or refine your search options below. Web all revisions for form 8822. Note that you should also pay your tax due. Web trusted form manager of the singapore government Web 5 rows we last updated federal form 4868 in december 2022 from the federal internal revenue service. Filing this form gives you until october 15 to file a return. Web the application costs $200. December 2018) department of the treasury internal revenue service. Web all you need to do is submit form 4868.

Citizen or resident files this form to request an automatic extension of time to file a u.s. Application for automatic extension of time to file certain business income tax,. You can find our most popular forms listed here, or refine your search options below. A tax extension gives you six additional months — until october. You will receive an electronic acknowledgment once you complete the transaction. Click on “search”, then search for the vcc that the extension of time is to be applied for. Web all you need to do is submit form 4868. Web trusted form manager of the singapore government Web april 18 is the deadline for submitting your tax return, and it's also the last day to file a free tax extension. You can only request for a maximum of 2 months extension from the current due date to submit certificate of residence (cor).

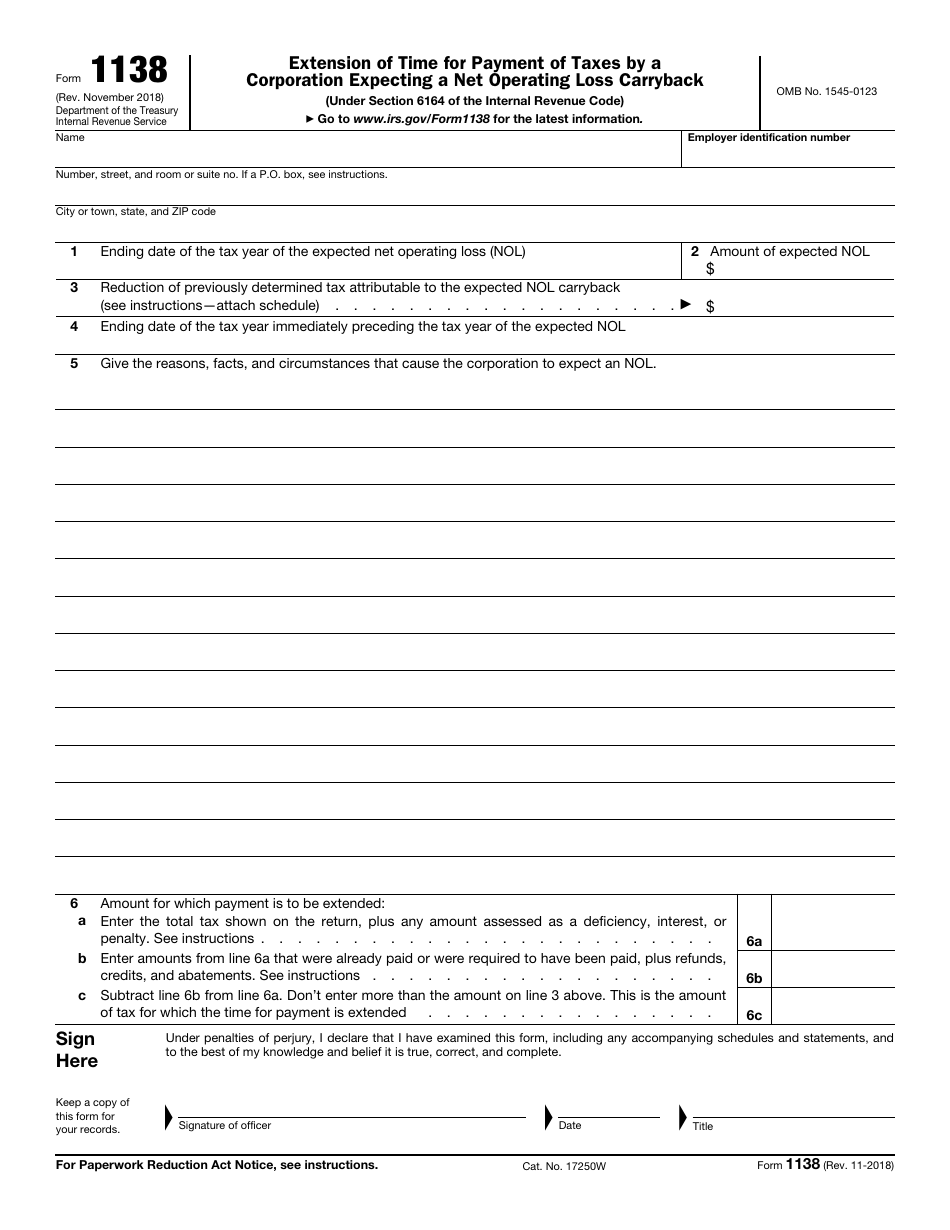

IRS Form 1138 Download Fillable PDF or Fill Online Extension of Time

You can find our most popular forms listed here, or refine your search options below. Either a company officer, or a professional firm representing the company, may apply for an eot as follows: Web april 18 is the deadline for submitting your tax return, and it's also the last day to file a free tax extension. Web if you prefer.

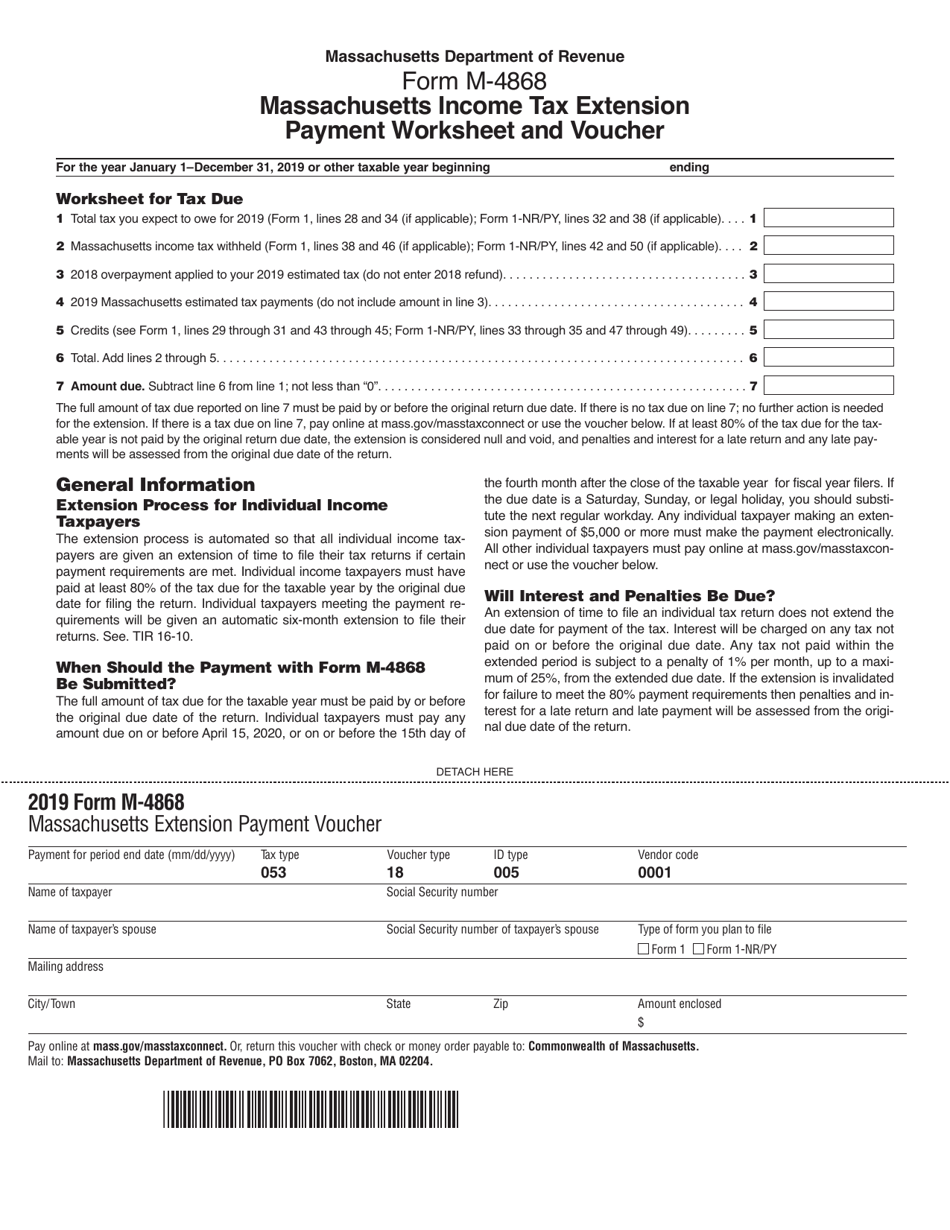

Form M4868 Download Printable PDF or Fill Online Massachusetts

If you are requesting for extension. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868, aka the extension request. Web trusted form manager of the singapore government Web federal tax return extensions | usagov home taxes federal tax return extensions federal tax return.

How to File an Extension for Your SubChapter S Corporation

You can use free file to electronically fill out the tax extension form. Web trusted form manager of the singapore government You can find our most popular forms listed here, or refine your search options below. Current revision form 4868 pdf recent. Make sure you click the ‘apply filter’ or ‘search’ buttons after.

Ms State Tax Form 2022 W4 Form

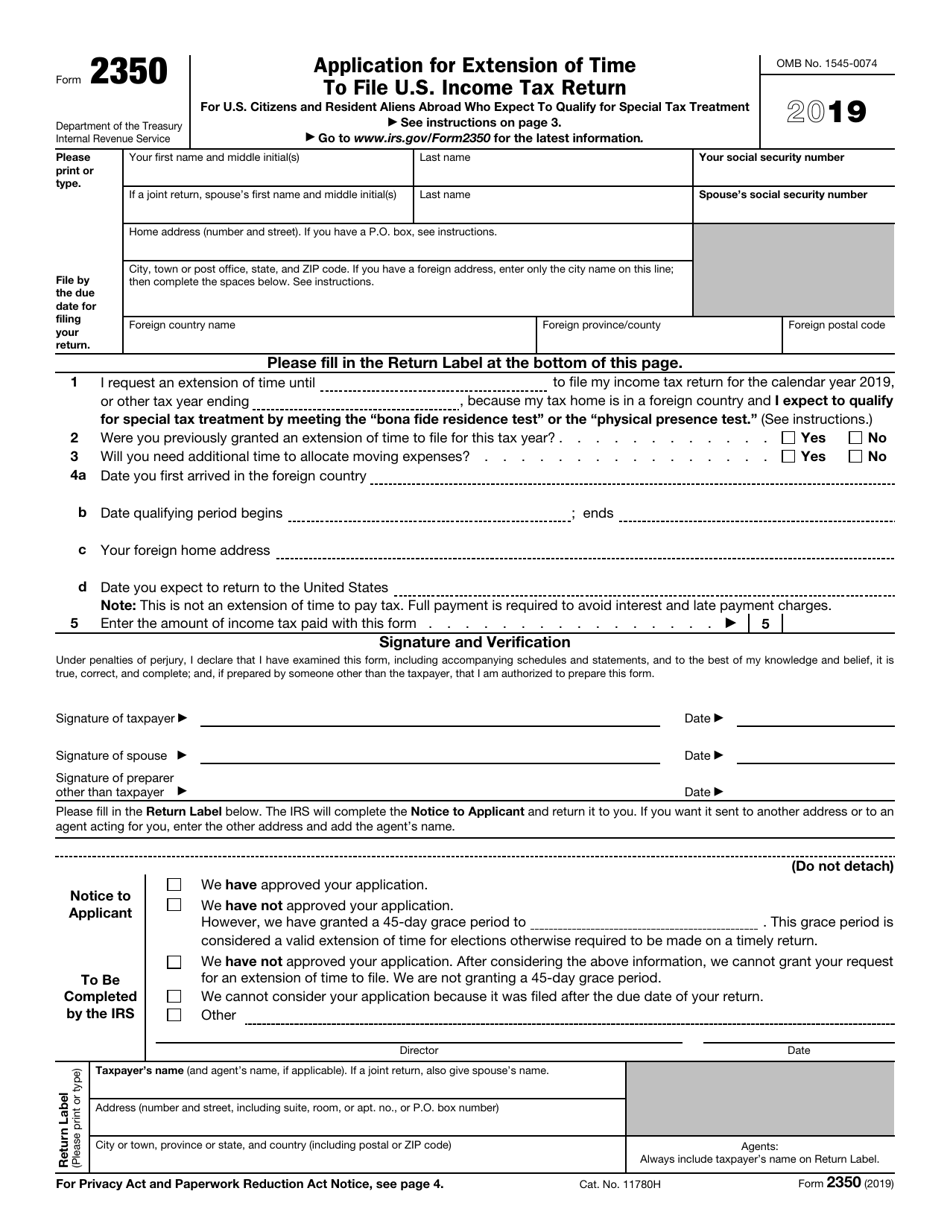

Web the application costs $200. Citizen or resident files this form to request an automatic extension of time to file a u.s. Web 5 rows we last updated federal form 4868 in december 2022 from the federal internal revenue service. Web you can get an extension of time to file your tax return by filing form 2350 electronically. To get.

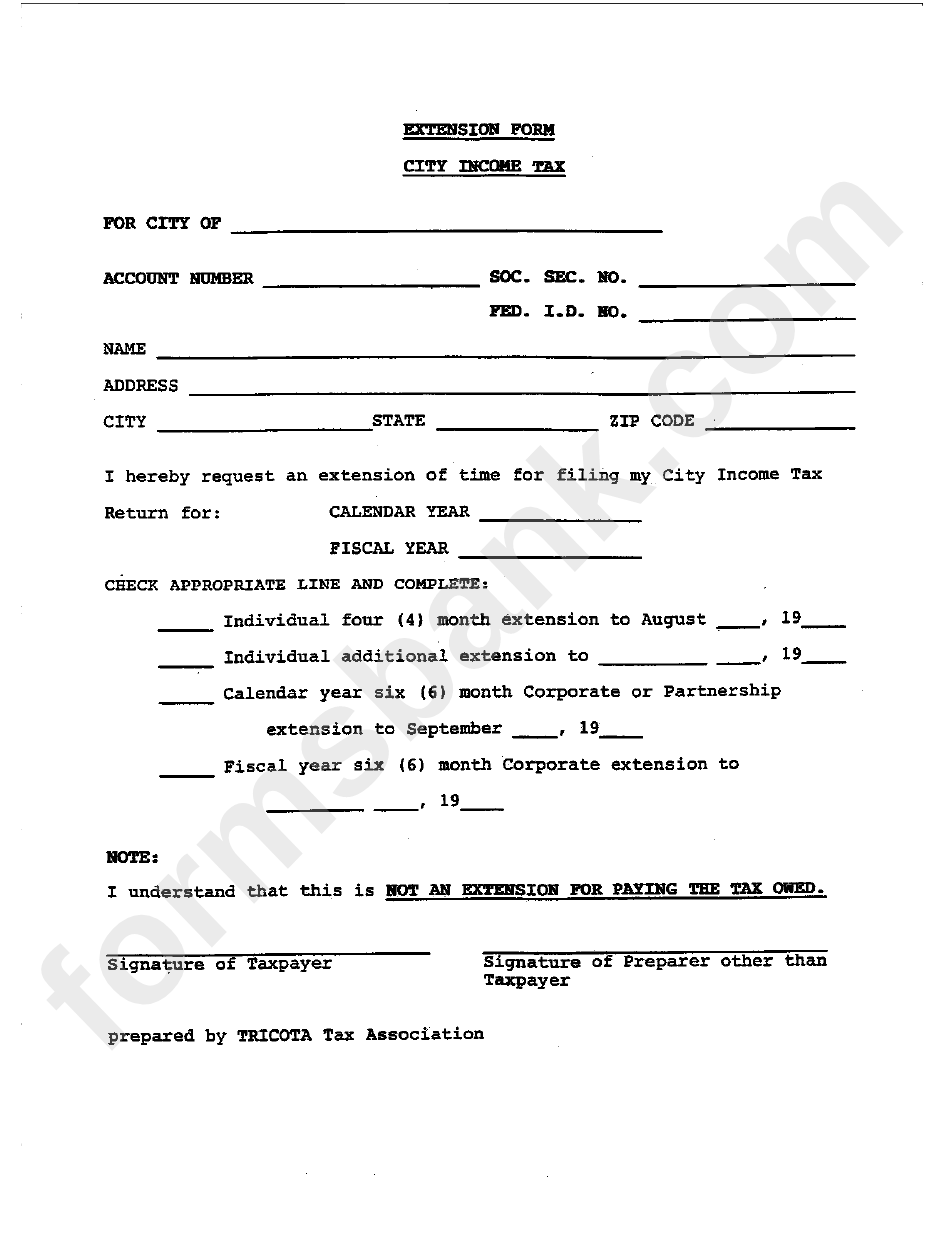

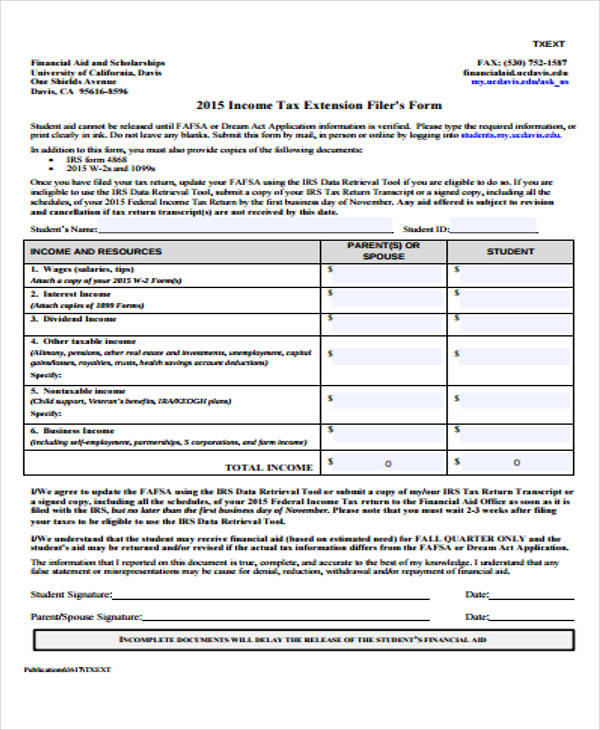

Extension Form Template City Tax printable pdf download

Either a company officer, or a professional firm representing the company, may apply for an eot as follows: Web 5 rows we last updated federal form 4868 in december 2022 from the federal internal revenue service. Web you can get an extension of time to file your tax return by filing form 2350 electronically. Make sure you click the ‘apply.

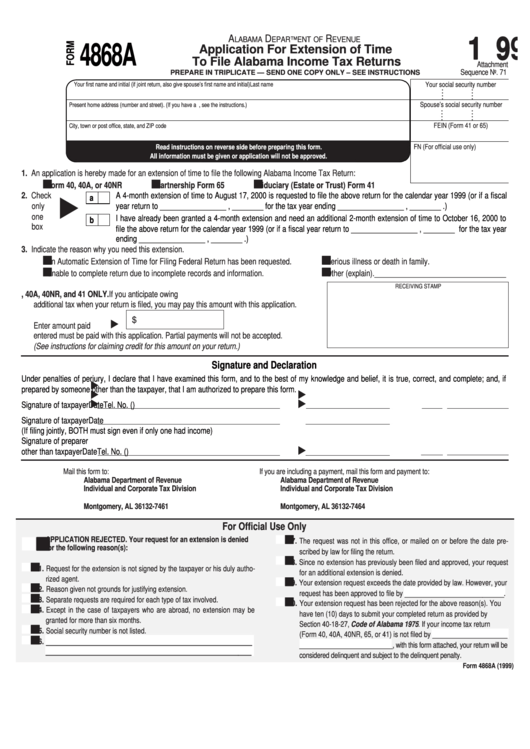

Form 4868a Application For Extension Of Time To File Alabama

Web trusted form manager of the singapore government Web you can get an extension of time to file your tax return by filing form 2350 electronically. Application for automatic extension of time to file certain business income tax,. Citizen or resident files this form to request an automatic extension of time to file a u.s. Filing this form gives you.

Printable Tax Extension Form Printable Form 2022

You will receive an electronic acknowledgment once you complete the transaction. Note that you should also pay your tax due. Filing this form gives you until october 15 to file a return. If you are requesting for extension. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete.

IRS 1040 Extension Form 2021 Tax Forms 1040 Printable

Click on “search”, then search for the vcc that the extension of time is to be applied for. A tax extension gives you six additional months — until october. You will receive an electronic acknowledgment once you complete the transaction. Citizen or resident files this form to request an automatic extension of time to file a u.s. Either a company.

IRS Form 2350 Download Fillable PDF or Fill Online Application for

Web all you need to do is submit form 4868. Citizen or resident files this form to request an automatic extension of time to file a u.s. Web how do i get a tax extension? Current revision form 4868 pdf recent. Can't file your income taxes by today?

tax extension form 2019 Fill Online, Printable, Fillable Blank irs

Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868, aka the extension request. Application for automatic extension of time to file certain business income tax,. You can find our most popular forms listed here, or refine your search options below. Web how do.

To Get An Automatic Extension, Fill Out Form 4868.

Web trusted form manager of the singapore government Filing this form gives you until october 15 to file a return. Click on “search”, then search for the vcc that the extension of time is to be applied for. Web april 18 is the deadline for submitting your tax return, and it's also the last day to file a free tax extension.

Note That You Should Also Pay Your Tax Due.

Web federal tax return extensions | usagov home taxes federal tax return extensions federal tax return extensions if you need more time to file your tax return,. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868, aka the extension request. Web all revisions for form 8822. Web the application costs $200.

You Can Find Our Most Popular Forms Listed Here, Or Refine Your Search Options Below.

You can use free file to electronically fill out the tax extension form. Select ar or/and agm to apply for extension of time. Citizen or resident files this form to request an automatic extension of time to file a u.s. Application for automatic extension of time to file certain business income tax,.

If You Are Requesting For Extension.

Web 5 rows we last updated federal form 4868 in december 2022 from the federal internal revenue service. You will receive an electronic acknowledgment once you complete the transaction. You can only request for a maximum of 2 months extension from the current due date to submit certificate of residence (cor). Web how do i get a tax extension?