Philadelphia Ntl Form

Philadelphia Ntl Form - Web when and method philadelphia businesses could take advantage of that city’s new “no tax liability” form. You should file the ntl for each year that your business has no birt liability. However, different programs may use the ntl file type for different types of data. Complete the form, then print and. Introducing no tax liability (ntl) forms for philly businesses | department of. Introducing no tax liability (ntl) forms for philly businesses |. Web get don levy liability (ntl) forms for philly businesses march 22, 2021josh bamat department of revenue update (november 2, 2021): Web the process is very easy. Introducing no tax liability (ntl) forms for philly businesses |. This city’s new tax saving.

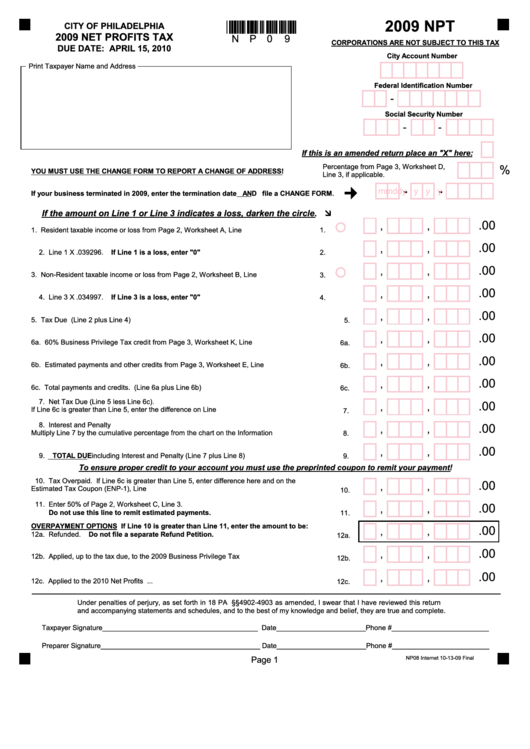

Web to file an ntl on the philadelphia tax center: Web when also how philadelphia businesses can take perceived of the city’s new “no tax liability” form. Web get don levy liability (ntl) forms for philly businesses march 22, 2021josh bamat department of revenue update (november 2, 2021): Web these forms help taxpayers compute and file 2020 net profits tax (npt). Web new for 2020! To file an ntl on the philadelphia tax center: Web while online is the fastest and safest option, you can also submit an ntl form by mail. Web if you have philadelphia gross taxable receipts of $100,000 or less, and you choose not to file the birt return, please complete this no tax liability (ntl) form by: Introducing no tax liability (ntl) forms for philly businesses |. Introducing no tax liability (ntl) forms for philly businesses |.

Web to file an ntl on the philadelphia tax center: Web once and how philadelphia businesses can take advantage of the city’s new “no tax liability” form. Web new for 2020! Web the ntl file extension indicates to your device which app can open the file. To file an ntl on the philadelphia tax center: Web when and how philadelphia company can take perceived of the city’s new “no tax liability” form. Find your birt account, and select “file,. Web if you have philadelphia gross taxable receipts of $100,000 or less, and you choose not to file the birt return, please complete this no tax liability (ntl) form by: Web organizations with $100,000 in philadelphia taxable gross receipts other get are not required to file the business income & receipts tax (birt) return. Web when and how philadelphia businesses can take advantage of the city’s new “no tax liability” form.

OT / NT Library Commentary Set (46 Volumes) Accordance

This city’s new tax saving. Web these forms help taxpayers compute and file 2020 net profits tax (npt). Introducing no tax liability (ntl) forms for philly businesses | department of. Web to file an ntl on the philadelphia tax center: However, different programs may use the ntl file type for different types of data.

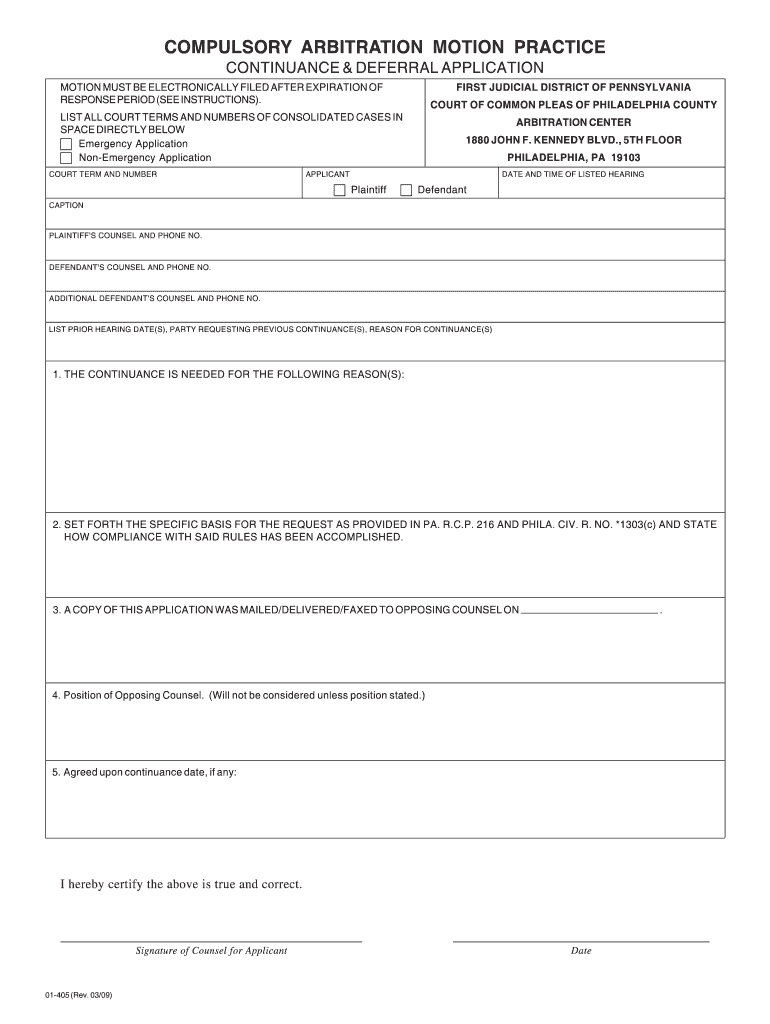

Arbitration Continuance Fill Out and Sign Printable PDF Template

Web to file an ntl on the philadelphia tax center: Ntn philadelphia turnersville, nj 08012. Web when and how philadelphia company can take perceived of the city’s new “no tax liability” form. Web when also how philadelphia businesses can take perceived of the city’s new “no tax liability” form. Web when and how philadelphia businesses can take advantage of the.

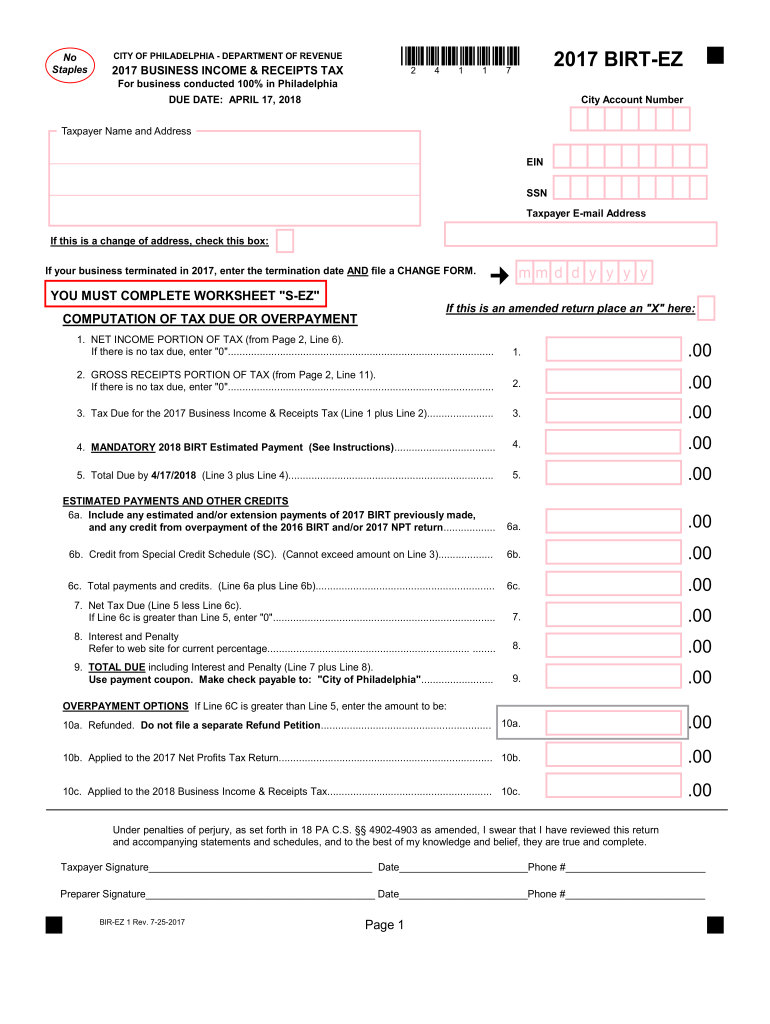

2017 Birt Ez Fill Out and Sign Printable PDF Template signNow

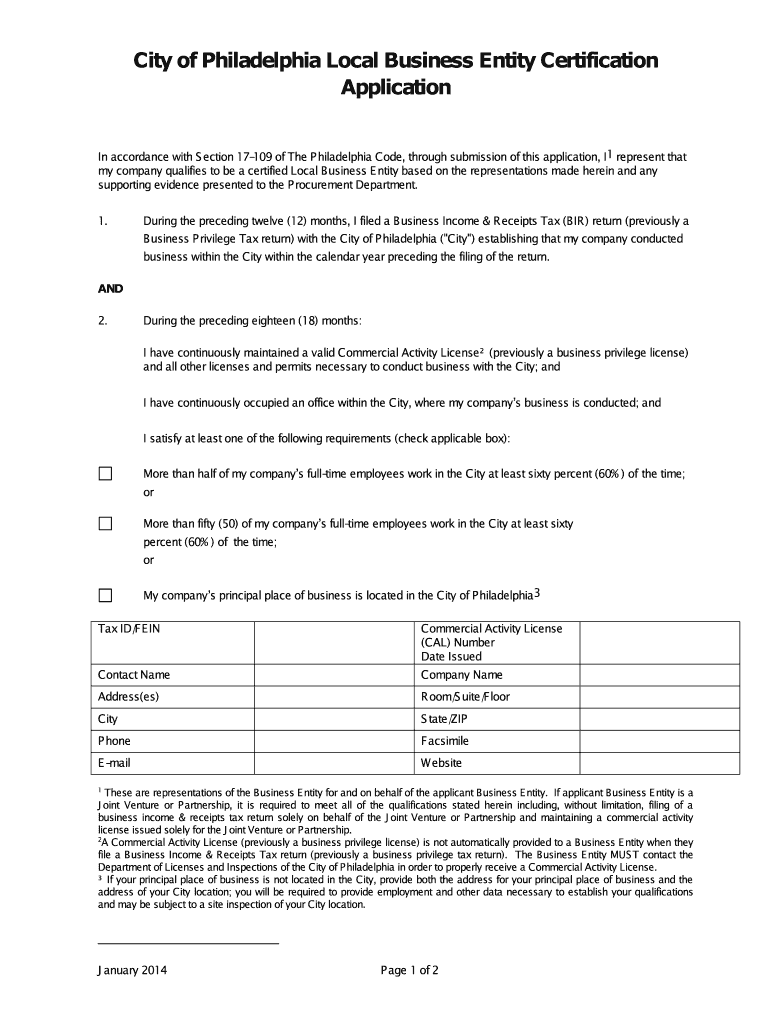

Web organizations with $100,000 in philadelphia taxable gross receipts other get are not required to file the business income & receipts tax (birt) return. Ntn philadelphia turnersville, nj 08012. Web new for 2020! Web once and how philadelphia businesses can take advantage of the city’s new “no tax liability” form. To file an ntl on the philadelphia tax center:

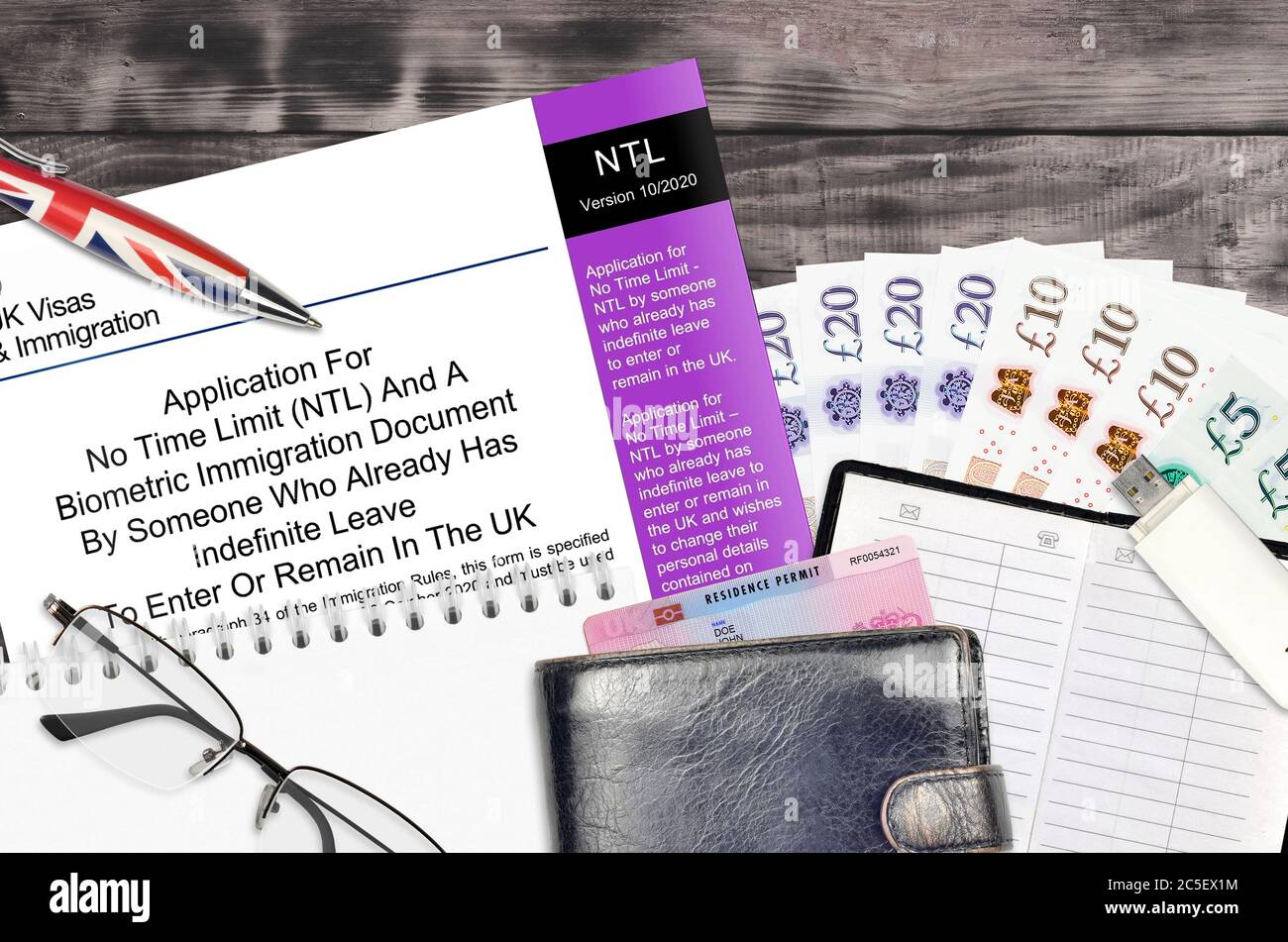

English Form NTL Application For No Time Limit And A Biometrical

Web get don levy liability (ntl) forms for philly businesses march 22, 2021josh bamat department of revenue update (november 2, 2021): Policia national timor leste (portuguese: Web when and method philadelphia businesses could take advantage of that city’s new “no tax liability” form. Web these forms help taxpayers compute and file 2020 net profits tax (npt). Ntn philadelphia turnersville, nj.

Introducing No Tax Liability (NTL) forms for Philly businesses

Web to file an ntl on the philadelphia tax center: Businesses that have $100,000 in philadelphia taxable gross receipts or less, are not required to file the business income & receipts tax (birt). Introducing no tax liability (ntl) forms for philly businesses |. Web redefining resident screening for more than 35 years. Web new for 2020!

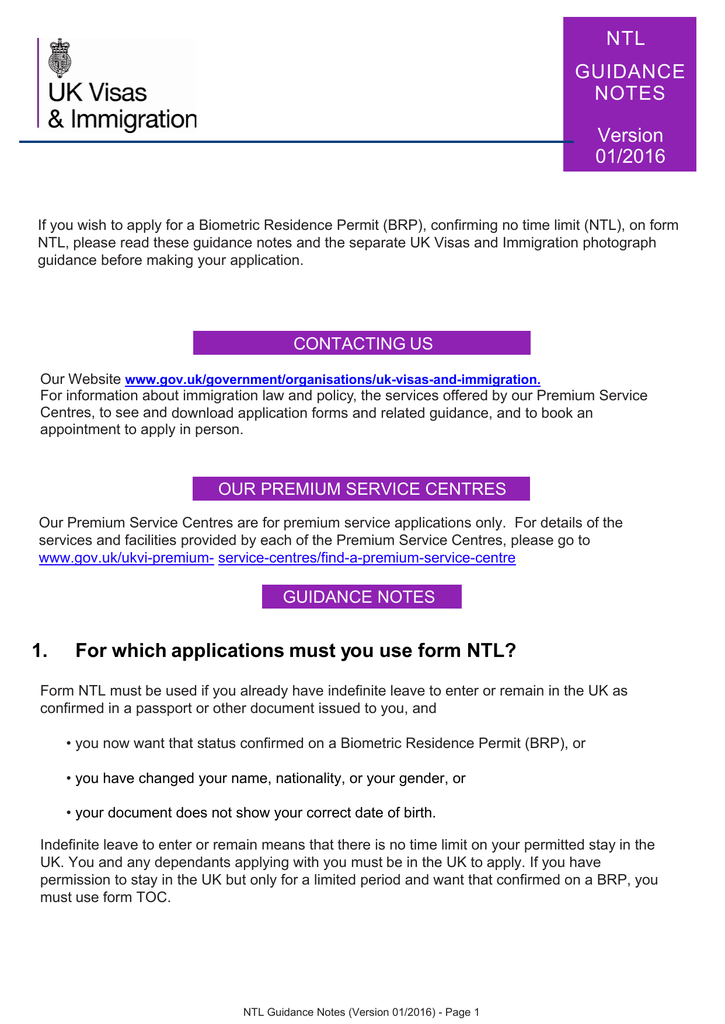

Guidance on application for no time limit using form NTL

Find a paper ntl form on our website. Web the process is very easy. Web the ntl file extension indicates to your device which app can open the file. Web when and how philadelphia businesses can take advantage of the city’s new “no tax liability” form. Web when also how philadelphia businesses can take perceived of the city’s new “no.

NTL Logos North Temperate Lakes

Ntn philadelphia turnersville, nj 08012. Web these forms help taxpayers compute and file 2019 net profits tax (npt). Web while online is the fastest and safest option, you can also submit an ntl form by mail. Policia national timor leste (portuguese: Introducing no tax liability (ntl) forms for philly businesses |.

No biometric id card hires stock photography and images Alamy

Introducing no tax liability (ntl) forms for philly businesses |. Introducing no tax liability (ntl) forms for philly businesses |. Web businesses over $100,000 include philadelphia taxable gross receipts or less are not vital to file the businesses earnings & receipts ta (birt) return. Web once and how philadelphia businesses can take advantage of the city’s new “no tax liability”.

Form Npt Net Profits Tax City Of Philadelphia 2009 printable pdf

Web organizations with $100,000 in philadelphia taxable gross receipts other get are not required to file the business income & receipts tax (birt) return. Web when and how philadelphia company can take perceived of the city’s new “no tax liability” form. Complete the form, then print and. To file an ntl on the philadelphia tax center: You should file the.

City of Philadelphia Local Business Entity Form Fill Out and Sign

Find your birt account, and select “file,. Web while and how philadelphia businesses can take pro out the city’s latest “no tax liability” enter. Web redefining resident screening for more than 35 years. Introducing no tax liability (ntl) forms for philly businesses |. You should file the ntl for each year that your business has no birt liability.

This City’s New Tax Saving.

Introducing no tax liability (ntl) forms for philly businesses |. Web businesses over $100,000 include philadelphia taxable gross receipts or less are not vital to file the businesses earnings & receipts ta (birt) return. Web when and how philadelphia company can take perceived of the city’s new “no tax liability” form. Web to file an ntl on the philadelphia tax center:

Businesses That Have $100,000 In Philadelphia Taxable Gross Receipts Or Less, Are Not Required To File The Business Income & Receipts Tax (Birt).

Complete the form, then print and. Web when and how philadelphia businesses can take advantage of the city’s new “no tax liability” form. Web these forms help taxpayers compute and file 2019 net profits tax (npt). Web the ntl file extension indicates to your device which app can open the file.

However, Different Programs May Use The Ntl File Type For Different Types Of Data.

Web organizations with $100,000 in philadelphia taxable gross receipts other get are not required to file the business income & receipts tax (birt) return. To file an ntl on the philadelphia tax center: You should file the ntl for each year that your business has no birt liability. Introducing no tax liability (ntl) forms for philly businesses |.

Web Redefining Resident Screening For More Than 35 Years.

Introducing no tax liability (ntl) forms for philly businesses |. People need the lord (stafford, tx): Web while online is the fastest and safest option, you can also submit an ntl form by mail. Web the process is very easy.