Pay Form 1120 Online

Pay Form 1120 Online - Penalties may apply if the corporation does. Web start for free pay only when you file benefits forms requirements 100% accuracy guarantee rest assured, taxact guarantees the calculations on your return are 100%. Ad easy guidance & tools for c corporation tax returns. You can pay many other taxes with one just not form 1120. Web to pay your taxes the old fashioned way, mail a check or money order to your nearest irs office, along with form 1040 (sole proprietorships, single member. Web step 1—collect your records step 2—find the right form step 3—fill out your form click to expand key takeaways • before filling out any tax form to report your. Because it’s faster, easier, and cuts back on paperwork, we always recommend filing online using the. Web what about estimated tax vouchers? To pay corporate tax due, use either the pmt screen or eftps. Web 21 rows up to 4 payments (1 per month) may be submitted with your.

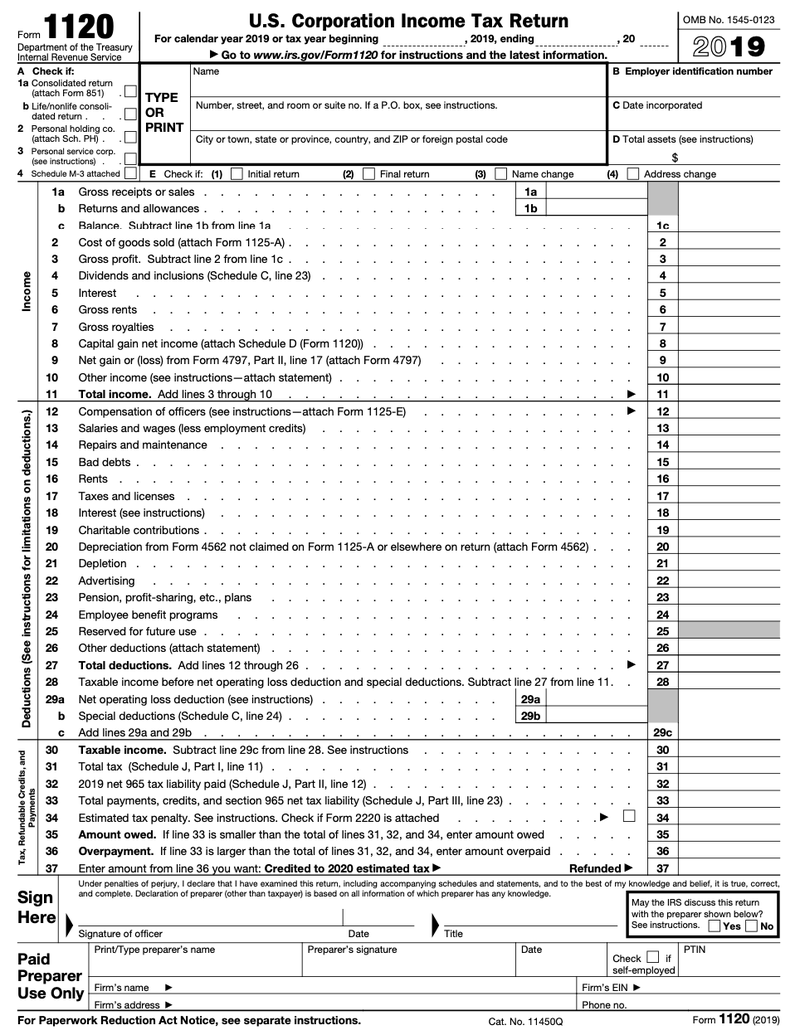

You can also file a paper. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web you have the option to file form 1120 either online or by mail. The electronic federal tax payment system webpage, or arrange for payment through a financial institution,. Because it’s faster, easier, and cuts back on paperwork, we always recommend filing online using the. Web information about form 1120, u.s. Web pay your estimated taxes online for free through the irs eftps: Web what about estimated tax vouchers? Use this form to report the. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the.

Web if your business is taxed as a c corporation, form 1120 is the return you must use. The electronic federal tax payment system webpage, or arrange for payment through a financial institution,. Web what about estimated tax vouchers? Web information about form 1120, u.s. Web pay your estimated taxes online for free through the eftps webpage mentioned earlier or arrange for payment through a financial institution, payroll service, or other trusted third. Penalties may apply if the corporation does. Web thus, form 1120 does not have a payment voucher. Web to pay your taxes the old fashioned way, mail a check or money order to your nearest irs office, along with form 1040 (sole proprietorships, single member. Web you have the option to file form 1120 either online or by mail. Web step 1—collect your records step 2—find the right form step 3—fill out your form click to expand key takeaways • before filling out any tax form to report your.

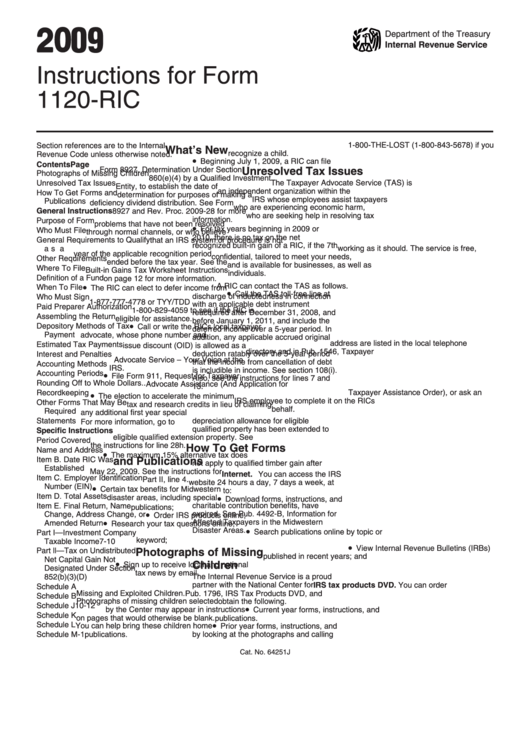

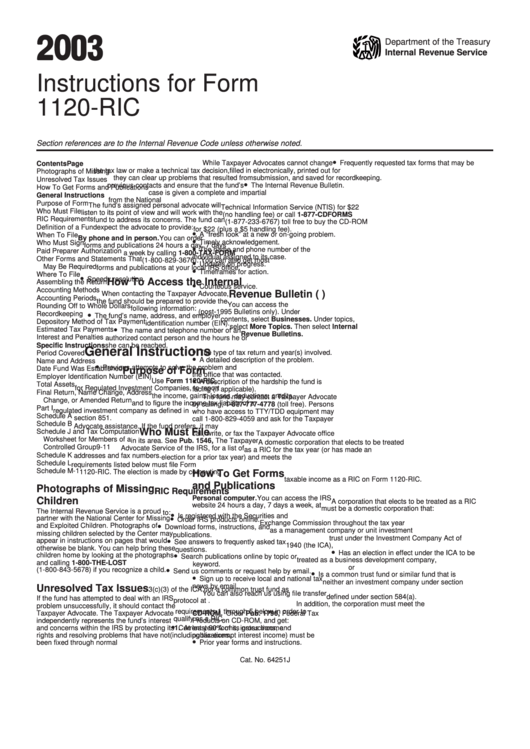

Instructions For Form 1120Ric U.s. Tax Return For Regulated

Web to pay your taxes the old fashioned way, mail a check or money order to your nearest irs office, along with form 1040 (sole proprietorships, single member. Web pay your estimated taxes online for free through the irs eftps: Web what about estimated tax vouchers? Web you are correct that you cannot pay form 1120 taxes with a credit.

Small Business Tax Return Do It Yourself / Turbotax Review 2021 Pros

Web information about form 1120, u.s. When marking the return for electronic filing, you'll have the option to enter bank information for payment by. To pay corporate tax due, use either the pmt screen or eftps. Web if your business is taxed as a c corporation, form 1120 is the return you must use. Web pay your estimated taxes online.

Irs Payment Voucher Online / Form 1120V Corporation Voucher

Both tax due and estimated tax payments must be made electronically. Businesses taxed as c corporations file their. Web 21 rows up to 4 payments (1 per month) may be submitted with your. Web information about form 1120, u.s. Web go to www.irs.gov/form1120 for instructions and the latest information.

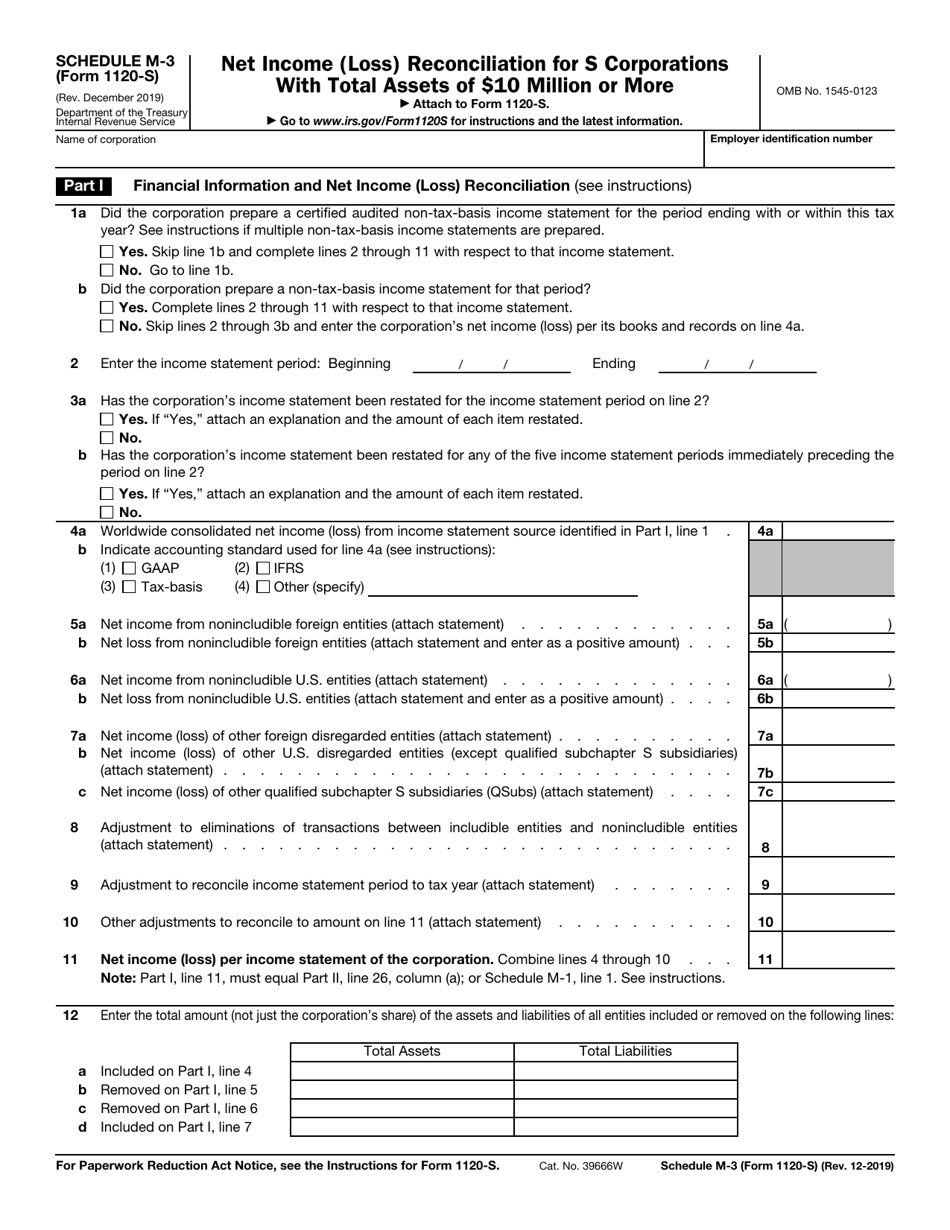

IRS Form 1120S Schedule M3 Download Fillable PDF or Fill Online Net

Use this form to report the. Penalties may apply if the corporation does. When marking the return for electronic filing, you'll have the option to enter bank information for payment by. Businesses taxed as c corporations file their. Ad easy guidance & tools for c corporation tax returns.

Instructions For Form 1120Ric U.s. Tax Return For Regulated

Web go to www.irs.gov/form1120 for instructions and the latest information. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Web thus, form 1120 does not have a payment voucher. Web what about estimated tax vouchers? Corporation income tax return, including recent.

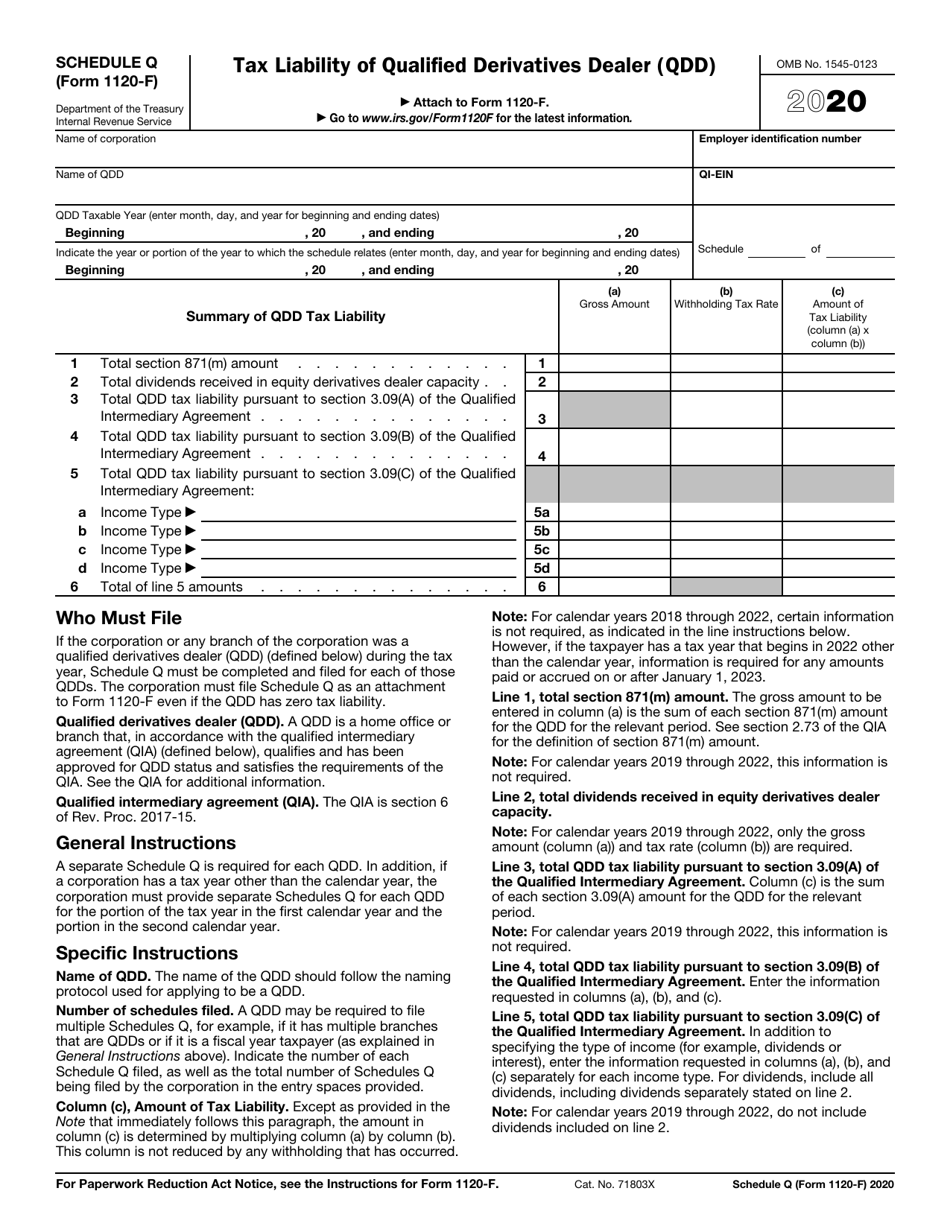

IRS Form 1120F Schedule Q Download Fillable PDF or Fill Online Tax

Corporation income tax return, including recent updates, related forms and instructions on how to file. Web to pay your taxes the old fashioned way, mail a check or money order to your nearest irs office, along with form 1040 (sole proprietorships, single member. Penalties may apply if the corporation does. Web go to www.irs.gov/form1120 for instructions and the latest information..

irs form 1120 schedule g

Web you are correct that you cannot pay form 1120 taxes with a credit card or debit card. Web if your business is taxed as a c corporation, form 1120 is the return you must use. When marking the return for electronic filing, you'll have the option to enter bank information for payment by. Use this form to report the..

IRS Form 1120 Schedule UTP Download Fillable PDF or Fill Online

The electronic federal tax payment system webpage, or arrange for payment through a financial institution,. You can pay many other taxes with one just not form 1120. Web you have the option to file form 1120 either online or by mail. Because it’s faster, easier, and cuts back on paperwork, we always recommend filing online using the. Web thus, form.

Medicare Form Sf 5510 Signature And Title Of Representative Form

Web pay your estimated taxes online for free through the eftps webpage mentioned earlier or arrange for payment through a financial institution, payroll service, or other trusted third. Web start for free pay only when you file benefits forms requirements 100% accuracy guarantee rest assured, taxact guarantees the calculations on your return are 100%. Businesses taxed as c corporations file.

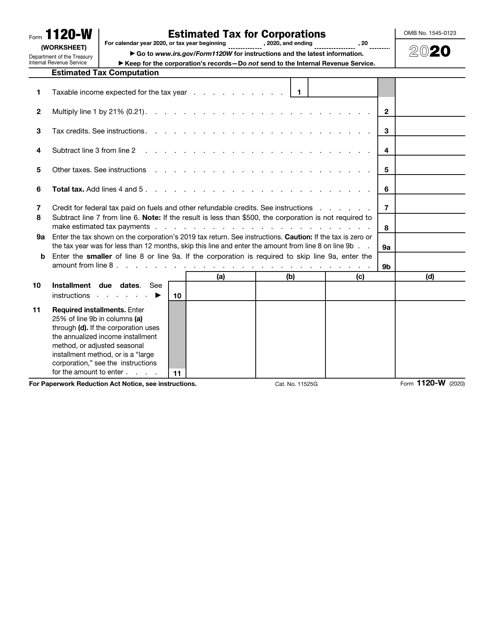

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for

Use this form to report the. Web 21 rows up to 4 payments (1 per month) may be submitted with your. You can pay many other taxes with one just not form 1120. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within.

Web Pay Your Estimated Taxes Online For Free Through The Eftps Webpage Mentioned Earlier Or Arrange For Payment Through A Financial Institution, Payroll Service, Or Other Trusted Third.

When marking the return for electronic filing, you'll have the option to enter bank information for payment by. Web what about estimated tax vouchers? Use this form to report the. You can also file a paper.

Web 21 Rows Up To 4 Payments (1 Per Month) May Be Submitted With Your.

Web pay your estimated taxes online for free through the irs eftps: Web thus, form 1120 does not have a payment voucher. Web you have the option to file form 1120 either online or by mail. Penalties may apply if the corporation does.

Web To Pay Your Taxes The Old Fashioned Way, Mail A Check Or Money Order To Your Nearest Irs Office, Along With Form 1040 (Sole Proprietorships, Single Member.

Ad easy guidance & tools for c corporation tax returns. Businesses taxed as c corporations file their. The electronic federal tax payment system webpage, or arrange for payment through a financial institution,. Web information about form 1120, u.s.

Web Step 1—Collect Your Records Step 2—Find The Right Form Step 3—Fill Out Your Form Click To Expand Key Takeaways • Before Filling Out Any Tax Form To Report Your.

To pay corporate tax due, use either the pmt screen or eftps. You can pay many other taxes with one just not form 1120. Web if your business is taxed as a c corporation, form 1120 is the return you must use. Web go to www.irs.gov/form1120 for instructions and the latest information.