Osu Housing Exemption Form

Osu Housing Exemption Form - Web homestead exemptions provide relief from property taxes by exempting all or a portion of the valuation of the homestead from taxation. Web incoming student room assignments. The exemption applies to certain injured veterans and surviving spouse of those. Web missouri housing development commission attn: Name and location of project staff: Web this form requests information needed to take action on your child support case. Web the seller is required to update their records every five years. 144.030.2 (22) all sales of propane or natural gas, electricity, and diesel. Guests must have stayed at the motel/hotel for more than 31 days (in the calendar quarter). Web out of state organizations applying for a missouri exemption letter must provide a copy of the sales and use tax exemption letter issued to the organization in their home state.

Under the latter option, professional assistance. If you are a custodial parent or custodian of the child(ren), youmust complete an application for each. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web homestead exemptions provide relief from property taxes by exempting all or a portion of the valuation of the homestead from taxation. You may contribute to any. Guests must have stayed at the motel/hotel for more than 31 days (in the calendar quarter). Web oklahoma law creates an exemption for certain veterans from property tax. The exemption applies to certain injured veterans and surviving spouse of those. Web the seller is required to update their records every five years. Jim ebbinger outwest express llc 11535 cedar oak drive

Rental production division 3435 broadway kansas city, mo 64111 re: Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web out of state organizations applying for a missouri exemption letter must provide a copy of the sales and use tax exemption letter issued to the organization in their home state. Web find out where open section 8 waiting lists are and be able to fill out a section 8 application form online for kansas city, missouri when applications are being accepted by the. Web an exemption certificate must be completed in its entirety, and should: The exemption applies to certain injured veterans and surviving spouse of those. Jim ebbinger outwest express llc 11535 cedar oak drive Web there are two ways a guest can qualify for exemption from the tax. 144.030.2 (22) all sales of propane or natural gas, electricity, and diesel. Web 144.030.2 (22) all sales of feed additives mixed with feed for livestock or poultry.

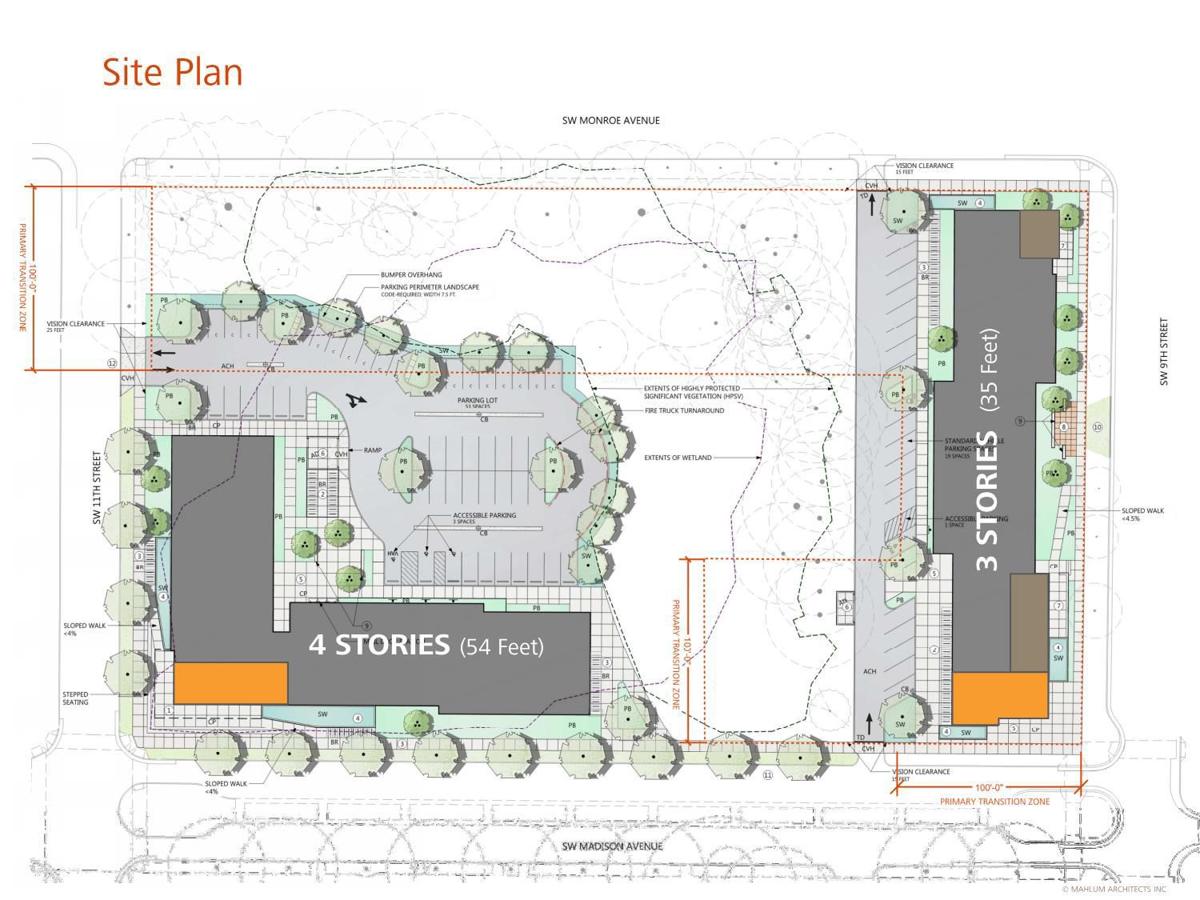

OSU plans new housing in Lower Campus Crime and Courts

Web support the kansas city, mo hope lodge. Web missouri housing development commission attn: Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. You may contribute to any. Web an exemption certificate must be completed in its entirety,.

Housing portal problems OSU housing portal overwhelmed, freshmen

Web the seller is required to update their records every five years. • explain why the sale is exempt, • be dated, • describe the property being purchased unless using form pr. Web support the kansas city, mo hope lodge. Under the latter option, professional assistance. Web legal exemption does not exist, compliance with the law may require.

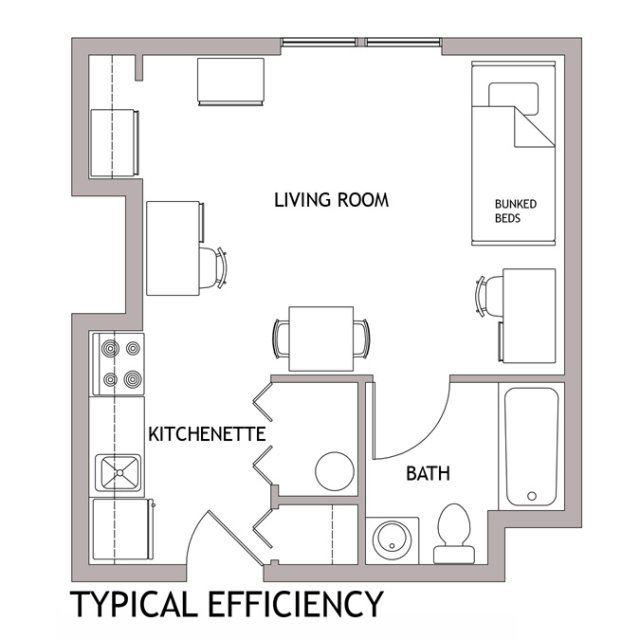

Osu Housing Floor Plan Raney Regional Campuses University Housing

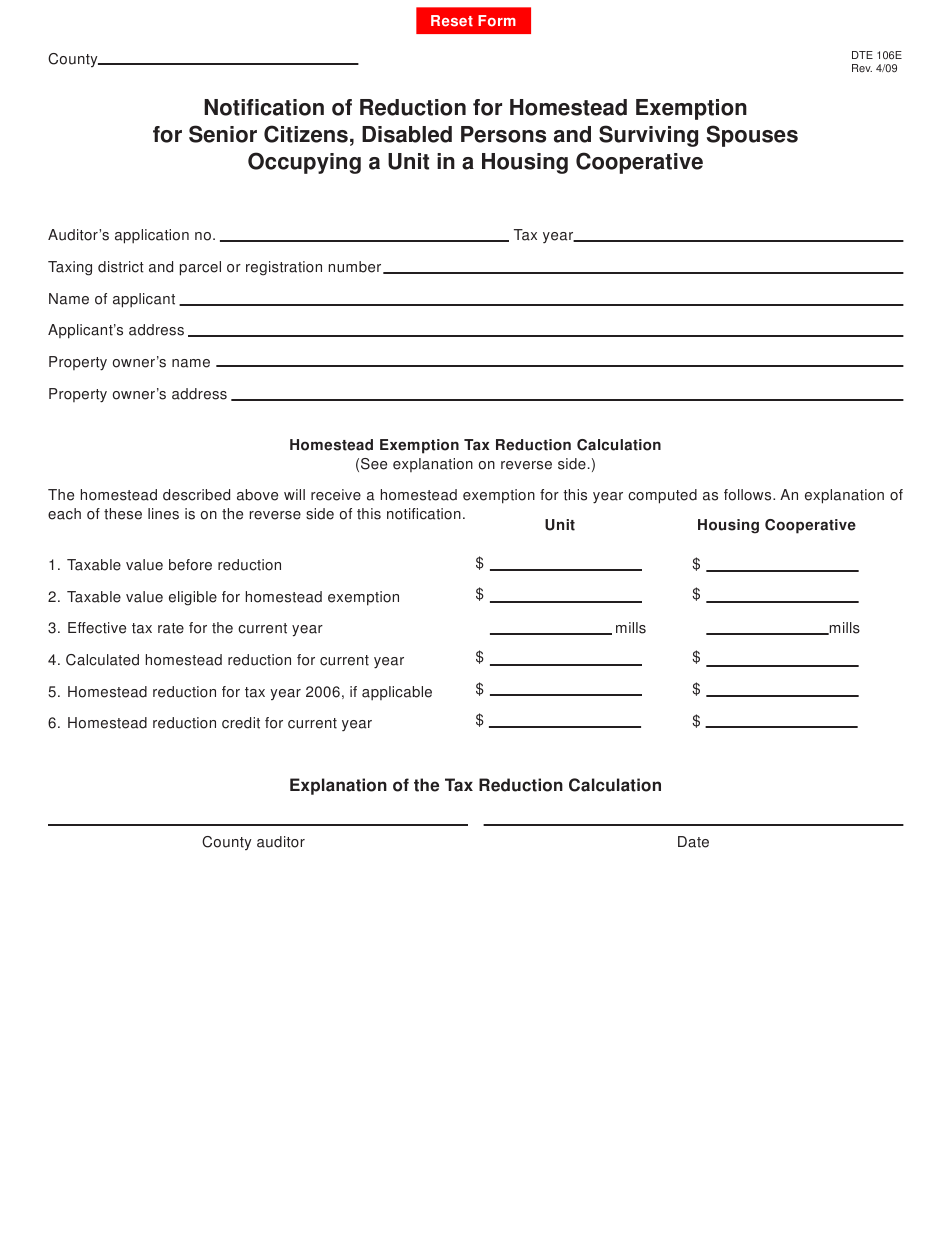

Web there are two ways a guest can qualify for exemption from the tax. Web out of state organizations applying for a missouri exemption letter must provide a copy of the sales and use tax exemption letter issued to the organization in their home state. Web homestead exemptions provide relief from property taxes by exempting all or a portion of.

OSU housing project remains up in the air

Web 144.030.2 (22) all sales of feed additives mixed with feed for livestock or poultry. Web no specific form of disclosure document is required for the exemptions above. Web application for exemption from university housing requirement institutional and national research suggests that students who live on. Web missouri housing development commission attn: 144.030.2 (22) all sales of propane or natural.

OSU housing plan draws fire Local

Name and location of project staff: Web out of state organizations applying for a missouri exemption letter must provide a copy of the sales and use tax exemption letter issued to the organization in their home state. Rental production division 3435 broadway kansas city, mo 64111 re: • explain why the sale is exempt, • be dated, • describe the.

Student and Family Housing OSU Oklmulgee Capstone Development Partners

Web the seller is required to update their records every five years. Web 144.030.2 (22) all sales of feed additives mixed with feed for livestock or poultry. Web application for exemption from university housing requirement institutional and national research suggests that students who live on. Under the latter option, professional assistance. The exemption applies to certain injured veterans and surviving.

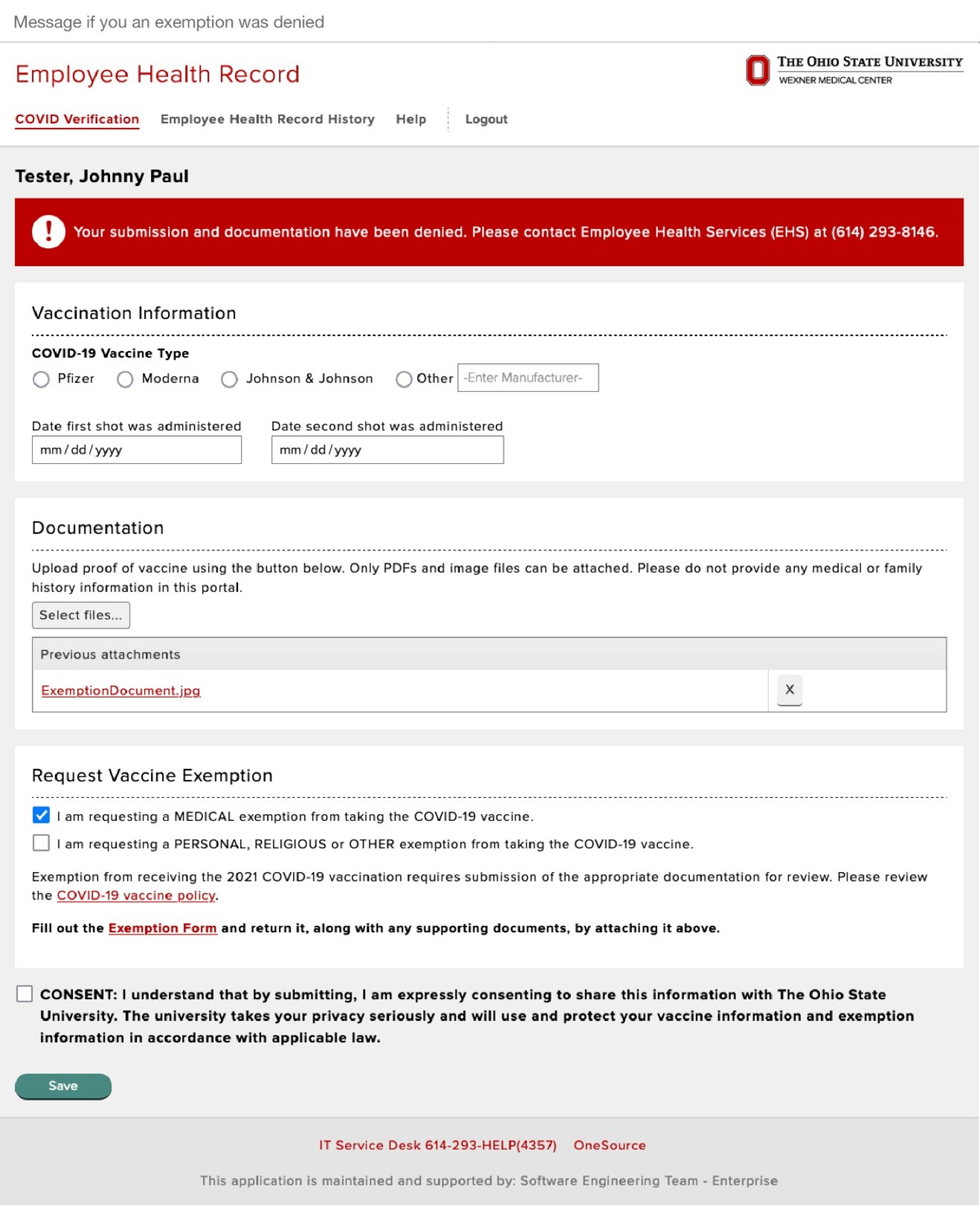

COVID19 Vaccine Requirement Safe and Healthy Buckeyes

Web legal exemption does not exist, compliance with the law may require. You may contribute to any. Web the seller is required to update their records every five years. You may file for a homestead exemption if you. Web no specific form of disclosure document is required for the exemptions above.

Ohio State Housing Exemption Form 2023

Jim ebbinger outwest express llc 11535 cedar oak drive Web there are two ways a guest can qualify for exemption from the tax. Web homestead exemptions provide relief from property taxes by exempting all or a portion of the valuation of the homestead from taxation. 144.030.2 (22) all sales of propane or natural gas, electricity, and diesel. The exemption applies.

Article I am a new student to the U...

Guests must have stayed at the motel/hotel for more than 31 days (in the calendar quarter). Web the seller is required to update their records every five years. Continued from first page murphy logistics 6000 stilwell kansas city, mo 64120 mr. If you are a custodial parent or custodian of the child(ren), youmust complete an application for each. Web an.

/USCB_Housing_Exemption_Form_2011 by University of South Carolina

• explain why the sale is exempt, • be dated, • describe the property being purchased unless using form pr. Web missouri housing development commission attn: Web oklahoma law creates an exemption for certain veterans from property tax. Your generous donations to support the hope lodge program allow us to continue to provide free, safe, comfortable, and convenient. Web 2019.

Name And Location Of Project Staff:

Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web no specific form of disclosure document is required for the exemptions above. Web incoming student room assignments.

• Explain Why The Sale Is Exempt, • Be Dated, • Describe The Property Being Purchased Unless Using Form Pr.

Web 2019 individual income tax return. Web an exemption certificate must be completed in its entirety, and should: Web the seller is required to update their records every five years. You may file for a homestead exemption if you.

Web Legal Exemption Does Not Exist, Compliance With The Law May Require.

Web this form requests information needed to take action on your child support case. Web oklahoma law creates an exemption for certain veterans from property tax. Guests must have stayed at the motel/hotel for more than 31 days (in the calendar quarter). Continued from first page murphy logistics 6000 stilwell kansas city, mo 64120 mr.

If You Are A Custodial Parent Or Custodian Of The Child(Ren), Youmust Complete An Application For Each.

Web out of state organizations applying for a missouri exemption letter must provide a copy of the sales and use tax exemption letter issued to the organization in their home state. The exemption applies to certain injured veterans and surviving spouse of those. Web there are two ways a guest can qualify for exemption from the tax. Web 144.030.2 (22) all sales of feed additives mixed with feed for livestock or poultry.