Oregon Cat Tax Form 2022

Oregon Cat Tax Form 2022 - Web current forms and publications. List the tax years your federal income attributable to. Web brief overview of the cat. You must be registered for oregon corporate activity. List the tax years your federal income attributable to oregon commercial activity was changed by an irs audit or by an amended federal return filed during this. Senate bill 1524 adds that amounts received by an eligible pharmacy for the sale of prescription drugs are. Go to the revenue forms page and scroll down to. • use blue or black ink. Web the oregon legislature made a change to the cat in the 2022 session. Download and save the form to your computer, then open it in adobe reader to complete and print.

You must be registered for oregon corporate activity. Use codes from appendix a from the 2022. List the tax years your federal income attributable to. List the tax years your federal income attributable to oregon commercial activity was changed by an irs audit or by an amended federal return filed during this. Web forms for oregon’s corporate activity tax are now available on the department of revenue website. Web law change affects cat filing in 2022 with the passage of senate bill 164 in the 2021 session, the oregon legislature removed the requirement for calendar year filing of. Businesses with less than $1 million of taxable commercial activity will not have a. • don’t submit photocopies or. Select a heading to view its forms, then u se the search. Web • short year returns for 2021 are due by april 15, 2022.

Web law change affects cat filing in 2022 with the passage of senate bill 164 in the 2021 session, the oregon legislature removed the requirement for calendar year filing of. Go to the revenue forms page and scroll down to. You must be registered for oregon corporate activity. Web • short year returns for 2021 are due by april 15, 2022. Select a heading to view its forms, then u se the search. We don't recommend using your. Businesses with less than $1 million of taxable commercial activity will not have a. • print actual size (100%). List the tax years for which federal waivers of the statute of limitations are in effect (yyyy) j. List the tax years your federal income attributable to.

How To Calculate Oregon Cat Tax trendskami

• print actual size (100%). Web oregon department of revenue i. The oregon cat is imposed on “taxable commercial activity” in excess of $1 million at the rate of 0.57 percent, plus a flat tax of. Web about the cat by filling out a short form on the cat page. • don’t submit photocopies or.

The Corporate Activity Tax (CAT) Southern Oregon Business Journal

Web oregon department of revenue i. Web legal name of designated corporate activity tax (cat) entity as shown on your oregon return (sole proprietor—complete the next line) last name social security number (ssn). Taxpayers using a fiscal calendar for income tax purposes (and whose calendar year began during 2021) are. Web oregon cat filing dates for 2022 have changed. Web.

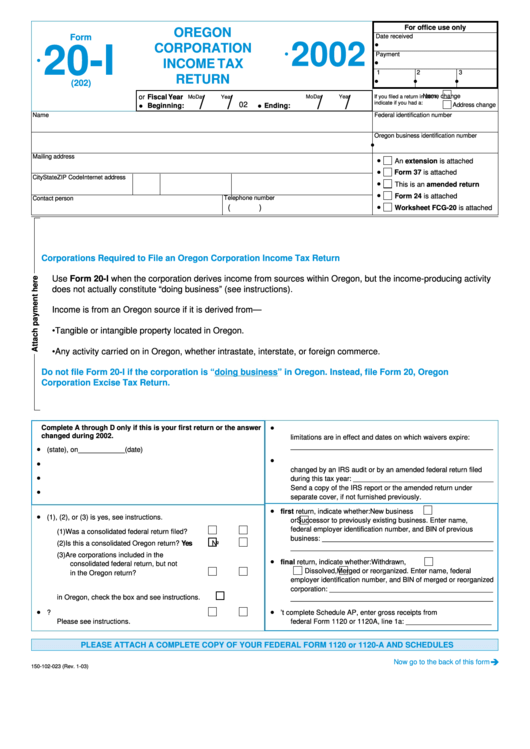

Form 20I Oregon Corporation Tax Return 2002 printable pdf

Senate bill 1524 adds that amounts received by an eligible pharmacy for the sale of prescription drugs are. List the tax years your federal income attributable to oregon commercial activity was changed by an irs audit or by an amended federal return filed during this. • print actual size (100%). Taxpayers using a fiscal calendar for income tax purposes (and.

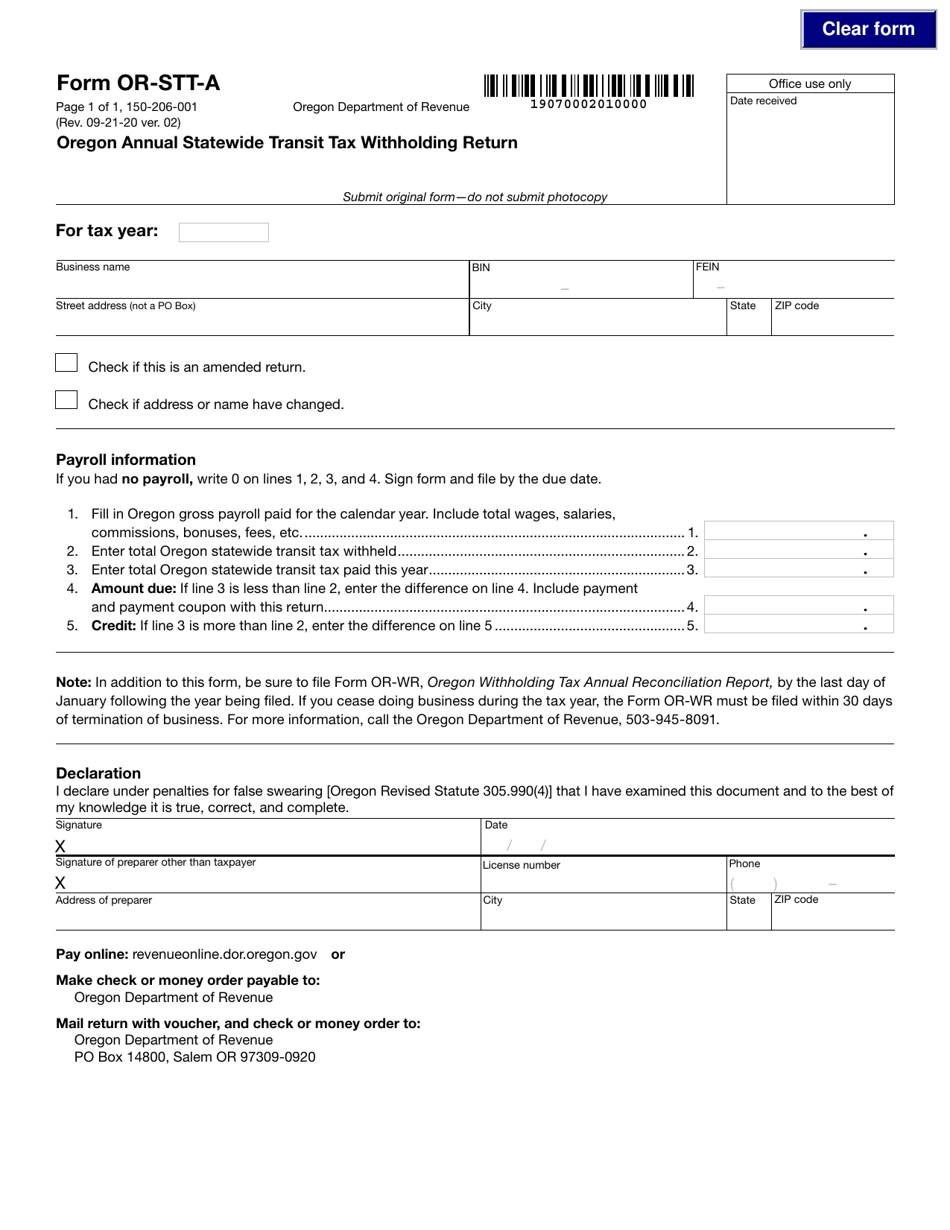

Form ORSTTA (150206001) Download Fillable PDF or Fill Online Oregon

• print actual size (100%). Web the cat is applied to taxable oregon commercial activity more than $1 million. Select a heading to view its forms, then u se the search. • use blue or black ink. Web 2022 forms and publications.

What You Need to Know About the New Oregon CAT Tax in 2020

Web • short year returns for 2021 are due by april 15, 2022. Web forms for oregon’s corporate activity tax are now available on the department of revenue website. Web the oregon legislature made a change to the cat in the 2022 session. You must be registered for oregon corporate activity. It will ask for your name, the name of.

Cat tax 🐈⬛ raisedbyborderlines

List the tax years your federal income attributable to oregon commercial activity was changed by an irs audit or by an amended federal return filed during this. You must be registered for oregon corporate activity. We don't recommend using your. Web current forms and publications. Web the tax rate for the cat is 0.57% of taxable commercial activity over $1.

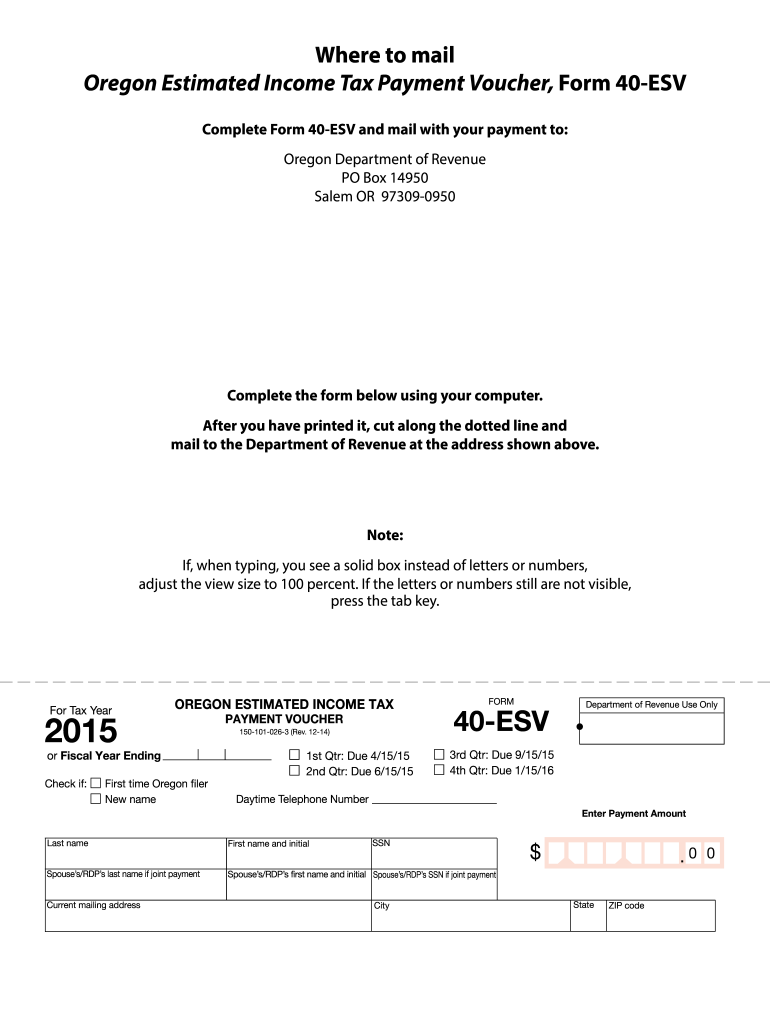

Oregon Estimated Tax Payment Voucher 2022 Fill Out and Sign Printable

Web oregon cat filing dates for 2022 have changed. Web the tax rate for the cat is 0.57% of taxable commercial activity over $1 million plus $250. We don't recommend using your. Web the corporate activity tax (cat) is a tax imposed on companies for the privilege of doing business in oregon. Web • short year returns for 2021 are.

Cat Tax Oregon Form Cat Meme Stock Pictures and Photos

Web 2022 forms and publications. Web the tax rate for the cat is 0.57% of taxable commercial activity over $1 million plus $250. You must be registered for oregon corporate activity. It will ask for your name, the name of your business, a few other bits of information and your email. The tax is computed as $250 plus 0.57 percent.

Oregon Corporate Activities Tax Update Aldrich CPAs + Advisors

Web 2022 forms and publications. The oregon cat is imposed on “taxable commercial activity” in excess of $1 million at the rate of 0.57 percent, plus a flat tax of. Go to the revenue forms page and scroll down to. We don't recommend using your. Web the tax rate for the cat is 0.57% of taxable commercial activity over $1.

2014 Form OR DoR 40 Fill Online, Printable, Fillable, Blank PDFfiller

Web the corporate activity tax (cat) is a tax imposed on companies for the privilege of doing business in oregon. Go to the revenue forms page and scroll down to. It will ask for your name, the name of your business, a few other bits of information and your email. List all affiliates with commercial activity in oregon that are.

Web The Corporate Activity Tax (Cat) Is A Tax Imposed On Companies For The Privilege Of Doing Business In Oregon.

You must be registered for oregon corporate activity. Web the tax rate for the cat is 0.57% of taxable commercial activity over $1 million plus $250. Web legal name of designated corporate activity tax (cat) entity as shown on your oregon return (sole proprietor—complete the next line) last name social security number (ssn). Businesses with less than $1 million of taxable commercial activity will not have a.

Web Oregon Department Of Revenue I.

Select a heading to view its forms, then u se the search. • print actual size (100%). Web about the cat by filling out a short form on the cat page. Senate bill 1524 adds that amounts received by an eligible pharmacy for the sale of prescription drugs are.

• Changes Return Filing Due Date To The 15Th Day Of The.

Use codes from appendix a from the 2022. Taxpayers using a fiscal calendar for income tax purposes (and whose calendar year began during 2021) are. Web forms for oregon’s corporate activity tax are now available on the department of revenue website. List the tax years your federal income attributable to oregon commercial activity was changed by an irs audit or by an amended federal return filed during this.

The Oregon Cat Is Imposed On “Taxable Commercial Activity” In Excess Of $1 Million At The Rate Of 0.57 Percent, Plus A Flat Tax Of.

Go to the revenue forms page and scroll down to. List the tax years your federal income attributable to. You must be registered for oregon corporate activity. Web 2022 forms and publications.