Onlyfans 1099 Nec Form

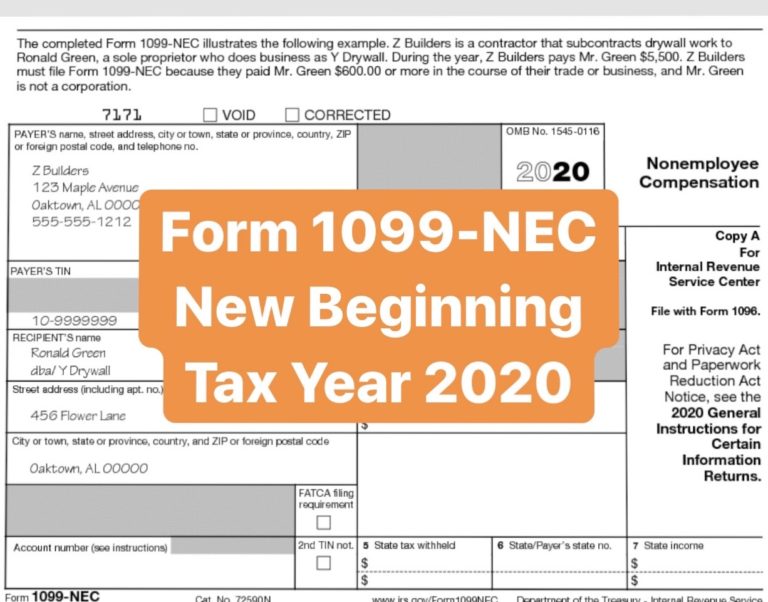

Onlyfans 1099 Nec Form - Web does onlyfans send you a 1099? Web when earnings exceed $600, the platform issues a 1099 form to account for taxes. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. The onlyfans 1099 form is a tax document that is issued to content. You should also receive a copy by mail, or you. What counts as being paid,. By filing online, you can.

Web does onlyfans send you a 1099? Do not miss the deadline. What counts as being paid,. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? The form is crucial for content. Get ready for tax season deadlines by completing any required tax forms today. The onlyfans 1099 form is a tax document that is issued to content. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. The form is typically sent out in late january or early february. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made.

Get ready for tax season deadlines by completing any required tax forms today. What counts as being paid,. The onlyfans 1099 form is a tax document that is issued to content. You are an independent contractor to the irs. This form is used to report. Web does onlyfans send you a 1099? By filing online, you can. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? The form is typically sent out in late january or early february. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year.

How to properly file 1099 form for Onlyfans FreeCashFlow.io 2023

Web when earnings exceed $600, the platform issues a 1099 form to account for taxes. You are an independent contractor to the irs. The form is crucial for content. The onlyfans 1099 form is a tax document that is issued to content. Web onlyfans will not send you any sort of income document so you just use your own records.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

By filing online, you can. You should also receive a copy by mail, or you. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? What counts as being paid,. The form is typically sent out in late january or early february.

What is Form 1099NEC for Nonemployee Compensation

Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. Web when earnings exceed $600, the platform issues a 1099 form to account for taxes. What counts as being paid,. The onlyfans 1099 form is a tax document that is issued to content. You should also receive.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

The onlyfans 1099 form is a tax document that is issued to content. The form is crucial for content. Do not miss the deadline. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? We’ll go over some of the most typical 1099 forms as a self.

How to file OnlyFans taxes (W9 and 1099 forms explained)

The form is crucial for content. We’ll go over some of the most typical 1099 forms as a self. The most common form creators will receive if they earn more. Do not miss the deadline. You are an independent contractor to the irs.

How To File Form 1099NEC For Contractors You Employ VacationLord

You are an independent contractor to the irs. This form is used to report. You should also receive a copy by mail, or you. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. Web does onlyfans send you a 1099?

What Is Form 1099NEC? Who Uses It, What to Include, & More

The onlyfans 1099 form is a tax document that is issued to content. You are an independent contractor to the irs. Get ready for tax season deadlines by completing any required tax forms today. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. The most common form creators will receive if they earn more.

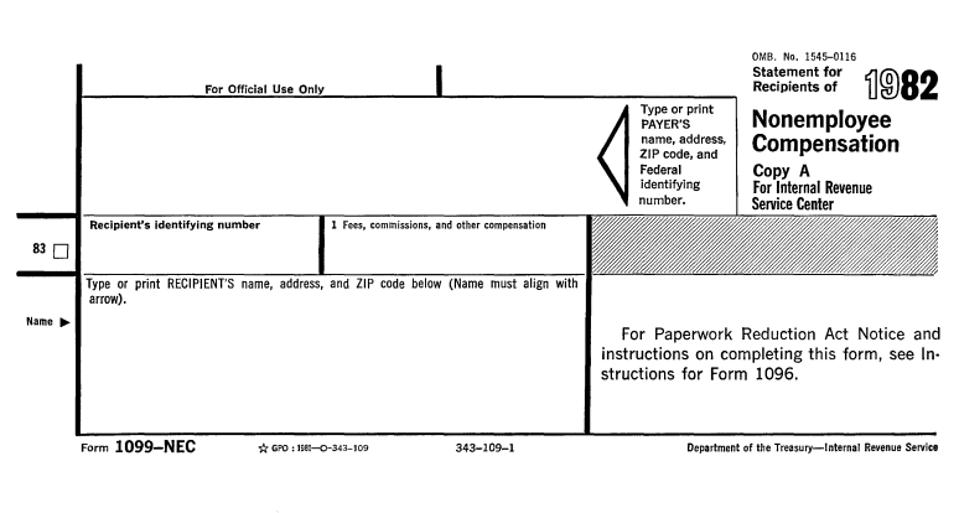

The New 1099NEC Tax Form for All NonEmployee Compensation

Web does onlyfans send you a 1099? This form is used to report. The form is crucial for content. Web when earnings exceed $600, the platform issues a 1099 form to account for taxes. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. We’ll go over some of the most typical 1099 forms as a self. The most common form creators will receive if they earn more. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? You are an independent contractor to the irs.

Move Over, 1099MISC IRS Throwback Season Continues With Form 1099NEC

Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. The form is crucial for content. What counts as being paid,. The form is typically sent out in late january or early february. Web onlyfans is required to send you (and the irs) a 1099 when you.

Web Onlyfans Will Not Send You Any Sort Of Income Document So You Just Use Your Own Records Of How Much You Made.

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. Do not miss the deadline. What counts as being paid,.

The Form Is Crucial For Content.

You are an independent contractor to the irs. Web watch on understanding onlyfans 1099 form online what is onlyfans 1099 form? The onlyfans 1099 form is a tax document that is issued to content. You should also receive a copy by mail, or you.

Web Onlyfans Is Required To Send You (And The Irs) A 1099 When You Make Over $600, But They Can Send You One Even If You Are Under That Amount.

By filing online, you can. Get ready for tax season deadlines by completing any required tax forms today. This article will simplify the process of filing taxes for onlyfans by providing five. The most common form creators will receive if they earn more.

Web When Earnings Exceed $600, The Platform Issues A 1099 Form To Account For Taxes.

Web does onlyfans send you a 1099? This form is used to report. We’ll go over some of the most typical 1099 forms as a self. The form is typically sent out in late january or early february.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://static.wixstatic.com/media/9fe6e6_c02527d741474d7e88dbd9fa3595b59f~mv2.png/v1/fit/w_1000%2Ch_853%2Cal_c%2Cq_80/file.jpg)