Ok State Income Tax Form

Ok State Income Tax Form - This form is for income earned in tax year 2022, with tax returns due in. Web individual income tax return (form 511) for oklahoma residents. Use • this table if your taxable income is less than $100,000. Web we would like to show you a description here but the site won’t allow us. Learn more about oklahoma tax rates here. Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april. If your taxable income is $100,000 or more,. When are oklahoma tax returns due?. • instructions for completing the form 511: Oklahoma state individual taxes for tax year 2022.

• every resident individual whose gross income. Web oklahoma income taxes. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. If your taxable income is $100,000 or more,. Web 2020 oklahoma resident individual income tax forms and instructions. When are oklahoma tax returns due?. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Web nonresidents and part time residents need to file form 511 nr when doing their income taxes for oklahoma. Use • this table if your taxable income is less than $100,000. Web 2021 oklahoma resident individual income tax forms and instructions.

Web oklahoma has a state income tax that ranges between 0.5% and 5% , which is administered by the oklahoma tax commission. • instructions for completing the form 511: Web opers has two forms to provide tax withholding preferences for federal and state taxes. If your taxable income is $100,000 or more,. • every resident individual whose gross income. Web we would like to show you a description here but the site won’t allow us. Ok tax return filing and payment due date for tax year 2022 is april 18, 2023. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. When are oklahoma tax returns due?. Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april.

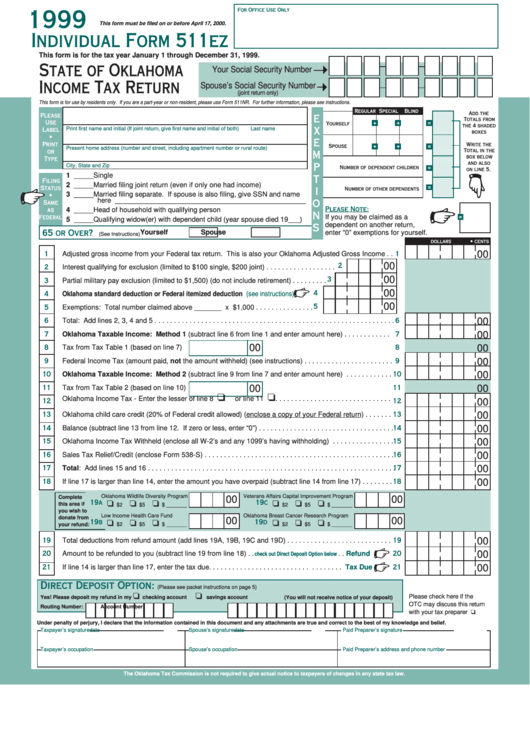

Individual Form 511ez State Of Oklahoma Tax Return 1999

• instructions for completing the form 511: Web we would like to show you a description here but the site won’t allow us. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. • instructions for completing the form 511: If your taxable income is $100,000 or more,.

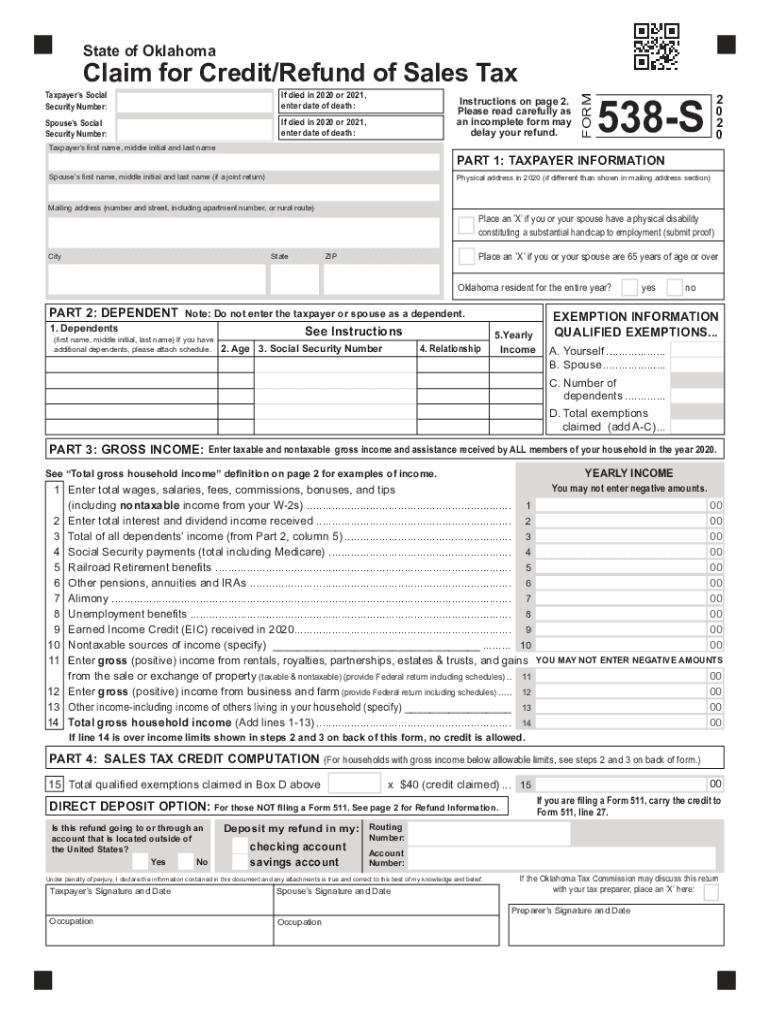

Oklahoma Tax Commission Forms Fill Out and Sign Printable PDF

Web we would like to show you a description here but the site won’t allow us. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Oklahoma state individual taxes for tax year 2022. Web 2020 oklahoma resident individual income tax forms and instructions. •.

Ms State Tax Form 2022 W4 Form

If your taxable income is $100,000 or more,. This form is for income earned in tax year 2022, with tax returns due in. Web we would like to show you a description here but the site won’t allow us. Web oklahoma has a state income tax that ranges between 0.5% and 5% , which is administered by the oklahoma tax.

IRS Form 1040 Download Fillable PDF or Fill Online U.S. Individual

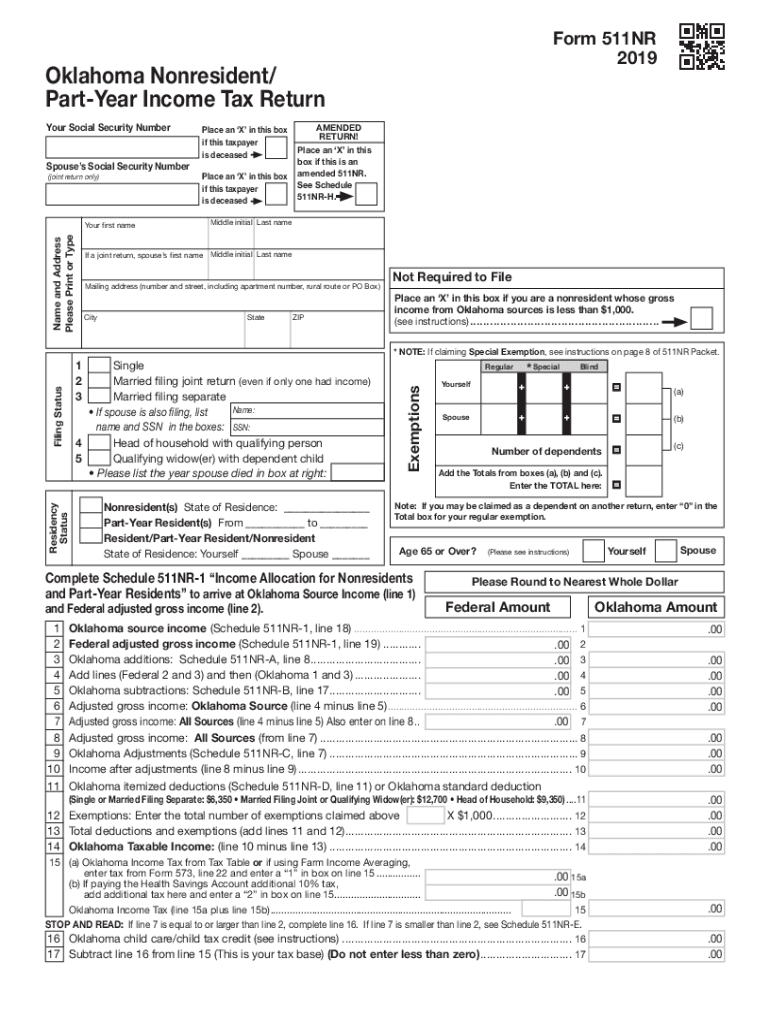

Web • every nonresident with oklahoma source gross income of $1,000 or more is required to file an oklahoma income tax return. Learn more about oklahoma tax rates here. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Use • this table if your taxable income is less than $100,000. When are oklahoma tax.

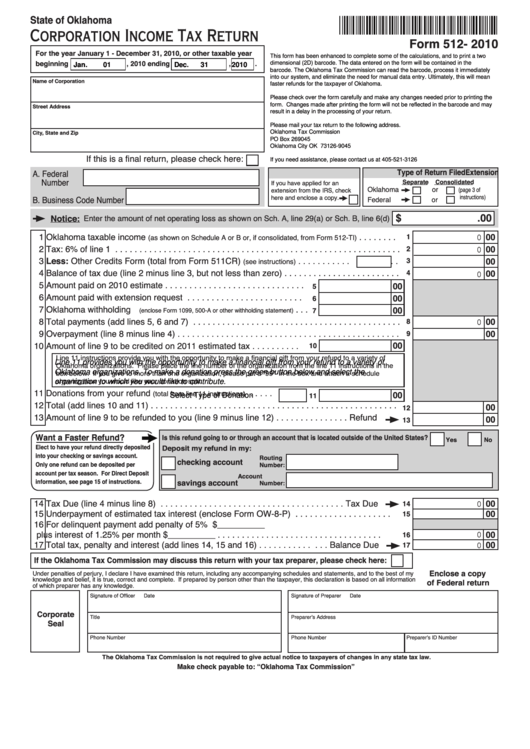

Fillable Form 512 Oklahoma Corporation Tax Return 2010

• instructions for completing the form 511: Web • every nonresident with oklahoma source gross income of $1,000 or more is required to file an oklahoma income tax return. You can complete the forms with the help of efile.com. Web 2021 oklahoma resident individual income tax forms and instructions. Web we last updated oklahoma form 511 in january 2023 from.

Ok Refund Fill Out and Sign Printable PDF Template signNow

When are oklahoma tax returns due?. Learn more about oklahoma tax rates here. Ok tax return filing and payment due date for tax year 2022 is april 18, 2023. Web 2020 oklahoma resident individual income tax forms and instructions. You can complete the forms with the help of efile.com.

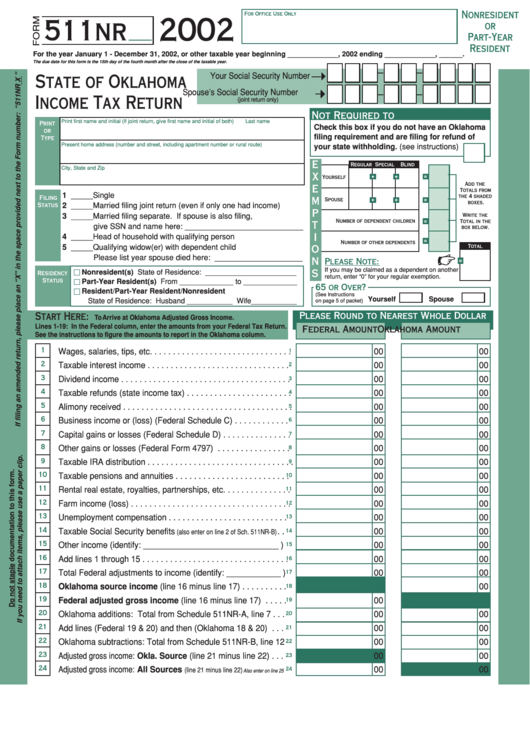

Form 511nr State Of Oklahoma Tax Return 2002 printable pdf

Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. You can complete the forms with the help of efile.com. Web individual income tax return (form 511) for oklahoma residents. Web oklahoma income taxes. Use • this table if your taxable income is less than.

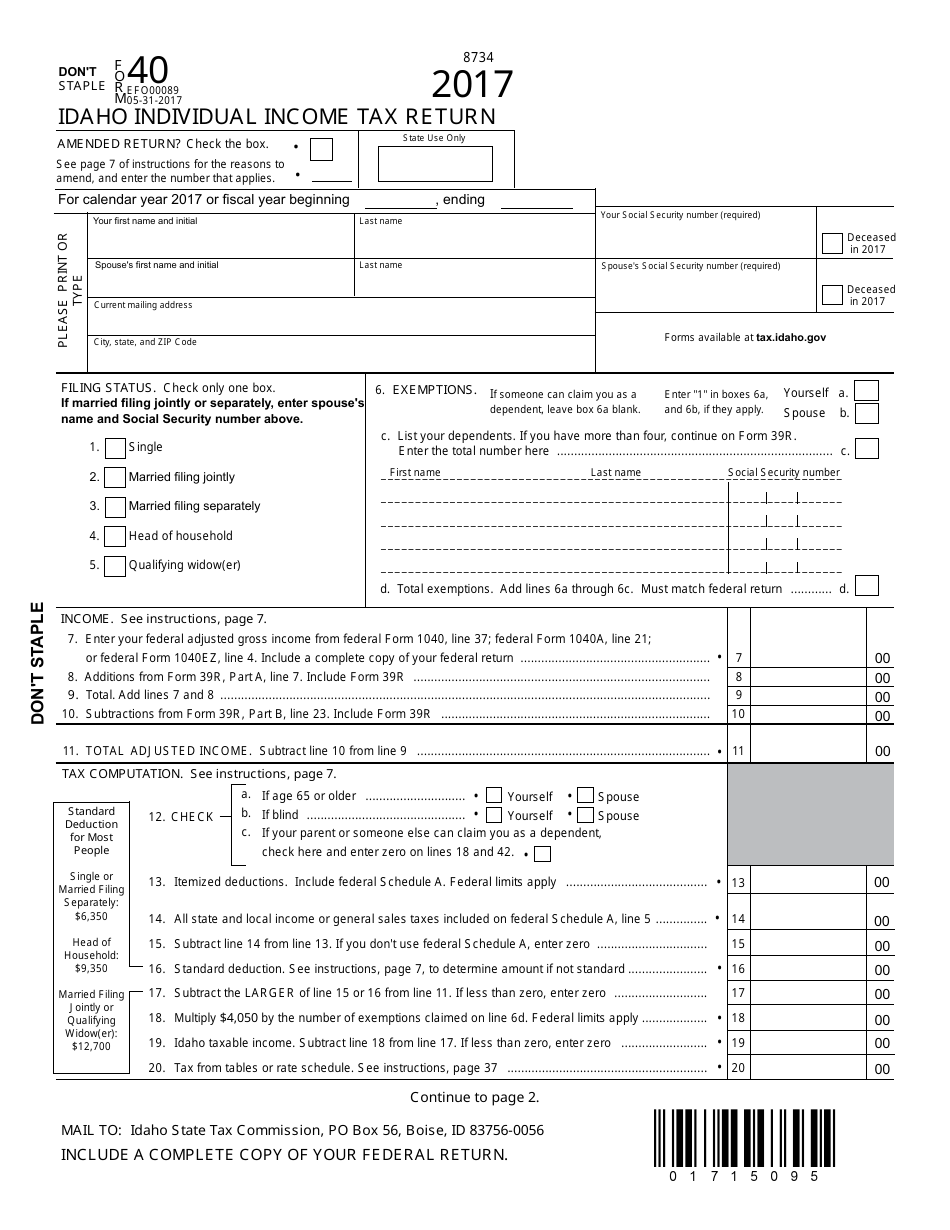

Form 40 Download Fillable PDF or Fill Online Idaho Individual

• instructions for completing the form 511: Web individual income tax return (form 511) for oklahoma residents. Web 2021 oklahoma resident individual income tax forms and instructions. Web 2020 oklahoma resident individual income tax forms and instructions. When are oklahoma tax returns due?.

301 Moved Permanently

Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april. Ok tax return filing and payment due date for tax year 2022 is april 18, 2023. If your taxable income is $100,000 or more,. Web 2021 oklahoma resident individual.

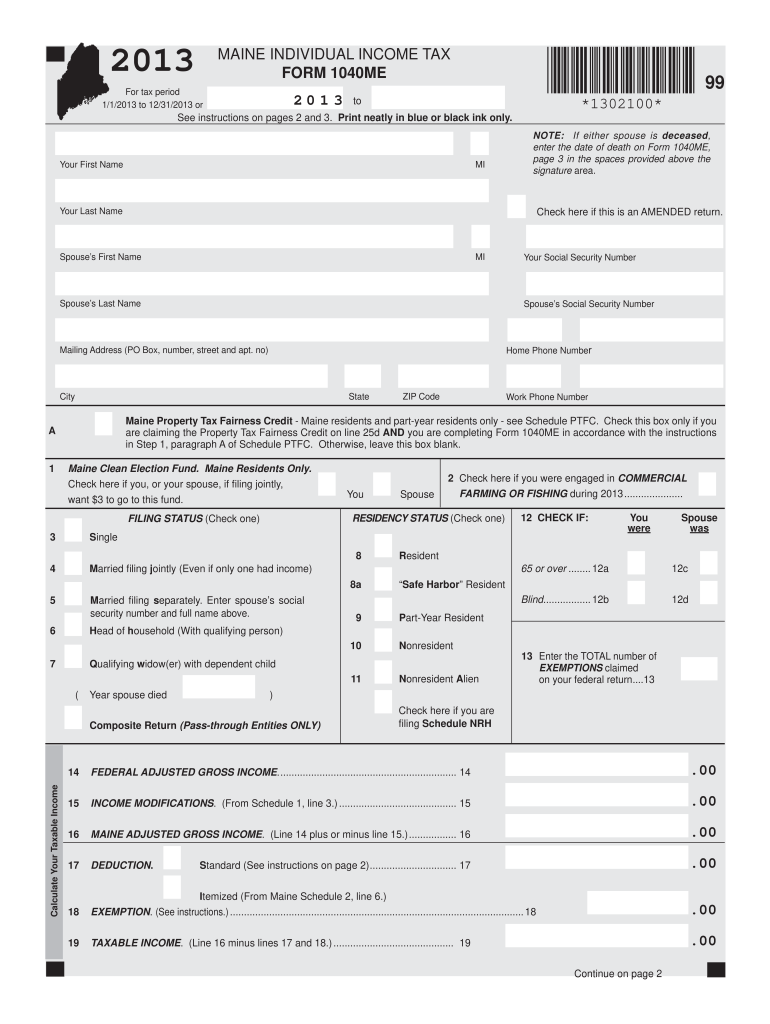

MAINE INDIVIDUAL TAX FORM 1040ME *1302100* 00 Fill Out and

• instructions for completing the form 511: Web 1 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april. Web oklahoma income taxes. Web individual income tax return (form 511) for oklahoma residents. Web we would like to show you a.

Learn More About Oklahoma Tax Rates Here.

This form is for income earned in tax year 2022, with tax returns due in. Web • every nonresident with oklahoma source gross income of $1,000 or more is required to file an oklahoma income tax return. Web nonresidents and part time residents need to file form 511 nr when doing their income taxes for oklahoma. Web opers has two forms to provide tax withholding preferences for federal and state taxes.

If Your Taxable Income Is $100,000 Or More,.

Web 2021 oklahoma resident individual income tax forms and instructions. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. • instructions for completing the form 511: Web we would like to show you a description here but the site won’t allow us.

When Are Oklahoma Tax Returns Due?.

• every resident individual whose gross income. Use • this table if your taxable income is less than $100,000. Web individual income tax return (form 511) for oklahoma residents. Oklahoma state individual taxes for tax year 2022.

Web Oklahoma Income Taxes.

• instructions for completing the form 511: You can complete the forms with the help of efile.com. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Web 2020 oklahoma resident individual income tax forms and instructions.