Offer Of Compromise Form

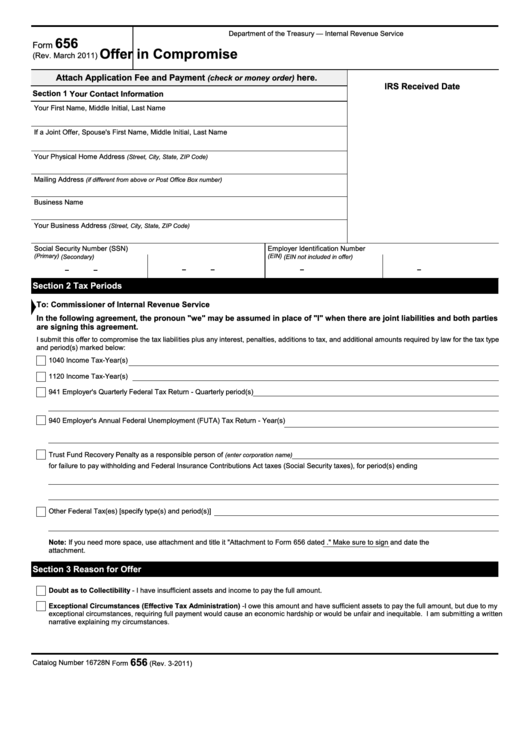

Offer Of Compromise Form - Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and thus to avoid or end a lawsuit or other legal action. Web station overview if you can’t pay your tax debt in full, or if paying it all will create a financial hardship for you, an offer in compromise (oic) may be an option. Web select from one of the options below for offer in compromise forms related to an individual or a business, or the forms required for an independent administrative review. Web an offer in compromise is an agreement that, if accepted by the irs, permits you to pay them less than you owe and will settle the tax debt that you included. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. Use form 656 when applying for. Web an offer in compromise or offer is an agreement between you the taxpayer and the irs that settles a tax debt for less than the full amount owed. Web the offer in compromise checklist lists the forms and documentation required to be submitted to the department in order for an offer in compromise to be. Web an offer in compromise is an agreement between you and the government to settle a tax debt for less than the amount you are legally obligated to pay. If you do not comply.

Web select from one of the options below for offer in compromise forms related to an individual or a business, or the forms required for an independent administrative review. Enter your financial information and tax filing status to calculate a. Web an offer in compromise or offer is an agreement between you the taxpayer and the irs that settles a tax debt for less than the full amount owed. If the irs accepts your offer, you’ll need to. Web station overview if you can’t pay your tax debt in full, or if paying it all will create a financial hardship for you, an offer in compromise (oic) may be an option. If the irs accepts your offer. Use form 656 when applying for. If you do not comply. Web an offer in compromise is an irs program that allows certain taxpayers to settle irs tax debt for less than they owe. Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and thus to avoid or end a lawsuit or other legal action.

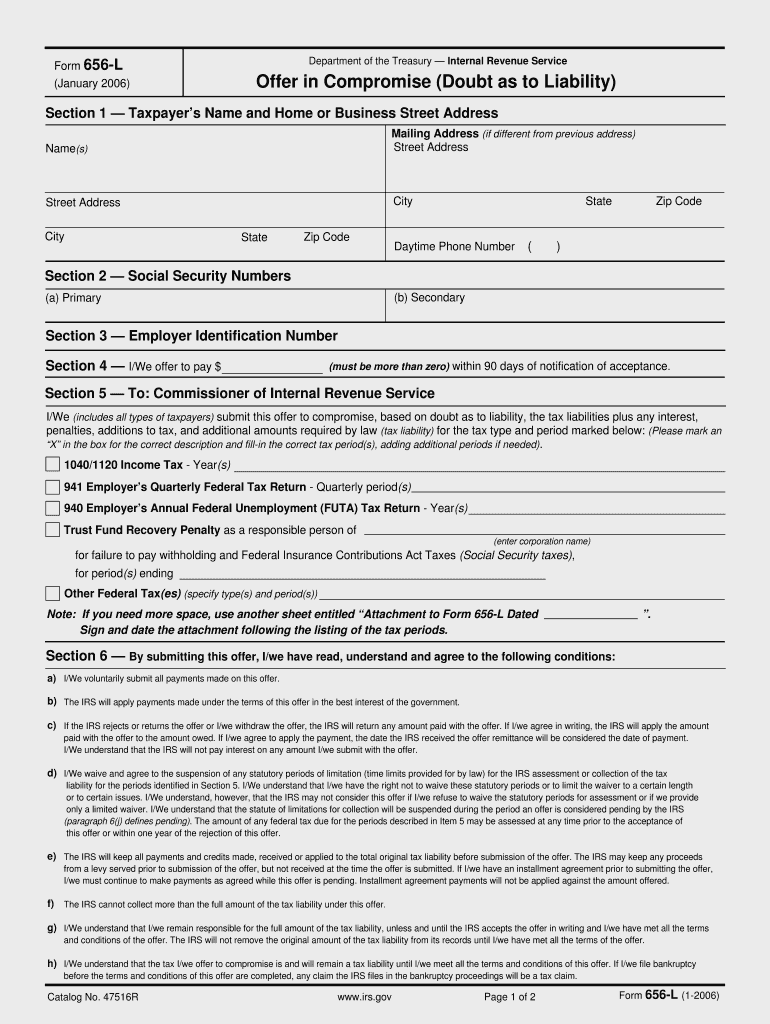

Web vladimir putin's forces have launched another wave of attacks on odesa. Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and thus to avoid or end a lawsuit or other legal action. Web what forms do taxpayers need? Web you may be eligible for the offer in compromise short form for low income taxpayers based on one of the reasons listed below. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. If the irs accepts your offer. Web to appeal a rejection, use irs form 13711, request for appeal of offer in compromise. Web select from one of the options below for offer in compromise forms related to an individual or a business, or the forms required for an independent administrative review. Use form 656 when applying for. Web station overview if you can’t pay your tax debt in full, or if paying it all will create a financial hardship for you, an offer in compromise (oic) may be an option.

Irs Offer In Compromise Form Universal Network

Web the offer in compromise checklist lists the forms and documentation required to be submitted to the department in order for an offer in compromise to be. • your income is 125% of the federal poverty. Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and.

Irs Offer In Compromise Form 433 A Form Resume Examples gq96knwYOR

Web an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles a taxpayer's tax liabilities for less than the full. Web to appeal a rejection, use irs form 13711, request for appeal of offer in compromise. Web an offer in compromise is an agreement that, if accepted by the irs, permits you.

Stop Wage Garnishments from the California Franchise Tax Board

And poland is beefing up its border forces after belarus violated its airspace. If the irs accepts your offer, you’ll need to. • your income is 125% of the federal poverty. Web an offer in compromise is an agreement that, if accepted by the irs, permits you to pay them less than you owe and will settle the tax debt.

Compromise Document Fill Out and Sign Printable PDF Template signNow

Web the offer in compromise checklist lists the forms and documentation required to be submitted to the department in order for an offer in compromise to be. Web station overview if you can’t pay your tax debt in full, or if paying it all will create a financial hardship for you, an offer in compromise (oic) may be an option..

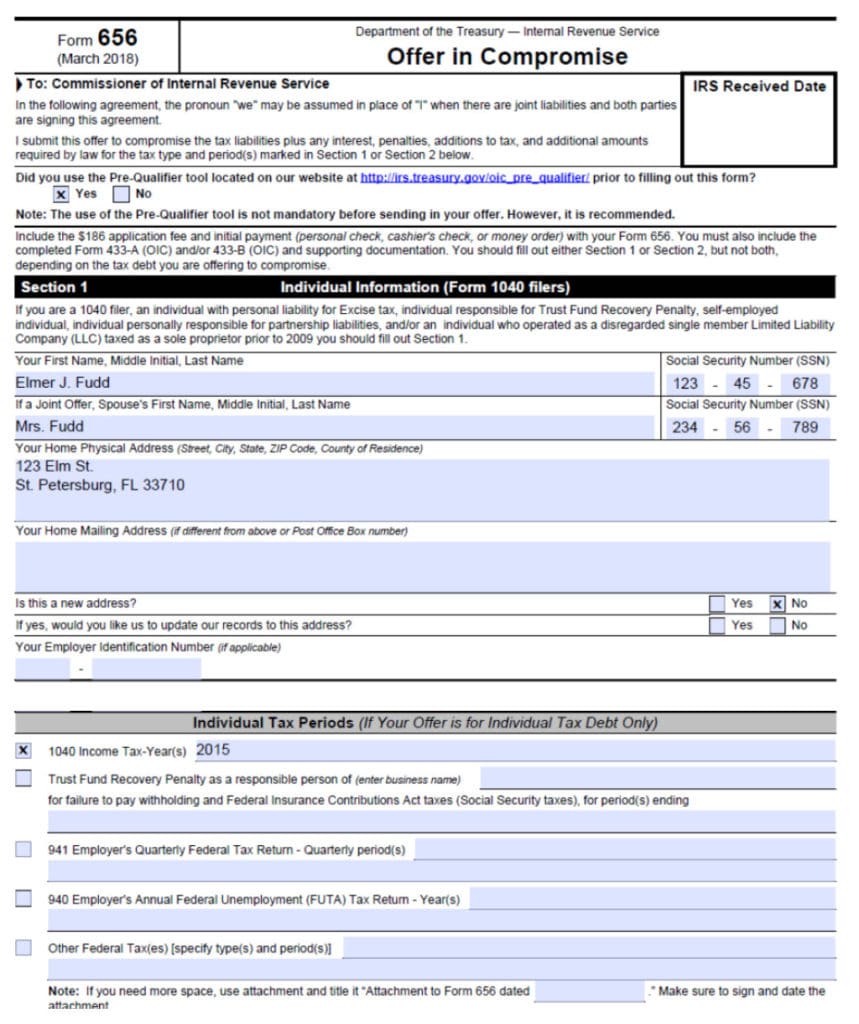

Fillable Form 656 Offer In Compromise printable pdf download

Web the offer in compromise (oic) program is for taxpayers that do not have, and will not have in the foreseeable future, the income, assets, or means to pay their tax liabilities. • your income is 125% of the federal poverty. Web what forms do taxpayers need? Web vladimir putin's forces have launched another wave of attacks on odesa. Web.

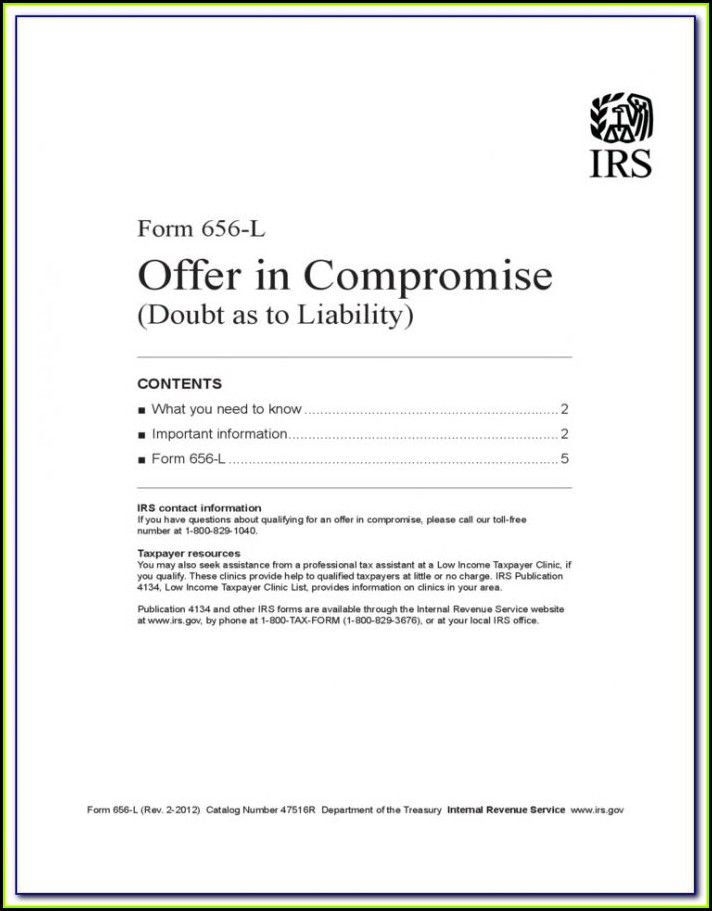

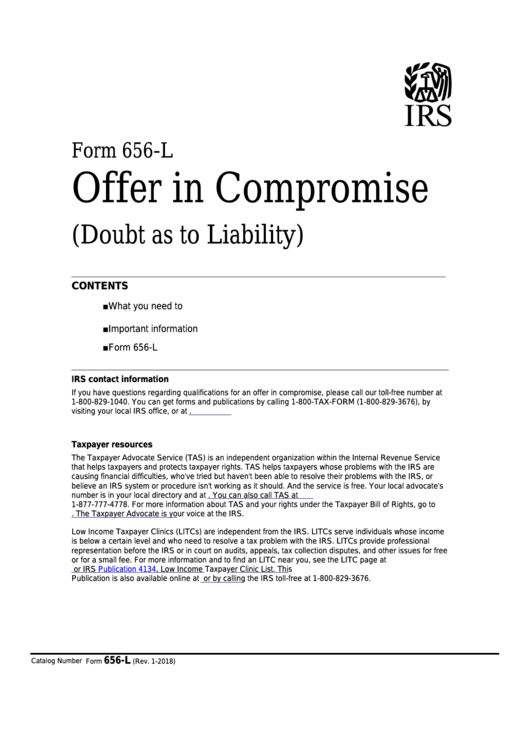

Fillable Form 656L Offer In Compromise (Doubt As To Liability

If the irs accepts your offer. Web what forms do taxpayers need? Enter your financial information and tax filing status to calculate a. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. Web an offer in compromise or offer is an agreement between you the taxpayer and the irs that.

Offer in compromise How to Get the IRS to Accept Your Offer Law

Web what forms do taxpayers need? Web the offer in compromise checklist lists the forms and documentation required to be submitted to the department in order for an offer in compromise to be. If the irs accepts your offer, you’ll need to. Web an offer in compromise is an agreement between you and the government to settle a tax debt.

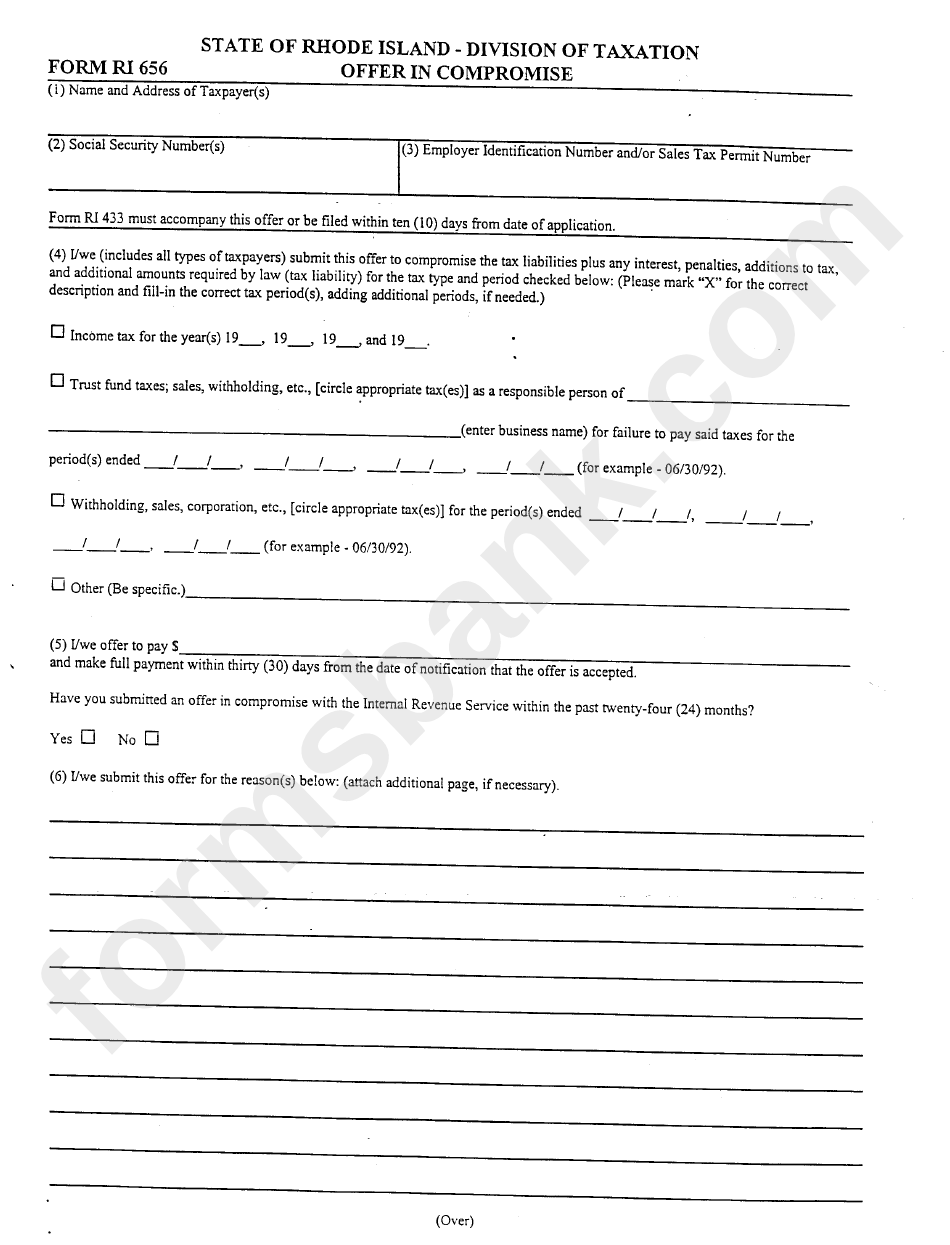

Form Ri 656 Offer In Compromise printable pdf download

Enter your financial information and tax filing status to calculate a. Use form 656 when applying for. Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and thus to avoid or end a lawsuit or other legal action. If the irs accepts your offer, you’ll need.

Irs Offer In Compromise Form 433 A (oic) Universal Network

Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and thus to avoid or end a lawsuit or other legal action. If you do not comply. Web you may be eligible for the offer in compromise short form for low income taxpayers based on one of.

Irs Offer In Compromise Payment Form Universal Network

Web an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles a taxpayer's tax liabilities for less than the full. Web an offer in compromise is an agreement between you and the government to settle a tax debt for less than the amount you are legally obligated to pay. Web an offer.

If The Irs Accepts Your Offer, You’ll Need To.

Web an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles a taxpayer's tax liabilities for less than the full. Web select from one of the options below for offer in compromise forms related to an individual or a business, or the forms required for an independent administrative review. Web vladimir putin's forces have launched another wave of attacks on odesa. And poland is beefing up its border forces after belarus violated its airspace.

Web Information About Form 656, Offer In Compromise, Including Recent Updates, Related Forms, And Instructions On How To File.

Web the offer in compromise checklist lists the forms and documentation required to be submitted to the department in order for an offer in compromise to be. If you do not comply. Web an offer in compromise is an irs program that allows certain taxpayers to settle irs tax debt for less than they owe. Web what forms do taxpayers need?

Web An Offer In Compromise Is An Agreement That, If Accepted By The Irs, Permits You To Pay Them Less Than You Owe And Will Settle The Tax Debt That You Included.

Web the offer in compromise (oic) program is for taxpayers that do not have, and will not have in the foreseeable future, the income, assets, or means to pay their tax liabilities. Use form 656 when applying for. Web to appeal a rejection, use irs form 13711, request for appeal of offer in compromise. Web an offer in compromise or offer is an agreement between you the taxpayer and the irs that settles a tax debt for less than the full amount owed.

Web An Offer In Compromise Is An Agreement Between You And The Government To Settle A Tax Debt For Less Than The Amount You Are Legally Obligated To Pay.

• your income is 125% of the federal poverty. Web offer of compromise is a voluntary offer by one party to another in a dispute so as to amicably settle the dispute and thus to avoid or end a lawsuit or other legal action. If the irs accepts your offer. Enter your financial information and tax filing status to calculate a.