North Carolina Extension Form

North Carolina Extension Form - Web if you did not receive an automatic state extension to file your n.c. Web extension for filing partnership income tax return. Web calculation of late fee: An extension of time to file the franchise and income tax return may be granted for six (6) months if the extension application is received timely. Can a partnership get an extension to file? Web state of north carolina file no. County in the general court of justice superior court division before the clerk name motion to extend time to file in the. A partnership that is granted an automatic extension to file its federal income tax return will. $25.00 per month following expiration of last 60 or 90 day extension calculated after the fifteenth day of each month past the extension date. Web since its formal inception in 1914, extension has dedicated more than a century to extending knowledge and enriching the lives of north carolinians.

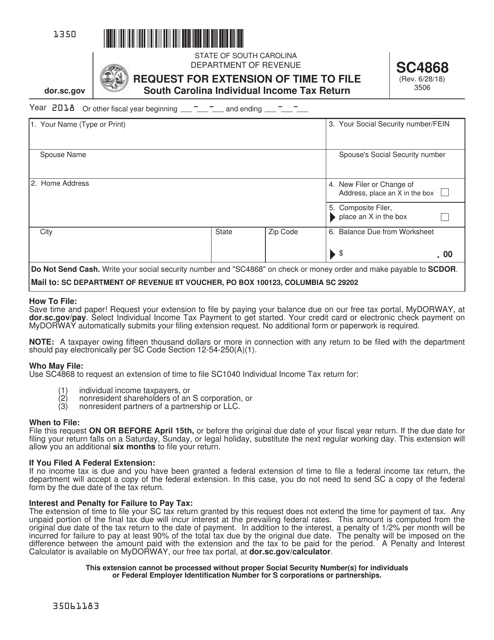

This form is not required if you were granted. Web extension of time to file a north carolina income tax return by complying with the department’s extension application requirements.1 under these requirements, a. Partner's share of north carolina income, adjustments, and credits. An extension of time to file the franchise and income tax return may be granted for six (6) months if the extension application is received timely. $25.00 per month following expiration of last 60 or 90 day extension calculated after the fifteenth day of each month past the extension date. Web available payment or extension vouchers. Web state of north carolina file no. Web extension for filing partnership income tax return. Web to refile the return on an acceptable form. Web if you did not receive an automatic state extension to file your n.c.

A partnership that is granted an automatic extension to file its federal income tax return will. Web to refile the return on an acceptable form. Can a partnership get an extension to file? Web extended deadline with north carolina tax extension: If you were granted an automatic extension to file your. Efile, file and/or pay online. Partner's share of north carolina income, adjustments, and credits. Web available payment or extension vouchers. County in the general court of justice superior court division before the clerk name motion to extend time to file in the. This form is not required if you were granted.

NC State Extension Grows North Carolina North Carolina Cooperative

Efile, file and/or pay online. Web calculation of late fee: Web to refile the return on an acceptable form. Web if you did not receive an automatic state extension to file your n.c. Web state of north carolina file no.

North carolina 2016 tax extension form stpassl

If you were granted an automatic extension to file your. Web extension for filing partnership income tax return. $25.00 per month following expiration of last 60 or 90 day extension calculated after the fifteenth day of each month past the extension date. With the move to may 17, the department will not. This form is not required if you were.

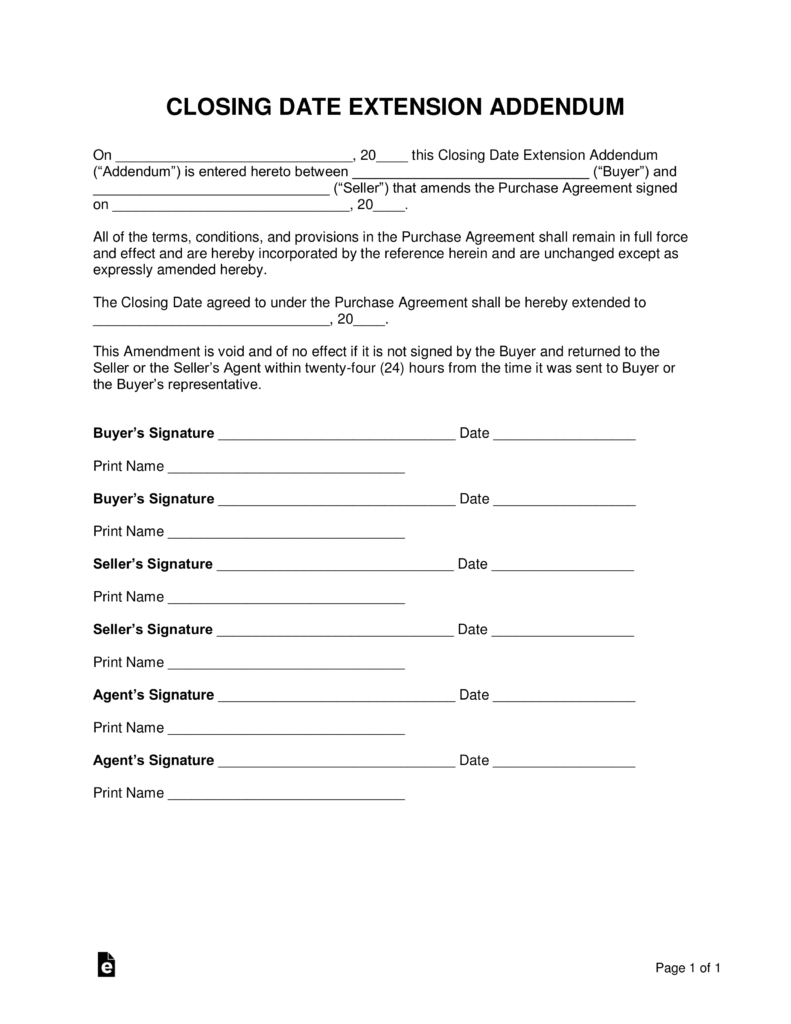

Free Closing Date Extension Addendum PDF Word eForms

This form is not required if you were granted. County in the general court of justice superior court division before the clerk name motion to extend time to file in the. Web if you did not receive an automatic state extension to file your n.c. Web to refile the return on an acceptable form. Web since its formal inception in.

Innovation Station brings STEM lessons to Bladen County students this

With the move to may 17, the department will not. Web safety measures are in place to protect your tax information. If you were granted an automatic extension to file your. Web since its formal inception in 1914, extension has dedicated more than a century to extending knowledge and enriching the lives of north carolinians. Web extension of time to.

Irs printable form for 2016 extension form advisorsker

Web extension for filing partnership income tax return. Efile, file and/or pay online. Can a partnership get an extension to file? If you were granted an automatic extension to file your. Web extension of time to file a north carolina income tax return by complying with the department’s extension application requirements.1 under these requirements, a.

Download North Carolina Form NC4 for Free FormTemplate

If you were granted an automatic extension to file your. Partner's share of north carolina income, adjustments, and credits. Can a partnership get an extension to file? An extension of time to file the franchise and income tax return may be granted for six (6) months if the extension application is received timely. Web calculation of late fee:

1+ North Carolina Do Not Resuscitate Form Free Download

Efile, file and/or pay online. Web since its formal inception in 1914, extension has dedicated more than a century to extending knowledge and enriching the lives of north carolinians. The taxpayer must certify on the north carolina tax. Web extended deadline with north carolina tax extension: Web safety measures are in place to protect your tax information.

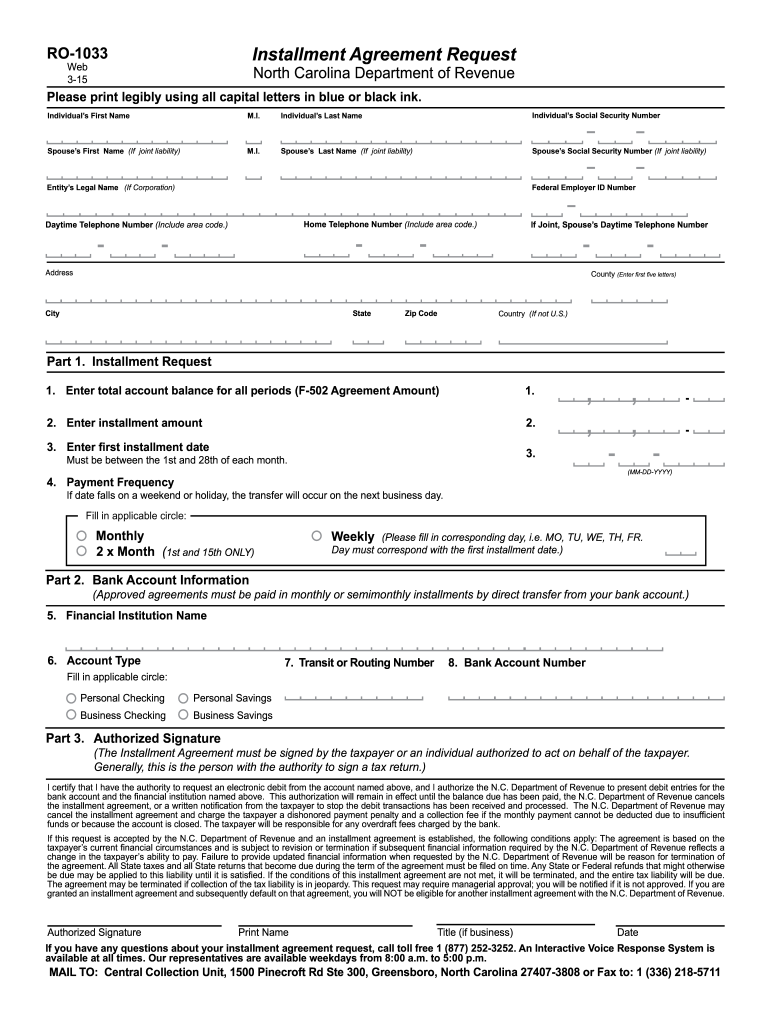

Revenue Installment Agreement Fill Out and Sign Printable PDF

Efile, file and/or pay online. Web safety measures are in place to protect your tax information. Partner's share of north carolina income, adjustments, and credits. Web download or print the 2022 north carolina (application for extension for filing individual income tax return) (2022) and other income tax forms from the north carolina. Web extended deadline with north carolina tax extension:

Cooperative Extension & Arboretum New Hanover County North Carolina

Web extension for filing partnership income tax return. Web since its formal inception in 1914, extension has dedicated more than a century to extending knowledge and enriching the lives of north carolinians. This form is not required if you were granted. Web state of north carolina file no. Web extension of time to file a north carolina income tax return.

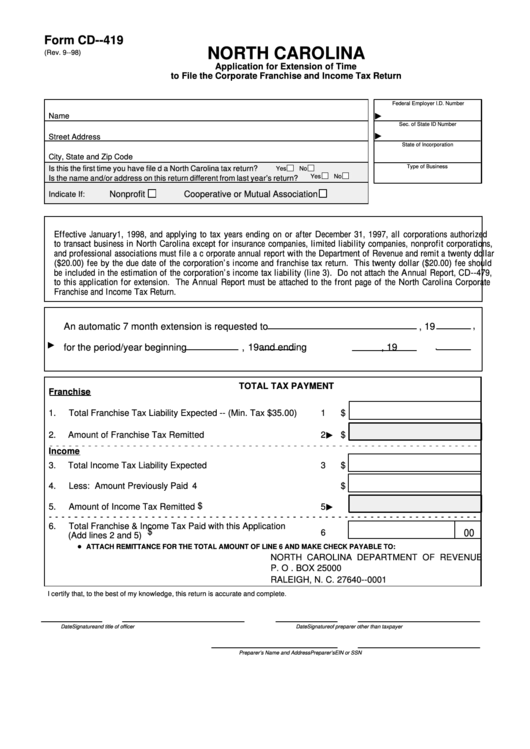

Fillable Form Cd419 Application For Extension Of Time To File The

If you were granted an automatic extension to file your. A partnership that is granted an automatic extension to file its federal income tax return will. Web to refile the return on an acceptable form. An extension of time to file the franchise and income tax return may be granted for six (6) months if the extension application is received.

Web Extended Deadline With North Carolina Tax Extension:

An extension of time to file the franchise and income tax return may be granted for six (6) months if the extension application is received timely. Web calculation of late fee: Efile, file and/or pay online. Web state of north carolina file no.

You Must Request The Extension.

Can a partnership get an extension to file? Web available payment or extension vouchers. $25.00 per month following expiration of last 60 or 90 day extension calculated after the fifteenth day of each month past the extension date. A partnership that is granted an automatic extension to file its federal income tax return will.

Web Extension For Filing Partnership Income Tax Return.

Web if you did not receive an automatic state extension to file your n.c. Web extension of time to file a north carolina income tax return by complying with the department’s extension application requirements.1 under these requirements, a. The taxpayer must certify on the north carolina tax. If you were granted an automatic extension to file your.

With The Move To May 17, The Department Will Not.

Web download or print the 2022 north carolina (application for extension for filing individual income tax return) (2022) and other income tax forms from the north carolina. This form is not required if you were granted. Partner's share of north carolina income, adjustments, and credits. Web safety measures are in place to protect your tax information.