Non Resident Indian Income Tax Return Form

Non Resident Indian Income Tax Return Form - Determine the residential status in india. Special provision s relating to certain incomes of non resident indian. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Resident during the year and who is a resident of the u.s. Web taxation of non residents in india non residents (hereafter referred to as nr) having a source of income in india are required to comply with the indian tax laws. Web find answers to frequently asked questions about nonresident withholding below. Web nonresident aliens can deduct certain itemized deductions if they receive income effectively connected with their u.s. Web these instructions are guidelines for filling the particulars in income‐tax return form‐2 for the assessment year 2021‐22 relating to the financial year 2020‐21. Web you must file form 1040, u.s. Nonresident alien income tax return.

Determine the residential status in india. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. How to deter mine that an individual is nri ?. Web find answers to frequently asked questions about nonresident withholding below. Nonresident alien income tax return. Web you must file form 1040, u.s. Special provision s relating to certain incomes of non resident indian. You can file income tax return online from anywhere in the world. Resident during the year and who is a resident of the u.s. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs.

Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Web you must file form 1040, u.s. Web follow the steps below to file and submit the itr through online mode: Web find answers to frequently asked questions about nonresident withholding below. Irs use only—do not write or. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Web you are not required to be physically present to file & verify your income tax returns. You can file income tax return online from anywhere in the world. Nonresident alien income tax return. Web taxation of non residents in india non residents (hereafter referred to as nr) having a source of income in india are required to comply with the indian tax laws.

INDIAN TAX RETURN FORM ITR5 and (iv) person filing rules

Resident during the year and who is a resident of the u.s. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Web follow the steps below to file and submit the itr through online mode: Web you must file form 1040, u.s..

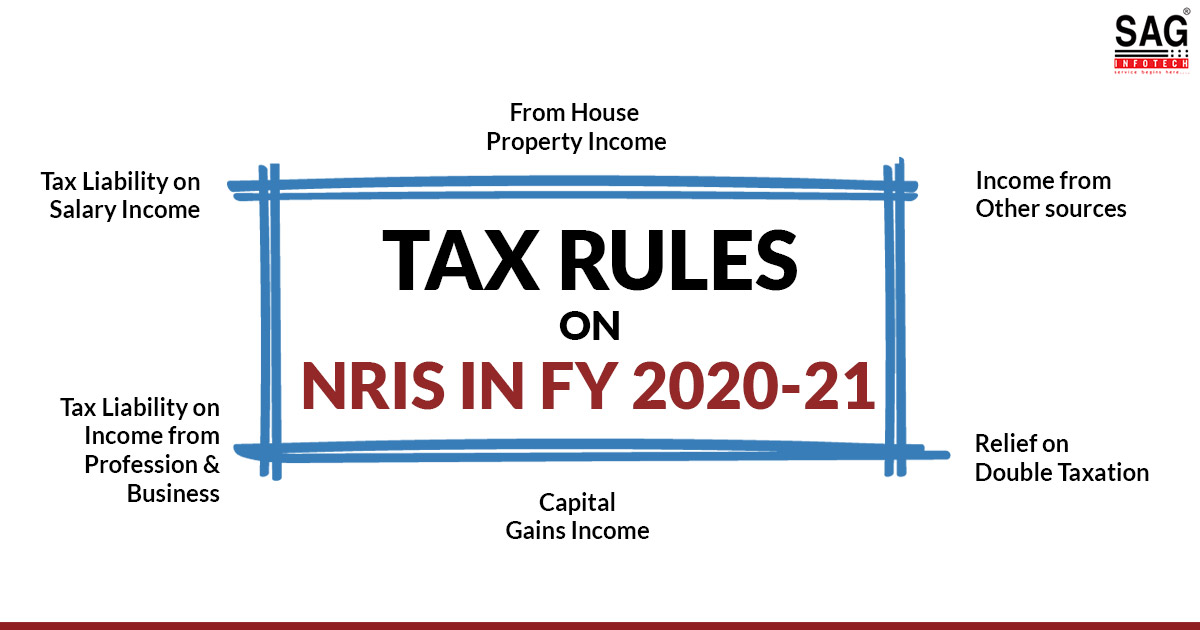

New Tax Law on NonResident Indians' for FY 202021

Determine the residential status in india. You can file income tax return online from anywhere in the world. Web find answers to frequently asked questions about nonresident withholding below. Web taxation of non residents in india non residents (hereafter referred to as nr) having a source of income in india are required to comply with the indian tax laws. Irs.

Is it Mandatory for NRI to File Tax Return in India? NRI

Web nonresident aliens can deduct certain itemized deductions if they receive income effectively connected with their u.s. Web find answers to frequently asked questions about nonresident withholding below. Irs use only—do not write or. Web these instructions are guidelines for filling the particulars in income‐tax return form‐2 for the assessment year 2021‐22 relating to the financial year 2020‐21. Resident during.

Nonresident Indian Taxpayer Checklist by Alonika Issuu

Web you are not required to be physically present to file & verify your income tax returns. How to deter mine that an individual is nri ?. Web nonresident aliens can deduct certain itemized deductions if they receive income effectively connected with their u.s. Irs use only—do not write or. Determine the residential status in india.

FILING TAX RETURNS IN INDIA FOR RESIDENTS & NON RESIDENT INDIANS

How to deter mine that an individual is nri ?. Determine the residential status in india. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Irs use only—do not write or. Web as the due date to file the income tax return.

NO TAX FOR NRIShould NRI (non resident Indian) file tax

Web these instructions are guidelines for filling the particulars in income‐tax return form‐2 for the assessment year 2021‐22 relating to the financial year 2020‐21. Web find answers to frequently asked questions about nonresident withholding below. Special provision s relating to certain incomes of non resident indian. Web nonresident aliens can deduct certain itemized deductions if they receive income effectively connected.

NonResident Indians Which are Taxed? Tax News

Web taxation of non residents in india non residents (hereafter referred to as nr) having a source of income in india are required to comply with the indian tax laws. You can file income tax return online from anywhere in the world. How to deter mine that an individual is nri ?. Web section 43 of the black money (undisclosed.

TAX INDIA ! NON RESIDENT TAXATION INCLUDING TAXATION OF CAPITAL

Web find answers to frequently asked questions about nonresident withholding below. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr.

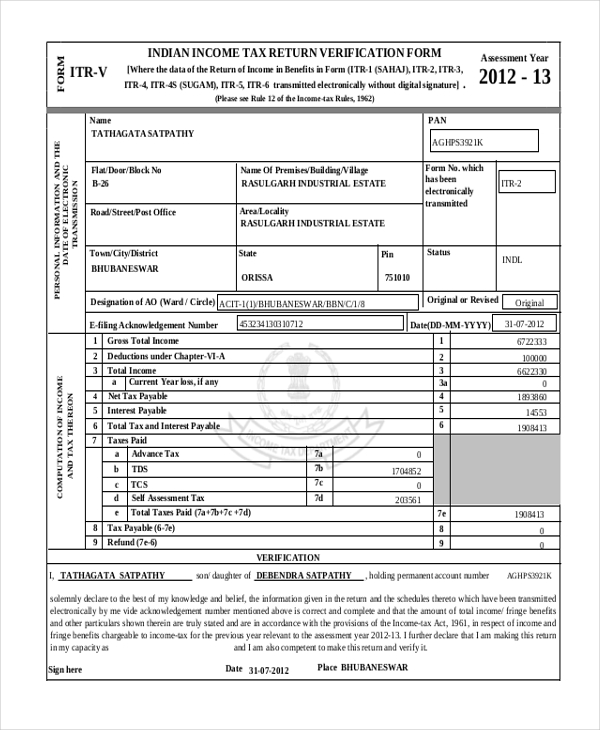

FREE 10+ Sample Verification Forms in PDF MS Word

How to deter mine that an individual is nri ?. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Web these instructions are guidelines for filling the particulars in income‐tax return form‐2 for the assessment year 2021‐22 relating to the financial year.

tax explained for Nonresident StudentAthletes in the U.S.

Web you are not required to be physically present to file & verify your income tax returns. Web nonresident aliens can deduct certain itemized deductions if they receive income effectively connected with their u.s. Determine the residential status in india. Resident during the year and who is a resident of the u.s. Special provision s relating to certain incomes of.

Web Find Answers To Frequently Asked Questions About Nonresident Withholding Below.

Web follow the steps below to file and submit the itr through online mode: Irs use only—do not write or. Nonresident alien income tax return. How to deter mine that an individual is nri ?.

You Can File Income Tax Return Online From Anywhere In The World.

Web you must file form 1040, u.s. Resident during the year and who is a resident of the u.s. Web you are not required to be physically present to file & verify your income tax returns. Web nonresident aliens can deduct certain itemized deductions if they receive income effectively connected with their u.s.

Determine The Residential Status In India.

Web taxation of non residents in india non residents (hereafter referred to as nr) having a source of income in india are required to comply with the indian tax laws. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Web these instructions are guidelines for filling the particulars in income‐tax return form‐2 for the assessment year 2021‐22 relating to the financial year 2020‐21.