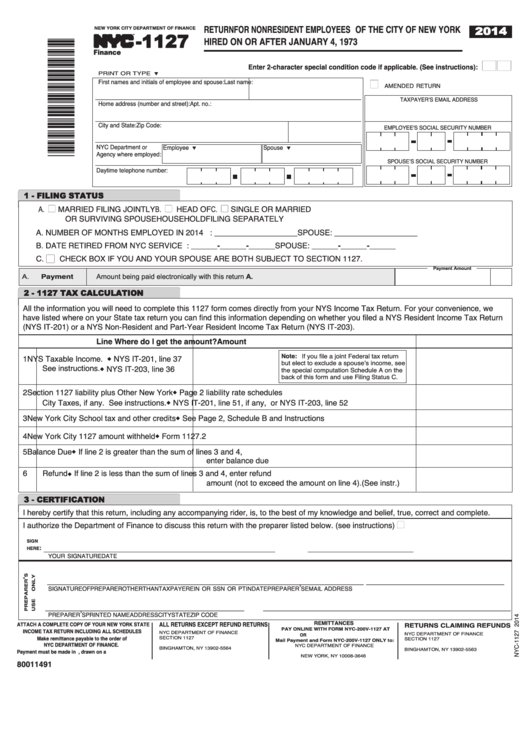

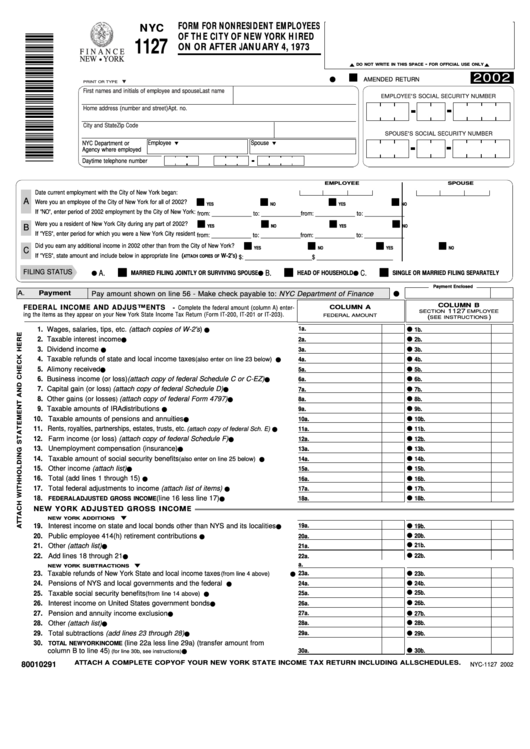

New York City Form 1127

New York City Form 1127 - Web payment under nyc form 1127 is not a payment of any city tax, but is a payment made to the city as a condition of employment (see the general information section on the 1127 instructions). Enter 1, 2 or 3 in the field 1=taxpayer is employee, 2=spouse, 3=both.note: Any new must file the 1127 tax return? Taxes box in the left navigation pane. First names and initials of employee and spouse last name home address (number and street) apt. An 1127 in most return. Go into screen 54, taxes. Employee's social security number spouse's social security number. View the current new york city personal income tax rates. Contact 311 or email us.

Any new must file the 1127 tax return? View the current new york city personal income tax rates. Hhc 559 (r may 18) Taxes box in the left navigation pane. Employee's social security number spouse's social security number. If you are subject to that law, you are required to pay to the city an amount by Web payment under nyc form 1127 is not a payment of any city tax, but is a payment made to the city as a condition of employment (see the general information section on the 1127 instructions). Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. First names and initials of employee and spouse last name home address (number and street) apt. Contact 311 or email us.

View the current new york city personal income tax rates. Taxes box in the left navigation pane. Contact 311 or email us. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Any new must file the 1127 tax return? This will take you to screen 54.097. First names and initials of employee and spouse last name home address (number and street) apt. An 1127 in most return. Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Enter 1, 2 or 3 in the field 1=taxpayer is employee, 2=spouse, 3=both.note:

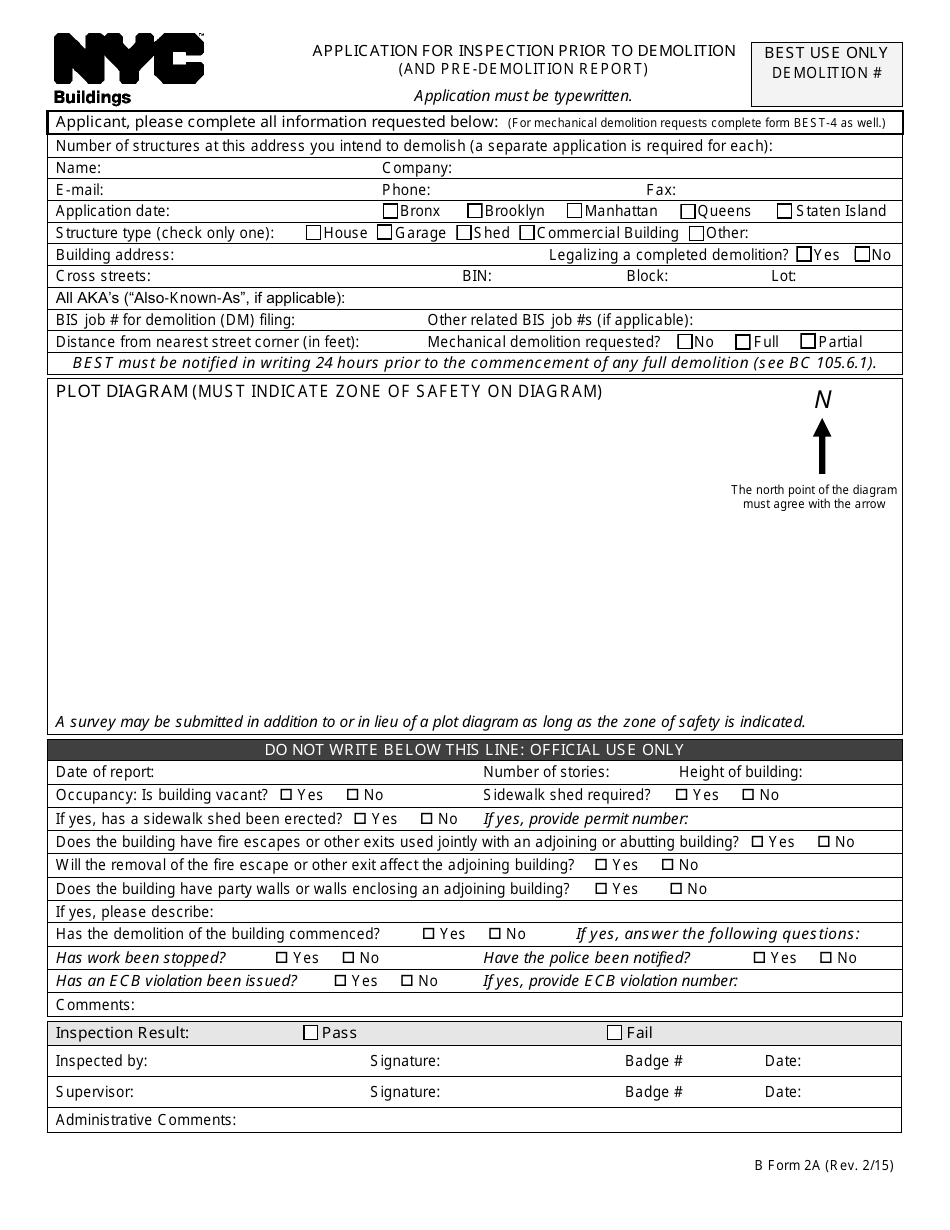

Form 2A Download Fillable PDF or Fill Online Application for Inspection

Taxes box in the left navigation pane. Enter 1, 2 or 3 in the field 1=taxpayer is employee, 2=spouse, 3=both.note: If you are subject to that law, you are required to pay to the city an amount by First names and initials of employee and spouse last name home address (number and street) apt. You are considered a new city.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

An 1127 in most return. View the current new york city personal income tax rates. Web form nyc 1127, which you will need to comply with this policy, may be obtained from the city department of finance. Contact 311 or email us. Ment of a particular york city employees a nonresident of the city (the five your employer, you would.

Fillable Form NYC1127 (2017) in 2021 Form, Fillable forms, Nyc

Web form nyc 1127, which you will need to comply with this policy, may be obtained from the city department of finance. Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Any new must file the 1127 tax return? Enter 1, 2.

20152022 Form NYC DoF NYC115 Fill Online, Printable, Fillable, Blank

Employee's social security number spouse's social security number. This will take you to screen 54.097. Web payment under nyc form 1127 is not a payment of any city tax, but is a payment made to the city as a condition of employment (see the general information section on the 1127 instructions). City and state zip code. Taxes box in the.

Form Nyc1127 Return For Nonresident Employees Of The City Of New

Web payment under nyc form 1127 is not a payment of any city tax, but is a payment made to the city as a condition of employment (see the general information section on the 1127 instructions). If you are subject to that law, you are required to pay to the city an amount by An 1127 in most return. Employee's.

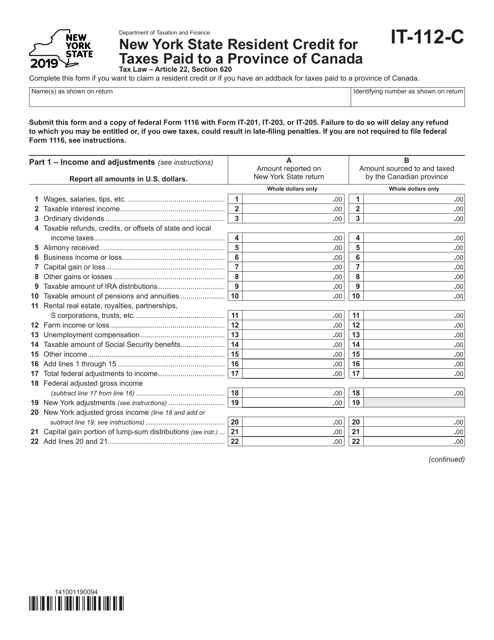

Form IT112C Download Fillable PDF or Fill Online New York State

An 1127 in most return. First names and initials of employee and spouse last name home address (number and street) apt. Enter 1, 2 or 3 in the field 1=taxpayer is employee, 2=spouse, 3=both.note: If you are subject to that law, you are required to pay to the city an amount by Contact 311 or email us.

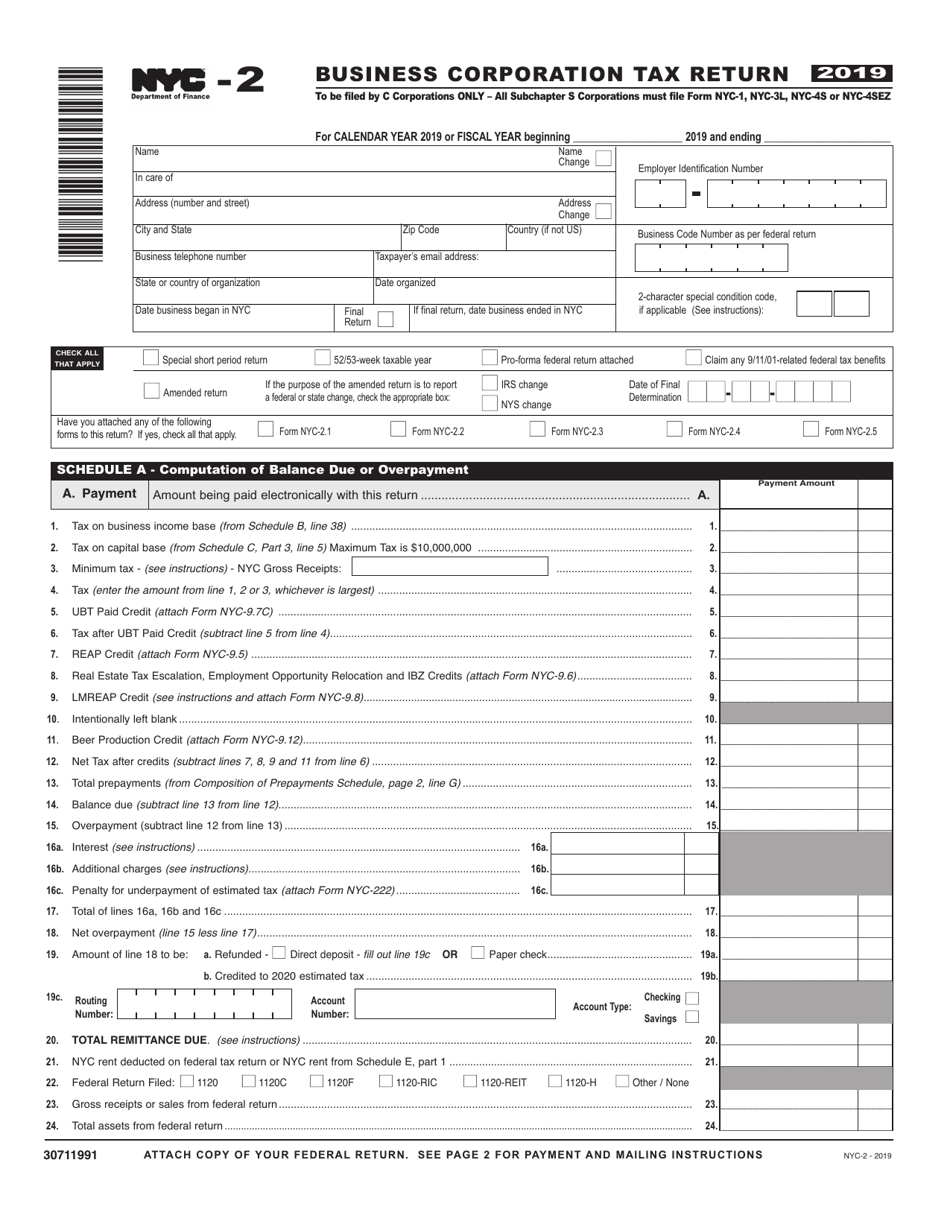

Form NYC2 Download Printable PDF or Fill Online Business Corporation

Taxes box in the left navigation pane. Hhc 559 (r may 18) City and state zip code. You are considered a new city employee? This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc.

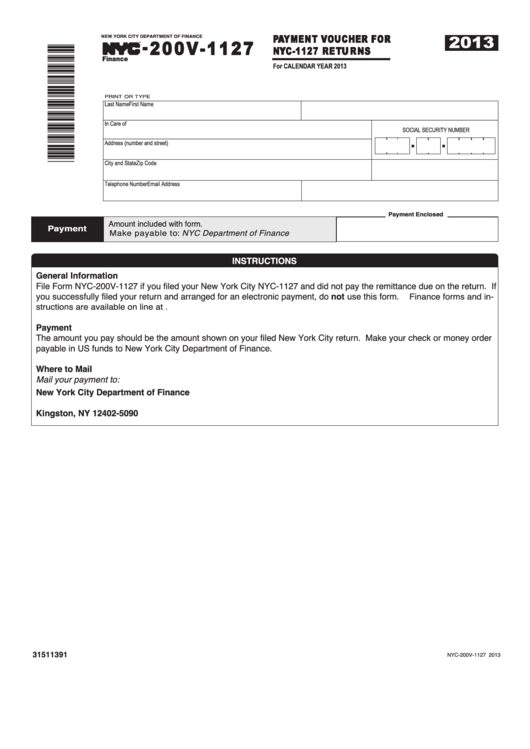

Form Nyc200v1127 Payment Voucher For Nyc1127 Returns 2013

Contact 311 or email us. You are considered a new city employee? Taxes box in the left navigation pane. An 1127 in most return. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc.

Form Nyc 1127 Form For Nonresident Employees Of The City Of New York

View the current new york city personal income tax rates. This will take you to screen 54.097. Enter 1, 2 or 3 in the field 1=taxpayer is employee, 2=spouse, 3=both.note: Web payment under nyc form 1127 is not a payment of any city tax, but is a payment made to the city as a condition of employment (see the general.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Taxes box in the left navigation pane. Go into screen 54, taxes. View the current new york city personal income tax rates. This will take you to screen 54.097. If you are subject to that law, you are required to pay to the city an amount by

Employee's Social Security Number Spouse's Social Security Number.

Web payment under nyc form 1127 is not a payment of any city tax, but is a payment made to the city as a condition of employment (see the general information section on the 1127 instructions). This will take you to screen 54.097. Web form nyc 1127, which you will need to comply with this policy, may be obtained from the city department of finance. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc.

Enter 1, 2 Or 3 In The Field 1=Taxpayer Is Employee, 2=Spouse, 3=Both.note:

An 1127 in most return. You are considered a new city employee? Taxes box in the left navigation pane. Hhc 559 (r may 18)

Ment Of A Particular York City Employees A Nonresident Of The City (The Five Your Employer, You Would Have To File Tax Year Must An 1127 Return.

Go into screen 54, taxes. If you are subject to that law, you are required to pay to the city an amount by Any new must file the 1127 tax return? Contact 311 or email us.

City And State Zip Code.

View the current new york city personal income tax rates. First names and initials of employee and spouse last name home address (number and street) apt.